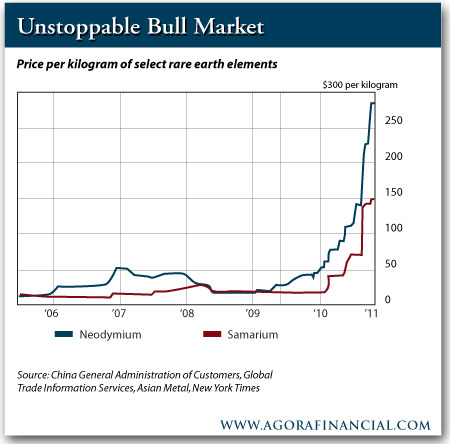

Amidst the longest commodity boom since 1997 (see chart), the hottest commodities currently have neither a corresponding ETF, nor a futures market. But there is a way you can still make money in what appears to be an aggressive uptrend:

The blue line represents the price of neodymium—used in everything from portable headphones to hybrid cars. The red is samarium—an essential metal for precision-guided missiles.

Both are rare earth elements (REEs) under the tidy production grip of China. You'll recall China slashed REE quotas 35% at the start of this year. . .on top of a 40% cut last year. World prices for many of these minerals have doubled in 2011—on top of a fourfold increase last year.

New developments appear to show this trend is with us to stay.

Attempts to break the Chinese stranglehold are smacking head-on into obstacle:

- Lynas, an Australian firm, attempted to open the world's largest rare earth refinery in Malaysia but ran headlong into stubborn regulators. An operating permit is being withheld as protesters raise alarms about the rare earth ore's radioactive contamination (which is naturally occurring) and low level. Approval has been delayed for six months.

- Toyota's running into its own regulatory roadblocks trying to partner with companies to mine and refine REEs in Vietnam. (The deal was announced last fall, but now production won't get underway until 2013).

- In Japan, Dowa Holding's attempts to recycle REEs from old electronics are proving more difficult than thought. Its factory is up and running, recycling 19 metals—but no rare earths.

China has upped the ante, once again. As of April 1, new taxes on rare earth miners were imposed. What used to cost producers $0.50/kg. for a refined product now costs $8.