Jason Burack: The rare earth elements (REEs)—mostly lanthanides and actinides—are elements with unique chemical and electrical properties. These elements are contained in host rocks with a unique mix of the 17 uncommon elements that can be found on the bottom of the periodic table. These elements are actually abundant around the earth's crust, but are spread out rather than concentrated the way gold, copper and lead are concentrated in vein deposits. For that reason, the majority of REEs are uneconomical for extraction, thus making them rare.

Mo Dawoud: What is new is an increased level of demand. In the last decade, REEs have been used to improve new electronics and green energy technology, including flat-screen televisions, mobile phones, hybrid vehicles, defense missiles, petroleum refineries, wind turbines and much more. If it wasn't for neodymium, dysprosium and terbium, we would still be walking around with Gordon Gekko's cell phone because these materials are key ingredients in neodymium-iron-boron magnets. Small quantities of these materials allow manufacturers to make phones, tablets and mp3 players smaller, thinner and lighter, while maintaining computer power, memory and functionality.

TCMR: If manufacturers can't access these materials at reasonable prices, won't they just engineer them out of the products?

MD: Automakers are exploring ways to make hybrid cars without rare earth metals, but it would be difficult for them to create REE-free motors because they provide more power and efficiency than traditional ferric magnet alternatives.

JB: We believe uses for these metals will continue to rise. One expert in natural resource investing estimates that China has over 1,000 engineers and scientists dedicated to creating new products using rare earth metals!

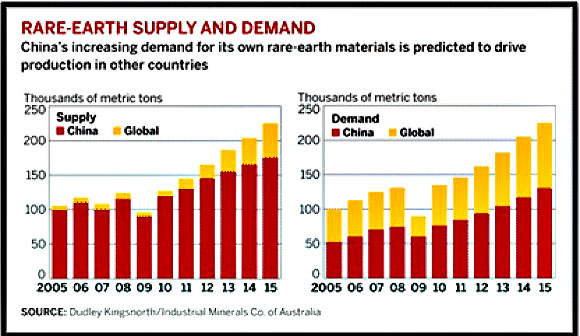

Over the last decade, as global consumers have continued to buy REE-dependent products, demand has risen from 80,000 tons (t) to over 130,000t. Demand could go as high as 300,000t by 2015 by some aggressive estimates.

Much of the demand increase is coming from China as the country moves toward creating green energy and advancements in military and defense technology. In 2010, China's demand was 72,000t; by 2015, China's forecast demand is over 117,000t.

TCMR: How will growing demand and shrinking supply posed by China's shrinking export quota impact rare earth prices and, ultimately, equity opportunities?

JB: China owns 30% of the REE deposits and controls 97% of the world's REE production. The rare earth monopoly allows Chinese suppliers to manipulate prices. As the former leader of China, Deng Xiaoping once said, "The Middle East has oil and China has rare earths." China's leadership plans to make the most of that fact.

MD: Japanese and U.S. governments and manufacturers are, therefore, at the mercy of the Chinese government for REE supply. The U.S. government has claimed that a supply shortage would threaten national security because defense manufacturers use rare earths to make lasers, guided missiles systems and predator drones. Japanese automakers are now locking up supplies in Vietnam, Brazil and India.

Some manufacturers moved to China to gain access to supply, which was part of the country's strategic plan to bring more jobs and capital to the Chinese economy. Outside China, we think it will be difficult to close the supply gap, particularly for the heavy rare earth elements (HREEs). Unfortunately, there are not many mines outside of China that have a big deposit of the heavies going into production within the next three years. This will create a major supply shortage for metals like dysprosium and terbium going into 2015.

The supply forecast for light rare earth elements (LREEs) is more optimistic, mainly because a few mines are coming into production in the next few years. Molycorp Inc.'s (MCP:NYSE) Mountain Pass Mine is projected to be in full production in the second half of 2012 and Great Western Minerals Group Ltd.'s (GWG:TSX.V; GWMGF:OTCQX) Steenkampskraal Mine could be operational in 2013.

