- The ministry issued separate quota allocations for light (LRE) and medium / heavy (M/HRE) rare earth products, and not just for rare earths as a whole. We’ve been anticipating this change for some time, based on industry chatter from within China, but 2012 marks the first time, to my knowledge, that these separate allocations have been rolled out;

- Also for the first time (again, to my knowledge), the ministry clearly telegraphed the intended total export quota for the entire year, prior to making the usual follow up allocation announcement next summer; and

- The Ministry separated individual companies into two groups – the first group received confirmed quota allocations, while the second received only provisional allocations. Companies were placed into one of these groups based on their progress towards implementing new pollution control regulations, with the latter group only getting their allocated quotas if they meet the various requirements by July 2012. Companies who fail to meet the new requirements, will have their quotas re-allocated to other companies.

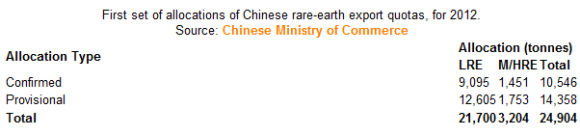

In the announcement from the ministry, it was stated that the first round of quota allocations (totaling 24,904 t) will represent 80% of the quota allocations for 2012, which indicates that the total for the coming year will be31,130 t of rare earths, slightly higher than last year. Here’s how the two groups of allocations break down:

Let’s now break this down further – first, here are the companies that received confirmed quota allocations, divided into sub-lists for Chinese and Chinese/non-Chinese joint-venture (JV) companies. The two sub-lists are sorted from highest-to-lowest total allocation:

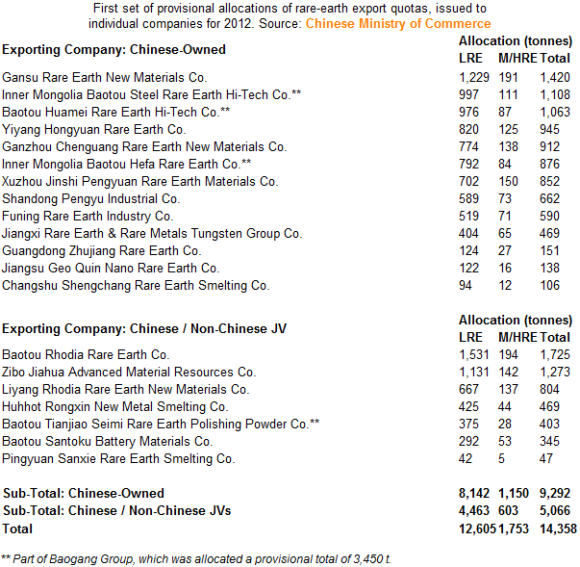

Next, are the companies that received quota allocations that are provisional on them meeting the new pollution-control standards, again divided into sub-lists for Chinese and Chinese / non-Chinese JV companies. The two sub-lists are sorted from highest-to-lowest total allocation:

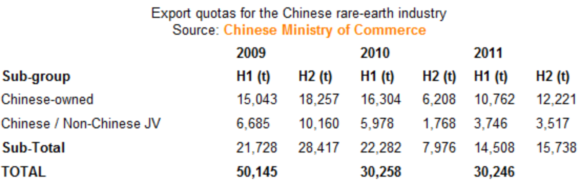

Finally, here is a comparison of the quota allocations for the past three years (compare to the projected total of 31,130 t of quota for 2012):

It can be seen that a significant majority of the Chinese/non-Chinese JV companies were placed into the provisional category, including both of the rare-earth enterprises operated by Rhodia (Baotou Rhodia Rare Earth Company and Liyang Rhodia Rare Earth New Materials Co.) and one of the enterprises operated by Neo Material Technologies (Zibo Jiahua Advanced Material Resources Co.).

As usual, in addition to the numbers, the ministry also published its algorithm for assigning specific quotas to individual companies, out of the total allowed. This year, it was based on both the total volume (50%) and the total value (50%) of exported rare-earth sales for each company, in the last three years, compared to the industry as a whole.

Also as usual, a significant section of the media (both mainstream and industry-specific) got this story all wrong, incorrectly focusing on the difference between total quotas allocated and announced at the end of 2010 for 2011 (14,508 t), and the confirmed quota allocations noted above (10,546 t). The valid comparison has to be between whole-year allocations. We probably need to stop thinking about these quota allocations as being specific to six months of a given year only. The Chinese Ministry of Commerce has specified the details for 80% of 2012's quota, and has indicated the total value of the quotas as a whole. We can expect an announcement in the summer of 2012 giving the details of which companies were allocated the remaining 20% of quotas, and whether or not the companies allocated provisional quotas, received them, or if instead they were reallocated to other companies, and which those companies might be.

There are still some unknowns about the recent quota announcement, which will be important to clarify in the near term. We need to see if any additional rare-earth product types have been added to the list that are counted for quota purposes. I’m also keen to confirm that the term "light rare earth" in the context of this announcement, refer to products based on lanthanum, cerium, neodymium, praseodymium and samarium, with the term "medium / heavy rare earth" referring to the rest.

A comment on the allocation of confirmed vs. provisional quotas: unlike a number of industry conspiracy theorists out there, I do not believe that the exclusion of the Baogang Group of companies (and others) from the confirmed quota category, until they complete efforts to clean up their environmental act, is some sort of smoke screen or ruse. Neither do I believe that any aspect (with perhaps one exception) of the announcement, was some sort of response to the approaching on-streaming of Mount Weld in Australia and Mountain Pass in the USA. It seems clear to me, based on discussions with industry insiders, that China continues to march to the beat of its own drum, and while potential new sources of supply from outside of China are of course on the radar in China, they do not drive internal policy.

That said, I will say that it seems curious to me, given the collapse in actual rare-earth exports from China in 2011 compared to the quotas allocated, that the total quotas planned for 2012 are actually higher than for 2011. We know that the significant price increases for these materials were the key factor in the demand destruction (temporarily or otherwise) seen in 2011 (with lanthanum- and cerium-based products seeing the largest declines in demand). It is possible that the authorities in China see prices falling much further than the recent decreases that we’ve seen, to such low levels that the demand for exports will return to 2009 / 2010 levels, which would "fill out" the 2012 quota allocations.

The questions in my mind then, are these: is the higher-than-2011 total quota level for 2012 simply an action taken passively in the face of anticipated price decreases (partially due to anticipated competition from Mount Weld and Mountain Pass towards the end of 2012)? Or is it in fact an indication that the authorities intend to actually step in and to intervene – forcing prices lower than their current levels, in a bid to get exports back up to the 30-31,000 tpa level? The answer remains to be seen…

One final note: although it is highly unusual for the Chinese Ministry of Commerce to make the allocation of quotas provisional on meeting certain regulations, it is actually not unprecedented. Last year, 62 t of quota were provisionally allocated to one company, Pingyuan Sanxie Rare Earth Smelting Company, on the proviso that its recent (at the time) infrastructure improvements were inspected and approved by a local regulatory agency in March 2011. The provisional nature of this quota allocation is the reason why you might see slightly different total quotas allocation numbers for 2011 – mine, above, includes the 62 t – many others do not.

Gareth Hatch analyzes the role of rare and strategic metals in the technology supply chain and is a co-founder with Jack Lifton of Technology Metals Research LLC as well as founder of Terra Magnetica and an editor at RareMetalBlog.