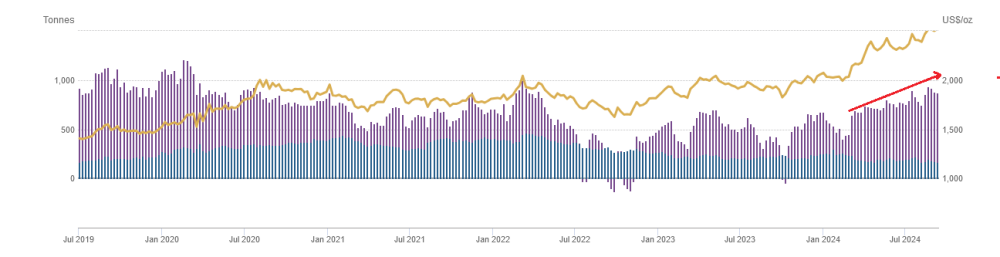

I have been commenting how little new interest there has been in Comex Gold contracts and the gold ETFs.

This is a stealth rally and just a trickle of participation out of North America thus far. Comex net long positions have increased some since April, but not near as much as the last rally in 2019/2020 when gold only reached $2,000.

However, it is a different story in Asia, mostly India and China. Earlier this spring, an article in the Financial Times said that Chinese gold speculation "helped supercharge" the gold rally. World Gold Council chief market strategist John Reade told the Times, "Chinese speculators have really grabbed gold by the throat."

The same reasons we often see rising demand here are cited there: a sagging Chinese stock market and real estate.

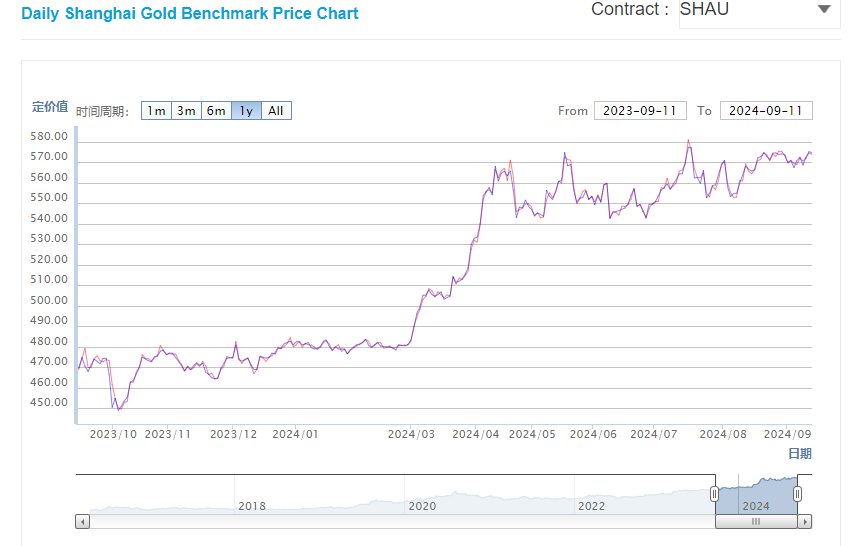

The Chinese Shanghai Gold Exchange only got going in 2014 but continues to grow trading volumes. You can see in the chart that trading volumes have steadily increased since 2019, and there has been a further spike this year with the jump in gold prices. Shanghai is taking the price-setting power away from the U.S. Comex. Basically the U.S. Fed is the only Central Bank (CB) trying to defend the dollar against gold and their main tool, the Comex has become less effective.

Since gold became a tier 1 asset in 2023, and in anticipation of that CBs have been moving out of dollars and euros and into gold. This along with higher Shanghai volume, strong retail physical demand in India and China are setting the price. I believe this is one of the reasons a lot of North American investors have not caught on and/or don't believe in this new bull market. Of course we need buyers at higher prices, so this is a good thing for us current bulls.

I mentioned I would try to find one or two more good, valued gold producers, laggards, so to speak. One of these is already on our list.

B2Gold

Recent Price -CA$4.50

Entry Price - CA$4.45

Opinion – Strong Buy

B2Gold Corp. (BTG:NYSE; BTO:TSX; B2G:NSX) has seen a good move up in the last few days, and not just because the gold price made new record highs, but because there has been a major fundamental change.

On September 11, B2Gold agreed to terms with the State of Mali in connection with the continuing operation and governance of the Fekola complex, including the development of both the underground project at the Fekola mine (owned 80% by B2Gold and 20% by the State of Mali).

