Globex Mining Enterprises Inc. (GMX:TSX; GLBXF:OTCPK) is a recent miningWEALTH pick. It is a self-proclaimed "mineral property bank" that holds numerous claims and projects available to be optioned by exploration companies. Exploration companies pay Globex in cash/shares, and agree to do a certain amount of work over a given period of time in exchange for the right to earn the property, minus a royalty. Over the years the company has accumulated well over 100 projects and a couple dozen royalties.

Since our recommendation the stock has fallen, but the fundamentals have improved in a way that should propel shares higher: one of the aforementioned royalties is going to begin generating cash flow for Globex in the near-term.

Globex owns a gross metal royalty on the Tennessee Zinc Mines owned by Nyrstar. The royalty entitles Globex to a percentage of the revenue generated from metal sales from the mine. The percentage is 1% if the zinc price is $0.90Ė$1.09/lb. and 1.4% at or over $1.10/lb. Zinc currently trades at ~$1.06/lb.

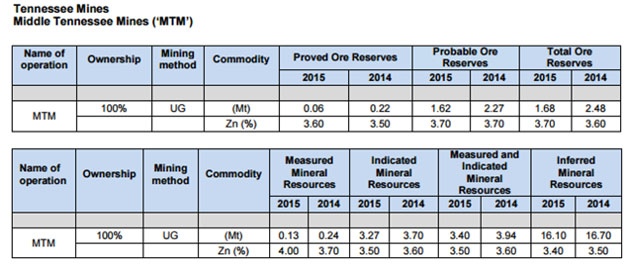

The Middle Tennessee Zinc Mine is a small underground mine in Tennessee that is part of a larger mining complex in the area. The mine operates with just a few years worth of rolling reserves, though it has decades worth of resources in the "inferred" category.

In response to low zinc prices, Nyrstar shut down the mine in the middle of 2015. Up to that point the mine was producing ~40,000 tonnes of zinc per year, and at that production rate Globex would generate ~$1 million in royalty revenue per year. It generates nothing if the mine isn't producing.

When we were assessing the company there was reason to be somewhat dismissive of this royalty. It had potentialóit has resources to support 30 years of production, not to mention the infrastructure in place to support productionóbut there was little likelihood of the royalty generating cash flow in the near term. Not only had Nyrstar put the mine in "care and maintenance," but the company had announced that it intended to sell all of its mining assets. It seemed as if we might have had to wait for Nyrstar to sell the mine and then for the new company to evaluate it before a restart of production would be a viable possibility.

Now, however, Nyrstar plans to bring the mine back into production during the first half of next year, meaning Globex will generate ~US$1 million per year in revenue, at no cost. This figure compares with a ~US$9 million valuation. Granted, this is a high-risk royalty in that there is no guarantee of a startup or the fact that it doesn't pay out if the zinc price is under US$0.90/lb., but it has the potential to generate a sizable amount of cash flow starting in the first half of 2017. Furthermore, the US$1 million per year figure quickly jumps to ~US$1.5 million should the zinc price rise a few pennies to US$1.10/lb.

This is a big deal for a small company such as Globex, yet the market did not react. Royalty companies often trade at a price to operating cash-flow multiple that is in the high teens to mid-twenties. Thus even if you take into consideration the fact that Globex doesn't have a diversified portfolio of producing royalties, and even given the risk that the royalty won't pay out (should the zinc price fall sufficiently) the company's current valuation seems appropriate, or even low relative to the value of this royalty.

This statement comes on top of the fact that Globex was attractive even when we thought that the mine could be in care and maintenance for much longer than we now anticipate. Globex has numerous projects that have substantial value relative to the company's current market capitalization. The market doesn't recognize this value, and this is probably due to the fact that the work on many of these projects is progressing slowly, if at all. Keep in mind that the company does little work on its own projects, and that only optioned projects will be meaningfully progressed. This passive approach comes with benefits (namely that Globex doesn't have to spend the money to explore its properties) but it means that the companies project portfolio will be developed more slowly than if they were in the hands of more conventional exploration companies. Investors may also be frustrated by the number of properties and the company's exposure to a wide array of commodities, including some that aren't well understood such as talc, feldspar, manganese or silica.

Nevertheless, the company has several valuable properties that justify the current market capitalization on a stand-alone basis. The list is too long to go through all of them, but some of the most valuable include:

- Magusi, which contains a high grade underground zinc/copper deposit in the Abitibi Greenstone Belt.

- Duquesne (50% owned by Globex), which contains an underground gold deposit exceeding 850,000 oz. (425,000 attributable)

- Timmins Talc and Magnesite, which is an advanced talc and magnesite project with a PEA estimating an after tax NPV (10%) of nearly $200 million.

A sum-of-the-parts valuation assessment would intuitively yield a result that is much higher than the current valuation. The news that Nyrstar will restart the Middle Tennessee Zinc Mine is a thick layer of icing on what is already an appetizing cake.

Ben Kramer-Miller is the chief analyst at miningWEALTH. He is well respected for his unique ability to find under-the-radar precious metals opportunities, as well as for his extensive research into rare earth elements and other critical materials. His research has been featured by Nasdaq, Kitco, Mining.com, The Financial Post, The Globe and Mail, Investing News Network and RealClearDefense, among others.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Ben Kramer-Miller: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. The companies mentioned in this article were not involved in any aspect of the article preparation. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.