In the early afternoon of a late summer day in 1975, Dr. Wolfgang Elston walked into my Economic Geology 401 class, introduced himself, and asked us to open the chosen textbook, Ore Deposits by Park and MacDiramid, second edition, to page one and read the following: “Ores are rocks and minerals that can be recovered at a profit.”

At a profit.

So now let’s expand the basic concept and definition to an “Ore Deposit: A mass of rock or mineral that can be developed, mined, processed, and delivered to the marketplace or technology at a profit.”

At a profit.

These two simple definitions have been the fundamental concept anchoring my continuing education and experience since I first set boot in the field as an explorer and prospector in the summer of 1976. The idea is so ingrained in my brain that I need reminding that the overwhelming majority of investors in the mining and exploration sector have absolutely no clue what an Ore Deposit actually is.

Another reminder of this serious lack of insight and understanding occurred a few weeks ago. In a public conversation, I heard meaningless statements such as: “(Unnamed company) has proven up a 1.5 million ounce resource”; “millions of ounces of gold have been taken out of the district and (unnamed company) is about ready to mine it again.”

What was that again? Resources…proven…about ready to mine??

Ai, Chihuahua! I was flabbergasted by these wildly promotional statements and will explain below.

There is a consistent, well defined, and absolutely critical difference between Mineral Resources and Mineral Reserves as defined by various securities, regulatory, and taxation agencies in the English speaking world. Since we, as junior resource speculators, deal mainly with Toronto Stock Exchange companies, I will discuss the Canadian Institute of Mining, Metallurgy, and Petroleum (CIM) classification system under National 43-101 regulations.

As you probably have already realized, this key difference between Resources and Reserves is summed up in three simple words: “At a Profit.”

From the CIM Standards on Mineral Resources and Reserves (2000):

A Mineral Resource is a concentration or occurrence of natural, solid, inorganic, or fossilized organic material in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics, and continuity of a Mineral Resource are known, estimated, or interpreted from specific geological evidence and knowledge.

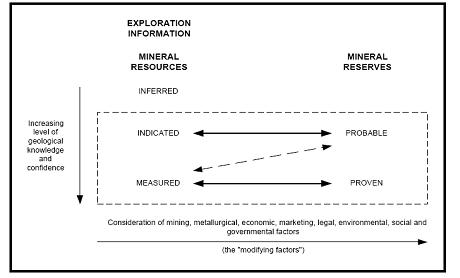

Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated, and Measured categories. Note that the confidence level in Inferred Mineral Resources is insufficient to allow the application of technical and economic parameters or to enable an evaluation of economic viability worthy of public disclosure.

A Mineral Reserve is the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined.

Mineral Reserves are sub-divided in order of increasing confidence into Probable Mineral Reserves and Proven Mineral Reserves. Mineral Reserves are those parts of Mineral Resources which, after the application of all mining factors, are the basis of an economically viable project after taking account of all relevant processing, metallurgical, economic, marketing, legal, environment, socio-economic and government factors.

The relationship between Mineral Resources and Mineral Reserves is shown graphically below:

Source: http://www.cim.org/committees/cimdefstds_dec11_05.pdf

The critical concept here goes straight back to our definition of “Ore”. A Mineral Reserve can alternatively be called an Ore Reserve and defined as: A quantified mass of rock or mineral that can be developed, mined, processed, and delivered to the marketplace or technology at a profit.

I repeat: At a profit.

Unfortunately many TSX company officers and directors, promoters, investor relations personnel, newsletter and website writers, analysts, financiers, and, sadly, even some that have the necessary education and experience to be designated Professional Geologists, Professional Engineers, Certified Professional Geologists, or other title that earns them Qualified Person status, do not understand the difference.

Or perhaps they do not care. Could it be that some deliberately and dishonestly use these classifications as if they are interchangeable at trade shows, in interviews, public presentations, and discussions with potential investors or subscribers?

As Mark Twain said over 140 years ago, “A mine is a hole in the ground with a liar standing beside it.”

When evaluating a company for investment, the lay investor should understand and realize that a Mineral Resource is simply a mineralized mass of rock that has highly elevated content compared to background abundance in a particular mineral commodity. There is often little or no economic input into this classification.