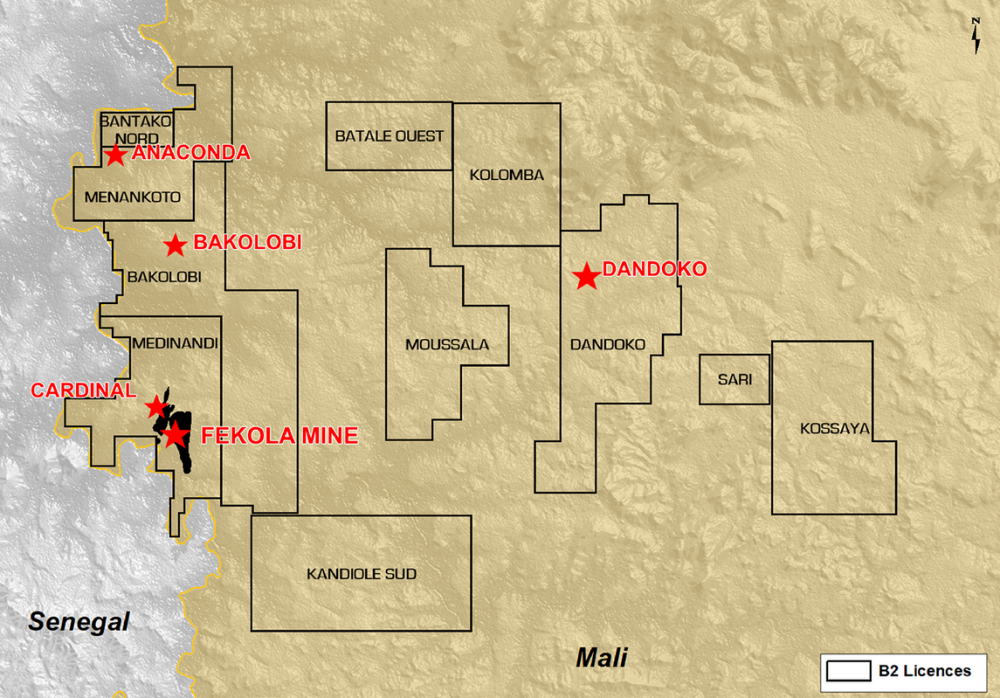

The Fekola complex comprised the Fekola mine (Medinandi permit hosting the Fekola and Cardinal pits and Fekola underground) and Fekola regional (Anaconda area (Bantako, Menankoto and Bakolobi permits) and the Dandoko permit), which is located approximately 20 kilometres (km) from the Fekola mine. Fekola is B2Gold's top producing mine.

In 2023, the State of Mali enacted a new mining code, and this delayed some of B2Gold's exploration permits to be finalized under the new code. B2Gold continued to mine Fekola, but their mine plan included about 100,000 ounces per year to be produced through the Fekola mine with regional deposits of about 20 km away.

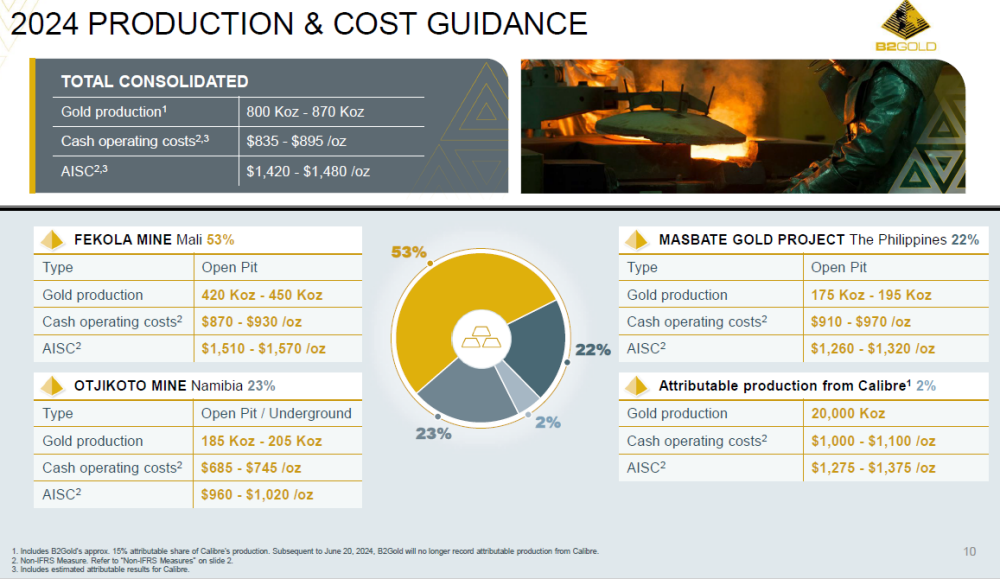

B2Gold could not do this until they got the new exploration permit for the region. As a result, B2Gold had to reduce 2024 production guidance, and it increased costs because overall grades would be lower, which would have a negative effect on the stock. Fekola also had a heavy rain event that reduced one quarter of production. Furthermore, B2Gold is developing a major new mine, the Goose project. In recent years, the market has been leery about rising costs for mine development. This also put another uncertainty on the stock. Goose is almost completed, so this will now turn into a positive for the stock.

