Recent breakthroughs have just let scientists and researchers tap into the hidden powers of 17 unique elements. The science to discover the true potential of these dynamic elements is only in its infancy; but already, it's becoming the driving force behind a brand new technical revolution.

Some consider these elements to be a whole new investment class. Others call it a fad. But, temporary mania or not, prices of these technology metals are soaring. And investors are just now starting to see real profits.

The elements I'm talking about are the rare earth elements.

It's seldom you hear about them in the mainstream financial media. But rare earth elements (REEs) are a vital component in most of the technology we use every single day.

It's seldom you hear about them in the mainstream financial media. But rare earth elements (REEs) are a vital component in most of the technology we use every single day.They're required for the production of everything from cell phones, computers and rechargeable batteries. . .to iPods, GPS units, televisions, speakers, magnets, fluorescent lighting and much more. . .

The automobile industry alone uses tens of thousands of tons of rare earth elements each year in the manufacturing of catalytic converters.

Meanwhile, the U.S. government has recently become very interested in REEs for advanced military technologies such as missile guidance systems.

As the demand for newer, faster and better technologies will no doubt continue to rise in the future, so too will demand for the raw rare earth materials needed to create them.

But there's a slight problem.

And it isn't that these elements are necessarily "rare."

And it isn't that these elements are necessarily "rare." The trouble is, approximately 95% of the global supply of rare earth elements comes from just one country: China.

And because the country needs these vital metals to maintain its position as the world's leading exporter, China might be preparing to stop exporting these strategic elements altogether.

Over the last eight years, China has reduced the amount of rare earths available for export by nearly 50%. Some suggest it'll simply cut off all supply by 2012.

Back in January 2010, London-based newspaper The Independent helped bring the rare earth story to the mainstream with a report stating:

Industry sources have told The Independent that China could halt shipments of at least two metals as early as next year and that by 2012 it is likely to be producing only enough REE ore to satisfy its own booming domestic demand, creating a potential crisis as Western countries rush to find alternative supplies and companies open new mines in locations from South Africa to Greenland to satisfy international demand.

China pulled back global rare earth exports by 72% during the second half of last year. And, in the first six months of 2011, REEs from China have dropped another 35%.

These cutbacks have sent rare earth element prices soaring higher.

The price of europium oxide—used in florescent light bulbs, TVs and smart phones—has nearly tripled from $35–$96/oz. in the past three weeks alone.

Meanwhile, dysprosium oxide—used in magnets, wind turbines and computer hard drives—has more than doubled from $20–$42/oz.

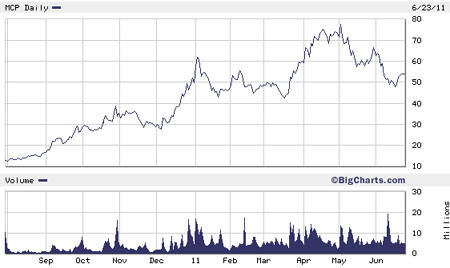

Rapidly rising prices have boosted share prices of the few public companies that have mineable rare earth projects outside of China. Take Molycorp (NYSE: MCP), for example. . .

Molycorp owns the world's largest, most fully developed rare earth project outside of China. Shares of MCP have run up over 300% since the company went public in August 2010.

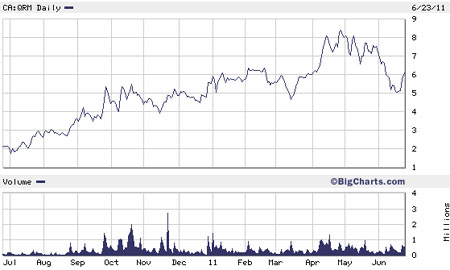

Meanwhile, companies with rare earth exploration projects like Quest Rare Minerals Ltd. (TSX.V:QRM; NYSE.A:QRM) have shared gains of nearly 200% with investors over 12 months. Take a look:

While companies with rare earth assets continue to perform well and draw new investment attention, there's a new way to invest in REEs that has everyone talking about—rare earth bullion.

How to Buy Rare Earth Bullion

After doing a bit a research, I've found two companies that sell rare earth bullion to the retail market.

The first one, Metallium, Inc., is geared more to collectors, schools and universities, researchers and jewelers. However, London-based Rare Earth Bullion is targeting investors.

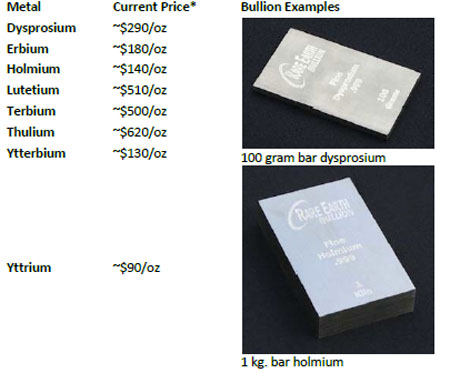

Rare Earth Bullion is a brand new company that offers certified .999 pure-metal rare earth bullion bars. The company doesn't sell all 17 elements, but rather focuses on investments in eight of the "heavy" rare earth elements, a subcategory of REEs that are in highest demand.

Rare Earth Bullion's selection and approximate current prices in U.S. dollars per ounce follow:

*These prices include taxes and are based on REB's current price for 100-gram bars. Buying larger bars is cheaper overall. Metal prices change daily, as do conversion rates between the British pound and USD. The prices listed above are simply to give U.S. investors an idea of REE prices compared to current gold and silver prices, which are $1,525/oz. and $35.25/oz., respectively.

Rare Earth Bullion says:

We firmly believe rare earth metals will outperform precious metals going forward. They have the same benefits as precious metals being that they are a physical commodity with finite supply. Unlike gold and silver, they do not have monetary status. Much like precious metals they will rise in price with inflation (like most commodities) and also appreciate in value as the USD weakens.

I'm not so sure I agree the rare earth elements will outperform gold and silver. But there is one thing I am absolutely sure of. . .

Before you go off betting the farm on ytterbium, dysprosium or any of the other impossibly pronounced metals, there's one major factor to consider: Liquidity.

The rare earth element market is as illiquid as the market for Pat Boone vinyl records. It's dry. Buying rare earth bullion is as easy as ordering anything else over the Internet. But finding another interested investor to sell it to when it comes time to turn a profit is another thing entirely.

In fact, unlike most precious metal bullion dealers, even Rare Earth Bullion won't buy your metal back. The company says it has plans to develop a buy-back mechanism in the future. However, at present, you'd have to find another private investor to which to sell your rare earth bullion.

So, if you're going to invest in a physical metal, I still recommend going with gold or silver for now.

But that doesn't mean you can't—or shouldn't—take advantage of soaring REE prices.

Perhaps a Better Way to Invest in Rare Earth Elements

You've already seen rare earth equities like Molycorp return a 300% gain and Quest Rare Minerals yield a 200% profit in under 12 months. But if you're looking for an easy way to get general exposure to rare earth elements, there's an ETF.

The Market Vectors Rare Earth/Strategic Metals ETF (NYSE: REMX) is a composite of 28 international rare earth companies. This ETF has performed ok, returning 28% since its inception in late October 2010—though not as well as individual stocks like MCP or QRM.

With global supplies dwindling from continued reduction in Chinese exports, rare earth elements offer quite an attractive risk/reward potential. But I recommend investors to shy away from investing in physical rare earth metals at this point. Investing in rare earth stocks is way easier and often way more profitable in the end anyway.

Good investing,

Luke Burgess

Analyst, Wealth Daily

Investment Director, Hard Money Millionaire and Underground Profits