Many of the world's largest mining companies used to have a strong presence in British Columbia—they left in the 1970s after the political landscape changed. Today's provincial Liberal government has been trying to remake BC into an investable and attractive place for the mining industry to do business again.

"The mining industry is a cornerstone of our provincial economy. Right now there are hundreds of exploration projects underway across BC injecting millions of dollars into communities and creating jobs." -BC Premier Gordon Campbell, LiberalVancouver BC is undoubtedly one of the greatest mining centers in the world, and British Columbia should be a mining powerhouse, consider:

- Excellent geology

- Good transportation system

- Reasonable mining regulations

- Competitive tax rates

- Strategic location with respect to Asian markets. Two modern ports, Vancouver—Canada's largest and the Port of Prince Rupert, which is the closest of any of North America's West Coast ports to Asia—up to 58 hours of sailing time shorter

- High-quality and easily accessible geological data

- Mining-friendly provincial government

- Communities receptive to resource extraction as a livelihood

- Attractive exploration incentives

- BC is the third-largest generator of hydro electricity in Canada—one of the lowest power costs in North America. Natural gas is plentiful, cheap and resources are growing

- Some of the most modern education and telecommunications infrastructure in the world

- Increasing demands for environmental protection

- Demands by First Nations for greater control over their traditional territory

- An overburden of red tape

I'd like to take a moment to address two specific cases where the exploration for mineral resources and or the development of a mine has been stopped in BC. Besides the fact there's definitely two sides to every story—with the truth falling somewhere in the middle—there's a common theme that runs through both stories.

Tatshenshini—The Windy Craggy Experience Mary Page Webster

http://oldfraser.lexi.net/publications/forum/1998/january/cover_story.html

http://www.docstoc.com/docs/30053532/Windy-Craggy-A-Retrospective

Flathead Valley—Flathead Valley Controversy

http://www.mineweb.com/mineweb/view/mineweb/en/page72068?oid=97890&sn=Detail

http://www.cim.org/bulletin/bulletinlive/articles.cfm?Issue_ID=977&row=6&Type=1&Segment_ID=33

The overriding commonality between the two situations is outside pressure on the BC provincial government of the day and that it might not be unreasonable to believe that there are places where resource extraction should not take place.

But we need to balance the needs of our communities for good jobs, hospitals and schools today, against the need to protect the areas we find special and would like to pass on to our children and their children for them to enjoy tomorrow and the day after.

Fortunately British Columbia is mineral rich and hugely underexplored. The province has a mining friendly government that recognizes the importance of a vibrant mining industry to individual communities, our First Nations and the province as a whole and is actively working to make BC a better place to do business.

BC is recognizing the need to accommodate First Nations who have a territorial interest in an area where a mine is proposed. Land claims of the First Nations remain a stumbling block in many areas—perhaps in part because so many claims overlap—but First Nations are now coming to understand and embrace resource development as a way to generate training, jobs and financial security for their people and their communities.

In 2006, the mining industry was the largest employer of Aboriginal peoples in the country, 7.5 % of the workforce was Aboriginal; and the BC mining industry is the largest private sector employer of First Nations workers in the province.

BC's provincial government and mining companies are talking to First Nations about revenue sharing (at no cost to the mining community), social issues, jobs and training within the aboriginal community. And while things aren't always as smooth as we would like dialogue is taking place and things are getting done—projects are moving forward.

"Governments can stimulate an economy in three ways: through tax cuts, increased spending, or streamlining regulation to allow business to create growth. Of these, streamlining of processes and smart regulation have the least impact on the bottom line. Therefore, we encourage government, as part of its review of expenditures, to consider refocusing on reducing red tape for the natural resources sector." -Gavin C. Dirom, president and CEO of AME BCThe largest cut in red tape could come from dropping the duplication of process in regards to environmental assessments. BC has taken the position that the province's own process already takes into account the responsibilities of the federal government and that doing a second duplicate federal review forces a company to spend more money and time on needless duplication of process.

There are roughly twenty-six mining projects in BC somewhere in the permitting or environmental assessment process that are being unreasonably delayed because proponents must often duplicate their work, first going the provincial route than waiting while the federal government does an almost identical review—with no time limit on the Federal review like BC has on theirs—that's billions of dollars tied up because of an environmental permitting process that is needlessly redundant. The bottom line is BC can do its own review—unlike many other provinces and territories—and should be allowed to do so.

