James Turk: We started this year in an unusual position. Normally, we see seasonal strength in the last quarter. We didn't get it. We'd been in a correction since the high in silver back in April 2011. The high in gold came during the summer, which was very unusual, but basically both metals have been moving sideways. Starting from the end of a correction, value is more important than seasonality. Clearly, gold and silver both represent good, undervalued assets at the moment.

The other factor is continuing problems in the financial system. The European banks are still on the brink and many American banks are in a similar situation. Questions about the currency—whether the euro will survive—and the ongoing sovereign debt issue will cause people to look at the precious metals. I've said we saw the low in the gold price the first week of January, and the further into the year we get without going lower, the greater the probability that it was, in fact, the low for the year.

TGR: Considering all the issues you mentioned that existed last summer as well, why didn't that seasonal strength return late in 2011?

JT: An interesting thing about markets is that nothing works all of the time. You just have to respond accordingly in looking at how things are going to unfold. That's why I think the low has been made already.

TGR: You also mentioned in a recent interview that you thought gold could get above $2,000/ounce (oz) in the next three months. With all the monetary issues on the table, not to mention a few new wrinkles, what will make the gold price pop up so much in such a short period of time? What's the catalyst?

JT: I can't tell you what the event will be, but I look at charts and things of that nature to give me an indication as to when something's ready to move. The fact that we've been in a correction for several months is one indication that something will happen. Whether it's a bank failure or a problem with the euro or some European bank, you can't really tell. But whatever is coming, the markets reflect it. It's like following footprints in the sand on the beach, leading a certain way. The charts and the circumstances are telling me to expect a big pop in the gold price this year.

TGR: And would it correct immediately afterward?

JT: Not necessarily, because at some point, the currencies will collapse. When they do, gold won't correct. It will just keep going up.

TGR: So are you projecting currency collapses within the next few months?

JT: No, I'm not, but they will at some point. It could happen in the next several months; it could happen in the next several years. We are in a bubble, not a gold bubble but a fiat currency bubble. The belief that fiat currencies have value will be tested. I think fiat currencies, which are backed by nothing but government promises, will collapse, and gold will return to center stage in global commerce. When it does, expect a straight shot up. It may be three months or three years. Take it month by month and see how it goes. Don't try to trade the gold market. Continue to build your gold and/or silver holdings, and when all is said and done, you'll be very, very happy.

TGR: You've also indicated that you expect the U.S. to get into hyperinflation, citing examples of currencies in the Weimar Republic, Argentina and Zimbabwe. None of those currencies was world reserve currencies as the U.S. dollar is. Would the world allow the U.S. dollar to go into hyperinflation?

JT: The world can't do anything to stop it. President Nixon's Treasury secretary, John Connally, captured it perfectly when he told one of his European counterparts, "The dollar is our currency but your problem." That's still true 40 years later.

The dollar continues to be the world's problem, and the U.S. government isn't doing anything to make the dollar worthy of the esteemed position of being the world's reserve currency. There is no pressure that can be brought to bear on the dollar that would cause the U.S. government to reverse course and go in the right direction.

We are seeing countries around the world accumulating more gold in case the dollar collapses, which is what individuals should be doing as well. Countries around the world are also taking other steps to protect themselves. For instance, they're entering bilateral trade agreements that don't involve U.S. dollars. China has been doing a lot of bilateral trade agreements that completely exclude the dollar. India and Iran, of all places, just recently announced an agreement whereby they're going to use gold for transacting.

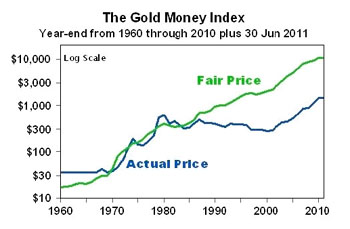

TGR: In King World News in October you wowed the world with the Gold Money Index discussion and how it shows that the fair price of gold is really $11,000/oz. You based your calculation on the combined total of central banks' foreign exchange reserves divided by their gold holdings. Why do you use only foreign-exchange reserves in that calculation and not total reserves?

JT: Because gold is international money, and I'm trying to focus solely on the monetary component. Instead of moving gold around as they did under the classical gold standard, the central banks have been using foreign currencies as a money substitute. If you're using a money substitute, the money itself should be equivalent to gold. The real factor underlying all of this is that gold is way too cheap, and accepting paper currencies instead of gold is the wrong thing to do, which is what the Gold Money Index shows.