TCMR: I know prices increased dramatically in 2009 and 2010, but most have come back down since then. Was it a bubble?

JB: We believe the price dip was long overdue because the market moved way ahead after China cut exports. A violent correction was normal after such a long-time price increase. We do not believe this will mark the new low due to the high global demand and the potential supply shortage. The rare earths market still holds a lot of promise in the future for astute investors, but capital needs to be carefully allocated into the sector. This is a stock picker's market now. More than 200 juniors list themselves as REE plays today. However, based on current conservative 2015 demand projections, we think the market can only support at most five or six companies.

What this means is many of the junior companies furthest away from production will go bust or sell out through a joint venture (JV) for pennies on the dollar. We think a massive consolidation of the sector is very good for its long-term health.

MD: Many of the rare earths companies, including some in the second tier, have management teams that don't properly understand the context of the current macroeconomic situation. Some of these companies in our second tier have high quality deposits, but are still years away from production with many companies in the second tier not scheduled to go into production until 2015 at the earliest. Despite this reality, a number of companies are not adequately managing cash flow burn rates to weather the storm and they will need additional equity financing in 12 months or less at a depressed stock price.

JB: For example, Arafura Resources Ltd. (ARU:ASX) management totally misunderstood the macroeconomic environment and did a massive equity financing/dilution after the stock price had already had an immense correction. This is one of the main reasons it didn't make either tier or our watch list, although the company could be saved by a surprise takeover or funding from the Chinese. Prudent company financing should have been done before early 2011 when rare earths prices were soaring.

TCMR: What companies positioned themselves well during this window?

JB: Molycorp used debt, equity and preferred shares to fund through production at higher stock price valuations. The company announced on Feb. 23 that it earned $0.26/share for Q411. Gross profit margins dropped less than 7% total, which means management is doing a very good job operationally considering how much REE prices fell and how some input costs have increased during the Phase 1 production ramp up of Project Phoenix at Mountain Pass. The company is in very good shape to weather out the storm of lower prices. It is now generating good cash flows from small production and doesn't need to go back to the market for any more debt/equity financing unless it wants to make an acquisition of accretive, undervalued assets, as it did earlier in the year by buying the rare earths processing company Silmet. The company recently announced a JV deal with Daido Steel and Mitsubishi Corp. (MSBHF:OTN) to make value added, higher profit margin rare earth magnets in Japan starting in 2013. Once more market penetration occurs, Molycorp is projecting massive sales growth for 2012 and should be able to achieve pricing power on all of their Xsorbx water treatment products and start getting a premium for the product. It's a sound long-term strategy. Innovating with the rare earths to create higher profit margin products to sell is the best way to weather the storm of a worsening macroeconomic environment.

Questions remain concerning permitting, execution on the mine-to-magnet vertical integration strategy, processing capacity and exposure to the HREEs. But the company is the best positioned of the group in our opinion. If Molycorp succeeds, the sector will start to get more people willing to finance other projects. The company could even reinvest profits into other juniors.

MD: Over at Great Western's Steenkampskraal Mine, the all-important total rare earth oxide (TREO) grades are well above 10% TREO, some of the highest grades of any deposit in the world, which could translate into the most robust profit margins. Rock mined at Steenkampskraal is monazite, so in-demand HREE concentrations are high. The mine could be in production in less than 18 months. The company already has a license to store the thorium byproduct at the mine, and since the mine was operated decades ago before it was shut down, infrastructure is already present. The company owns two quality processing facility assets worth more than the current market cap. Management has already said demand is increasing so rapidly that another doubling of production capacity is possible after the first expansion is implemented in the next three years.

Great Western Minerals owns a few other promising REE deposits. It will be buying tailings from other South African miners. It has a deal negotiated with Aichi Steel, a subsidiary of Toyota Group, for Aichi to buy a large quantity of rare earth alloys and another long-term supply contract with German permanent magnet maker, Vacuumschmelze.

