"For every action, there is an equal and opposite reaction." —Sir Isaac Newton (Newton's Third Law)

In nature, where everything moves freely absent human interference, her omnipotent forces are allowed to manifest themselves in manners that create a living ecosystem that supports life in the air, on land, and on and within the oceans. It is perfectly balanced to sustain itself and has done so over billions of years.

During the Cuban missile crisis of the early 1960s, elementary school children were worried that a nuclear holocaust would cause the world to come to an end, to which my late father would reply, "The world is not going to come to an end. Humanity might come to an end but the world will be just fine."

So, as this is now Month #3 of "not QE4," with tens of billions of dollars very recently added to the Fed's balance sheet, I am reminded of a conversation with a young investor during which I told him that these global levels of debt are threatening the very survival of the current bull market in stocks. His reply was much along the same line of logic as my father offered back in '62: "Debt is not going to end the bull market in stocks. It might end the global economy but the stock market will be just fine."

That vocal perversity perfectly capsulizes the degree to which moral hazard has invaded the public psyche. There is seemingly nothing that can or will derail the stock markets and their rightful advances toward the Trumpian Heavens.

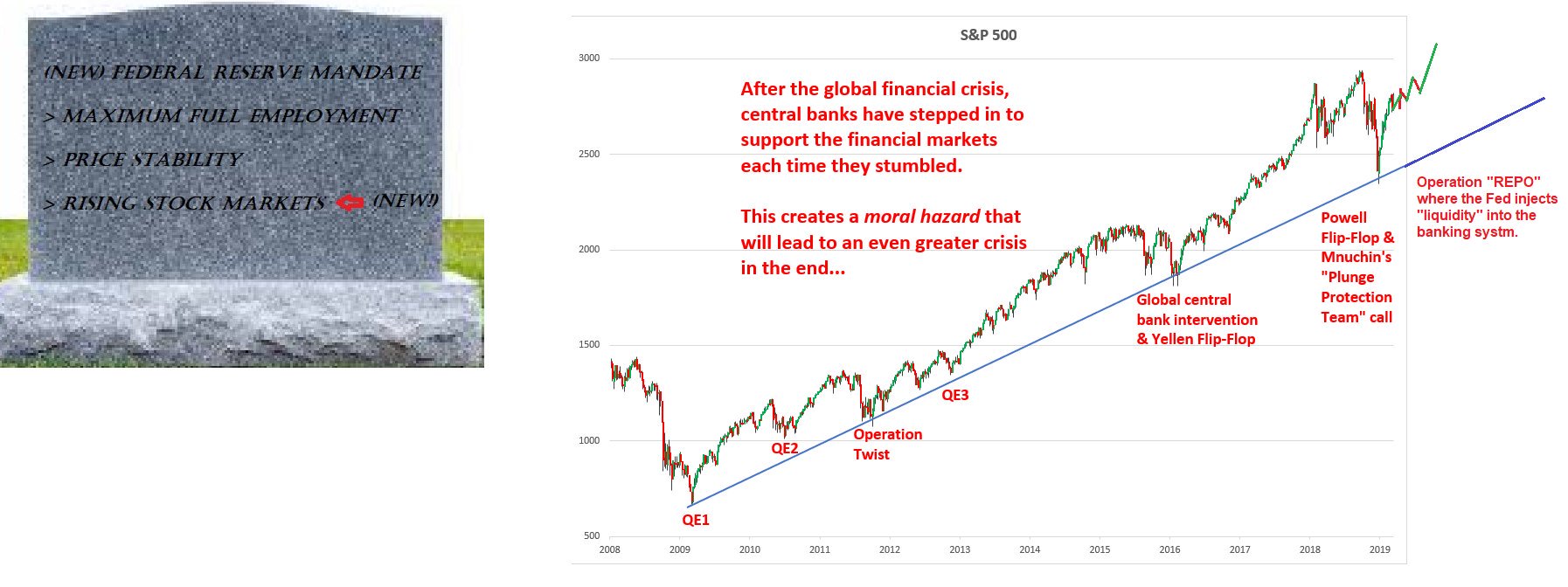

Accordingly, I have a question for you anyone and everyone that invests in U.S. financial instruments: What actually is the Federal Reserve's "mandate"?

The recent Fed stimulus extrapolates to over $1 trillion in liquidity over the next twelve months despite a supposedly booming economy.

