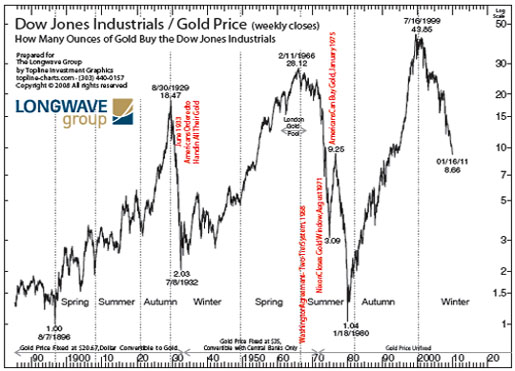

This is best demonstrated by a review of the Dow:Gold chart, which is the value of the Dow Jones Industrial Average divided by the U.S. dollar price for an ounce of gold. When the stock market and general stocks perform well, as in spring (1949–1966) and autumn (1982–2000), the ratio rises and at the end of the season reaches an extreme high. When the price of gold and the values of gold shares are the seasonal investment in favor (summer 1966–1980 and winter 2000–?) the ratio falls in value and reaches an extreme low at the season's finale.

In effect, what this means is that you should have to make only four investment decisions in your lifetime. You should be invested in the stock market and stocks other than those of precious metals at the beginning of the Longwave spring and autumn when the ratio reaches an extreme low and you should buy gold and gold stocks at the beginning of the Longwave summer and the Longwave winter, when the ratio reaches an extreme high.

So, you ask, "When will I change my investment strategy?" That's easy. I'll move my investment money out of gold and gold shares and into the general stock market when the Dow:Gold ratio reaches an extreme low. Previous extreme lows have been at 1/1. I'll be watching at that level, but I think this time the low is going to fall to something like 1/0.25 (the dollar value of 1/4 ounce of gold will be the same as the value of the Dow Jones Industrial Average). Why do I expect such an extreme low? I have two reasons:

- The high value of 43.85 set at the end of autumn was an extreme high and was 64% above the previous extreme high; I believe that one extreme always leads to another.

- All industrial nations are facing a major debt catastrophe due to printing massive amounts of paper money. This has led to an unprecedented flight from paper into gold. This flight will likely accelerate into panic as the debt crisis assumes epic proportions.

Ian Gordon

Longwave Group