We're not there yet! Federal Reserve Chairman Jerome Powell was relatively hawkish at his last press conference, as Fed members predicted another hike this year and raised their forecasts for rates next year. More importantly, rates on long bonds moved up as the market faced an onslaught of Treasury issuances and a shortage of buyers.

These latest developments hurt bonds, stocks, and gold, all closing down into the quarter's end. Looking ahead, however, we see an economy accelerating on the downside and inflation set to move back up as the impact of higher oil prices works its way through all goods in the stores.

That combination is the dreaded stagflation, typically a positive environment for gold, if not always for equities. As the economy slows and the government's debt service burden moves up, all ahead of a presidential election, the Fed will likely opt for caution.

Most Everything Was Down in the Quarter

Pretty much all assets and all markets fell during the last quarter, though some remain up for the year. Every major stock market (and most smaller ones) fell during the quarter, with the S&P down nearly 4% and global markets a little more. For the year, the S&P remains up over 11%, though only a handful of stocks drove the returns.

Gold, as we'll discuss separately, may still have some near-term risk but is set to outperform next year.

Global markets are positive less than 3%, led by the Americas and Europe, with most of Asia negative; global funds are up even less. Our global accounts were down for the quarter by 7.6% for our mid-risk growth account. Conservative accounts were down less and aggressive a little more. (Numbers are preliminary.)*

We underperformed because we owned none of the handful of high-flying U.S. stocks and were overweight Asia, as well as gold. More conservative accounts did better because of a high allocation to the well-performing and high-yielding Business Development Companies. Going forward, we believe there is considerably risk in the U.S. leaders, while China and Hong Kong look to be bottoming. Gold, as we'll discuss separately, may still have some near-term risk but is set to outperform next year.

Gold Succumbs at End of Quarter

Although gold itself held up well until the end of the quarter — it was still positive until last week but closed the quarter down 3.7% — the stocks fell exactly 10% (basis XAU Index), and are down for the year by virtually the same amount.

Rising interest rates and a strong dollar finally proved too much of a headwind for bullion, while there is a lack of interest in the stocks among generalist investors. We discuss our outlook later in this Review. Our gold accounts fell a little less than 9% for the quarter and 5.6% for the year to date.

The outperformance was due to selection among the seniors, avoiding the weakest, though the latest quarter also saw two of our largest holdings fall more than the market; we also had a couple of significant winners among our top positions, boosting overall returns.

We are well-positioned with a mix of senior miners, large and small royalty companies, and junior exploration companies.

Markets Looking To Fed

Much of the near-term outlook for both equities and gold stocks depends on future tightening by central banks. After the last Fed meeting, various Fed spokesmen did the rounds to reinforce the hawkish message, while the Fed members' projections (the so-called "dot-plot") are calling for another hike this year even as they revised upwards their projections for next year.

Bonds and stocks, as well as gold, all fell after Powell spoke, not only because of the "higher for longer" message but also because of the implication that inflation was not getting under control soon. The market seems to have gotten the message, with investor expectations of another hike this year moving up sharply after Powell spoke. According to the Fed Funds Futures, about two-thirds of investors are expecting another hike in December.

We are well-positioned with a mix of senior miners, large and small royalty companies, and junior exploration companies.

Of course, anything can happen between now and then: a government shutdown when the current agreement expires, improved inflation numbers, and so on. More importantly, perhaps, market rates have moved up and are likely to move up further. The Treasury is still playing catch up in bond issuance after the debt ceiling agreement in June, with perhaps as much as half a trillion additional bonds to be issued this year.

That will withdraw liquidity from the economy, hurting asset prices. This comes as traditional key buyers, including the Federal Reserve itself, and China, Japan, and Russia are not buying, requiring higher rates to attract new buyers.

In addition, almost one-third of all Treasuries outstanding will mature over the next 12 months, requiring the Treasury to roll over at today's higher rates. In addition to higher interest rates, the Fed is also reducing the size of its balance sheet, down a little less than $1 trillion since the March 2022 peak. If this sounds impressive, the balance sheet is now back to its level of mid-2021 and far higher than it was pre-covid. Nonetheless, it is tightening. And when fiscal policy is loose and monetary policy tight — as now — the likelihood is for strong inflows into the dollar. We saw this in the first few years of Reagan's presidency.