The most recent Federal budget includes a promise to strike a "Red Tape Reduction Commission" to review federal regulations with a mandate to suggest reforms in various processes.

"When we reduce red tape we increase productivity, profitability, wages and living standards. BC has shown political leadership in addressing this problem and I know the small business consultations and form redesigns will go a long way to furthering this momentum." -Laura Jones, western vice-president of the Canadian Federation of Independent Business who ranked BC first in a cross-Canada survey of leaders in regulatory reform.BC is taking the lead in regulatory reform, conservation and dialogue with First Nations and significant progress is being made. There are numerous large projects that have recently gone through the environmental process, the process as is, does work—it's just the duplication that presently exists makes for a slower and more expensive timeline:

- Taseko Mines Limited owns the $800 million Prosperity copper-gold mine located near Williams Lake, construction starts this summer

- Terrane Metals Corp (TSX.V:TRX) owns the $915 million Mt. Milligan mine located 155 kilometers northwest of Prince George, construction will start immediately

- Copper Mountain Mining Corporation (TSX:CUM)'s Copper Mountain mine is 15 kilometers from Princeton and is under construction. This mine is expected to start producing copper and gold in the spring of 2011

- NovaGold Resources Inc. and Teck Resources Ltd own the multibillion-dollar Galore Creek copper-gold mine and are trying for a 2011 construction start

- According to Stats Canada, estimates of the value of mineral sales in BC more than doubled over the last seven years reaching $6.6 billion in 2008, up from $2.9 billion in 2001.

- In 2008 14% of provincial exports, or $4.6 billion, was metallic minerals and fabricated metal products.

- The mining industry in BC generated gross revenues of $8.4 billion in 2008.

- Since 2001, a total of 12 metal and coal mines have opened or reopened in BC. In 2008, there were 10 metal mines, 9 coal mines and more than 35 major industrial minerals quarries and mines in operation.

- There are currently 26 major mining projects seeking permitting or environmental approvals in BC.

- There was $367 million spent on 388 exploration stage projects (carried out by 770 publicly listed BC companies) for minerals, coal, industrial minerals and aggregates throughout BC in 2008—just off the record level reached in 2007—and a 1,266% increase over the 2001 investment level of $29 million. The number of exploration projects with budgets in excess of $1 million was 98 in 2008.

- In 2009, exploration and deposit appraisal by both junior and senior companies totaled $178 million. Announced spending intentions for 2010 are $238 million.

- Average worker earnings in the mining industry in 2008 increased from $101,700 to $112,800. In 2008, a total of 28,000 people were employed in the mining and minerals sector in more than 50 BC communities.

- In 2008, the mining industry paid government $545 million in direct taxes, levies and payments related to employment.

- 17% of the total amount spent on exploration in Canada in 2007 was spent in BC, compared to just 7% in 2000.

"The federal government has announced its intention to remain fiscally prudent while continuing to support the world-class Canadian mineral exploration and development sector" - Gavin C. Dirom, president and CEO of AME BCFederal and Provincial Government support for the mining sector comes in the form of:

- Extending the 15% Mineral Exploration Tax Credit by one year

- Renewed funding for the Targeted Geoscience Initiative

- Continued reduction in corporate income tax rates

- Continued investment in modernizing the regulatory review process for major projects

- Continued investment in the Aboriginal Skills and Employment Partnership Initiative

- Harmonizing the provincial sales tax with the federal goods and services tax

- Construction of the Northwest Power Line along Highway 37

- Funding from the federal government for a Red Tape Reduction Commission

- Ottawa created regulations exempting most economic stimulus projects from the need for an environmental assessment

- Extending the BC Mining Flow-Through Share Tax Credit for another three years to 2013

- Provincial Government created Straightforward BC to track and monitor its regulations

"This three-year tax credit extension will help bring more certainty to the minerals sector and ensure BC's mining industry remains globally-competitive and attractive to investment." -Premier Gordon Campbell, LiberalIn 2001, the Province introduced the Mining Flow-Through Share Tax Credit to provide a 20% tax credit for grass roots mineral exploration. Flow-through shares allow exploration companies to pass eligible Canadian exploration expenses to investors. When combined with a similar federal tax credit, the flow-through tax credit helps to reduce the cost of a $1,000 investment to approximately $380.

