In a speech I recently gave at The Empire Club of Toronto, I referred to gold as the "anti-currency." Gold is not and never has been a currency. Gold is something entirely different and far more valuable. It is money.

"If you're holding paper currency, you have to have some kind of trust that the country that issued it is not just going to print its way out of its problems. That's a real concern right now. Gold, on the other hand, has real intrinsic value, unlike a paper currency which can be debased by its government." - Sacha Tihanyi, currency strategist, Scotia CapitalCurrency Versus Money

Most investors confuse money and currency, but they are not the same thing. Money is defined as a medium of exchange, a unit of account and a store of value. For centuries, money referred to coins made of rare metals (gold and silver) with intrinsic value, and to notes backed by precious metals.

Currency, while it is a medium of exchange, is not a store of value. It only derives its value by arbitrary fiat government decree and hence the term "fiat currency." Paper banknotes represent money but they are not money. They are simply promissory notes whose long-term "value" or purchasing power depends entirely on the fiscal and monetary discipline of the government that issued them.

And therein lies the problem. In an era of massive fiat currency expansion by profligate governments across the globe, today's currencies are depreciating in value faster than yesterday's news. Fortunately for precious metals investors, gold and precious metals have risen in value, and will continue to rise in value against all currencies because they have once again resumed their historical role as stores of value: money.

"When the price of gold moves, gold's price isn't moving; rather it is the value of the currencies in which it's priced that is changing." - John Tamny, economist, H.C. Wainwright EconomicsThe Decline of the World's Currencies

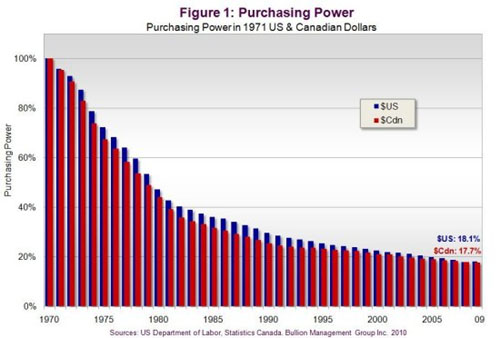

Currency debasement isn't a recent phenomenon. For decades, governments around the world, through their central banks, have been creating money out of thin air to cover their excessive spending and mounting debt. Investors have for the most part accepted this subtle form of taxation, because it seemed to have little personal impact. But appearances are deceiving. Investors are discovering that the value of their dollar-denominated assets has actually declined a staggering 82% since 1971 (not coincidentally, the year the U.S. cut its link to the gold standard). Figure 1 tells the story.

The Media Is Using the Wrong Measuring Stick

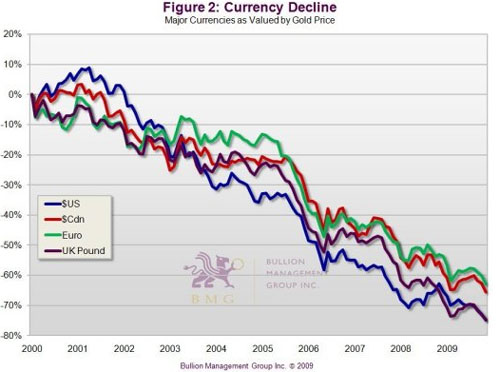

Every day, the media (via currency traders) informs Canadian investors about the latest price of the Canadian dollar in U.S. dollar terms, while U.S. investors compare the U.S. dollar to a basket of the world's major currencies. But this information gives investors surprisingly little insight into the true value of their portfolios. If we started measuring the world's currencies against money (i.e., gold), investors would be horrified at the stark decline in the value of all currencies. Most investors' portfolios are heavily weighted towards currency-denominated financial assets (stocks and bonds), but few realize that the true value or purchasing power of their portfolios is declining every single year because of currency depreciation.

The Rate of Currency Decline Is Accelerating

Since 1913 (the year the U.S. Federal Reserve was established), the U.S. dollar has lost over 95% of its value. The U.S. and Canadian dollars have lost 82% of their value since 1971, as noted earlier. But the rate of currency decline is now accelerating.

In the past ten years alone, the U.S. dollar, the Canadian dollar, the UK pound and the euro have collectively fallen 70% in value if measured in real (currency-debased) terms. In other words, when they are priced in terms of gold (Figure 2).

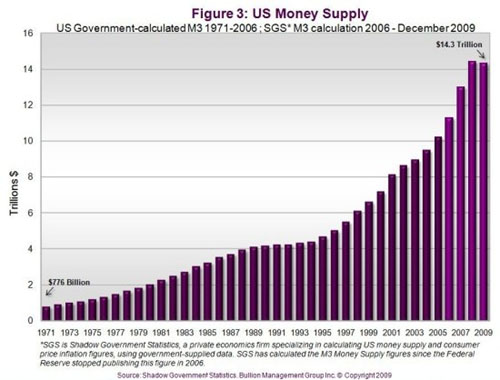

It's All About the (Fiat Currency) Money Supply

Not too long ago, all the world's major currencies were backed by gold because it was a universally recognized store of value. The gold standard imposed fiscal and monetary discipline, since each country had to hold enough gold to equal the amount of money in circulation. But not any longer. Government spending around the world is exploding, and (fiat currency) money supply, along with government debt in the world's major economies, is exploding along with it. But nowhere in the world has spending become more out of control than the U.S. (Figure 3), where the monetary response to last year's financial crisis is creating yet another bubble, and this time it will be the bubble to end all bubbles.