Long Rates Will Stay High

Beyond this year, however, conditions are likely to change. The U.S. economy is moving inexorably and ever more rapidly towards a recession at the same time as CPI numbers will rise again as the recent jump in the oil price flows through to most goods in the stores.

That combination — stagflation — would suggest a fundamental change in favored asset classes. Historically, in stagflationary periods, the winners are gold and gold stocks. Next come other resources and smaller global equity markets.

Major equity markets are less positive but mixed, often falling initially and rallying later in the period. A slowing economy ahead of the election, even if inflation has not been extinguished, suggests the end of hiking, particularly as payments on the Federal debt are rising sharply. It is important to note that while Fed members have increased their forecasts for rates next year, they are still predicting, in aggregate, at least one interest rate cut next year. Only two out of 19 members are not predicting a cut next year, and the median of members' expectations is for two cuts next year.

This does not mean that long rates will necessarily decline. With the federal debt at $33 trillion, there is a lot of Treasury issuance ahead. In addition to the new Treasuries to finance the new debt, there is still another $5 trillion of debt maturing in the balance of this year that needs to be rolled over, according to Bloomberg, and another $4.5 trillion next year. Financed at today's 5% plus rates, just the maturing debt would cost almost half a trillion in additional annual servicing interest. Rates on Treasuries will likely stay elevated unless the Fed steps back in and starts buying again.

Economy Close to a Recession After Policy Lag

Higher rates and prices are having their effects on the economy. Establishment economists, mostly in government and academia, who have gone from a "soft landing" scenario to "no landing" are delusional. They are ignoring the famous lags with which monetary policy works.

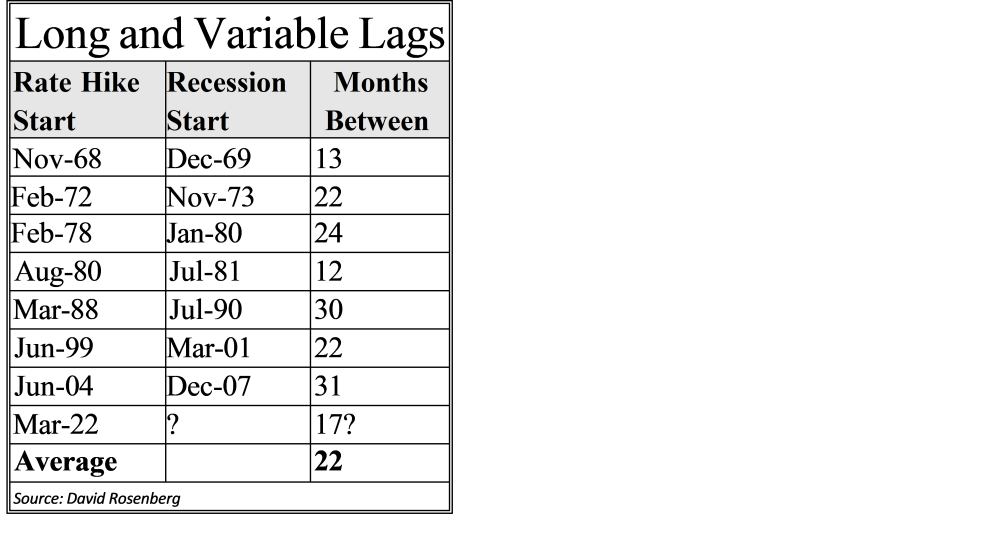

As can be seen in the table nearby, the average number of months from the first rate hike in a tightening cycle until the onset of recession in all U.S. recessions since the late 1960s is 22 months. We are not even 18 months yet since this cycle started, and although the pace of rate hikes has been unprecedented, it follows a long period of easy money during which households and particularly businesses were able to extend debt maturities at ultra-low rates.

These moves provide a longer runway before this debt has to be rolled over. But signs of a deteriorating economy abound in housing (mortgage applications, new home sales, and pending sales all down in the latest figures), in durable goods (negative in real terms), and in manufacturing (flat per the PMI report), but is most evident for the consumer.