So it's basically reestablishing gold's role in the international monetary system and what its value would be based on historical evidence, particularly from the 1960s and 1970s, when the index was working much more clearly. Over the last 20 years, the gap between the fair value of gold and its actual price has become huge.

TGR: Have you gone back to 1900 with that calculation?

JT: It's hard to get all the data, but the logic is basically there. I've gone back prior to 1900, not with the Gold Money Index, but with my Fear Index, looking at domestic money supplies. The Fear Index is at about 3% now, so gold today backs about 3% of the domestic money supply. When Sir Isaac Newton devised the classical gold standard, an average of 40% of the monetary system's value was based on gold and 60% on paper. That we're so far below the guideline he established is an indication to how undervalued gold is relative to all the paper money systems out there.

TGR: You mentioned using foreign-exchange reserves because they mimic the way gold was transferred under the gold standard. But wasn't it part of being on the gold standard that each currency unit reflected a gold component?

JT: Yes. But, the Fear Index and the Gold Money Index distinguish between domestic and international money supplies. That's why I was saying this 40% on the Fear Index is the historical norm.

TGR: Your Gold Money Index is interesting, and the $11,000/oz number grabs a lot of attention, but maybe the real underlying question is whether this ratio is really relevant.

JT: What makes the ratio relevant is that it had relevance up until the last 20 years. The fair price and the actual price have separated so far due to government intervention—attempts to cap the price of gold. Governments intervene in the gold market for the same reason they intervene in any market. When they don't like the outcome, they try to change things around. This index gives people an opportunity to understand how undervalued gold is.

The index is relevant, too, in that it makes it very clear that we're living in a bubble. How can something work for so many years and then all of a sudden not work? It's because we're in a bubble.

TGR: Didn't it work for so many years because we were on a gold standard?

JT: Exactly, but we went off the gold standard in 1971, and even in the 1970s, that ratio worked. It continued to work in the early 1980s. Then it stopped working.

TGR: So it wasn't until they started printing money, and expanding the M1—increasing the money supply—that the imbalance grew.

JT: Yes. The attributes that gave gold value and made it money in the first place did not disappear, but they were ignored or forgotten. Gold was marginalized. Then in recent years, people started to rediscover those attributes and realized that gold is very, very useful.

At some point the price of gold will just keep rising and not stop. That's when the currency collapses. And while we can't predict when it will happen, people have to reach one of two conclusions. Either 1) monetary history is not relevant and the fiat currency system will survive, or 2) monetary history is relevant, this is a bubble, the fiat currency system will collapse and gold is much undervalued.

TGR: There's no doubt about which conclusion you've reached. You've also made it clear that while you can't predict when the fiat currency will collapse or when hyperinflation will kick in, you recognize where the path we're going down leads. Still, as an astute historian of the currencies, could you tell us how long it took from the tipping point to all-out hyperinflation in the countries that experienced it?

JT: Once you hit the tipping point, it's usually six months before the currency is finished. To give you an example, I went to Argentina in 1991 to study what was happening there. Hyperinflation appeared to be brewing. The currency, the austral, was linked to the U.S. dollar at 14:1 in January, and the link was broken. During the first week of May, when I arrived, the austral had already devalued to 64:1 against the dollar. When I left at the end of the week, it was 96:1 and by December, it was 10,000:1. So I was right there at the tipping point.

But here's the interesting thing. Hyperinflation is first recognized outside the country before it's recognized within, because foreigners own another country's currency by choice. If they don't like what's going on, they sell that currency and move into something else. Where we are with the U.S. dollar, so many indications suggest that internationally we've hit the tipping point, but not yet within the U.S., where people are still getting paid in dollars and still spending dollars. Once the domestic tipping point is reached, it's six months before the currency collapses.

TGR: Considering that you're based in London now and presumably have greater insight into what's happening with the euro and in the European Union than most of us, how do you see the situation in Europe vis-à-vis the U.S.?

JT: Last year, the euro was in the doghouse and the dollar was relatively strong. A couple of years ago, the dollar was in the doghouse and the euro was relatively strong. As a famous hedge fund manager in New York said, trying to pick between the currencies today is like trying to choose the best-looking horse in the glue factory. You really can't say that the dollar is a good choice just because the euro is weak this year. It's not. All fiat currencies have serious problems.

The problems differ to a certain extent, and at any moment in time—depending upon what different central banks are doing or how investor sentiment is moving—you could have relative strength in one or the other. But they're all sinking relative to gold, so when deciding how to hold your liquidity, you have to consider gold bullion as one of the best choices simply because it's done so well against all of the world's major currencies for the past decade.

