There are two big factors in play that make Libero Copper and Gold Corp. (LBC:TSX.V; LBCMF:OTCQB) a compelling story and a most attractive stock for investors now. One is that a massive copper shortfall is bearing down on the market that is due to hit big next year — and Libero just happens to have the largest copper resource in Colombia which is also one of the world's largest undeveloped molybdenum deposits. The other is that its stock is at a very low price now after a brutal bear market that took the price down almost to zero, and it is just starting to reverse out with very favorable technical indications that we will examine later.

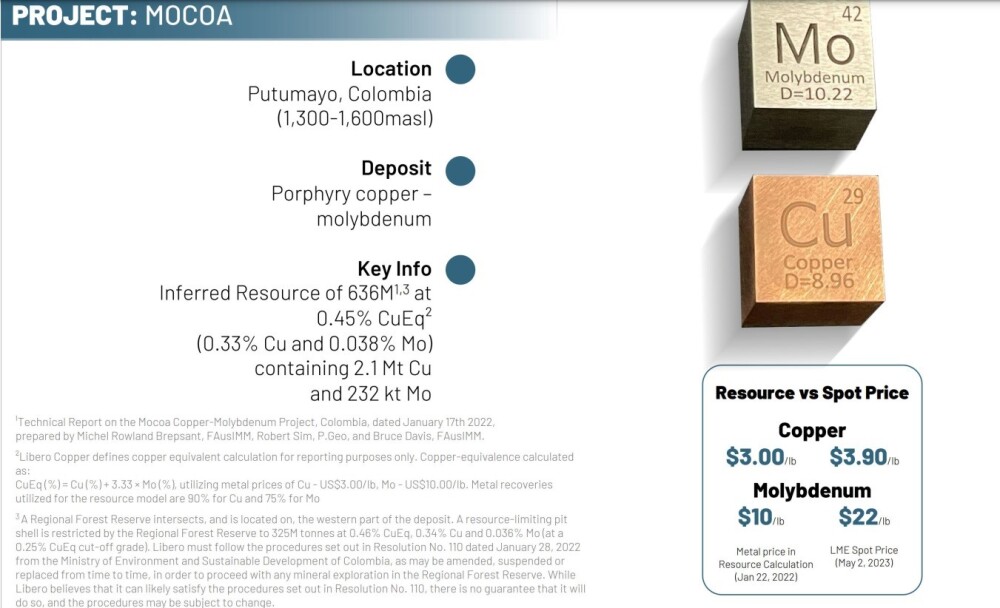

Libero Copper is a mineral exploration company that is focused on developing the Mocoa copper-molybdenum porphyry deposit in Columbia. Mocoa has 636 million tonnes of 0.33% copper, containing 4.6 billion pounds of copper and 511 million pounds of molybdenum. There is additionally the potential to extend the resource with drill targets ready.

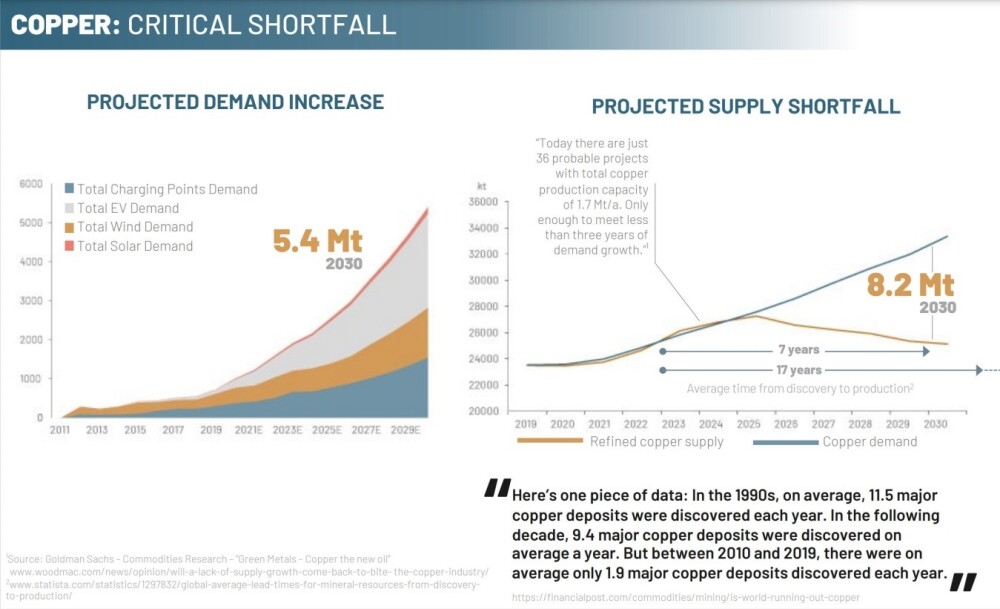

As we know, with interest rates set to drop and inflation set to ramp up further, the metals sector is entering a major bull market, and among metals, copper is looking set to do very well, especially with the impending supply crunch made clear by this graphic from the company's investor deck which in addition to showing the huge projected increase in demand for copper, also shows the increasingly massive yawning gap between supply and demand that kicks off next year.