Personal consumption "unexpectedly collapsed" in the second quarter, according to newspaper headlines, dramatically underperforming expectations. Even if consumer spending is still increasing, it is doing so at a rate far lower than recent CPI increases, meaning the consumer is retrenching as savings collapse and credit card balances and defaults explode. Automobile financing delinquencies are back to the record levels of the 2008 credit crisis.

For all but the top 20% of earners, the consumer is struggling, with one-third living paycheck to paycheck. No wonder consumer confidence and expectations are falling sharply in recent surveys.

Reliable Indicators Point to a Recession

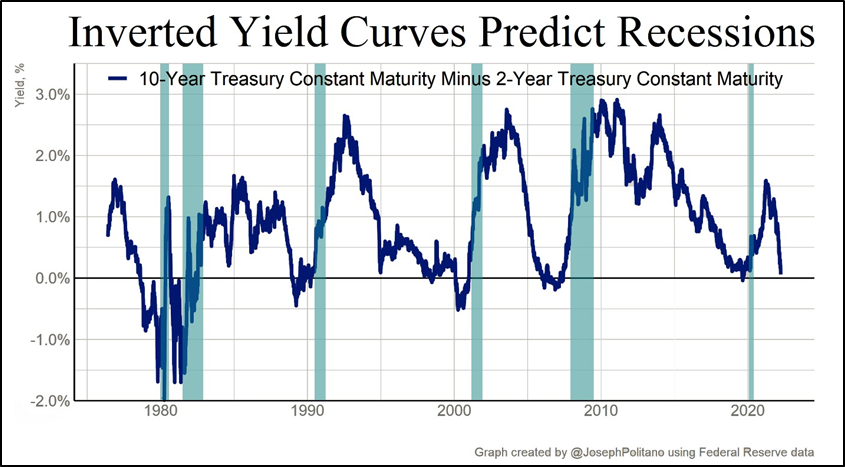

Technical indicators are indicating a recession, particularly the Conference Board's Leading Index, which has now been negative for 17 consecutive months. The last time there was such a long string started in early 2006 and culminated with the great financial crisis. Similarly, the yield curve is often inverted for well over a year ahead of the onset of recession.

That these two powerful recession Rate Hike Start Recession Start Months Between Nov-68 Dec-69 13 Feb-72 Nov-73 22 Feb-78 Jan-80 24 Aug-80 Jul-81 12 Mar-88 Jul-90 30 Jun-99 Mar-01 22 Jun-04 Dec-07 31 Mar-22 ? 17?

That these two powerful recession Rate Hike Start Recession Start Months Between Nov-68 Dec-69 13 Feb-72 Nov-73 22 Feb-78 Jan-80 24 Aug-80 Jul-81 12 Mar-88 Jul-90 30 Jun-99 Mar-01 22 Jun-04 Dec-07 31 Mar-22 ? 17?

Average 22 Long and Variable Lags Source: David Rosenberg Page 4 predictors have been flashing red for such long periods, which does not mean they are broken. An inverted yield curve has forecast each of the last seven recessions, back to the 1960s, without a single false positive.

Again, these indicators work with lags all the longer because of the long period of easy money before they turned negative.

Most Economies Slowing as Rates Rise

Much the same story is being played out in other major economies around the world. In Europe, as the ECB continues to tighten, the consumer is struggling, and Eurozone Economic Confidence has fallen to its lowest level since late 2020. Sweden, Turkey, Australia, and more have all raised rates recently, while Japan and the U.K. both kept rates where they were. In the former, two-year JGBs now yield 0.76%, not a lot, but it's a 10-year high.

In the latter, since inflation came in lower than expected after a period of high numbers, the Bank of England took its opportunity not to raise rates again, given some sectors of the economy (including residential housing) are responding very negatively to previous rates. Everywhere one looks, key economic indicators are deteriorating; exports have fallen in Japan, Taiwan, and Singapore (ex-oil), all three export-heavy economies.

Even though many emerging markets are not raising rates, the global tightening along with a strong dollar is putting pressure on emerging markets, with a record number of sovereigns now distressed. Many global countries, of course, like the U.S., continue to employ fiscal stimulus even while tightening.

And China continues to inject liquidity in the face of a sharply slowing economy and a real estate bust.

