Looking back at the events of last week, the S&P 500 finally took out the October highs at 2,941 intraday, making the 2018 bear market one of the shortest on record at 93 days (Sept. 21–Dec. 24). You will recall that I wrote in early January that the action of the Santa Claus rally (positive) and the action of the First Five Days rule (positive) was finally confirmed by the January Indicator (positive), setting up new highs for 2019 (which was right). I also said that I expected a retest of the December lows (wrong) and a pullback from the 200 daily moving average (dma) in February (wrong) and that Goldman Sachs was headed back to $150 (wrong) (at least so far).

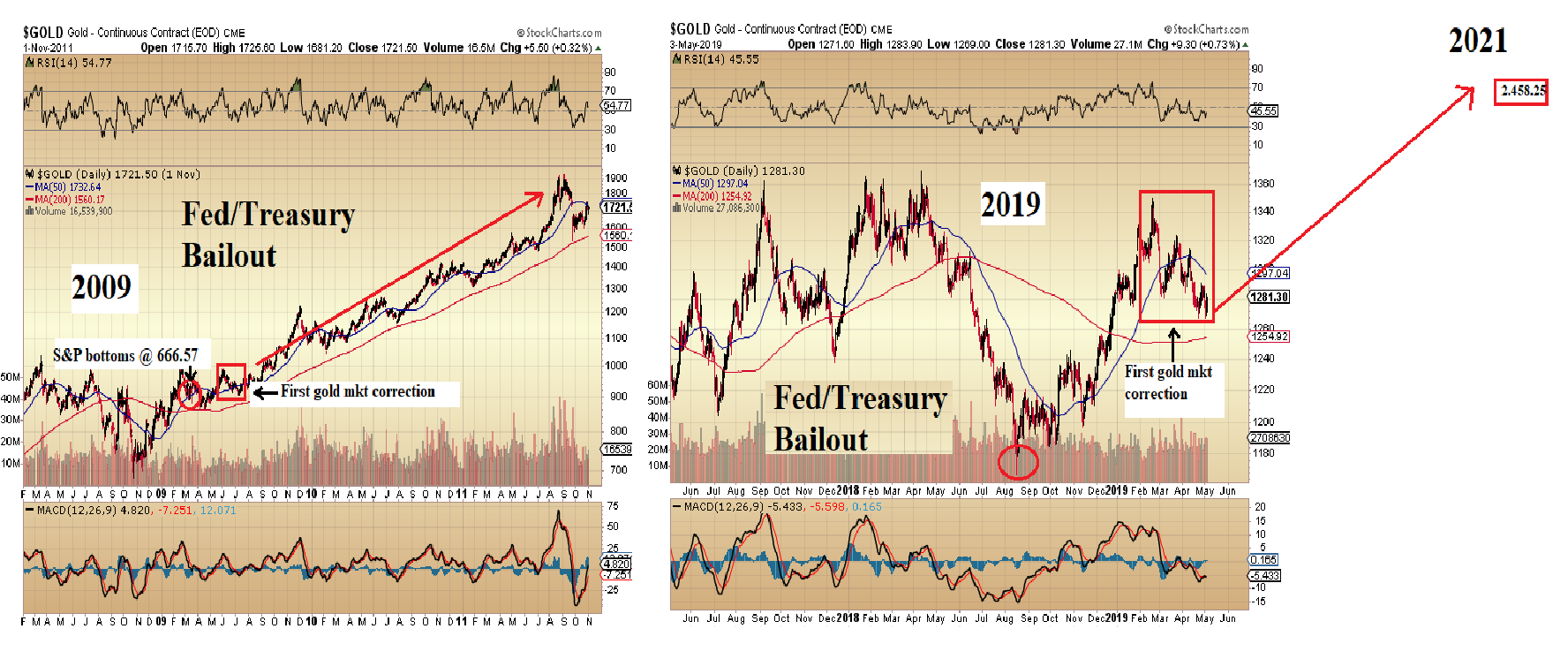

Look at these charts. Can any of you honestly see any difference? They both reek of intervention but the only difference is that the one from 2009 has now had books and movies written about it. We know that no one went to jail over the causes of the crash, and we know that the method used by the central bankers to correct the problem (which was to take in all of the toxic paper that was rotting their balance sheets) resulted in more debt creation ($14 trillion worth). This was exactly the root of the 2018 problem because as soon as they tried to remove the 2009 "bandaid,"they were catapulted right back to 2009. Stocks were simply gravitating back to their old trajectory before the Fed/Treasury bailout temporarily saved the stock market. What we got last Christmas Eve was the same bailout as in 2009, but it came about before people started to lose jobs and homes. The "V-bottom"turns in 2009 and in 2019 are identical, and emanated from interventions of the highest order and priority.