The importance of this question is underscored by the recent breakout of the S&P 500 to record highs, fueled 1,000% by the injection of $60 billion per month of liquidity into the banking system by the Federal Reserve bank, whose balance sheet is already overflowing at $1 trillion (yes, with a T) in "assets," many of which are carried at "par" (100% of maturity value) despite being completely worthless.

Now, the official mandate from the website is "promote effectively the goals of maximum employment, stable prices, and moderate long term interest rates." Nowhere is there anything about "stock prices" and yet, despite overwhelming evidence of a preoccupation—no, obsession—with the level of the S&P 500, they would argue until they are blue-in-the-face that stock prices are not part of their mandate.

I submit to you that the sheer insanity of the current sovereign debt markets implies that the central bankers, knowing full well that governments the world over are insolvent, have decided that whatever credibility they have left can only be retained as long as stocks remain buoyant. To wit, the S&P, after limping along into September after a rudderless summer, began to resemble a replay of 2018, when out of the blue, up sprang the central planners. and before you could say "printing press," the Fed had launched REPO actions. Why they needed to "reliquefy the system" with near-full employment (BLS numbers), inflation running "below target" (2%), and long-term yields at 50-year lows is beyond my ken. With zero problems related to the Fed mandate, what was Jay Powell looking at when he pulled out the old Hank Paulsen "bazooka" and launched the singular most gold-and-silver-friendly action since the 2008 Great Financial Bailout.

There are virtually no protests (of any size) in the USA, so what exactly spooked the Fed?

Dovetailing back to the title of this missive, it is really quite easy to identify optical anomalies in financial markets based purely on the reaction of prices in the context of sudden new liquidity. When several hundred years of financial market history is used as a backdrop against which to compare current market behaviors, what unfolds is a macabre distortion of Newton's Third Law. If a nongovernmental, privately owned agency pumps several trillion dollars of their currency units into the "system," they are diluting the purchasing power of that unit. These being "digital entries" referencing "cash,"the reality is that every time you cash your paycheck, you are getting less purchasing power because of the debasement of "currency" as a medium of exchange.

When one looks at a balance sheet, on the left side of the sheet under the title of "Assets" you always find "cash." That does not mean the entity necessarily has a private vault with a stack of paper dollars held within; it is simply a bookkeeping entry, a fabrication, or better still, a "conjuring." However, whatever you call it, it is that "conjuring" of liquidity that remains the singular most powerful driver for stocks, and it matters not from whence it came. Investors no longer bother to question the source of this added liquidity because there is no source. In the same way that a sorcerer conjures up demons with the wave of a wand or the utterance of magic words, the Fed simply uses a keyboard and a series of press releases to conjure up a trillion dollars.

However, since perception is nine-tenths of reality, the time-tested barometers by which to forecast future inflation—gold and silver—must not be allowed to function lest the average citizen hear the wailing of a financial air raid siren. The charts shown below are clear illustrations of this policy action in full bloom, and it is manifested by way of direct interventions and behavioral conditioning. Traders read of "Fed REPO OPS" and they think "stocks up; gold down," not so much because a trillion dollars of added liquidity is a sensible, strong policy decision, and anti-inflationary, but rather a "call to arms" for the interventionalist traders operating for the Treasury department or the Fed.

Any way you cut it, I don't want to be short stocks in this type of environment because they never get margin calls and I do. Period. No short seller alive today has access to S&P futures "phone" armed with a bottomless bank vault.

Since the Crash of 2008, stock prices have been under the direction and supervision of the either central bank or treasury officials, and as such, economic conditions have zero impact on direction and by default, valuation. Those in charge are concerned only with absolute levels of stock averages, such as the S&P, FTST, Paris Bourse, or Nikkei, so it is the flow, as opposed to value, that catches their attention. Because flow trumps value in today's world, massive money-printing orgies, such as the one in which we now reside, have no bearing on value but do have absolute and total bearing on flow, because the liquidity provided by the Fed REPO OPS are direct boosters to flow.

Accordingly, I have been telling everyone since September to be very careful in trying to short the S&P into year-end, and thus far, that advice has proven spot on. As for gold and silver, ironically, the more I see major market averages achieving escape velocity, the less concerned I am that the invisible hand will continue to lean on the metals. The best period I can recall for gold and silver was 2009–2011, a period in which the world under Fed chairman and bank-rescuer Ben Bernanke, obsessed with Thirties-style deflation, called off the precious metals guard dogs and turned a blind eye as gold hit $1,920 and silver $50, while the S&P and NASDAQ healed up. That kind of boy-in-a-bubble protection from the microbe menace is what I pray for as we close out 2019.