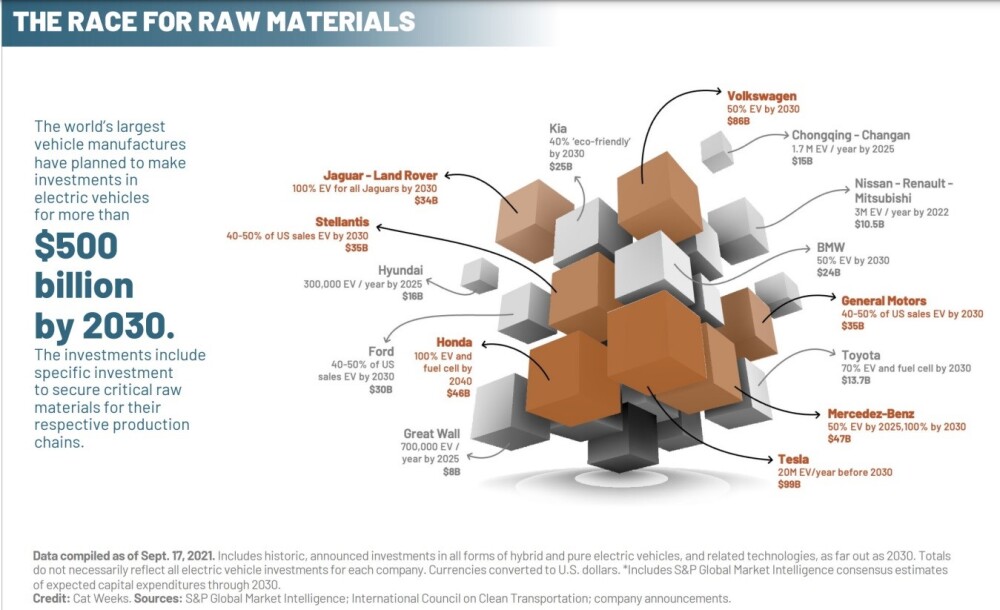

The following graphic, also from the Investor Deck, shows the projected changeover to EVs by the main automakers, and even if this is only partially realized, it will still result in a huge increase in demand for copper.

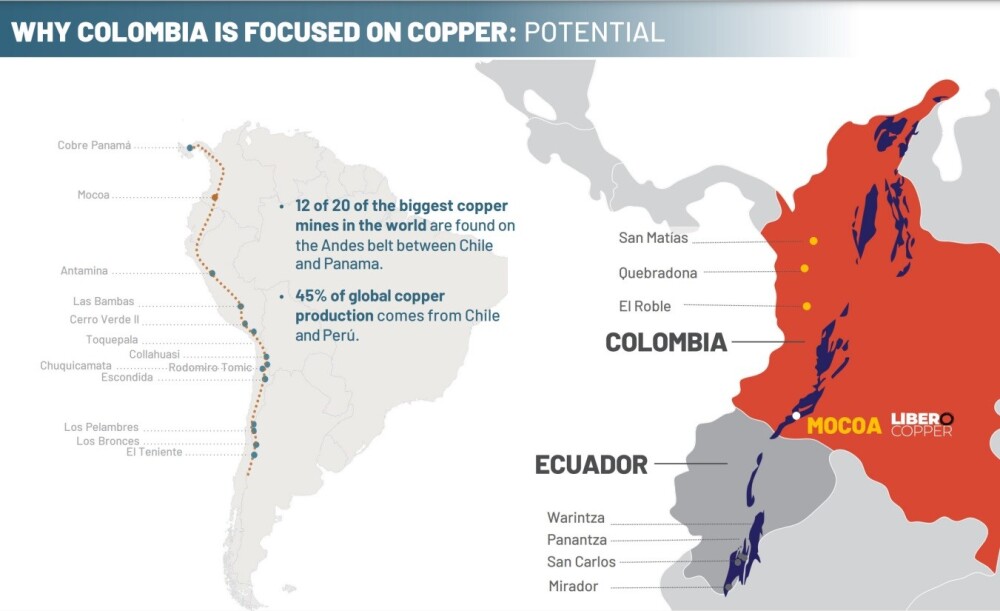

The following slide shows how Libero's Mocoa project is located in Columbia in the great Andes copper belt.

The following slide shows the magnitude of the company's resource at Mocoa.