The Province has also eliminated the capital tax and the proposed introduction of the HST will increase the savings from the current sales tax exemption for mining machinery and equipment by eliminating all sales tax currently paid on mining inputs when fully implemented.

"British Columbia is a world centre for mining and mineral exploration. We host over 1200 mineral exploration companies in BC, and thousands more companies are involved in providing services to those companies. We must stay competitive with similar mining jurisdictions around the world such as Ontario and Western Australia, both of which now have an HST-style tax." -Gavin C. Dirom, president and CEO of AME BC.BC Mining Tax Credits

In BC a mineral exploration company can raise equity funding in one of two ways, each of which is tax advantaged. These types of share issues are normally referred to as hard dollars or soft dollars.

Hard dollars come from non-flow-through stock that is issued, usually at market price or at a slight discount. Hard dollars can be spent on all capital expenditures including exploration, office expenses or promotion. If the hard dollars are spent on exploration, a company will get 20% of that amount back from the provincial government through the Mining Exploration Tax Credit (METC), and if the exploration is in a pine beetle kill area that credit jumps to 30%. Most of BC is now classified as in the pine beetle kill area, so the majority of companies now get 30% of qualifying exploration expenditures back. This tax credit is usually paid three to six months after the claim is filed. The remaining after tax credit amount of 80% or 70% is added to the company's Canadian Exploration Expense (CEE) pool to be used for future tax sheltering which has an advantage of never expiring and is 100% deductible against any capital gains in the future.

Soft dollars come from issuing flow-through shares to investors. The continuation of the BC Mining Flow-Through Shares Tax Credit (BCFTSTC) and the Federal Investment Tax Credit is intended to help companies raise capital for mining exploration by providing an incentive to individuals who invest in flow-through shares issued to finance exploration. The program only applies to preliminary mineral exploration activities conducted from ground level or above ground level. Expenses for underground exploration or for the purpose of bringing a mine into production are also excluded.

A company can issue flow-through shares at a premium to the market price, preserving their capital structure with less dilution, since buyers will end up getting tax savings and credit from the purchase. The company can only spend this money on exploration in Canada, nowhere else, and it must be spent within a limited period of time. For the privilege of issuing stock at above market prices, all the exploration expenses flow through to investors and the company does not get any tax credit money or CEE tax pools.

Geoscience BC

http://www.geosciencebc.com/s/Home.asp

The Province of British Columbia is very progressive when it comes to mineral exploration. In 2005, the province implemented online staking—saves exploration companies money and time by allowing ground to be staked on the internet instead of boots on the ground.

The budget also allocates $12 million over two years to Natural Resources Canada for renewal of the Targeted Geoscience Initiative, with a focus on developing new ways of exploring for deeper mineral deposits.

The province also created—in 2005 with a $25 mm grant—an organization to put money into grassroots exploration in BC. Geoscience BC is an industry-focused organization with a mandate to encourage mineral, oil and gas exploration investment in British Columbia through the collection, interpretation and marketing of publically available, applied geoscience. Subsequently, almost $12 million has been given to Geoscience BC to spend on grassroots mineral and oil & gas projects.

Geoscience BC puts money in the ground by funding regional airborne surveys and soil sampling projects. Geoscience BC's QUEST Project in south central BC covered the Cariboo Region and included an airborne electromagnetic (EM) survey, an airborne gravity survey and the collection of 2,200 new geochemical samples. Projects such as this help exploration companies identify targets and do grassroots exploration that would have been too expensive and high risk to undertake previously.

Gold, Copper and Gold

"What really bothers me is that in the 1980s or 1990s, we saw three to five discoveries of 5 to 20 million ounces each, and upwards of 30 to 50 million ounces a year. That is what makes or breaks the industry. There are no discoveries of that magnitude now." -Pierre Lassonde a veteran gold analyst, co-founder/chairman of Franco Nevada Mining Corp., acting chairman of the World Gold Council and former president of Newmont Mining Corp.Each year the mining industry must come up with a major new gold discovery of five million ounces just to replace what one of the world's top gold miner's digs up.

