The Gold Report: Lawrence, would you briefly recap your background?

Lawrence Roulston: I studied geology and then business at the University of British Columbia. I worked with one of the major mining companies as an analyst in head office, where I spent a few years evaluating potential investments in all parts of the world. From there, I went into management of a midtier resource company and then got into the junior sector. For about 15 years, I wrote an independent, subscriber-supported investment newsletter. And then I spent three years leading the Vancouver office of a big United States private investment group. Just over a year ago, I started an advisory. We're now working with several different companies and also looking for investment prospects for a number of investors. Through all that, I've seen a lot of different mining and exploration projects all over the world.

TGR: When we last spoke, you said that there were a couple of areas in the world where you were really excited about the exploration potential. We talked about Fiji. What's another area where you see exceptional potential?

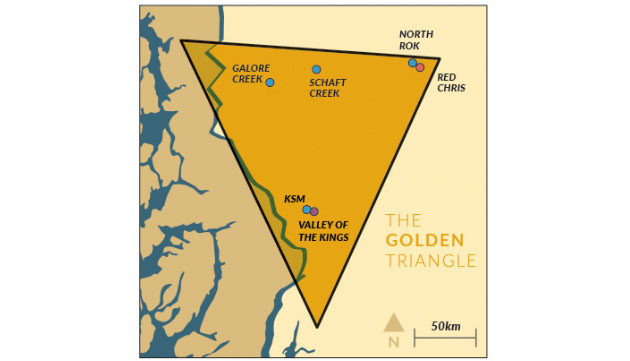

LR: After decades of traveling around the world looking for big high-grade metal deposits, I found the best area was right here in my backyard—the northwest part of British Columbia (B.C.), an area called the Golden Triangle. It's one of the most richly endowed mineral regions on the planet. The gold resources that have already been outlined in that region exceed the Carlin Trend, which is generally seen to be the biggest depository of gold on this side of the planet. And in addition to the gold, there's an equivalent value of silver, copper and other base metals as well as exotic metals like scandium. So, this is a really exceptional depository of metals and there will be a lot more ounces and pounds found in that region over the next couple of years.

TGR: I understand the Golden Triangle has some deposits that are quite large but the grades aren't very high, for example, Seabridge Gold Inc.'s (SEA:TSX; SA:NYSE.MKT) KSM project. It's a huge deposit but relatively low grade.

LR: If you just look at the gold grade of the KSM deposit, it's about 0.6 grams per tonne (0.6 g/t) in the Proven and Probable reserve at this moment. On its own, that gold grade would not support development of a mine in that region. But the thing that makes it work for Seabridge and for some of the other deposits in the region is the presence of copper, silver, molybdenum and the other metals. In the case of KSM, those other metals double the in-the-ground value of the gold. So, on a per tonne basis, the deposits are really very attractive. They're large and have a good metal content.

There are also some spectacular high grades there. At Pretium Resources Inc.'s (PVG:TSX; PVG:NYSE) Brucejack mine, which is right next to KSM, the average reserve grade is 16 g/t, and some of the drilling on that deposit exceeded 10,000 g/t. One of the samples from drilling had 41,000 g/t gold. I've never seen a gold assay as high as that, anywhere.

The Eskay Creek mine, which is in that same region, had over a 14-year mine life; the average grade was 49 g/t of gold and 2,400 g/t of silver, yielding 3 million ounces of gold and 160 million ounces of silver. And some of the other mines, like the Premier mine of Ascot Resources Ltd. (AOT:TSX.V), with over a 60-year mine life, had an average grade of 13 g/t gold, 300 g/t silver, 2.3% copper, plus credits of lead and zinc. The Snip mine produced a million ounces of gold at an average grade of 27.5 g/t.

The Golden Triangle is unique on the planet, in that it has both size and exceptionally high grades. For that reason, I've decided to focus a lot of attention on the Golden Triangle.

TGR: With these deposits, what is going on with the geology? It seems that a deposit like Seabridge's KSM, which is very large but relatively low grade, would be a porphyry deposit. Are the high-grade deposits also porphyries?

