- Lord Chesterfield

The media is all excited about the announcement of the Facebook IPO, treating it as if it's the second coming of sliced bread. At its anticipated IPO later this year, Facebook will be three times more expensive than Google was at its IPO—and nearly 40 times more expensive than the average large IPO of the last four decades. The valuation metric that some analysts chose to focus on is the price-to-sales ratio (PSR). Of course, it's too early to know for sure what Facebook's will be when it comes to market, since its offer price hasn't been set. But, based on the early reports that Facebook will be valued at its IPO at as much as $100B, and 2011 revenues of $3.8B, Facebook's PSR will be around 26. In order to produce a profit stream that is great enough to support a prayer of its stock doing even close to as well as Google's did in its first few years of life, Facebook's revenue growth will have to be several orders of magnitude greater, or have a profit margin that is several times greater—or both.

According to estimates prepared by Goldman Sachs a couple of months ago Facebook's profits will not reach US $1B in 2011. That means they are going to sell for almost one hundred times earnings. For those of you who don't grasp the concept of price/earnings it means you are going to wait one hundred years before you get your initial investment back! Doesn't that bother anybody? Doesn't it make you question why anyone in his or her right mind would buy a stock like that? If that's not a sign that we are close to a market top I don't know what is.

Meanwhile I continue to watch the U.S. dollar and of course there is little being said by the American media. Almost no one seems to grasp that we are about to bear witness to what very well could be the single greatest event in our lifetime—the demise of the U.S. dollar. The greenback has been the world's reserve currency since before we were born and it's what the world knows. The fact that it is about to begin the final leg down into nothingness is a life-altering event. Most people gauge their wealth in dollars and their wealth will disintegrate with the dollar. The dollar had been headed higher since May of last year but ran out of gas in mid-January as you can see below:

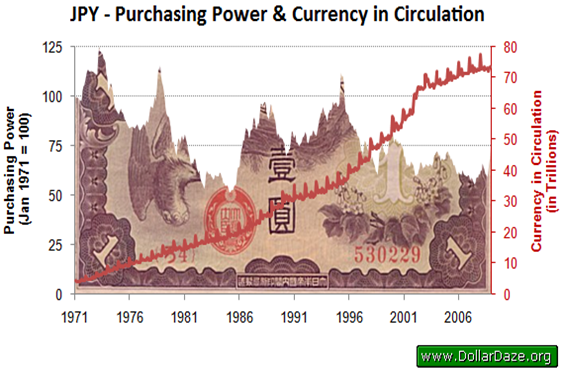

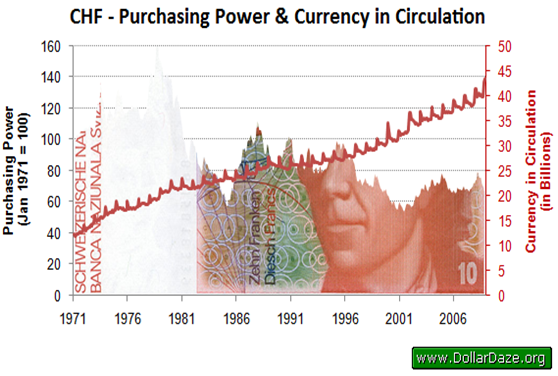

We are all familiar with the rising money supply in the US over the last couple of decades and I've shown you the charts a dozen times. What most of you don't realize is that other money supplies around the world have been exploding as well. Take a look at the Yen and Franc below:

Their money supplies have exploded right along with the dollar. So all major fiat currencies have and are continuing to expand their money supplies. Also, all these countries are heavily in debt, so much so that they'll never be able to pay it off. Do you see the connection? They've all made a conscious decision to devalue their respective currencies down to nothing until that debt disappears! So not only is the dollar going down the tubes, but also over time the Euro, the Yen and maybe even the Swiss Franc will follow, and it's all by design!