"In the case of gold, the world is currently mining it faster than it is finding it. Furthermore the average size and grade of gold discoveries continues to decline." -Richard Schodde, Managing Director of MinEx ConsultingMining is the story of depleting assets, that asset must be constantly replenished; miners that want to stay in business must replace every oz taken out of the ground and there isn't a lot of the larger-sized gold deposits left to find or buy that would really affect most of these larger company's bottom lines. Replacing what they've mined let alone finding more productivity/resources is getting harder and harder.

In BC, there are two styles of mineralization that are becoming increasingly important in the global quest to replace declining gold production. These two styles are porphyry copper/gold mineralization and sediment hosted mineralization.

Porphyry Copper/Gold Deposits

Porphyry copper deposits are copper ore bodies that are associated with porphyritic intrusive rocks and the fluids that accompany them. Porphyry ore bodies typically contain between 0.4% and 1 % copper with smaller amounts of other metals such as molybdenum, silver and gold.

In Canada, British Columbia enjoys the lion's share of this type of deposit, and they contain the largest resources of copper, significant molybdenum and 50% of the gold in the province.

There's a very real trend by the major mining companies toward making deals with the junior resource companies that presently own copper/gold porphyry projects in BC:

- Copper Mountain/Mitsubishi

- NovaGold/Teck Resources

- Cariboo Rose/Gold Fields

- Terrane Metals/Goldcorp

- Kiska Metals (formerly Rimfire Metals)/Xstrata

- Taseko joint ventured 25% of Gibralter to the Cariboo Copper Corp.—jointly owned by Sojitz Corporation (50%), Dowa Metals & Mining Co., Ltd. (25%) and Furukawa Co., Ltd. (25%)

There are two factors that make these kinds of deposits so attractive—firstly by focusing on profitability and mine life instead of solely on grade your other inputs of scale/cost can offset the lower grade and this results in almost identical gross margins between high and low grade deposits. Low grade can mean big profits for mining companies.

The second factor affecting profitability of these often-immense deposits is the presence of more than one payable metal. For gold miners using co-product (copper) accounting the cost of gold production is usually way below the industry average.

Copper-gold porphyries can offer both size and profitability. These kinds of deposits are one of the few deposit types containing gold that have both the scale and the potential for decent economics that a major mining company can feel comfortable going after to replace and add to their gold reserves.

Abacus Mining AME (TSX.V)

Abacus Mining has been advancing and developing it's multiple copper porphyry deposits in the Afton Mining Camp since 2002 and now has an updated (January 2009) NI 43-101 resource estimate on the Ajax project which states the resource area has 365 million tons, measured and indicated, grading 0.31% Cu and 0.20 g/t Au, which contains 2.51 billion lbs of Cu, and 2.29 million ounces of Au. This 365 million ton resource is an in pit resource, meaning it is totally contained within the proposed Ajax pit walls; it is not a property wide global resource.

"This PEA, which in many areas is as advanced as a prefeasibility study, clearly demonstrates the long term viability of this brownfield project. While the base case economics are themselves attractive, the significant economic value of this deposit is clearly demonstrated when using today's commodity market prices." -Tom McKeever, Executive Chairman of AbacusThe National Instrument 43-101 ("NI 43-101") compliant study was completed by Wardrop, a Tetra Tech company ("Wardrop"), and contains production parameters, capital costs, operating costs, and other financial projections for an open pit mine processing 60,000 tons of mill feed per day. The metal prices used for the base case were US$2.00 per pound copper and US$700 per ounce gold.

Base Case Highlights (All figures in U.S. dollars and pre-tax):

- Net present value of $192.7 million discounted at 8%.

- Return on initial capital expenditures of $535 million is 40.4%.

- Average life of mine cash costs of $1.17 per pound copper net of gold credit at $700/oz.

- Average annual production estimated at 106 million pounds of copper and 99,400 ounces of gold in concentrate.

- Mine life of approximately 23 years.

- The pit inventory resource contains 2.6 billion pounds of copper and 2.4 million ounces of gold in the measured and indicated category .