TGR: You've said many times that anyone who gets into precious metals needs to know why. You've suggested it's either exposure to the silver and gold prices—in which case people can opt for instruments such as exchange-traded funds—or elimination of counterparty risk, which means they need tangible assets. Most of the rationale for people getting into precious metals these days is the insurance factor. Does protection against currency devaluation fall into either of those two categories?

JT: It falls into the tangible asset category. If you're holding gold or silver for insurance, you're holding bedrock assets with thousands of years of history. Come what may, they're going to have value in the future.

TGR: The typical advice for people holding gold as insurance is to have 10% of your assets in gold. Maybe now that things are so volatile, 20% would be a better idea. But you're even more aggressive on that.

JT: I am, but everybody has unique circumstances, so it's hard to make sweeping generalizations. My basic view, though, is the older you are the more conservative you should be and, therefore, the more gold you should own. As a rule of thumb, use your age as a guide. If you're 20, you may want 20% of your portfolio in gold and the rest in higher risk assets because you still have time to generate wealth as you get older. But once you're older, you want to be conservative, and the way to be conservative in this environment is to own physical bullion. If you're 60, you should have 60% of your portfolio in gold.

TGR: People look at gold now and see the wonderful returns—17% annually on average, in the U.S. alone. What about an investor who says, "Hey, I'm just going to invest in gold because it will give me a better return than equities"? Is that a bad way to look at it?

JT: No, but understand that gold doesn't create wealth. It doesn't have cash flow, it doesn't have a management team and it doesn't have a price/earnings ratio. It's just a sterile, tangible asset. Gold doesn't even really generate a return. When you talk about returns in gold, you're actually talking about the lost purchasing power of the dollar. An ounce of gold today buys the same amount of crude oil it did 60 years ago. It didn't increase your wealth. It basically just preserved your purchasing power over that period of time.

Even when the gold price rises, even at 17.7%/year on average over the last 11 years against the U.S. dollar, it's not creating wealth. It's taking wealth that already exists and is being held by people who own fiat currencies. That wealth is being moved from them to people who own gold. But gold is not a wealth-generating asset. It doesn't grow anything.

TGR: A lot of vehicles that people put in their portfolios mimic stock indices, which also don't create wealth, but they do create returns.

JT: If they mimic stock indices, they create wealth. Ultimately, if the shares themselves go up, what mimics those shares goes up. If the stock in these indices goes up, the wealth in the world expands because it generates cash flow. A company generates some goods or services that benefit people, and people are willing to use their hard-earned cash to buy those goods or services. Ultimately, the firm grows and, as a consequence, creates wealth.

TGR: Now that we're talking about stocks, what's the role of gold equities? You said that people should use their age when they think about what percentage of their portfolio should be in gold. Let's say someone is 50. Would that 50% be in physical gold, or could it also include gold equities?

JT: Gold equities are different than gold. Gold equities are investments. Gold bullion is money. A portfolio has two components. The investment component focuses on risk versus return. The monetary component provides liquidity. When you sell an investment, you have liquidity, whether gold, a national currency or some mix. You hold that liquidity until you're ready to use some of it to make your next investment or to buy goods or services.

But, mining stocks are fundamentally different than gold. A company you invest in has a balance sheet. It has a management team. Acts of God can destroy a mine. There are political risks and other considerations involved in owning mining stocks. Of course, that's also how you actually create wealth—if you choose the right stock, you get a return. It's also true that these stocks have exposure to the gold price in the sense that if the gold price goes up, the mining stocks probably will go up also. But even then, there's no guarantee that the mining stocks will go up.

And remember, gold mining stocks are investments. Gold is money. Do you want liquidity or do you want an investment?

TGR: For those who want an investment, how do you feel about the gold equities? They do carry the additional risks you outlined but not so much the counterparty risk.

JT: I happen to be bullish on mining stocks because I think their bear market ended a few years ago. We're just now retesting lows that had been made previously, and with the rise in gold and silver I expect this year, I think we'll see the mining stocks go up as well.

In fact, if you choose the right mining stock and the gold price increases, the mining stock should rise by a higher percentage than gold itself. This has to do with the fact that a rising gold price improves the bottom line, increases the profit margin and ultimately results in a higher price/earnings ratio because the market senses that this is a major bull market, and the earnings and cash flow generated will lead the company to possibly increase dividends or something like that down the road.

