I was sitting in our local Port Perry pub this week when I overheard a couple of the local senior citizens discussing the upcoming arrival of the Saint Patrick's Day celebration where everybody dons a green shirt or a green tie or a green glass of beer and announces to the world that they have "Irish blood" flowing through their veins. Seizing upon yet another excuse for the initiation of "unnecessary drinking," Canadians of all shapes, sizes, colors, creeds and denominations are suddenly transformed into quasi-Leprechauns to the extent that even my Jamaican ex-classmate from the 1970s would call himself an "overdone Irishman" in order to qualify for stupefaction.

It never ceases to amaze me how my Canuck brethren will leap upon any and all excuses with which to justify inebriation, present company of course excluded. In fact, I proudly declared to the world and in fact, to all of my actual friends of Irish lineage, that only true Canadians of colonial fiber and soul will raise a glass with nary a hint of excuse nor heed of time of day. The Canadian "Clarion Call To Imbibe" has been best described as "The Leafs won last night!" or "There was a goose on the lawn this marnin'" or "I woke with a pulse!" but what is truly memorable is the feeling you get when it's March 16 and you look down the aisle and your 90-somethin' granny has an armful of Guinness on her way to the checkout counter, her green Paddy cap setting an early tone to the festivities.

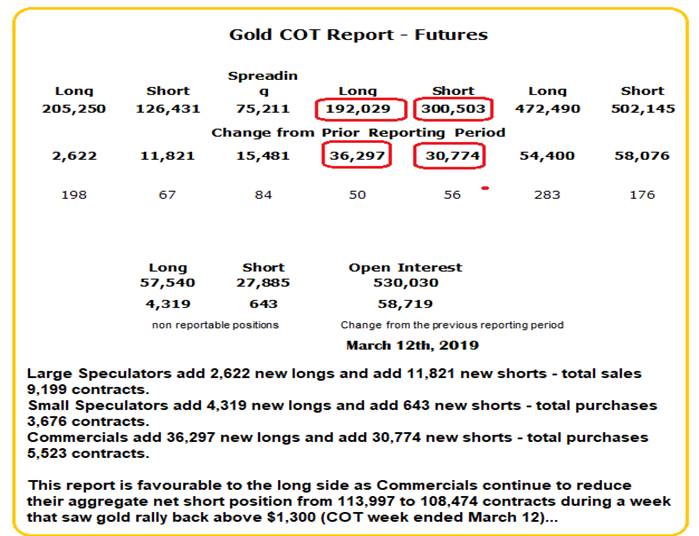

Gold and silver put up decent numbers for the week with gold reclaiming the $1,300 barrier and going out with the second weekly gain since my Feb.20 sell signal and subsequent $50 per (gold) ounce correction. Both investor sentiment and RSI have collapsed back down into neutral territory after being dangerously high during the February run to $1,349.80 but both have now begun an ascent since I replaced all leveraged positions sold on March 6 and 7 with gold in a two-day range of $1,280–$1,291. The past COT week ended on Tuesday March 12 with Commercials continuing to wind down the aggregate short position to 108,474 from 131,242 on Feb. 19 when price peaked.

The COT is mildly improved but as I wrote about last week, the set-up for the metals and miners is merely sufficient to justify a rally to $1,320–$1,330 and silver to $15.65–$15.75, which is a decent trade but by no means ideal, as the poor action in the HUI and silver relative to gold remains problematic. To have the Gold-to-Silver-Ratio (GTSR) at 85 is a sad non-confirmation to the long term veracity of the gold rally, which I seized upon last August at around the $1,190–$1,200 level. To be clear, I desperately need silver to OUTPERFORM gold sending the GTSR sharply lower in order to turn off the quote monitors and happily hibernate in advance of $2,000 gold and $100 silver BUT (and it is a large and very unsightly BUT), silver is UNDERPERFORMING gold, so caution—and tight stops—are warranted.