The Quesnel Trough is a large regional depositional belt extending over 1200 kilometers through the central part of the province of British Columbia, Canada. It encompasses most of the operating mines in the province as well as most of the projects at the pre-feasibility and feasibility stages of development. The region hosts several large tonnage copper-gold porphyry type deposits including Imperial Metal's Mt. Polley Mine, Terrane Metal's Mt. Milligan deposit and Northgate's Kemess Mine. In addition, Taseko's Gibraltar mine and Abacus's Afton Project lie just outside the Quesnel Trough.

The lion's share of exploration dollars in the province is being spent in this geological belt. The Quesnel Trough has become one of BC's most sought-after exploration/developmental targets due to the large number of porphyry copper-gold and skarn occurrences.

The Woodjam copper-gold-molybdenum project is in south central British Columbia approximately 50 kilometers east of Williams Lake.

An IP study performed in 2007 gave evidence that a large intrusive/hydrothermal complex measuring approximately five kilometers by six kilometers underlies the Woodjam property. This geophysical survey data dramatically expanded the area of interest for exploration on the Woodjam property and suggested a much greater potential for discovery than previously envisioned.

Northeasterly trending geologic features have long been considered important in determining the location of large mineralizing systems in the generally northwest trending Quesnel Trough. Interpretation of this data suggests that such a feature is present and is aligned with the known mineralized areas on the property.

The Woodjam project is a joint venture between Fjordland Exploration Inc. with a 60% interest and Cariboo Rose with a 40% interest. The land holdings measure up to 40 kilometers east/west and 30 kilometers north/south encompassing approximately 48,000 hectares.

Mineralization is calc-alkalic porphyry style with higher than average grades for a Quesnel Trough porphyry. Chalcopyrite is the dominant copper mineral but boronite is also present. Gold mineralization is directly correlated with copper—where there's copper there's gold.

Gold Fields Horsefly Exploration Corporation—a member of the Gold Fields Limited group of companies (NYSE: GFI)—signed an Option and Joint Venture Exploration Agreement which grants them an option to earn up to a 70% interest in the northern portion of the Woodjam gold-copper property (Woodjam North Property).

Gold Fields may earn an initial 51% interest by expending $7 million in exploration, and making $350,000 in cash payments over a three-year period with a minimum expenditure of $1 million in the first year. Gold Fields may extend the option to earn a further 19% interest in the Woodjam North property by funding a further $12 million in exploration over a 4-year period.

Recently Gold Fields has provided written notice that it intends to exercise a right of first refusal with respect to the Woodjam South copper-gold property. This offer matches one presented by another major international mining company.

Gold Fields has decided to increase its planned winter drilling program—which resumed on February 10, 2010—to 7,000 meters. The 12-month program which began in July, 2009 is budgeted at $3 million.

Sediment Hosted Vein (SHV) Deposits

The term sediment hosted vein (SHV) deposit is used for a family of gold deposits that consist of gold in quartz and quartz-carbonate veins hosted by shale and siltstone sedimentary rocks. These deposits occur throughout the world, but are most prolific in size and number in Asia. Most are poorly known to westerners because of their location in the former Soviet Union.

SHV gold deposits are some of the largest in the world:

- Muruntau >80M oz. "Hilly place" opened in the Kyzyl-Kum desert of Uzbekistan in 1969.The mine is still worked as an open pit now nearly 4km (2.5 miles) long, over 2.5km (1.55 miles) wide, and nearly 400 meters (1,300 feet) deep. The Muruntau Mine produces enough gold to make the Republic of Uzbekistan the world's ninth largest gold producing country—the mine produces around 70% of Uzbekistan's total gold output.

- Sukhoi Log >20M oz. Detailed exploration of the Sukhoi Log deposit started in the autumn of 1971. The work included 209.6 km of diamond core drilling in 846 drill holes, 11.7 km of underground drives, 61 raises, 110.3 km of trenches, 13,000 channel samples, three bulk samples of 150 t, 800 t, and 980 t and tens of thousands of assays for gold, In addition to the Sukhoi Log deposit, several lesser gold deposits of the same type were discovered in the region.

- Amantaytau, Daugiztau, Kumtor, Bakirchik, Olympiada, Nezhdaninskoe, Natalka, and Maysky are all over 5M oz.