Conclusion #1: There can be no—repeat—noFed balance sheet "normalization"ever again and interest rates are headed lower at the first glimpse of stock market duress. Conclusion #2: Technical analysis is useless when analyzing rigged markets.

Now, we had a Fed/Treasury-induced bailout for stocks in 2009, and the day the S&P bottomed, gold was around $930 per ounce, after bottoming in October 2008 at $681. Gold began to sniff out a bailout earlier than stocks did, but once the stock market got the scent (or more appropriately, odor) of a bailout in all aspects, including interventions in stocks and bonds, gold behaved accordingly.

It was about five months after the 2009 bottom in the S&P that gold experienced its first correction, dropping from $985 to around $900 (8%) only to turn and make progressively higher highs for the next two years. Well, since we had a 2009-style stock market rescue last December, I contend what we experienced in the last two weeks in gold was the conclusion of a similar "first correction"in gold from the February highs at $1,349.80.

Could we inch down another 2% to test the 200-dma? Of course, we could—but take a closer look at the price performance of gold post-2009-rescue. If you tried to finesse an entry back in 2009, you left $1,000 per ounce on the table.

So, how I am treating this current gold correction is exactly how I played it in 2009. Bottom line: Whenever central bankers, government bureaucrats or elected officials with agendas collude to alter the natural course of the capital markets, gold catches a bid. While those same conspiratorialists can delay the move, they cannot prevent the move. Ergo, I am a buyer.

Gold Market Sentiment

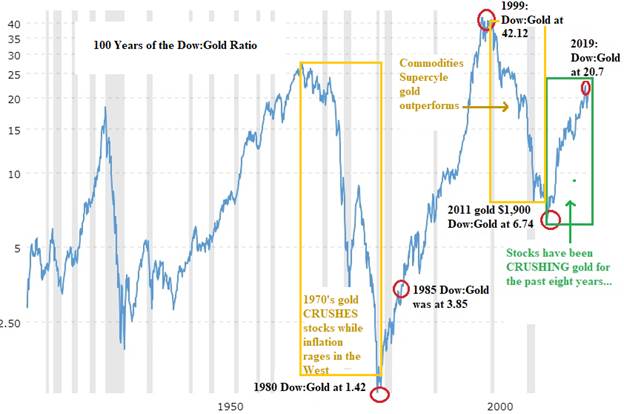

The first-ever market commentary I can recall issuing was a three-page update on a few of the junior exploration issues I was following, and the year was 1985. Gold was trading in the $280–320 range and the Dow Jones Industrials had moved into a full-blown bull market after the 1981-1982 bear, and were trading at 3.85 times the price of gold or around $1,155.

I had just come away from my best-ever investment (up until 1985), which were two companies (Golden Sceptre and Goliath Gold Mines) involved in the then-famous Hemlo gold discovery in northwestern Ontario. We had made many multiples of our original investment (10–30 times our money) and were in the hunt for the "next big one."Driving the Canadian markets was a generation of Baby Boomers who had put away their love beads, peace signs, and hookah pipes in favor of three-piece pinstripe suits and convertible BMWs, and the only sector that carried any form of sexiness was the mineral exploration field.

Oil exploration had been squashed by the liberal government under the first Trudeau snapperhead, so all that was left was gold fever. It paid off in spades three years later with my second major hit, the Eskay Creek discovery of 1988. I have told this story before but it is worth repeating: I originally got the idea from the legendary Murray Pezim, and after looking at the 30 million Calpine shares issued in HID deal, I elected to go with Ron Netolitzsky's Consolidated Stikine.

