Fed Raises Discount Rate, Investors Panic

Then, just as precious metals closed out the day with an impressive advance, the Fed announced a surprise hike in the discount rate from 0.50% to 0.75%, which strengthened the dollar and erased all of gold's gains for the day (black line). This was widely expected by the Fed, but the timing was much sooner than most had anticipated.

Despite the Fed saying this move was not a tightening of its monetary policy, investors reacted by selling stocks in after-hours trade, buying dollars and pushing the gold price down significantly. Remember, the Fed's main policy tool, the federal funds rate, was not changed and remains in a 0% to 0.25% range. Still, this move may have been an attempt to test the waters, prop up the dollar and hold precious metals in check a while longer. I believe investors over-reacted to the news as usual and the dollar strength will be short-lived.

Inflation—Don't Call it a Comeback

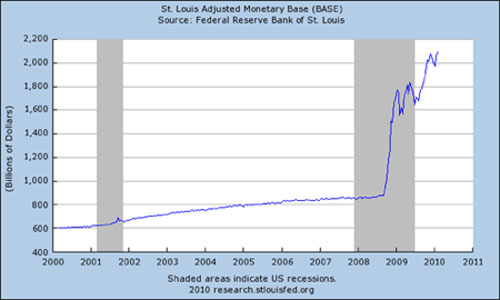

The Fed may also be worried about the potential of runaway inflation, as the Producer Price Index (PPI) shot up 1.4% during January. This was significantly more than the 0.9% expected and equates to 16.8% annually. The St. Louis Fed also posted updated charts showing the monetary base expansion is once again going vertical.

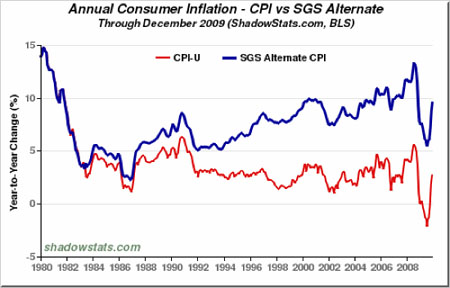

Inflation is also beginning to rear its ugly head in the CPI and adjusted CPI chart provided by Shadow Stats. The officially-reported CPI (red line) went negative for a brief period, but now both lines are pointing straight up with true CPI reaching back towards 10%.

The Hypocrisy of George Soros?

In other gold news, SEC documents show that George Soros doubled his gold investment during the end of 2009, while publicly calling gold the “ultimate asset bubble.” While there seems to be some contradiction in this story, perhaps what Mr. Soros meant by “ultimate” was the definition of ultimate as “last, further, farthest or ending a process or series.” All other asset bubbles will burst and gold will be the last one standing? Or maybe George had already sold his holdings or was trying to get lower prices at which to buy more.

It is pointless to speculate, but for those that follow one of the world's most successful investors, I would say that action speaks louder than words. As of the latest information we have available, Mr. Soros is an aggressive buyer of gold and for good reason. Gold has been one of the best performing asset classes over the past decade and is the best storage of wealth during times of monetary expansion and economic uncertainty. These are concepts that I'm sure are not lost on Mr. Soros.

China Dumps Treasuries, No Longer Largest Holder of U.S. Debt

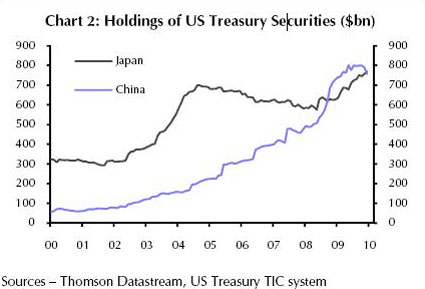

Foreign owners of US government debt reduced their holdings by the largest monthly amount ever in December, with China offloading so many Treasury securities that it is no longer the largest foreign holder. Total foreign holdings of treasury securities plunged by $53 billion in December. China led the sell-off, reducing its holdings by $34 billion, while Japan increased its holdings by $11 billion to become the new largest foreign holder of Treasuries. You can see from the chart below that China has increased their holdings of U.S. Treasuries eight fold over the past decade, so this latest dumping is relatively small in the grand scheme of things. It is newsworthy only in the fact that China is no longer the largest holder of Treasuries and this could be the beginning of a much larger trend to divest of U.S. debt.

This news has seriously bearish implications for the U.S. dollar and is extremely bullish for precious metals. If China stops buying U.S. debt, the Fed will be forced to monetize a greater portion of the auctions, creating currency at a blistering pace and sending the dollar much lower in an inflationary tailspin. This news also calls into question the U.S. government's triple-A credit rating and could lend further support to my belief that investors will stop turning to the dollar as a safe haven in the near future and instead begin turning to precious metals.

Many believe China is retaliating against the United States economically for the recent decision to sell $6.4 billion of arms to Taiwan. The Chinese government was also none too pleased by Obama's recent meeting with the Dalai Lama. Whether or not these events were the impetus, I believe we are likely to see more lightening of U.S. debt from not only China, but countries around the world.

Precious Metals to Benefit

While I believe precious metals prices will continue to be prone to short-term sell offs like we have witnessed over the past few months, we have to keep the larger picture in mind. The Fed and government have no other way out of the current mess than to crank up the printing presses to the point where they can monetize their rapidly expanding debt and offset the collapsing credit market. If you think the amount of currency printing over the past few years has been reckless, you ain't seen nothing yet.

I will be looking to relieve weak hands of their gold and gold stocks over the next few days of anticipated panic selling. I am holding to my prediction of $1,500 gold and $25 silver before the end of the year. I also believe we are likely to experience a double dip recession during the back half of 2010. If you want to view the Gold Stock Bull portfolio, receive the monthly newsletter and get email trading alerts whenever I am buying or selling, become a premium member. It is just $35 per month and you can cancel at anytime if you aren't 100% satisfied.