Risk in Stock Markets Increases

Economic realities finally caught up with global stocks, with the U.S. and other major markets peaking at the end of July. For more than a decade after 2009 and the onset of global monetary easing, stock markets rallied, despite various headwinds, on the TINA principle: "There is no alternative."

With Treasury bills now yielding 5%, there is an alternative, adding to very real risk of holding equities. It should also be noted that stocks continuing to move up, despite more than a year of tightening, does not support the "no landing" scenario at all. In the last five hiking cycles, stocks continued to go up until the very end.

Page 5 Sentiment has dropped sharply at the end of the quarter; the AAII survey, for example, had bulls at only 28%. Such a negative reading after a market decline suggests a rally is possible. We do not expect such a rally to be particularly strong or long-lasting, and over the medium term, the risk is on the downside. We covered most of our market shorts last week and would look to re-establish them after a rally.

Earnings to Decline Next 12 Months

In the months ahead, we are likely to see growth faltering at the same time as inflation moves back up, even as many corporations have to start rolling over debt. The last of these will have varying impacts on companies, depending on how much debt they have and when it matures. But in aggregate, it will have a negative impact on earnings.

Consensus estimates, however, are for earnings to increase, albeit modestly. With the S&P trading at a high 19.5 times p/e ratio, there is room for both earnings and the multiple to decline, giving stocks a double hit. In a weakening economic environment accompanied by inflation, S&P earnings of 200 is not an aggressively bearish call (they are now just under 220).

Although we do not rule out a market crash, our base case is for a slower decline, with the erstwhile market leaders potentially falling sharply but with rotation into value and oil, so the market indexes overall decline more moderately. Much the same applies in broad terms to other major global markets, except that they are not starting from such high multiples. So long as the dollar remains strong, smaller markets will face a headwind as well, particularly if they have dollar-based debt.

The next move, when it comes, will be led by the smaller markets, particularly in Asia, as well as commodity exporters, but that move is not yet.

Small Moves in Commodities, Led by Oil

Commodity prices are up just over 3% in the quarter, led by oil and gas and some agricultural commodities. Oil (basis WTI) is up 30%, and other oil products, including heating oil and gasoil up even more. Among the metals, only aluminum, iron ore, and copper are up, through the last quarter, by a meager 1%, and that from a particularly depressed second-quarter end.

After a volatile year, it's down, also by just over 1%. We remain very bullish on copper in the longer term, but a slowing global economy, particularly in China, amid rising rates, will hurt demand. After trending down in volatile trading for the first half of the year, oil took off as Saudi Arabia made moves to reduce output. The report on the last day of the quarter that Saudi Arabia was seeking a stronger military agreement with the U.S. as a price for a treaty with Israel led to suggestions that this could mean more cooperation on the oil price and, potentially, a stalling of the advance to de-dollarization of global trade.

Oil fell from its $95 peak on Thursday as rumors spread, closing under $91. If the Saudis ease their production cuts, the price can fall a lot more. They will need to do it soon, given that global inventories are down sharply, with a potential supply deficit of 3 million barrels a day, according to Bloomberg.

Exploration Down

Over the last decade, U.S. production has increased while the rest of the world has declined. But exploration globally, including in the U.S. has declined over that period, leading to reserves halving. Some 75% of global production is from government-owned companies, which are not only typically inefficient but, in many parts of the world (Venezuela, Mexico), constrained for capital spending.

This is one reason that U.S. production has been able to move ahead. But many U.S. fields, particularly onshore shale, have peaked, and companies are subject to the war on fossil fuels, whether from this administration restricting licenses or halting pipelines or from large funds with ESG agendas.

Renewable Can't Replace Fossil Fuels, Not Yet

The plain fact is that for the foreseeable future, and well beyond the ludicrously near-term and arbitrary "net zero" deadlines of many Western countries, fossil fuels will continue to play a dominant role in the world's energy needs, certainly until there is a broad nuclear renaissance. If one considers that the $3.6 trillion spent on renewables such as wind and solar over the last decade has seen the amount of energy derived from fossil fuels decline from 82% to 81%, one can see the huge amounts of capital that would be required to bring that down to 50%, let alone zero.