The downside is that the Steenkampskraal Mine is located in South Africa, which is politically unstable. However, Great Western's processing plants will comprise most of the profit and those facilities are located in the U.S. and U.K.

Also, although it is generating significant revenues, Great Western Minerals is still not profitable because it pays high input costs for processing materials. The company imports rare earth metals from China at great expense. Management has not done a good job of understanding the macroeconomic situation or of managing the cash levels at the company and because of this, management botched a financing in the last few months that it could have easily done at a much higher stock price earlier in the year and have diluted less. The company is not fully funded yet and is not completely self-sustaining. Cheaper materials from Steenkampskraal will generate higher profits. The company's other processing facility, Great Western Technologies in Michigan, is currently sitting idle because of a dearth of HREE materials.

Great Western Minerals is a long-term play. Financial statements are getting stronger with increasing gross profit margins due to the Less Common Metals processing plant. Great Western's stock price also benefited tremendously when the rare earth metals price rose from 2010 to July 2011. Since then, the stock price had a violent correction, mainly from declining rare earth prices and dilution. Investors will have to have a two- to three-year timeframe when investing with Great Western Minerals. The most important thing to watch is management execution. Can they can recover from the dilution? Will they bring the Steenkampskraal Mine to full production on time with no major setbacks? Will they reduce processing costs? And can they continue to expand profit margins? If management can execute, we would not be surprised if this stock goes up tenfold.

TCMR: What REE-related companies could benefit from demand for REEs' unique physical properties?

JB: Neo Material Technologies (NEM:TSX) is generating significant profits and free cash flow. The company makes higher, valued-added profit margin products in the form of permanent magnets. Not many firms are capable of making neodymium iron-boron magnets outside of China, Japan and Germany. The company has been using profits to acquire smaller magnet-making firms.

The company recently announced a share buyback program to counteract what it believes is severe undervaluing. Neo Material still buys some of its rare earth alloy materials from China to make magnets and is vulnerable to higher export tariffs/taxes on Chinese rare earth products or disruptions in supply. To better protect itself, the company needs to further diversify its supply.

Similar to Great Western Minerals, Neo Materials is also a long-term play for rare earth investors. However, if you invested in this stock over a year ago, then it should be paying off now. Financial statements continue to get stronger every quarter with 10 consecutive increases in quarterly revenue due to the increasing rare earth prices. The quarterly earnings per share (EPS) increased almost sixfold and operating income is at $109 million (M), compared to $19M last year. Long-term debt is at $197M, but the company is sitting on $319M in cash, so it can pay off debt in full at any time and still have enough cash to reinvest.

It will be interesting to see how management increases revenue with declining rare earth prices. Will buyers lock up supply at a discount or will demand taper off due to the bad macroeconomic environment? Since Neo Materials has no exposure to the beginning part of the vertical integration strategy, the company might want to use its cash to do private placement or a royalty deal with rare earth mining companies in exchange for rare earth oxides (REOs) and alloys at a discount. We will have to watch this one.

TCMR: Why isn't Lynas Corp. (LYC:ASX) included in the top tier?

MD: At one point, Lynas was ahead of Molycorp in terms of its production timeline. That time has passed. Lynas has a very good and very economic deposit at Mt. Weld with great grades and a nice mix of rare earths, but the company has some very serious issues it needs to address with more than words if it is going to be moved back into our top tier.

For starters, Lynas has received very credible allegations of cutting corners at its proposed Malaysian REO processing facility. The plant was put in Malaysia because of a large tax break and the plant was supposed to be online already. What most people do not understand about the rare earths sector is that the concentrate produced from mining is worth up to 80% less than the market will pay for processed REOs, which are easier to move up the value chain and into more advanced products.

Lynas is currently mining its Mt. Weld Deposit, but it can't make the concentrate from there into REO at the Malaysian processing facility. The environmental permit for Lynas to process there has been delayed by the Malaysian government for more than eight months. Additionally, production costs have risen twice already to well above original project economics. We do not like the trend we are seeing out of management.