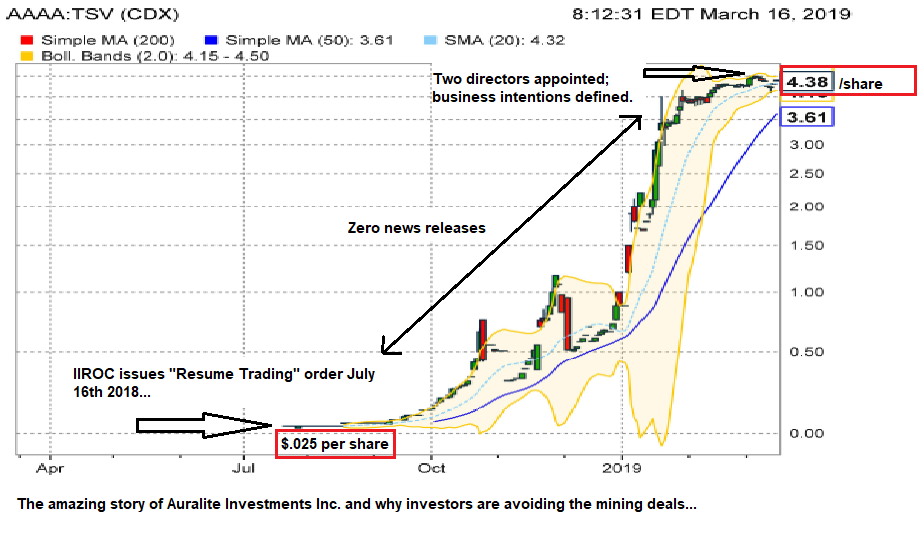

On another topic, I had a call from a good friend and market colleague on Friday afternoon during which he explained in a most vociferous manner that perhaps my obsession with the resource sector in this new (and mystifying) era of Millennial myopia has grown somewhat "obsolete" (at best) and "redundant" (at less best) while hinting that at my dangerously advanced age has rendered my market musings as "antiquated" (at the absolute worst). Of course, I proceeded to defend the efficacy of gold and silver in today's money-printing central bank orgy at which point my friend stopped me dead-in-my-tracks by asking me to pull up the stock chart of a company called Auralite Investments Inc. (AAAA:TSX.V), which I did and which I present to you all below:

This company was formerly called "Cabernet Capital Corp." and went through a restructuring last year before being acquired by an investor group out of the West Coast. After a name change and some obvious investor relations activities, which included the application of social media marketing wizards, the company began trading last July at around $0.025 (yes, that's 2 and half cents!), proceeded to trade 5,487,937 shares (4,786,250 bought by that legendary brokerage house "Anonymous") hitting a peak price of $4.50 per share before settling at $4.38 last Friday. During the run from $0.025 to $4.50, the company was never required to make one news release to account for the 180-fold (18,000%) increase in the stock before finally at the end of January 2019 making a news release confirming the appointment of two new directors and stating the company's business plan, which is:

"Going forward, Auralite is looking to invest in revolutionary and disruptive technologies in the following six key verticals:

Environmental Technology

Artificial Intelligence (AI)

Internet of Things (IoT) & Blockchain

Fintech

BioTech, BioPharma, and Cannabis Tech

Quantum Technology"

Those six business sectors have one word plastered all over them—MILLENNIAL. After an 18,000% advance in nine months, AAAA puts out a news release explaining what they INTEND to do to justify $1,251,287,100 market capitalization on a "Go Forward Basis." It covered EVERY issue relevant to the Millennial Generation—the environment, tech and weed. You will find nothing in its "go forward" model that relates to resources, sound money, or debt because these are issues important to the older generation of Boomers who basically "don't get it" and with one glance at this stock chart, how can I say they are wrong?