LR: There's an broad range of deposit types in the Golden Triangle. The KSM deposits are a series of large porphyry gold-copper deposits, and there are several other large porphyries in the region as well.

But the adjacent Brucejack deposit is an epithermal vein deposit. It's probably related to a porphyry, but it's a series of high-grade veins that come right to surface.

Eskay Creek is different again in that it's a volcanogenic massive sulphide (VMS) deposit—but a unique VMS deposit with exceptional enrichment of precious metals. There are numerous prospects for other occurrences of all three of those deposit types in the region.

And then last summer, there was a lot of work done on Garibaldi Resources Corp.'s (GGI:TSX.V) property, which came up with an entirely different deposit type, which is an ultramafic intrusion with nickel, copper, cobalt and platinum group metals. Until the work by Garibaldi, nobody really appreciated the presence of that deposit type in the region.

So the Golden Triangle has a rich diversity of deposit types.

TGR: Can you give me some idea of the size of the area considered the Golden Triangle?

LR: It's about 200 km per side, with the southern part of the triangle just south of the Port of Stewart.

TGR: There doesn't seem to be a lot written about the history of this region. What can you tell us about the area?

LR: That region has a fascinating history. Very few people really appreciate the history and all that went on in the region. It goes back into the 1850s when they were putting in a telegraph line to connect New York and Paris. The route took them through the northern part of B.C., believe it or not. There was already a line from New York to San Francisco. They ran a line from San Francisco up the coast, and they were going to go across the Bering Strait and then through Russia. Most of the line through BC was completed before they abandoned the project. That telegraph line was really the first step in opening up the region.

There was some gold exploration in the 1860s.

Then, in the late 1890s, the Klondike Gold Rush brought a lot of people to the region. Initially, they were passing through to the Klondike, but in the early 1900s, they found a lot of gold around Stewart, which became established as a town. Before the First World War, Stewart had a population of 10,000 people, which is hard to believe when you see it now, with about 500 people living there. But before the First World War, there were 10,000 people in Stewart, and they were working many tens of small, high-grade gold mines all around that area. By the end of the First World War, the population of Stewart was three. So, it went from zero to 10,000 to three.

After the war, some people came back, and there was some mining activity in the region, but it was very different than before the First World War. There were larger companies, and they were, for the most part, looking for larger deposits. They found a number of deposits, but at that time, the infrastructure was such that it was very difficult to develop mines. The Premier mine operated just north of Stewart. A little farther north, there was a mine developed at Granduc. They put in a road that actually had to go through Alaska and then back into B.C. and at the end of it was a 20 km long tunnel to get to the mine site.

And then the Eskay Creek mine was developed in the 1990s. That kicked off a huge wave of exploration. Literally hundreds of companies were looking for the next Eskay and they explored all through the region. They made lots of discoveries, but the work was scattered over small claims and it was hard to tie anything together to get a meaningful interpretation of the geology.

Over the last couple of decades, companies have been assembling larger claim blocks, which is allowing them to take a more comprehensive look at the geology. Starting with the work that was done over the prior decades, some of those projects have advanced quickly.

For example: Garibaldi Resources generated a market value of CA$300 million by following up on some nickel assays that were reported in the 1960s. After being in the public domain for 50 years, Garibaldi followed up on those assays last year and demonstrated the presence of a large nickel-cobalt-platinum-palladium occurrence.

TGR: Can you tell us about mines that are operating there now?

LR: The first one was Imperial Metals Corp.'s (III:TSX) Red Chris mine. It's at the northern end of the triangle and on the east side of Highway 37. It's a porphyry copper-gold deposit. It's now a very successful, profitable operation.

And then just last year, Pretium Resources developed the Brucejack mine, which is in the heart of the Golden Triangle. That development required building a road into the area, which has really opened up access.

In addition to those two mines, there were three hydropower facilities developed over the last few years. There were roads developed into those facilities and power lines that tie the facilities into the provincial power grid. BC has among the cheapest power in the world. Some of that power is being produced in the heart of the region, and there is a power line tying the region into the provincial grid.

The area now has road access and cheap hydropower. That infrastructure is going to make the next mine development project a whole lot easier than it has been in the past.