It was an enormous pass, moving from $0.80 to over $40 in less than a year, but what is significant about both Hemlo and Eskay is that the narcotic of stock market enrichment through mineral exploration was engrained in the brains of the Baby Boomers forever. It became a full-blown mania in the 1990s, when retail speculative capital fueled the exploration sector and it was sopopular and soexciting that entire mutual fund companies were born for the express purpose of speculation in mining.

It paid off handsomely as Canadian explorationists delivered a brand new diamond industry in North America, beginning with the 1991 DiaMet discovery in the Northwest Territories, and then a gargantuan nickel find in Labrador through Diamondfields, a massive Peruvian gold discovery (Pierina) by Vancouver-based Arequipa Resources, and of course, the Kennedy Lake diamond discovery by Mountain Province Mining in 1995.

Alas, while the boomers were reveling in their multiple resource industry windfalls, a new generation of younger investors were discovering a thing called "the worldwide web."Suddenly, millionaires wearing baseball caps, round-rimmed glasses, and beard-and-goatee facial hair styles were popping up everywhere because they knew how to "write code"and could design web pages.

The blow that finally ended that twenty-year love affair with mining and exploration was delivered on April 1, 1997, with the release of the devastating Strathcona report on Bre-X, which exterminated an entire industry for the next five years. More importantly though, was that Baby Boomers were pivoting away from drill hole speculation and into dot.com speculation. That continued for another three years until it, too, came tumbling down in 2001.

Since the '90s, the boomers have aged and are now second fiddle to the Generation X demographic. But successive generations, which include the Echo Boomers and Millennials, have not only found entirely new non-mining, non-exploration vents for speculation, they have been rewarded with unfathomable riches in the last ten years by crypto, artificial intelligence, and weed deals, all the while the S&P has advanced from the March 6, 2009, low of 666.79 (Sign of the Beast?) to this week’s high of 2,954.13.

Furthermore, the number of junior exploration companies in the last ten years that made a discovery; had the share price explode to the upside; and then stay upuntil they ultimately got taken over can be counted on one hand. The sad part is when you look at the thousands of junior resource companies listed on the TSX.V or CSE that all claim to be "the next twenty-bagger,"there actually very few that do. Now, there were companies like Newmarket Gold (co-founded by my friend Doug Hurst), which started off small, made their discovery (Fosterville), and then got taken over by Kirkland Lake Gold Inc. (KL:TSX; KL:NYSE) after which KLG quadrupled in price, thus delivering the kind of returns that were commonplace in the '80s and '90s.

Today these are, sadly, few and far between. To say that the junior exploration sector has met up with massive competition for discretionary investment demand is an understatement; compounding the problem is the dreadful management of the senior miners whose share price performances haven't come even close to matching the performance of their underlying commodity prices.

The Dow:Gold ratio shown here is a terrific graphic depicting everything I have just typed. There was a four-year window in the mid-late '70s, and again in 2001–2011, when gold massively outperformed the Dow and the S&P. But the one thing absent from the latter period was that unlike the '70s, the financial engineers had created about three dozen products to choose from to participate in rising precious metals prices. In the prior booms, you either bought precious metals physical or futures or you bought the miners. There were no ETFs or derivatives upon derivatives upon ETNs upon manhole covers clouding the precious metals (PM) marketplace, which are so abundant today they have diffused the impact of sector shifts by the global investing world.

Since 2001, I have seen at least a dozen events that, in the past, would have sent gold and silver prices soaring, starting with the 2008 vaporization of the global banking industry in a maelstrom of greed and fraud and including the longest-ever military spending orgy in world history, which the cost of fighting WWII look like a church collection plate, as well as the increase in U.S. debt to over $23 trillion. Any oneof these fiscal/monetary events should have sent all the investor generations scurrying for the precious metals havens, but since all potentially negative stock market events since 9/11 have been met with Fed/Treasury rescue protocols, the younger generations of investors have been trained, as if in a Pavlovian miasma, to buy any and all dips in stock prices and sell any and all rallies in gold and silver.

When I sit down to write one these missives, I like to have certain degree of anger or outrage flowing through my veins but recently, the fire-in-the-belly bellicosity that fuels my rants has become somewhat muted. Call it age or call it resignation or call it fatigue, but the net result is that I am finding it more and more difficult these days to impart confidence and certainty in the predictions I offer. The reason for this is seen in the last green rectangle shown in the graphic: stocks have been crushinggold for the past eight years. . .and it reallydoesn't matter whether it is the result of interventions or the PPT or rigging. What matters is that it continues to happen day in and day out, and it gets more blatant and in-your-face at every turn.