Countries Are Increasingly at Risk of Sovereign Debt Default

"In the process of saving a few 'too big to fail' corporations and their bond holders, policymakers are greatly increasing the risk of sovereign defaults." - Puru Saxena, editor/publisher, Money MattersThe risk of massive and widespread sovereign debt default has never been higher. "Official" U.S. government debt has soared to 90% of GDP, while multi-trillion-dollar budget deficits for the next several years will send that number soaring. Japan, the world's second-largest economy, was recently put on credit watch. Its debt is twice total GDP, yet its newly elected government has announced much higher spending for 2010. The UK's 2009 budget deficit will be over 14% of GDP, adding to a net debt that will reach 56% of GDP this year, 65% in 2010 and 78% by 2015.

Spain, Italy and Portugal are facing major fiscal deficits, as is Eastern Europe. Dubai is billions in debt and its prize jewel, Dubai World, is bankrupt. Greece's credit rating has been slashed, and its debt is forecast to reach 130% of GDP. And then there is Iceland, whose debt had exploded to seven times GDP before the global meltdown. The country's banking system has now collapsed, its currency is deeply devalued, its real estate market has imploded and the country is in a full-blown economic depression.

The Incredible Shrinking Dollar

As the world's reserve currency, the U.S. dollar is a proxy for the rest of the world's currencies. The dollar's decline is a direct reflection of America's deepening financial troubles, exacerbated by a ravaged banking system that, by 2010, may see over one thousand banks insolvent. In 2009, the U.S. incurred a budget deficit of $1.4 trillion, and its debt rose by $1.9 trillion due to off-budget expenditures. These off-budget expenditures alone were more than the 2008 budget deficit. At the end of 2009, America's total debt was over 100% of GDP.

In their attempt to reflate the bubble-driven economy, President Barack Obama, Fed Chairman Ben Bernanke and Treasury Secretary Tim Geithner have decided to add to this financial house of cards. Instead of raising taxes or cutting expenditures, they have decided to borrow their way out of the problem and have the Fed create money out of thin air, which will almost certainly create another bubble. This bubble will make the others pale by comparison and will help destroy the U.S. dollar. The dollar may be the world's reserve currency, but China and other countries are not only questioning its status, but also actively campaigning for greater use of alternative currencies.

Investors Are Demanding Real Money

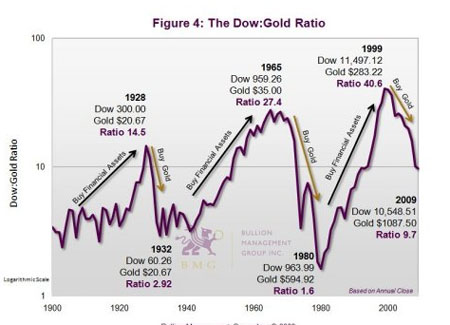

Where are most investors putting their cash? It should no longer be in stocks. Key stock indices like the Dow Jones Industrial Average have been flat to negative in nominal terms since the end of the last century. But if the Dow is priced in gold (in other words, money) as opposed to depreciating dollars (in other words, fiat currency), its decline is far more dramatic. As Figure 4 shows, the Dow:Gold Ratio is not only in a downtrend, the downtrend is steepening which is a continuing indicator to move from equities to bullion.

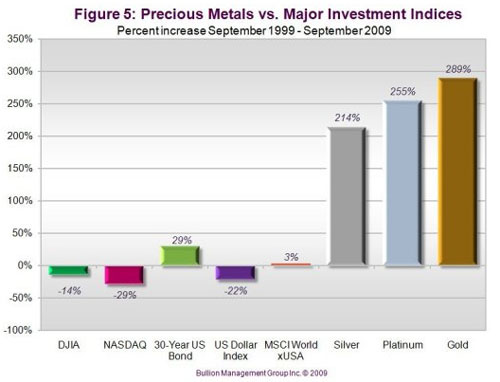

Global creditors who currently hold trillions of dollars' worth of dollar-denominated financial assets are dumping them to preserve their wealth. That is why gold bullion, along with its precious metals cousins, silver and platinum bullion, have been consistently keeping their value against financial assets (Figure 5).