And those simple numbers don't even begin to tell the whole story: the low energy efficiency from renewals, as well as the fossil fuels that must go into the infrastructure for renewables. So fossil fuels are here to stay for the foreseeable future, but the oil and gas stocks, notwithstanding a modest rally in the last quarter, are grossly underinvested. In the last 12 months, flows into energy have dropped more than 15% after sharp declines in earlier years.

Although we are long-term positive on the sector, there are three factors that could see lower prices: Saudi could reverse its quota cuts; nations from Russia to Iran to Venezuela could see a return to world markets; and on the demand side, a global economic slowdown would lead to a reduction in demand. So, while we have taken some short-term trading positions in both oil and gas, we have not built large long-term positions yet.

Gold Could Fall More Before Year End

Although gold is down less than 4% in the last quarter — and still up on the year — it was the suddenness of the recent decline, after it had moved strongly close to new highs, that has frustrated investors. As mentioned, it was the relentless tightening and threat of more to come, as well as the strong dollar to which gold finally succumbed.

There are risks of even lower prices before the end of the year. Another Fed rate hike would likely hurt gold despite growing expectations of one. On the other hand, the Fed is unlikely to hike during a government shutdown, while the automobile strike might suggest caution. And, of course, if inflation numbers move down again, that would provide the reason to pause.

Next year, the Fed is unlikely to hike rates as the economy slows going into an election. We are very close to the point where conditions will favor gold. If the Fed blinks even as the inflation numbers are moving back up, that would be very positive for gold. Meanwhile, investor sentiment is extremely negative; gold ETFs continue to see larger outflows. From a contrarian point of view, that suggests that the eventual rally will be all-the-more strong. Retail interest is Page 7 higher, as evidenced by Costco now selling one-ounce gold bars, which the company says typically sell out "within a few hours."

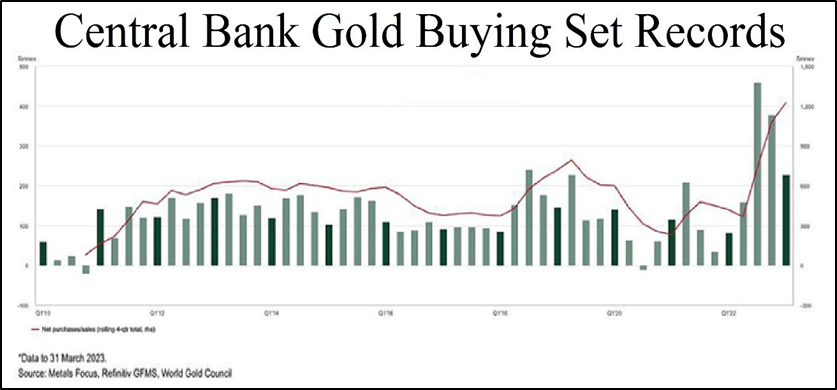

But larger investors seem uninterested in gold and gold stocks, other than, of course, some central banks, whose buying over the past year — at 73-year highs — has been responsible for holding up the gold price. Banks as disparate as those of Poland and the Czech Republic, Singapore, and China were heavy buyers. But net buying was already slowing in the second quarter as Turkey undertook massive sales, though that was all released to the local market as imports were constrained.

The latest data (for July) suggest a slowdown in the pace of buying. A pause in central bank buying, rather than any selling, could have led to gold's recent decline.

The Stocks Are Compelling Value

The sharp drop in the gold price last week dragged the stocks down even further to where many are compelling value. We could look at many indicators of value. For one, the GDXJ ETF is four standard deviations below the level implied by a 10-year regression model, a measure of price rather than value, to be sure, but an unusual occurrence.

The seniors continue to trade close to multi-decade low valuations on many metrics. Of course, if gold falls further, the stocks are likely to follow, but given current valuations, they will not fall far. We are close, in terms of price and time, to the lows, and today's prices will look very good a year or two from now. This is true across the sector, from senior miners to small exploration companies.

Overall, we remain increasingly cautious on global equity markets, with risk outweighing potential additional gains from here. We continue to hold a handful of global blue chips, as well as high dividend-paying stocks in the U.S. and other selected markets.

We also look for opportunistic buys or selling puts on stocks that are temporarily depressed, but we are also buying short-term Treasuries to earn a yield while we wait. Most of our holdings, however, continue to be in gold and other resources.