This of course has implications since it appears that no fiat currency can serve as a store of value. The implication is that

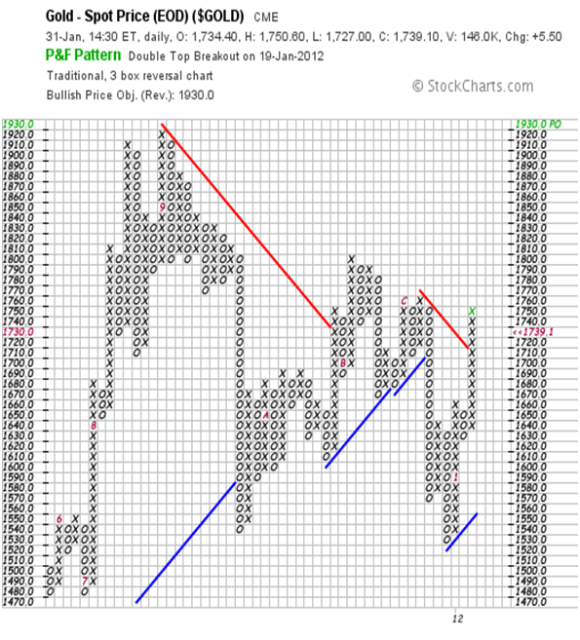

gold will move to the front of the line and take its rightful place as the one and only real money. I think that is the real message behind the top in the U.S. dollar and the recent breakout to the upside in gold. This morning the spot price for gold is up another 10.00 at 1,746.70 as it just keeps chugging along.

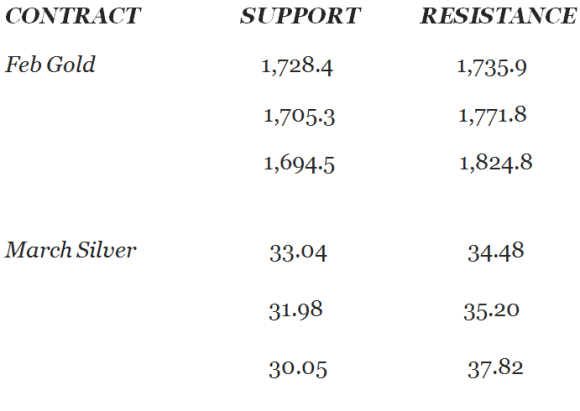

Silver is headed down the same road as gold, just a couple of car lengths behind. As you can see here it staged a break out

two weeks ago, but it will not reach gold's status until it breaks through a major trend line at +/- 38.00. This morning spot silver is up 75 cents at 33.88 so we do have some distance to travel yet.

Finally assuming that gold can hold on to its gains until the New York close there is really no resistance until it reaches 1,771.80 and as far as the short term is concerned, I continue to see gold challenging the all-time high within a month or two at the most. That fits well with gold's bullish price target of 1,930.00 contained in the following Point & Figure chart:

Point & Figure charts are a favorite tool of mine because they focus solely on price action and leave emotions and opinions out of the mix.

In closing, a lot of clients waited to see if the rally was for real and didn't buy. Now they are waiting for a correction. That is the wrong way to go about gold. If you don't own gold, you should buy it today. If you didn't add on a month ago, you should do so today. Gold has now entered the lucrative third phase of its bull market and many investors are on the sidelines stupidly waiting for a lower price. Question: if gold is going to 4,500.00 what difference does it make if you bought it at 1735.00 or 1,695.00? Answer: none! Do yourself a favor and go out and buy some gold and silver today.

Giuseppe L. Borrelli

February 01, 2012

www.unpuncturedcycle.com

[email protected]

Disclaimer: All the reports and content in the entire Unpunctured Cycle web site (including this report) are for educational purposes only and do not constitute trading advice nor an invitation to buy or sell securities. The views are the personal views of the author. What's more the author may already hold a position or positions discussed in this article. Before acting on any of the ideas expressed, the reader should seek professional advice to determine the suitability in view of his or her personal circumstances. All material in this article is the property of Unpunctured Cycle.