Central Banks Are Buying Gold Bullion

"We have a market-friendly Fed injecting a lot of liquidity in the system which will set us up for another bubble economy. Excessive monetary accommodation just takes us from bubble to bubble to bubble." - Stephen Roach, chief economist, Morgan StanleyIndia recently bought 200 metric tons of gold bullion from the International Monetary Fund for $6.7 billion. Russia has recently added 120 tons of bullion to its reserves, while China has steadily (and surreptitiously) increased its gold bullion reserves from 600 tons in 2003 to 1,054 tons today. China is even urging its people to put 5% of their savings into gold and silver because it is so worried about the dollar. And because trillions of dollars of its reserves remain in U.S. dollar-denominated assets, China's central bank will be diversifying into gold for many years to come.

The world's central banks know that gold is primarily a monetary asset, not a commodity. That's why a growing number of them are quietly diversifying out of U.S. dollars and adding to their 29,000 tons of gold reserves.

In its 2010 Precious Metals Outlook, Scotiabank noted that "seeing the value of the dollar steadily erode must be a nightmare for large U.S. creditors such as China, Japan, South Korea, Russia, the oil producing countries and Sovereign Wealth Funds (SWF). . .

Major Investors Are Diversifying Into Gold

"Both China and America are addressing bubbles by creating more bubbles and we're just taking advantage of that." - Lou Jiwei, Chairman, China Investment CorporationIt is not just governments that are dumping dollars for bullion. A rapidly growing number of sovereign wealth funds (including China Investment Corporation) are participating, as are major institutional investors. Hedge fund manager John Paulson, who made $3 billion in 2008 by shorting subprime mortgages, recently took a multi-billion-dollar position in gold as a hedge against inflation. Northwestern Mutual Life Co.'s CEO Edward Zore said his company purchased $400 million in gold (the first time in its 152-year history) because "the downside risk is limited, but the upside is large. We have stocks in our portfolio that lost 95%. Gold is not going down to $90."

Hedge fund manager David Einhorn, through his Greenlight Capital fund, has sold gold ETFs in order to invest in longer-term and lower-risk gold bullion because of current U.S. economic policy. Lone Pine Capital significantly increased its stake in gold this year. Perhaps of even greater interest to the unwary investor is a survey of U.S. hedge fund managers by London-based Moonraker Fund Management: 90% (20 of the 22) of the hedge fund managers surveyed admitted they had bought physical gold for personal investment. These sophisticated investors know something that the average investor doesn't: that the global policy response to the financial crisis will not only devalue the world's major currencies, it will decimate the U.S. dollar.

Many Investors Still View Gold as a Commodity

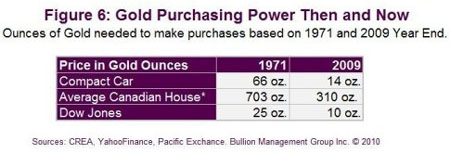

Individual investors are not so farsighted – yet. Because most of them have only experienced one kind of market – a 25-year bull market in stocks – many still think gold is just a commodity like copper, zinc or pork bellies. But gold is far more than that. It has a 3,000 year history as money; for much of that time, it was the universal medium of exchange because of its divisibility, portability, rarity, beauty, malleability and indestructibility. Despite today's negative sentiment, gold is not a speculation or a barbaric relic. Gold is money. Gold retains its purchasing power year after year, as Figure 6 shows).

Forty years ago it took 66 ounces of gold to buy a compact car. Today it takes only 14 ounces. If you had put your money in gold instead of dollars, the same car would actually be 79% cheaper, because gold keeps its value. Houses, stocks and virtually every other asset on earth would also be cheaper if bought with physical gold.

The more investors learn about bullion, the better for their portfolios If you are already a bullion investor, now is the time to add to your portfolio. If you are new to investing in bullion, now is the time to start dollar-cost-averaging into bullion. I encourage investors to learn as much as they can about bullion and about the markets in general. A good place to begin is the Learning Center section of our website (www.bmgbullion.com). It offers a comprehensive look at the economy, money, markets and bullion investing, and provides a variety of thought-provoking articles written by experts in the field of gold and precious metals.

Gold Is Money

Gold is money because it cannot be created out of thin air by government decree. Unlike bonds, gold does not represent someone else's liability and, unlike stocks, gold does not rely on someone else's promise of performance. Gold is money because, unlike currencies, impatient monetary policymakers cannot change its value. The rising gold prices we have experienced for the last eight years do not signal a bull market in precious metals, but rather a vote of decreasing confidence in the future value of paper currencies.

Currency-denominated financial assets are a disaster waiting to happen. The current economic rebound is a mirage, being entirely dependent on something artificial and unsustainable: massive government spending. A new crisis is building out of unprecedented fiscal and monetary mismanagement. Fortunately, smart investors can protect their wealth from the coming storm. The true level of risk has not been priced into the markets. The time to shelter your wealth from the storm is now. And there is no safer investment on earth than bullion, because bullion is and always will be money.

Gold Outlook for 2010: Gold Resuming its Historical Monetary Role—as the Anti-Currency