As I indicated at the start of our conversation, though, an interesting thing about markets is that nothing works all the time. So while generally speaking, mining stocks rise by a higher percentage in a rising gold price environment, it doesn't always work that way. For the last 10 years, gold has done very well, but the mining stocks have basically gone nowhere.

TGR: One of the themes of the Vancouver Resource Investment Conference seemed to be that gold stocks are a really good deal for that very reason, and that they're on sale at bargain prices right now.

JT: I agree completely.

TGR: You're also bullish on silver and apparently expect the silver/gold ratio to return to historic levels.

JT: I am very bullish on silver, but not because of that ratio. The ratio is basically just the outward measure used to show how silver is undervalued relative to gold. The underlying fundamentals suggest to me that the silver price is very cheap relative to how I sense the supply and demand characteristics.

TGR: We have minimal economic growth in Europe and the U.S., if any, and everyone seems to agree that China's growth is slowing. With the world economy in slow motion, and silver being an industrial metal, what makes you so bullish on this commodity? What underlying fundamentals will drive the silver price up?

JT: It's a good substitute for gold. Fifty-one ounces of silver do the same thing as one ounce of gold. Silver is a monetary asset that preserves and protects purchasing power. It's the combination of the monetary and industrial demands that creates so much volatility in silver relative to gold. With gold, you have only the monetary demand. Economists call that demand inelastic, because people want to own gold regardless of the price. With silver, the demand is very elastic, meaning it's very sensitive to changes in price.

TGR: If people want both metals in their portfolio, what kind of balance do you recommend?

JT: Two-thirds gold and one-third silver.

TGR: You've suggested that silver prices are going to rise faster than gold. Should that carry over to silver equities? Do you expect them to outperform gold equities?

JT: Yes, I do. Again, it's difficult to make a sweeping generalization, but the odds are that silver stocks will do better than gold stocks in the foreseeable future.

TGR: You've covered some of the same points here that you made in your presentation at the Vancouver Resource Investment Conference. What would you consider the key takeaways from that presentation?

JT: First of all, I hope people understand more clearly that gold is money, and that they view it from that perspective in order to properly assess whether it makes sense in their portfolios. Secondly, I hope people realize that despite the fact that the gold price has risen, it's important to distinguish between price and value—they're different things. The gold price has risen because the dollar is being debased, but gold remains very undervalued and it's well worth it for you to continue to accumulate it. Work it into your family budget, and every month or two, buy more gold—and silver, if you're so inclined. That leads to the third point. Don't try to trade gold; save it. When you're doing that, you're saving sound money, and that's a good thing.

TGR: When you started GoldMoney, you talked about a vision that at some point people would use GoldMoney units as currency to trade for services—a bit like using PayPal or an online bank but using your digital gold currency (DGC) instead. Do you still see that coming?

JT: Yes, it seems inevitable to me. In fact we've used the DGC payment feature, but recently stopped for a variety of reasons. It had not been used very actively anyway because of Gresham's law—that bad money drives out good. In today's world, people would rather spend fiat currency as a form of payment and save their gold and silver. That's a good thing, for now, but that will change as fiat currency itself becomes less trusted and ultimately collapses.

James Turk, a renowned authority on gold and the precious metals markets, is founder and chairman of GoldMoney®, patented gold-based electronic money—digital gold currency (DGC)—that's transferred over the Internet. In vaults in London, Zurich and Hong Kong, GoldMoney.com stores more than $2 billion worth of precious metals bullion, including platinum and palladium as well as gold and silver, for customers located in more than 100 countries. In August 2009, Turk's Freemarket Gold & Money Report, which began in 1987 as a subscription-based investment newsletter, completed a transformation to become a free, web-based commentary. Accordingly, its name changed to the Free Gold Money Report (FGMR).

Turk is also a director of the GoldMoney Foundation, a nonprofit educational organization dedicated to providing information on the role of gold and silver as money and currency and their importance to society. Co-author of The Collapse of the Dollar, Turk has specialized in international banking, finance and investments since his 1969 graduation from George Washington University with a Bachelor of Arts degree in international economics. He began his business career with The Chase Manhattan Bank (now JPMorgan Chase), which included assignments in Thailand, the Philippines and Hong Kong, followed by several years with a prominent precious metals trader's private investment and trading company, and, based in the United Arab Emirates, several more years managing the Abu Dhabi Investment Authority's Commodity Department.

Information on the Cambridge House conference is available here.

Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE:

From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.