Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ) is a momentum play, and the reason why we are looking at it now is that it looks like the current strong upside momentum will continue for a while yet and if so, it will result in substantial gains over the short to medium-term and these gains will likely occur over the short-term for reasons that quickly become apparent when we look at its 6-month chart.

The story with this stock and the reason for its recent strong gains is that Perpetua Resources Has Received Indication for up to US$1.8 Billion Financing from the Export-Import Bank of the United States for Stibnite Gold Project, and a big reason for this appears to be that the mine, once constructed, will also produce large quantities of antimony that is used in munitions which currently is not produced at all in the U.S.

This funding is subject to certain conditions being met, but by the look of it, they will be. On the 6-month chart, we can see that upon this news being released, the price shot up on the 8th of this month, but after further gains, the next day resulted in it becoming extremely overbought short-term, it settled down to mark out what looks like a bull Pennant that once completed calls for a move of similar magnitude to the one leading into it. The way volume has died back steadily as this Pennant has formed indicates that it is genuine and not a top.

We can, therefore, expect another sharp towards the resistance level in the US$9 area that would result in a swift near 50% gain, and that could happen in short order given that this Pennant is now fast closing up.

The 5-year chart shows us the origins of the resistance that caused the advance to halt temporarily early this month and also the origins of the resistance in the US$9 area, which is our next target.

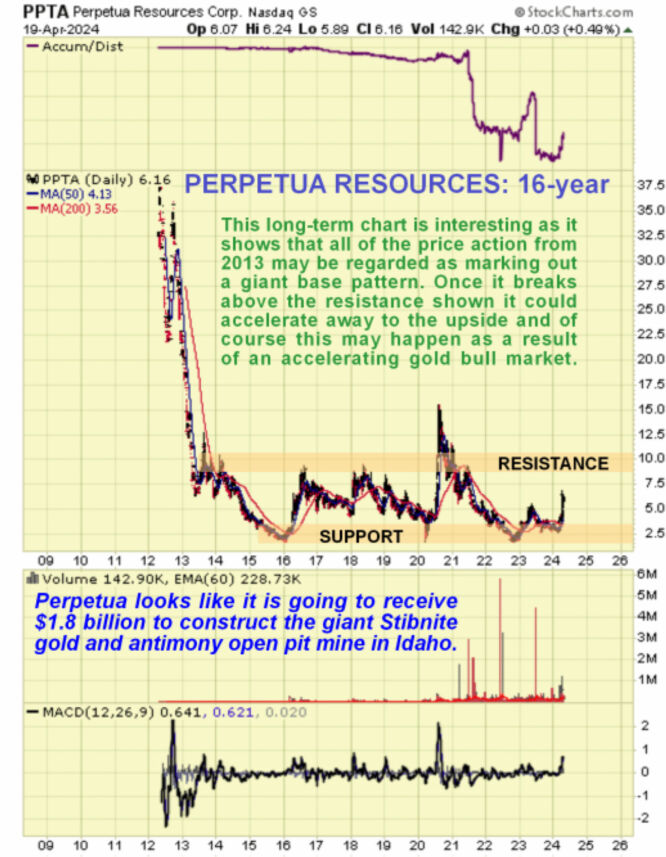

The long-term 16-year chart is interesting as it shows us that all of the action from 2013 may be regarded as marking out a giant base pattern, and if this is the case, it is not unreasonable to suppose, given the enormous upside potential of gold in the next several years, that once it succeeds in breaking above the resistance in the US$9 - US$10 area it could drive rapidly higher to equal or even exceed its 2012 highs in the US$37.50 area.

Perpetua Resources is therefore rated a Buy for all timeframes that will appeal to quick-fire speculators who want to make a big gain fast, and a stop may be placed beneath the lower boundary of the Pennant, say at US$5.45, to limit loss in the (unlikely) event that it breaks down from it.

This would probably only happen in the event that EXIM says to the company, "You know that money we said we were going to front you to build that mine? Well, you're not getting it."

This seems highly unlikely.

Perpetua Resources' website

Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ) closed at US$5.46, CA$7.54 on Aril 30, 2024

Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Perpetua Resources Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.