- Tectonic setting

- Host rocks

- Alteration style

- Metal content

- Hydrothermal fluid chemistry

- Absolute and relative timing of formation

- They can be gold-only systems and therefore are metallurgically simple

- SHV deposits are associated with prolific placer gold fields if conditions are right for the formation of placer deposits

- Sulfide content is low for this type of deposit

- Type of setting is specific and identifiable among sedimentary belts of the world

- SHV deposits occur in groups, usually with one large deposit associated with numerous satellite deposits

So far, Spanish Mtn. Gold has put 323 diamond drill holes—representing 74,797 meters of drilling—into its Likely, British Columbia Spanish Mountain project.

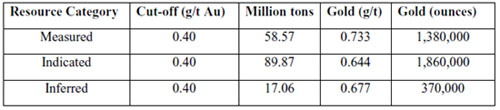

2009 Spanish Mountain resource estimate

Over 50% of the deposit is close to the surface. The Gold is contained in 9 zones, that may sound like a lot but 90% of the gold is in just 3 zones. In those 3 zones 60% of the contained gold is close to the surface. Using a .7g/t cut-off 50% of the gold grading over 1g/t ton is in the upper layer.

A three-dimensional geologic model recently completed demonstrates a shallow north-south structural corridor of mineralization that may extend for over 2000 meters, is up to 600meters in width, is open to the north, south and to depth, has a low strip ratio and might is amenable to open pit mining.

Preliminary metallurgical recovery test work consisting of a coarse grind and simple flotation followed by regrinding and direct cyanidation obtain recoveries between 88-90%.

All needed infrastructure—power, water, rail, supplies and major highways are close by. There are many operating mines in the area and locals are very receptive to resource extraction as a way to make a living. There is an experienced trained labor pool to draw from in the nearby towns of Likely, Williams Lake and 100 Mile House and supplies are easy to access.

Spanish Mountain Gold has a new name (formerly Skygold [TSX.V —SKV]) a new office, logo, website and new management team. Insider share ownership has gone from less than 1% to roughly 22% of outstanding shares.

Spanish Mountain will commission a Preliminary Economic Assessment shortly and this report should be ready by late summer.

Tiex Inc. TIX (TSX.V)

Tiex is a greenfields exploration play with an enormous, potentially target rich land package (79 claims equates to 136,663 hectares, a land package 108 kilometers long by 57 kilometers wide) in the Cariboo's Quesnel Terrane. The Cariboo Gold Fields—second in Canada only to the Klondike in size and production—are currently being explored by more than twenty companies that employ up to date exploration technologies.

Technical studies have expanded the search to all parts of the Cariboo District where highly prospective black shales and phyllites of the "Quesnel Terrane" occur in deformed and metamorphosed sedimentary formations.

This terrane is also perspective for volcanoclastic hosted hydrothermal gold vein systems and porphyry deposits.

This is an early day's exploration play but their huge mineral tenure has given them what should be a pipeline of high quality targets with undoubtedly many more to be found.

Gold Creek Project—100% owned and comprises 30 contiguous claims encompassing 8,536 hectares. Gold Creek is located 3 kilometers northeast of Likely, BC—in the central portion of the historic Cariboo placer goldfields—and 8 kilometers west of Spanish Mountain Gold's sedimentary hosted vein gold deposit on Spanish Mountain.

The discovery of a wide area of mineralization at Gold Creek was the direct result of an ongoing induced polarization (IP) and resistivity survey which depicted a wide area of mineralization over 900m (3000 ft.) in strike length and open to the north and south.

"This represents an extensive zone containing high levels of disseminated metallic sulphide mineralization. The zone of chargeability is very strong and continuous." -Tiex's VP of Exploration John Buckle P. Geo.Soils were collected from the Gold Creek target late in 2007 and examination of the pan concentrates showed the morphology of gold grains to be very fine and coarse (wire-like) textured—indicates a local source. Fine visible gold was observed in some of the quartz veins occurring with galena (lead sulphide) and as fine wire gold in oxidized-limonitic pyrite. Fine free gold was also found along the walls of the quartz veins away from the sulphides.