However, my personal mood swings have over the years grown to become a kind of harbinger in the same manner that my trusty dog Fido has taken on the same role. Sure, we had a sure-fire bottom in late 2015 at $1,045, and a rip-roaring rally the following year, but since August 2016, we have been rangebound, with $1,350–1,375 as a carbonate steel ceiling, which has certainly had a negative influence on sentiment and that includes on my own.

All of this means nothing in the bigger picture, but over the very short term, the angst and ennui I am experiencing can only be interpreted as a bottoming condition. I felt the same feelings of discontent last August at $1,167, while living in an house bereft of spouse and the dog sleeping (hiding) under the tool shed. By September, I found myself repairing the holes in the walls and removing shattered desk ornaments used as projectiles while carrying tattered dart boards of bankster faces out to the trash bins.

I have noticed that my antisocial behavior is quite common at or near market bottoms, along with periods of isolation and loneliness as those close to me retreat for the safety of relatives (or tool sheds). Most importantly, when I am unable to put together more than one missive a week on the precious metals, I just knowthat I am experiencing subliminal capitulation—a final resignation to the futility of expecting the status quo to change while mired in deep denial. In other words, the exact moment when I should be buying is the exact moment where my emotions are screaming, "Don't do it."By last Friday, you couldn't hear a cement truck approaching over the screeches of my inner self. Take that for what it is worth.

Getchell Gold Corp. (CAD$.15) announced that diamond drilling had commenced on the highly prospective Hot Springs Peaks project located in north-central Nevada. I have written extensively over the past year about this target, and while the junior explorers are suffering from a lack of interest right now, what sets GTCH apart is that discoveries in Nevada are unique and set apart from discoveries anywhere else in the world. That is because Nevada's gold is the sole property of two companies (the two largest gold miners in the world)—Newmont Mining Corp. (NEM:NYSE) and Barrick Gold Corp. (ABX:TSX; GOLD:NYSE). Three million ounces found in Nevada is ten million ounces found anywhere else.

That is why I looked at the size of the resistivity high being drilled this week as being the "must-own"rationale behind the investment decision. As mentioned in an e-mail to clients under the heading "The Bullish Perspective,"I wrote: "In the press release the cross-section shows the resistivity below hole 1. The size of that resistivity anomaly is 1 kilometer long X 1 kilometer wide X 1 kilometer deep. A cubic kilometer of rock contains approximately 2 billion tons of rock. If that entire block contained 0.1 ounces per ton gold, there would be 200 million ounces of gold in that block. Even if only 10% of that block contained 0.1 ounces per ton gold, there would still be 20 million ounces of gold, large enough for any major company to want it. Hot Springs Peaks definitelycarries'scale'."

I own GTCH for that very reason: scale. Recognizing that this is a challenged environment for junior gold explorcos, I am still accumulating shares on the assumption that the upside potential vastly outweighs downside risk, especiallyin Nevada.

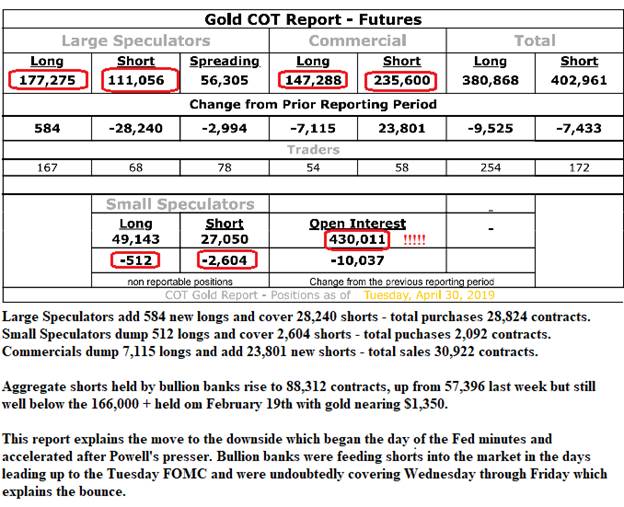

COT Report

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

[NLINSERT]Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Getchell Gold Corp. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., a company mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.