Review of Individual Accounts

Global Accounts

We remain cautious on global equity markets, though we have added a couple of new holdings. Our cash has increased a little to around 4% on average, though more for conservative accounts (22%) and less for aggressive accounts.

Notwithstanding our general caution, exposure to global markets picked up to a still-low 6%, while our allocation to U.S. high-yielding equities remained at just under 10% despite some changes and trimming of positions. We continue to hold large allocations to gold, other resources, and special situations.

Bought two new companies After a long period with no new global buys, we found two attractive companies this quarter, which we have bought for some client accounts where appropriate. The first is a major Swiss chocolate company with growth potential after a series of mishaps depressed the stock price, and the second is a Malaysian maker of sterile gloves and other products for highly controlled environments.

Pursuant to SEC instructions, we cannot provide names, unfortunately. The first is rather illiquid, and the second is an emerging market, so we have not bought across all global accounts.

Trimming BDCs

We sold one Business Development Company after disappointing results suggested trouble ahead, but we have started adding another, more conservative one with a yield of almost 10%. We have also trimmed some holdings on rallies, given the volatility of the sector and given that the stocks can be vulnerable at the onset of a recession.

We will buy back if the opportunity arises for long-term above-average income. Though we recently sold most of our market shorts, anticipating a near-term rally, we have gone long volatility by buying the VIX and will also look to buy back shorts after a rally.

Going forward, we expect to raise cash even as we search global markets for good values, preferably companies with solid dividends. We also expect to maintain our allocation to gold and other resources, both as hedges on accounts and for above-average potential in their own right. Though this year has been painful, we are well-positioned for the stagflationary environment that lies ahead.

Gold Accounts

Our gold accounts remain fully invested, with exposure across the sector. There has been a slight reduction in exposure to the senior producers, partly because of one sale and partly because in a weak market, the more-liquid senior stocks are usually sold first.

But allocations across the sector remain broadly where they have been: a little less than 30% in senior royalties and producers, 7% in intermediates, 30% in juniors and exploration, and a little over 30% in silver and other resources.

New Exploration Buys

After no new buys for six months, we have added two new exploration companies, both with projects in North America. Because they are very thinly traded, we have been buying very slowly.

We also returned to a development company that may soon undertake a joint venture that should see the stock move. This stock is very leveraged to the gold price, and we sold earlier at higher prices amid no news on the long-awaited transaction.

Most buying during the quarter, however, was focused on a handful of our favorite companies, both major producers and exploration companies, taking advantage of low prices in most cases to add to positions. We also added to a favorite junior royalty company, one of whose assets is seeing tremendous growth in resources.

Constantly Upgrading Portfolios

To make room for the new buys, we sold some laggards, but selling was at the margin, resulting in an upgraded portfolio. We had just one broad sell, per above, a U.K.-based producer with some Russian assets that delisted from the London Stock Exchange. (No prize for guessing, but again, we cannot name the company.)

Looking ahead, we expect to remain fully invested, always taking opportunities to trim from gainers or sell laggards to raise cash for new buys. We have a solid allocation to the best of the major companies that will be the first to move when gold turns while also holding several smaller companies with shorter-term potential.

After a difficult few months, we expect next year to be a year when gold shines, and the gold stocks come into their own.

Resource Accounts

Our resource accounts remain fully invested, while our largest weightings continue to be to gold, silver, copper, and gas. However, we are very broadly exposed across the sector, mostly through diversified royalty companies or exploration, which accounts for a quarter of portfolios and gives exposure to everything from phosphate to lithium.

During the quarter, in addition to the gold and silver company mentioned under our "Gold Accounts" discussion, we have also sold our uranium stocks into the rally. We look to buy back on any pullback. Our buying has mostly been on adding to our favorites on depressed prices and to short-term special situations (a convertible on a large silver company or an undervalued phosphate company, for example).

These tend to be shorter-term investments, and over the next 12 months, we expect to be selling one or two of these. We also added incrementally to our oil & gas, with one global major and another U.S. gas company. As per our discussion above, we are not yet ready to be aggressive in this sector.