Also, Australia now shows significant geopolitical risk. Last year, politicians attempted a mining super-profits tax. This year, Australian politicians successfully passed carbon cap-and-trade legislation tax that will hurt mining production costs. We are avoiding investing in the country entirely.

TCMR: What can we expect from the rest of the field in 2012?

JB: Because we are using a more conservative demand estimate for 2015, we believe there will be a forced shakeout/consolidation period in the rare earths market, similar to what is still happening in the uranium market. Volatility caused by the worsening macroeconomic situation, fluctuations in REE prices and the abundance of rare earth juniors too far away from production with little to no hope of getting the financing means more shakeout to come.

MD: That said, there are still many positive, bullish reasons why investors should still be willing to allocate capital to the rare earths space. The entire market is more than capable of growing at a 7% or more annual growth rate in terms of industrial demand for many years because of the growing acceptance of products that only rare earths currently make possible and the future products that will most likely come from continued innovation in rare earths.

However, investors really need to be discriminatory with their capital. Concentrate on the top tier in the sector. Then sprinkle some of the second-tier companies that aren't generating cash flow yet but have quality deposits or processing facilities. Those companies are Quest Rare Minerals Ltd. (QRM:TSX.V; QRM:NYSE.A), Avalon Rare Metals Inc. (AVL:TSX; AVL:NYSE; AVARF:OTCQX), Tasman Metals Ltd. (TSM:TSX.V; TAS:NYSE.A; TASXF:OTCPK; T61:FSE), Stans Energy Corp. (HRE:TSX.V), Ucore Rare Metals Inc. (UCU:TSX.V; UURAF:OTCQX), Lynas, and Rare Element Resources Ltd. (RES:TSX; REE:NYSE.A).

Below the second-tier companies is a watch list of dark horse companies that could leapfrog or surprise and jump ahead of the second tier that we listed because these companies are selling at extremely low valuations and are potentially takeover targets or JV partners for companies like Molycorp and Great Western Minerals.

In our opinion, Molycorp and Great Western Minerals Group are going to end up consolidating the rare earth sector in the next three to five years—unless Lynas gets its act together and joins the ranks of one of the companies doing the consolidating. Neo Material Technologies has not hinted that they are interested in a fully vertical integrated strategy, but they have been acquiring firms higher up in the value chain in processing rare earth magnets. In 2013 going forward, we expect dividends in the common shares from Molycorp, Neo Material Technologies, and maybe even Great Western Minerals.

Jason Burack is an investor, entrepreneur, financial historian, Austrian School economist, and contrarian. Burack co-founded the startup financial education company Wall St. for Main St., LLC, to try to help the people of Main Street by teaching them the knowledge, skills, research methods, and investing expertise of Wall Street. You can also find Burack's work at his blog website at www.jasonburack.com.

Mo Dawoud graduated from James Madison University with a Bachelor of Arts in finance. He is the co-founder of Wall St. for Main St., a financial education company focusing on providing information on the economy and the market to contemporary Main Street investors. Dawoud believes in the Austrian school of economics and a free-market economy. He is an expert in technical analysis and fundamental analysis. His interviews and articles can be found on Forbes, Money Show, Financial sense and The Daily Gold. His technical analysis work has been featured in Kerr's Commodity Trading Newsletter. For more information on Mo Dawoud, go to http://www.momoneyblog.com.

Want to read more exclusive Critical Metals Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators and learn more about critical metals companies, visit our Critical Metals Report page.

Disclosures

1) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

2) The following companies mentioned in the interview are sponsors of The Critical Metals Report: Quest Rare Minerals Ltd., Stans Energy Corp., Ucore Rare Metals Inc. and Rare Element Resources Ltd.

3) Jason Burack: I personally and/or my family own shares of the following companies mentioned in this interview: Molycorp and Great Western Minerals.

4) Mo Dawoud: I personally and/or my family own shares of the following companies mentioned in this interview: Great Western Minerals.