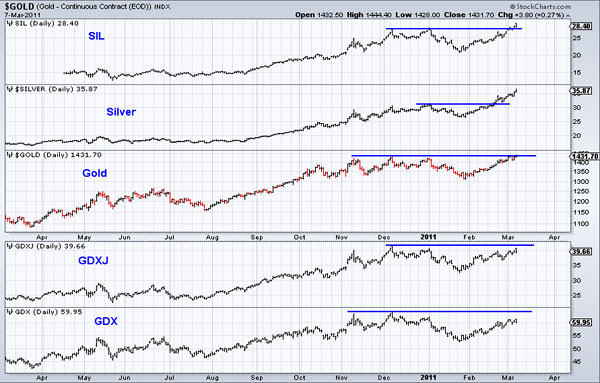

Silver has been the clear winner as it broke out first while the large and junior silver shares would break out later. Note how gold has yet to breakout and how GDXJ and GDX have yet to test recent highs. We believe the lack of a breakout in gold and the gold shares is a warning sign for silver. Rather than a breakout that initiates an impulsive advance that lasts for months, this breakout in silver could be potentially dangerous for those jumping in at these levels.

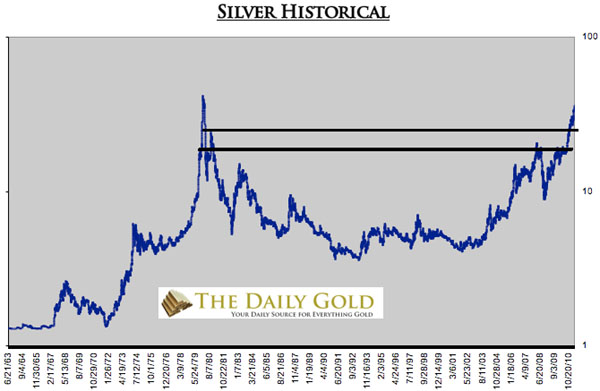

Take a look at the historical chart of silver. The advance past $22/oz. and $25/oz. was obviously a major breakout. There is some supply at $35–$40. A break past $40, would lead to a blow-off top. Silver closed near $36 on Monday.

Though we are cautious in the short term, we note the very bullish cup pattern that dates back to 1980. Yet, the cup often includes a consolidation (the handle). Silver is overbought and will need time to digest the recent gains. Moreover, the inability of gold and gold shares to break out lends questions to the sustainability of recent gains in the silver complex. The last time we had this bifurcation was in early 2004. Gold and silver would consolidate for more than a year before breaking to new highs in late 2005. Are we saying that will happen again? Not necessarily.

This is a raging bull market that has many years to go. Yet, the veterans know that shakeouts can be brutal. What exactly do we see in the near-term and how are we playing it? Consider a free trial to our 14-day service.

Good Luck!

Jordan Roy-Byrne, CMT

[email protected]

Subscription Service