TGR: Can you tell me about the permitting situation and First Nations issues?

LR: B.C. has a bad reputation for both of those issues. I still talk to people who say: Why bother investing in B.C. exploration because you'll never get anything permitted. But I remind them that Brucejack is now in operation. The First Nations there are some of the best partners you could have on a mining project. . .if they're treated right. The B.C. government wants jobs just like any other government. Brucejack sailed through the permitting process and is now a successful operating mine. So, yes, there are challenges and there are hoops to jump through, but if it's done properly, it's no different, and in many ways it's easier and faster than developing mines in any other part of the world.

TGR: Would you talk about your own involvement in the Golden Triangle?

LR: It actually goes back over 30 years. In the 1980s, I directed an exploration program in that region, and it resulted in the discovery of the Bam deposit. We hit 8 feet (8 ft) of 0.4 ounces per ton of gold (0.4 oz/t) and 2.5 ft of 0.8 oz/t. But at that time, in that location, those results weren't enough to get investors excited, so the deposit sat untouched for decades. But it introduced me to the region, and I spent a lot of time on the ground and got to understand a little about the geology up there.

And then when I was editing the Resource Opportunities newsletter, I kept a close eye on the companies that were operating in that region. I followed Pretium, for example, right from the very beginning. Early last year, when I was setting up an advisory firm, I paid particular attention to the Golden Triangle, so I'm now involved in various ways with four companies that are active in the region. These are all companies that I've sought out because of their exceptional property potential. I invested in those companies and took an active role in the management of the companies.

TGR: Would you tell us about some of those companies?

LR: Let me emphasize that I'm invested in these companies and I'm involved in managing them, so I'm not independent from them. But as I said, I sought these companies out because of the geological merits of their projects.

The first one is Metallis Resources Inc. (MTS:TSX.V). Last May, we struggled to raise CA$500,000 ($500K) at $0.16/share to carry out a summer program. By July, Eric Sprott had invested CA$2.2 million (CA$2.2M) at CA$1.10 and then he came back for more. Metallis was the second best performing mining company on the TSX Venture Exchange last year. Today, the company has CA$5M cash and has already started work on an aggressive exploration program that will build on the results that were achieved in the work last summer, and in many years of prior work.

The project is named after a very highly regarded geologist named Rod Kirkham, who initially put the properties together. It's located right in the heart of the triangle, between Snip, Eskay and Brucejack. Its immediately adjacent to Garibaldi's nickel prospect and appears to have a significant piece of that big ultramafic system.

There was a geophysical survey already conducted this spring. They are now processing that geophysical data and will then be gearing up for a big program over the summer that will involve fieldwork on several different individual targets. It's a very large property, and it has four distinctly different geological targets.

I'm also a director of a company called Mountain Boy Minerals Ltd. (MTB:TSX.V), which has interests in two gold deposits near Stewart. Mountain Boy has a 20% interest in the Silver Coin deposit. It's fully funded by a partner. And, they have a 35% interest in the Red Cliff deposit, which is a joint venture with Decade Resources Ltd. (DEC:TSX.V). There's going to be more drilling this year, which we believe will be enough to lead to a resource estimate for Red Cliff. Mountain Boy also has a large property position all through the southern part of the Golden Triangle, with multiple precious and base metal occurrence. MTB also has a big barite occurrence. Barite was designated as a Critical Raw Material by the United States in December and earlier in the year in Europe, with China being the biggest supplier and more of their production being used internally. Barite is going to begin to get a lot of investor attention.

Another one that I'm involved in is Romios Gold Resources Inc. (RG:TSX.V; RMIOF:NASDAQ; D4R:FSE). Romios has 700 square kilometers (km2) of mineral rights in the Golden Triangle. The biggest part of that is adjacent to the Galore Creek project. In the early 2000s, when the Galore project was moving forward, Romios looked like it was next in line to be taken over, as NOVAGOLD Resources Inc. (NG:TSX; NG:NYSE.MKT) was consolidating properties around the Galore area. But then Galore was put on hold, and Romios has struggled ever since because of the perception that the properties are all linked to Galore. But the reality is that Romios has a compliant gold resource completely distinct from the Galore properties. A few years back, that deposit was remote. It is now within sight of the roads leading into the hydroelectric projects. It's ideally suited for mine development, with road access within sight and already having a compliant gold resource. So that will be the focus for Romios over the course of this summer. We are talking to other companies that are very interested in getting a stake in the other properties that Romios has in that area. Romios also has several projects in eastern Canada and in Nevada.