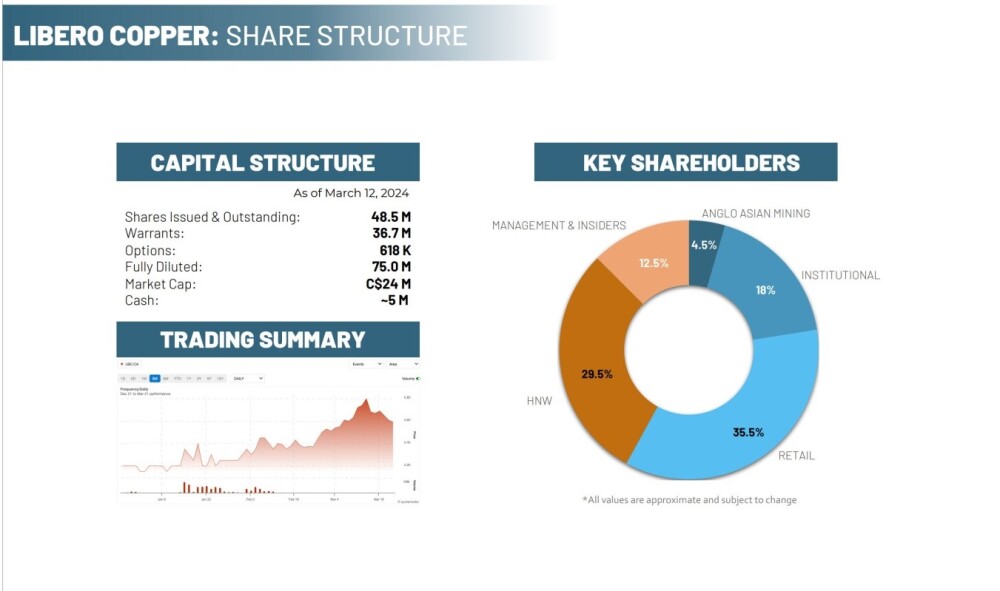

This slide shows the share structure, and on it, we find not only that the number of shares in issue is a reasonable 48.5 million, but of these, only about 35.5% are in the float, since 29.5% are owned by HNW with a further 18% owned by institutional investors, 12.5% by management and insiders and 4.5% by Anglo Asian Mining.

Now, we will proceed to review the latest stock charts for Libero Copper to see why it is such a strong buy here.

In order to fully understand what is going on with Libero Copper stock, we are going to adopt a "Russian dolls" approach — start big by looking at a very long-term chart and then zoom in step by step to conclude with the chart showing recent action in detail.

The very long-term 17-year chart reveals that Libero has seen much better days, getting as high as CA$63 back in 2011, but since then, it has been a downhill story. It had looked like it had hit bottom and was getting its act together with it starting to emerge from a fine Cup pattern in 2016, but the pattern aborted and it then ran off sideways in a huge trading range that culminated in the final ignominious plunge from its 2022 high with it hitting bottom at a mere 15 cents last November – December.

On the 5-year chart, we can see the latter part of the giant trading range in more detail. This shows how, following the brief 2022 spike high at the top of the range, it tipped into another decline that, this time, crashed through the support at the lower boundary of the range, with the price running off lower and lower in a savage downtrend that finally hit bottom late last year with the stock being close to worthless.

Then — at last — the turn came with very heavy buying this year, reversing the trend to the upside. We will now look at this brutal downtrend in more detail on the 2-year chart.

The 2-year chart shows the highly destructive downtrend from the 2022 spike high in its entirety and in more detail. After breaching the support at the lower boundary of the big trading range that is now resistance, the price kept going lower and lower, but then, when the stock was almost worthless, the turn came early this year, and it was dramatic.

Huge buying kicked in and it reversed the trend to the upside and drove the On-balance-volume line shown at the top of the chart steeply higher. This is very bullish and is taken to signify the start of a new bull market.

Now normally, after such a severe decline, a stock needs to spend time marking out a base pattern before it can mount a sustainable advance, but this massive volume suggests that it will not need to on this occasion, and this may be partly due to the metals complex starting a major bull market now.

It is thus interesting to observe that Libero may have actually been basing in a clandestine manner since the middle of last year, for if we look carefully, we can see what is believed to be a tilted Pan and Handle base that started to form as far back as the middle of last year. If this interpretation is correct, then it explains why it did not "stand on ceremony" before taking off strongly higher this year and, furthermore, is free to continue to advance.

Lastly, we will look at the action so far this year in detail on a 3-month log chart. We are using a log chart here because it neatly defines the trend.

As we can see, the stock is ascending in an orderly, almost parallel uptrend and this being so the substantial but normal reaction back of the past several weeks has brought the price back to a very favorable "buy spot" at an important support level and at the lower rail of the uptrend channel where it is viewed as a Strong Buy.

The conclusion is that Libero Copper looks exceptionally attractive here with huge upside potential, and it is rated as an Immediate Strong Buy.

Libero Copper's website.

Libero Copper and Gold Corp. (LBC:TSX.V; LBCMF:OTCQB) closed at CA$0.50, $0.46 on April 2, 2024.

Want to be the first to know about interesting Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Libero Copper and Gold Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.