Napoleon supposedly maintained that he would rather his generals be lucky than skillful under the interesting theory that you can beat skill but you can never beat luck. Avrupa Minerals Ltd. (AVU:TSX.V) has been displaying a lot of skill with their latest drill results in Kosovo of 3 meters of 38.7 g/t Au in hole SLV058. As luck would have it, potential investors will have the chance to buy Avrupa on sale for the next five weeks due to warrants expiring soon.

Avrupa is a Canadian junior focused on projects in Europe. They use a project generator model. They pick up likely looking projects that fit their model and vend them to partners who get a big piece of the project and spend all the money. Avrupa keeps a small piece of each project but doesn't spend money.

In the very earliest stage of new bull markets the medium size in-production companies go up the most. A good example would be Silvercorp that sold for $0.60 a share in January and is now $4.54 for a 650% gain in 8 months. Project generator companies are among the last to get on board the train because their deals take years to show benefits.

Avrupa, however, has the advantage of being around for some time and has deals now showing the fruits of investment during the wave of terror in the junior mining space. As markets improve, project generators will regain the respect and valuation they had back in 2011 at the top of the market. With just over a $10 million market cap, Avrupa has a lot of room to run.

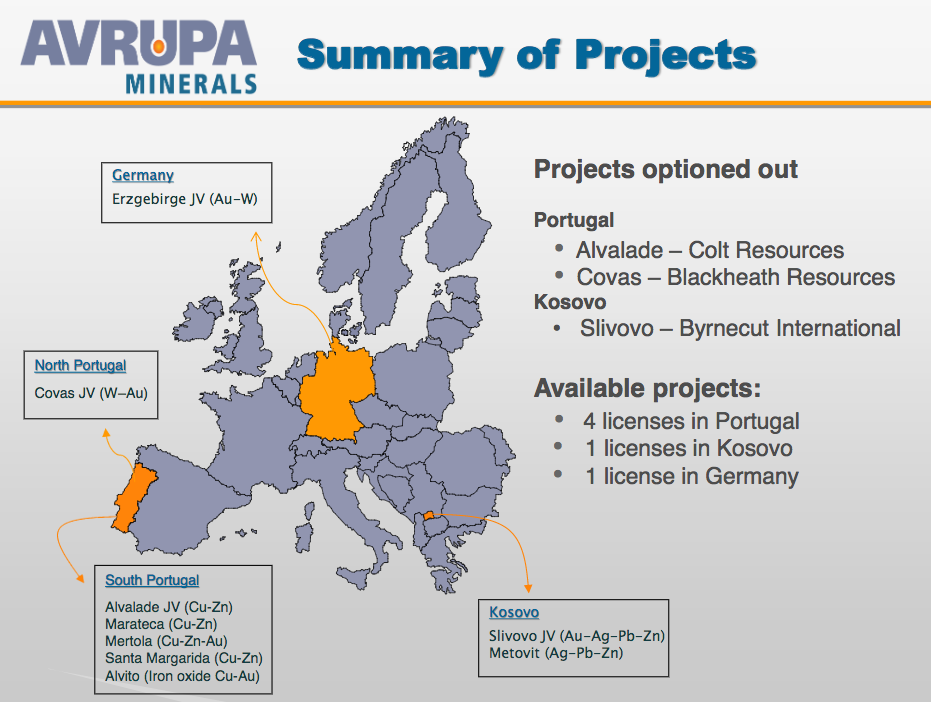

Avrupa has a joint venture with Colt Resources called the Alvalade copper/gold project in the Iberian Pyrite Belt. They have a tungsten project in the north of Portugal with Blackheath Resources named the Covas Joint Venture. And the superb gold assays just released came from the Slivovo gold property in central Kosovo. Avrupa also has 85% of a gold project in what was East Germany in the ancient Erzgebirge mining district. Mining took place in Erzgebirge as early as 2500 BC and provided much of the tin used in the Bronze Age.

The single most significant project right now has to be the Kosovo Slivovo Gold property. An Australian company named Byrnecut International Ltd. will fund the project to a PFS (prefeasibility study) to earn 85% of the project. The PFS must be complete by April 10, 2017, to finish the earn-in. The local company owned by Avrupa is named Peshter Mining and it is completing all the requirements for a mining license that will be submitted by Q2/Q3 of 2017.

While the Slivovo project only has a 43-101 gold resource of about 100,000 ounces, the recent drilling has opened up an entirely new zone of high-grade mineralization. Avrupa's partner is a major Australian mining contractor who is doing the PFS and an updated resource. The general plan is to start with an open pit mine and mill and go underground after more drilling. The partner has spent in excess of 3.5 million Euros so far. With a 40% unemployment rate in Kosovo the government is going out of their way to make permitting a smooth process. The required infrastructure is nearby.

The 2nd most advanced project of Avrupa is called the Covas Tungsten property and is located some 100 km north of Porto in the north of Portugal. Avrupa is in a joint venture with Blackheath Resources. Blackheath has so far earned 75% of the project. In April of 2015 the company released an updated 43-101 that showed an in-ground resource of about $200 million of tungsten. The specific grades and tonnage are in the report above but there was a mine at Covas before and with that value of tungsten, there probably will be a mine again.

The downfall of project generator companies is that it's really hard to put a value on the company. Avrupa has three major joint ventures now that are progressing and an additional six in the wings ready for either the company to advance themselves or to JV out. Rarely does a company holding multiple projects get much value beyond their first project and perhaps half the value of the second and none for the rest of the stable. So valuation is relative and in the mind of the beholder.

I don't know what Avrupa is worth. The company has sold for as little as $0.075 for one day earlier in March and hit a high of $0.25 in mid-August. I'm going to presume both those prices reflected the general market for juniors this year with the low in March and the high five months later. Many juniors have gone up 200–300% from their lows so presumable the $0.25 price in August reflected a reasonable price. But and this is a big BUTT, the company has about 2.5 million unexercised warrants outstanding at $0.15 that expire on September 24th of this year. That's an artificial roof for the stock. Every time the stock gets up to $0.17 or higher, warrant holders are going to be dumping shares to exercise warrants, (1) to make a few cents and (2) to put some much needed money in the treasury. And there are another 2.8 million warrants at $0.15 due to expire in October.

If the company has any sense and I know management and I know them well, they will be putting out all the good news they can over the next five weeks. Meanwhile my opinion is that the company shares are on the sales table and come the middle of October there will be a reasonable bounce as soon as the selling pressure is lifted.

Avrupa is an advertiser and I am biased. Their presentation is excellent and informative and should be viewed. The stock is fairly tightly held with over 50% in the hands of about eight investor groups and management. Please do your own due diligence.

Avrupa Minerals

AVU-V $.15 (Sep 09, 2016)

AVPMF OTCBB 69.7 million shares

Avrupa Minerals website

Bob and Barb Moriarty brought 321gold.com to the Internet almost 14 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 820 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) The following companies mentioned in the article are sponsors of Streetwise Reports: Avrupa Minerals Ltd. The companies mentioned in this article were not involved in any aspect of the article preparation so the expert could write independently about the sector. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

2) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. Avrupa Minerals Ltd. is an advertiser of 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.