Going forward, we anticipate continuing to be fully invested and emphasizing gold and other commodities less exposed to a global economic slowdown. As with the gold accounts, our holdings include some major miners and royalty companies as well as exploration and special situations. Where authorized, we are also selling puts on our favorite companies where premiums are very attractive right now. Though demand for some metals will be hurt by a global slowdown, the longer-term outlook for most is very favorable, with both growing demand and potential supply shortfalls, the result of a decade of underinvestment in the sector.

In sum, we are increasingly cautious of global stock markets. Although we are looking for opportunities, particularly in the smaller markets, we are moving slowly, given the strength of the dollar. Most recent buying is adding to favorites on dips or special situations. Accounts also continue to have a high weighting to gold. We expect cash in accounts to increase, particularly in the global accounts.

Want to be the first to know about interesting Gold, Critical Metals, Base Metals, Silver and Oil & Gas - Exploration & Production investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.

Adrian Day Asset Management Disclosures

Adrian Day Asset Management (“ADAM”) is an SEC-registered investment adviser located in San Juan, Puerto Rico. ADAM and its representatives are in compliance with the current filing requirements imposed upon SEC-registered investment advisers by those states in which ADAM maintains clients. ADAM may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. (Note: Global Strategic Management, our legal name, is registered, or qualified to accept clients from all states and territories, including the District of Columbia.) A direct communication by ADAM with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of ADAM, please contact the SEC or the state securities regulators for those states in which ADAM maintains a notice filing. A copy of ADAM’s current written disclosure statement discussing ADAM’s business operations, services, and fees is available from ADAM upon written request. (Note, all clients receive this document prior to opening and account and are offered it annually.) ADAM does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party and takes no responsibility therefor. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Past performance may not be indicative of future results. Therefore, there can be no assurance (and no current or prospective client should assume) that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended or undertaken by ADAM) made reference to directly or indirectly by ADAM will (i) be suitable or profitable for a client or prospective client’s investment portfolio or (ii) equal the corresponding indicated historical performance level(s). Different types of investments involve varying degrees of risk. Historical performance results for investment indices and/or categories generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, or the impact of taxes. (Note, any performance number provided for Adrian Day Asset Management accounts is after the deduction of all transaction costs and fees.) The material contained herein is provided for informational purposes only and does not constitute an offer to buy or sell or a solicitation of an offer to buy or sell any option or any other security or other financial instruments. Certain content provided herein may contain a discussion of, and/or provide access to, ADAM’s positions and/or recommendations as of a specific prior date. Due to various factors, including changing market conditions, such discussion may no longer be reflective of current position(s) and/or recommendation(s). Moreover, no client or prospective client should assume that any such discussion serves as the receipt of, or a substitute for, personalized advice from ADAM, or from any other investment professional. ADAM is neither an attorney nor an accountant, and no portion of the content provided herein should be interpreted as legal, accounting, or tax advice. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if ADAM is engaged, or continues to be engaged, to provide investment advisory services, nor should it be construed as a current or past endorsement of ADAM by any of its clients. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser.

*Please note: Past performance is no guarantee of future results. For complete information on our past performance, including factors

to be considered in viewing past performance and other disclosures, please contact our office. Specific stocks mentioned herein are

intended solely as illustrative of strategies and types of stocks we are buying or selling and are not intended as indicative of entire

portfolios or of any individual client's portfolio. The numbers mentioned represent our composite averages. They represent all accounts

that fall within the stated objectives and have the ability to buy and sell options; they exclude accounts under $25,000 and accounts with

significant limitations or restrictions that would make them unrepresentative of the account type. Performance figures for composites

reflect the deduction of administrative fees but do not take into account any performance fee that may be charged for the period stated.

The performance of any individual stock or stocks does not take into account fees. Performance numbers include dividends; dividends are

not reinvested. Commissions charged may vary depending on the brokerage firm at which an individual account is held. All accounts are

managed individually and are, therefore different, even within the same broad objective. Factors such as an individual's circumstances, the

size of the portfolio, and the time the account is opened can affect specific buy and sell decisions. Factors such as price movements and

security liquidity can affect whether any trade is made for all accounts. Global Strategic Management, an SEC-registered investment

advisor, does business as Adrian Day Asset Management.