With the announcement on September 11, exploitation permits for Fekola regional and approval of the exploitation phase of the Fekola underground will be expedited. Upon issuance of the exploitation permit for Fekola Regional, mining operations will begin with initial gold production expected to commence in early 2025, with the potential to generate approximately 80,000 to 100,000 ounces of additional gold production per year from Fekola Regional sources through the trucking of open pit ore to the Fekola mill. Initial gold production from Fekola underground is expected to commence in mid-2025.

The Fekola mine will continue to be governed by Mali's 2012 mining code, with the Fekola mining convention remaining in place until 2040. The Fekola regional to be governed by the 2023 mining code. The agreement includes continued stability of the ownership, income tax and customs regimes, and the company's dispute resolution rights under the Fekola mining convention.

This provides the Fekola complex a clean slate to move forward under the new economic partnership with the State of Mali. These three slides from B2Gold's presentation will give a clear picture of the events I describe above. You can see that Fekola is their major mine.

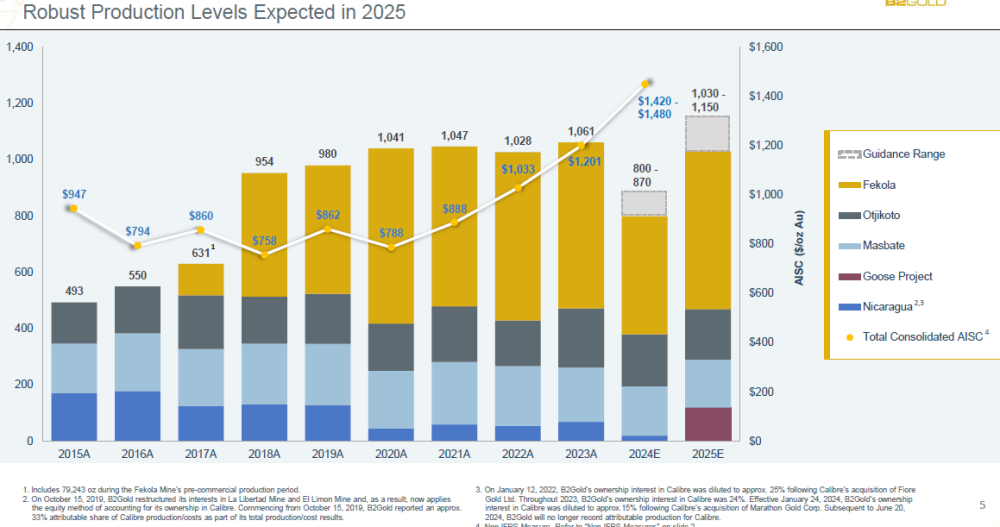

This next slide shows the 2024 drop in production and big jump in costs. This all gets back to the trend and is normal in 2025.

At this point, these are estimates, but I have no reason to believe they cannot be met. Also, note that the Goose project kicks in later in 2025.

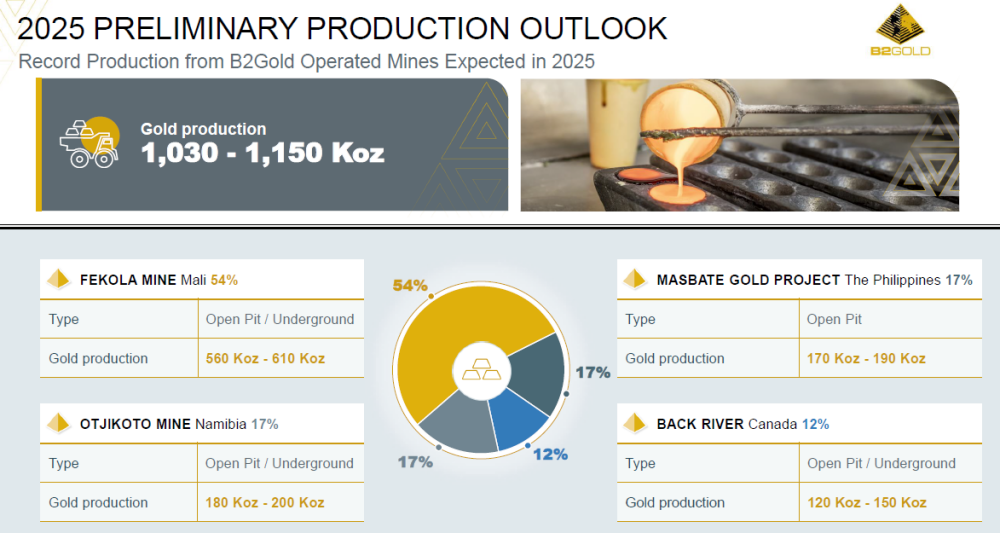

The next slide for 2025 highlights that Fekola is still about the same percentage of production because output increases to around 600k from about 450k in 2024.