I'm also involved with Auramex Resources Corp. (AUX:TSX.V) as the CEO. When I stepped into it a few months ago, the company was a real mess and was about to lose a big part of its property position. We've now salvaged the properties. We've cleaned up the debts. We've brought in some cash. And we just very recently brought in a management team with two highly experienced geologists and a first-rate chief financial officer to help run the company. Auramex has 200 km2 in the southern part of the Golden Triangle. That includes a past-producing, high-grade gold mine. That project is literally within sight of the Port of Stewart.

The geological interpretation is that the high-grade gold that was mined historically is the upper expression of a large gold-bearing system similar to other large gold deposits in the Golden Triangle. The company also has interests in a dozen other projects through that region. We are now reviewing the geological information on the various projects, prioritizing them and laying out plans for a summer program.

There are some other really interesting companies that I'm not involved in but are worth mentioning. One of them is Aben Resources Ltd. (ABN:TSX.V; ABNAF:OTC.MKTS), which has a big property position in the northern part of the triangle. It has some historical high-grade hits on its property, and it intends to follow up on those over the summer.

It's also significant that the majors are getting very active in the area. Teck Resources Ltd. (TCK:TSX; TCK:NYSE) has been involved there for decades. The company has interest in two big deposits: It has a half interest in Galore, and it has a control position in the Schaft Creek deposit.

Another big company that's come into the area recently was Antofagasta Plc (ANTO:LSE), which is one of the big copper producers based in Chile, a London-listed company, and it's joint venturing with a junior on a property in the Golden Triangle.

With two mines now operating, the area is really coming alive. There's going to be a huge amount of activity in the Golden Triangle over this summer. Investors are really starting to wake up to the potential of that district and beginning to recognize the huge advances in infrastructure.

TGR: It sounds like it'll be a most interesting summer with so many companies building on previous success on their exploration projects. Do you have any parting thoughts?

LR: I just want to emphasize that this is one of the most highly prospective metal-bearing regions anywhere on the planet. It has changed dramatically with regard to infrastructure. And the whole permitting perspective is poorly understood by a lot of other people: Brucejack is a demonstration of how effectively the permitting process actually works in the province. A lot of work has been done there over a period of decades. Geologists are now building on that earlier work to get a jump start of exploration. I'm very excited about what's happening up there right now and about the prospects for a highly successful summer season.

TGR: Thanks for your time, Lawrence.

Lawrence Roulston is an expert in the identification and evaluation of exploration and development companies in the mining industry. A geologist with engineering and business training, he is the managing director of WestBay Capital Advisors. He generated an impressive track record for Resource Opportunities, the subscriber-supported investment newsletter of which he was founder and editor. He is now an advisor, director and/or CEO of several companies in the mining sector and also works on behalf of institutional and high net worth individuals to scout opportunities and do due diligence.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new interviews and articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo conducted this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this interview are billboard sponsors of Streetwise Reports: Seabridge Gold, Pretium Resources, NOVAGOLD Resources and Aben Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Aben Resources. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Lawrence Roulston: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Metallis Resources Inc., Mountain Boy Minerals Ltd., Romios Gold Resources Inc. and Auramex Resource Corp. I, or members of my immediate household or family, are paid by the following companies mentioned in this article: Metallis Resources Inc., Mountain Boy Minerals Ltd., Romios Gold Resources Inc. and Auramex Resource Corp. My company has a financial relationship with the following companies mentioned in this interview: Metallis Resources Inc., Mountain Boy Minerals Ltd., Romios Gold Resources Inc. and Auramex Resource Corp. I determined which companies would be included in this article based on my research and understanding of the sector. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Pretium Resources, Auramex and Aben Resources, companies mentioned in this article.