A distinction must also be made between Historic Resources and 43-101 qualified Resources. A Historic Resource is a mineralized mass of rock that was defined by exploration and development work prior to adoption of 43-101 regulations on February 1, 2001. This older data must be validated by confirmatory and often duplicative exploration and development work under the supervision of a Qualified Person before it can be incorporated into a 43-101 Technical Resource Estimate.

We find in past producing mines that unmined rock that was once classified as a Proven and Probable Mineral or Ore Reserve by operators prior to 2001 is now classified as a Historic Resource pending confirmatory exploration and development work. Once that work is completed and grade-thickness products are corroborated, it may be defined as a 43-101 Resource. However, a positive Preliminary Feasibility Study is still required to move it back into a Mineral Reserve category.

Mining, metallurgy, processing, economic, marketing, legal, environment, socio-economic, and government factors change drastically over time. What was Ore yesterday is not always Ore today and may or may not be Ore tomorrow.

A 43-101 Mineral Resource that consists of all material or a large majority of material in the Inferred category is particularly suspect to the informed investor. Mineralized rock in this category of Resource has a low confidence level and will require additional phases of exploration and development work and many more millions of equity funded dollars before it could possibly be classified as a Mineral Reserve.

My experience is that many Inferred Resource project estimates delivered by hired gun consulting geological engineers in 43-101 Technical Reports have little chance of ever being upgraded to Measured and Indicated Resources let alone an economically feasible Proven and Probable Mineral Reserve.

Don’t forget that most junior resource companies are simply “mining the stock market”. Few have potentially viable Resources let alone economic Reserves. Most don’t want to be miners. Of those that aspire to this difficult goal, perhaps 1 in 15 will ever develop a project with Mineral Reserves, and more than half of those will fail for one reason or another. Assuming those numbers are more or less correct, about 100 of the 1373 Venture Exchange exploration and mining juniors will define a Reserve and less than half of those, perhaps 30 or 40 at most, will develop a profitable mine for their shareholders or, more likely, the bigger company that takes them over will develop said mine.

Let the buyer beware.

Remember the definition of “Ore”:

At a profit.

Now let’s go make some.

Ciao for now,

Mickey Fulp

Mercenary Geologist

The Mercenary Geologist Michael S. “Mickey” Fulp is a Certified Professional Geologist with a B.Sc. Earth Sciences with honor from the University of Tulsa, and M.Sc. Geology from the University of New Mexico. Mickey has over 29 years experience as an exploration geologist searching for economic deposits of base and precious metals, industrial minerals, coal, uranium, and water in North and South America and China.

Mickey has worked for junior explorers, major mining companies, private companies, and investors as a consulting economic geologist for the past 20 years, specializing in geological mapping and property evaluation. In addition to Mickey’s professional credentials and experience, he is high-altitude proficient, and is bilingual in English and Spanish. From 2003 to 2006, he made four outcrop ore discoveries in Peru, Nevada, Chile, and British Columbia. These discoveries have led to two economic deposits for companies that are now raising debt and equity financing for mine development.

Mickey is respected throughout the mining and exploration community due to his ongoing work as an analyst for public and private companies, investment funds, newsletter and website writers, private investors, and investment brokers.

Contact: [email protected]

Disclaimer: I am not a certified financial analyst, broker, or professional qualified to offer investment advice. Nothing in a technical report, this website, or other content constitutes or can be construed as investment advice or an offer or solicitation to buy or sell stock. Information is obtained from research of public documents and content available on the company’s website, regulatory filings, various stock exchange websites, and stock information services, through discussions with company representatives, agents, other professionals and investors, and field visits. While the information is believed to be accurate and reliable, it is not guaranteed or implied to be so. The information may not be complete or correct; it is provided in good faith but without any legal responsibility or obligation to provide future updates. I accept no responsibility, or assume any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information. The information contained in a technical report this website, or other content is subject to change without notice, may become outdated, and will not be updated. A technical report, this website, and other content reflect my personal opinions and views and nothing more. All content of this website is subject to international copyright protection and no part or portion of this website, technical report, or other content may be reproduced, copied, emailed, faxed, or distributed in any form without the express written consent of Michael S. (Mickey) Fulp, Mercenary Geologist.

Copyright © 2008 Mercenary Geologist. All Rights Reserved.