The delayed 80,000 to 100,000 ounces that were scheduled in the life of mine plan to be trucked to the Fekola mill and processed in 2024 but now expected to commence in 2025.

The above slide shows the start of production from the Back River District (Goose Project). Commercial production is not expected to Q3 2025.

Goose Project, Nunavut, Canada, 100% B2Gold

All planned construction year to date in 2024 has been completed, and project construction and development continue to progress on track for the first gold pours at the Goose project in the second quarter of 2025, followed by a ramp-up to commercial production in the third quarter of 2025: B2Gold anticipates that once in commercial production the Goose mine will produce approximately 310,000 ounces of gold per year over the first full five years. M&I resources are 6.3 million ounces at 5.88 g/t. The Goose Project ranks among the highest-grade undeveloped gold projects globally.

Total Goose project construction, mine development, and sustaining capital cash expenditures (construction and mine development cost) before the first gold production estimate is now CA$1,540 million, a CA$290 million (or 23%) increase from the previous estimate.

Approximately 52 % (or CA$150 million) of the increase in the estimated total Goose project construction and mine development cost before the first gold production can be attributed to the one-quarter delay in the first gold production previously disclosed, combined with the acceleration of capital items that were previously anticipated to occur after first gold production. The acceleration of certain capital items is expected to make the Goose project a more reliable and derisked operation upon mill start-up. The accelerated capital items include accelerated purchases of mining equipment versus the previous estimate to ensure continued growth in mining rates through 2025, the building of an accommodation complex at the MLA, which will reduce continuing annual costs associated with running the Winter Ice Road (WIR), the construction of critical infrastructure at the Goose site, inclusive of warehousing, maintenance, mine dry facility, camp facility expansion and the design acceleration of a reverse osmosis plant to optimize water management and lower continuing operating costs.

Approximately 24 % (or CA$70 million) of the increase in the construction and mine development cost can be attributed to the increased cost of the logistics of shipping materials to the Goose project site.

Conclusion

B2Gold is fully financed to complete their Fekola plans and completion of the Goose mine. As of June 30 financials, they had $467 million in cash and no debt. They also have available an undrawn credit facility of $700 million.

The negative factors on total gold production and costs will all vanish in late 2024, so 2025 will be a very good year. And production will grow further in 2026 as the Goose project has a full-year effect. It is a high-grade, low-cost mine.

Also piled into 2024 is the total consolidated all-in sustaining costs per ounce, reflecting the final full year of spending on both the new Fekola Tailings Storage Facility ("TSF") and the Fekola solar plant expansion, in addition to the ongoing substantial capitalized stripping campaign planned at Fekola for 2024.

A metric I often use is the enterprise value of ounces of gold in the ground. B2Gold has a total M&I resources of 19.6 million ounces. They have US$467 million cash and 1,311 million shares at US$3.30 = US$4,326 Market Cap – US$467M cash= US$3,859 = US$197/ounce.

In 2022, Kinross acquired Great Bear Mining for US$1.8 billion. There was no resource number at that time but the recent Kinross PEA says 2.74M oz M&I resource for a value around $650 per ounce based on the 2022 buyout.

Very recent, Osisko's (OSK) 50% of Windfall is being bought by Gold Fields for CA$2.16 billion - CA$300M cash values the gold at CA$1.86 billion or about US$1.37 billion. Osisko's Windfall project has 4.1 M ounces M&I, so 50% of that is 2.05 million ounces. That takeover values those ounces at US668 per ounce.

Granted, these are both high-grade projects selling for around $650 per ounce. I believe that B2Gold's ounces for a producing company should be way higher than $197 per ounce. It should at least be double that.

The stock has languished with these over hanging issues and is not fully pricing in a turn around for 2025. The recent downward trend (blue lines) driven by the previous negative fundamentals appears to be broken and with a higher high this week. We also have a nice double bottom in 2024. The stock is a long way from it's 2020 highs and I see $6 as a minimum target for this year/early 2025.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Ron Struthers: I, or members of my immediate household or family, own securities of: B2Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.