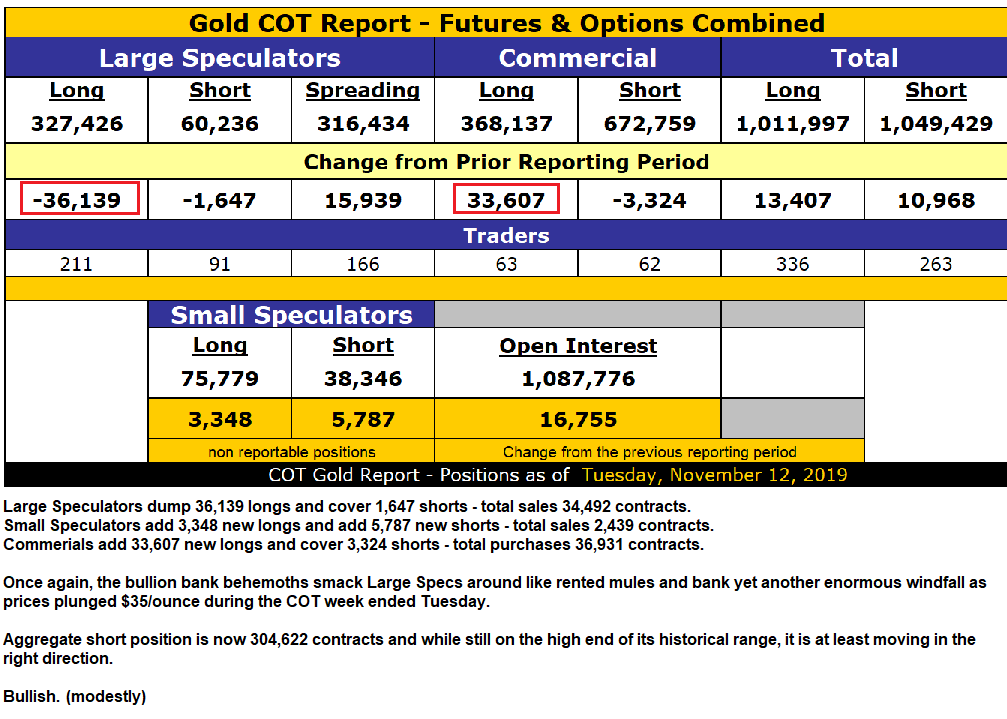

This week's COT report shifted to a moderately bullish stance as the bullion banks reversed course and start covering shorts and adding new longs. While the aggregate short position is still in the high-and-bearish zone, above 300,000 contracts, the bullion banks bought 36,931 contracts, the largest weekly purchase since before the rally began last May.

While one measly week does not a market make, it is a distinct improvement and when added to the arrival of favourable seasonality, this constitutes a solid "BUY" signal, which I formerly issued for the gold with last week's brief dip below $1,450. Silver has turned up after touching the sub-30 RSI [relative strength index] zone similar to the May upturn, so I want to see December silver north of $17.50 quickly to confirm the bullish case. Forgive the redundancy, but we need miners outperforming the physicals and silver outperforming gold for this to develop into a rip-roaring year-end rally.

Finally, as a matter of housekeeping, this publication is going to go "Full Twitter" shortly (New Year) so that all BUY and SELL signals and GGMA portfolio moves will be available only through direct messages. It will cost you (USD) $49.99 per month to know my thoughts and exactly how I intend to avoid drawdowns.

To put it into perspective, the SELL signal on silver on Sept. 4, the exact day that the four-month, $5.28-per-ounce rally ended, saved fortunes for those long the December silver contract. Within one month, silver was back below $17, so with each contract requiring (USD) $5,200 in maintenance margin requirement (MMR), a $2.75/ounce drop was a (USD) $13,750 haircut, or 2.64 times MMR. Your savings on the September signal was 22.91 times the annual subscriber fee, so while I beseech you to forgive this shameless promotional plea, you can email me at [email protected] for further instructions and information. I should add that to maintain maximum effectiveness, the subscriber list will be capped at eight-hundred members.

Remember, the December contract for gold goes off-the-board on Nov. 29, so we have ten more Crimex sessions to see this record open interest disappear. The potential is there in spades for heightened volatility as we approach month-end, the algobot that control "flow" will be on the lookout for Trumpian Tweets, and Kudlovian cackles celebrating the "improving trade talks" and the "scintillating economy," so trade smart and be nimble.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

[NLINSERT]Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.