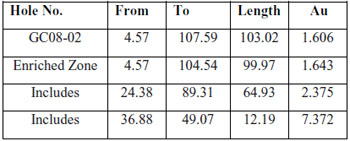

In 2008, Tiex entered into an agreement for 6,500 meters of diamond drilling. Eleven holes were drilled during the 2008 program. Holes one through six showed some significant values. No significant values were reported from drill holes 7 through 11.

Core loss was up to 50%. Because the ground in the Gold Creek area is extremely fractured very few of drill holes reached their planned depth and orientation of the drill required steep angle holes in order to minimize drill blocking and core loss.

It is the company's opinion that many of the assay results are unreliable—results would not be less than published, but in fact, because of the high core loss, results are not truly representative of the rock grades they drilled through.

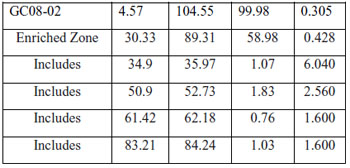

This might be evidenced by the assays obtained from drill sludge samples collected from the drill return water for Hole GC02-08.

Drill Sludge Assays:

Core Assays:

The company cautions that the assay results of the drill cuttings of hole #2 on the Gold Creek Property were taken and analyzed due to problems with the drilling of hole#1. These drill cutting assay results cannot be relied on as if they were drill core assay results to indicate gold mineralization.

Mackay River and Horsefly River Projects

Reconnaissance MMI soil sampling was carried out during the 2008 exploration season along roads within two areas of the Mackay River Property area which is located 55 Km east-northeast of the village of Horsefly and 110 km east-northeast of the town of Williams Lake. The first area is located along the northeast side of the northwest-flowing Mackay River, a tributary of Horsefly River, and within which the reconnaissance lines trend in an east to southeast direction. The second area occurs along the west-southwest-flowing Horsefly River where reconnaissance MMI samples were taken from sites close to roads that parallel both sides of the river.

A total of 684 samples were taken at 50-meter intervals along existing roads on the properties. 486 samples were from the Mackay River section and 198 samples were from the Horsefly River section. Analyses for 46 elements were performed by SGS Minerals Laboratories in Toronto, Ontario.

Reconnaissance sampling results revealed two anomalies:

Anomaly A is located near the northwest end of the Mackay River sampling area and is mainly comprised of gold values, up to 126 times background. Anomaly A can be traced for approximately 1,300 meters and is open to the west.

Anomaly B occurs within the Horsefly River sampling area and comprises samples that are anomalous in silver, zinc, cadmium and copper.

The company plans follow-up programs of MMI sampling on 25 meter grids on both Anomaly A and Anomaly B, followed by induced polarization and resistivity surveys that should better define their magnitude and extent.

Conclusion

Mining Deals 2009 Annual Review

Tim Goldsmith

PricewaterhouseCoopers

- M&A is a consistent part of the mining landscape, as explorers are swallowed up by those who couple operational capabilities with a desire to continue growing the resource base.

- Another trend, although less dramatic, was the increase in precious metals' contribution to deal value. Gold returned to favor and did not experience the same valuation reduction when compared with base metals and bulk commodities.

- 2009 saw North America as once again the origin of the largest aggregated deal value, with US$20.8 billion of deals, comprising US$12.1 billion in Canada and US$8.7 billion in the U.S.

- We anticipate M&A activity to return as a driver of expansion and growth in the sector with renewed focus on consolidation

"There's a lot of money around looking for a home, and some of these exploration vehicles with successes are great candidates." -John Ing, President, Maison PlacementsThe resurgence of mining and the possibility of further M&A activity within the Province of British Columbia should be on every investors radar screen.

Is it on yours?

Richard (Rick) Mills

[email protected]

www.aheadoftheherd.com

If you're interested in the junior resource market and would like to learn more please come and visit us at aheadoftheherd.com

Richard is host of aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 200 websites, including: Wall Street Journal, SafeHaven, Market Oracle, USAToday, National Post, Stockhouse, Casey Research, 24hgold, Vancouver Sun, SilverBearCafe, Infomine, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald and Financial Sense.

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Disclosure:

Richard Mills owns shares of Tiex Inc.

Abacus, Cariboo Rose, Spanish Mountain Gold and Tiex are advertisers on aheadoftheherd.com.