After sitting with the telephone in my ear, speechless, for the better part of 10 minutes, I mumbled to my colleague something or other about calling him back next week and proceeded to stare, slack-jawed and bereft of emotion, at this chart, the creation of which defies and defiles every shred of training and philosophy ingrained in me since the mid-'70s. You see, my work week is composed of literally dozens upon dozens of phone calls, emails, Skype chats and general information-gathering intended to reveal trading and investment ideas all centered around the notion that the only real money in this whacky world of serial counterfeiting and debt issuance is gold and, to a lesser degree, silver. Whether or not it was because my academic training in finance came in the inflationary '70's and from the ultra-conservative Jesuits, I have been through every imaginable cycle known to investors. Crashes, prolonged bear markets, commodity and exploration booms, internet, crypto and cannabis manias all within a regime of central bank and political fiscal and monetary largesse have given me a vast canvas of market memorabilia upon which to paint my portraits of actionable opportunities.

However and alas, no amount of experience or training would have ever allowed me to recognize the investment merits of a company like Auralite Investments Inc. unless I was in possession of an algorithm that identified it on a momentum screen that forced me to allocate capital on the basis of "tape-action momo" alone. And since I do not have in my possession such an algobot, I remain banished to the remote, redundant and irrelevant hinterlands of precious metals and sound money principles and practices. Will I be taking a refresher course in Economics 101 any time soon to reorient myself with this new wave of investment theory? Sadly, the answer is "no" because all of these cheers will end in tears as occurred with the internet scams of the late '90s, the uranium mania of 2006, the subprime lunacy of 2003–2007, the cryptocurrency nonsense of 2017 and finally, the recent weed crash. To wit, what precious metals investors are crying for is their own personalized mania that serves to rescue them from that $35/ounce average costs for silver and that $8 average cost for Rick Rule's Yukon darling Atac Resources (ATC.V) that traded over $10 in 2011.

The last time anyone wrote a piece about the "gold bubble" or the "silver mania" was nigh on eight years ago when gold was approaching $1,900 per ounce and silver was doing its second-in-a-lifetime visitation of the $50/ounce level. To the Millennials, that is someone else's investment thesis, and until the chickens of runaway debt creation and fiscal malfeasance come home to roost, they will all appear as investing geniuses as they happily gobble up Auralite Investments at a billion-dollar market cap. This weekend the green you see is in honor not of the March 17 celebration but rather the color I turn when thinking about AAAA. I just have to shake my head (and bang it loudly and painfully on the desk for missing it at three cents a share).

As to the upcoming week, if history repeats, the global markets led by the S&P 500 should have a pullback as the quad-witching weeks are normally strong while the following are the reverse. 26 out of the last 38 post-quad-witching weeks have seen pullbacks so with a 68.4% chance of lower prices with both RSI and MACD either at or approaching "overbought," the triple bear S&P ETF (SPXS:US) had the April $20 calls for $1.45 on Friday so I took a run at a modest position. Now, the one thought that persists in bothering me about trying to short the S&P 500 lies in one old adage that I have mentioned countless times before in this forum: "NEVER underestimate the replacement power of stocks within an inflationary spiral."

When Jerome Powell did his about-face policy reversal on December 26, 2018, he gave a resounding vote in favor of renewed monetary inflation. The significance of the policy reversal is best observed in context of the repercussions of that insidious "quantitative tightening" that is seen in the performance of the S&P 500 during the final quarter of 2018. Just as the markets refused to believe it until October, Jay Powell refused to believe it until the December crash and it was then that he gazed into the crystal ball and finally realized that no one will be able to unwind the Great Financial Experiment/Bailout/Crisis of 2008 and the trillions of toxic junk now on the Fed's balance sheet. Markets know it and the Fed knows it so the only modern examples of monetary madness and debt infernos are Zimbabwe, Turkey, and Venezuela where price inflation finally caught up to and surpassed monetary inflation with the main beneficiaries being the stock exchanges of those respective countries.

The ultimate utility of precious metals ownership is there for all to observe but in an inflationary conflagration, stocks do not fall while gold rises; EVERYTHING appears to rise but the reality is that the currency is crashing and that is the risk in attempting to short this advance. If the S&P does not follow the pattern next week, then the run to new all-time highs is in the cards so I shall proceed with my finger very close to the hair trigger that represents the "Exit all shorts" button.

Raise a glass to the Irish, to all things green, and to pulses…

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

[NLINSERT]Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. My company has a financial relationship with the following companies referred to in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.