We are talking gold mines today. When will I ever learn?

Gold, as I'm sure you've heard, has broken out to new highs. There are two things that excite me about this move.

First is that this has happened in the face of huge ETF outflows: gold ETF holdings have declined by about 25% over the last 18 months — that is a big number — and those outflows have accelerated in recent weeks as investors have been selling gold ETFs to buy bitcoin ETFs.

Second, there is hardly any fanfare. Bitcoin has been making all the noise. It's a so-called "stealth breakout," the best kind of break-out. That should mean the time has finally come for a turn in the miners. Yes and no. Miners' profits won't be up nearly as much as one might hope because the costs of mining — whether energy, equipment, personnel, meeting regulatory requirements, permitting delays — input costs, in other words — have all increased by more than gold has.

There is also the ongoing problem of incompetent operators and excess dilution, which leads to the perennial underachievement of mining. But this relentless, interminable, horrible, protracted bear market looks like it may have finally drifted to an end.

If miners can't rise with gold breaking out to new highs, when can they?

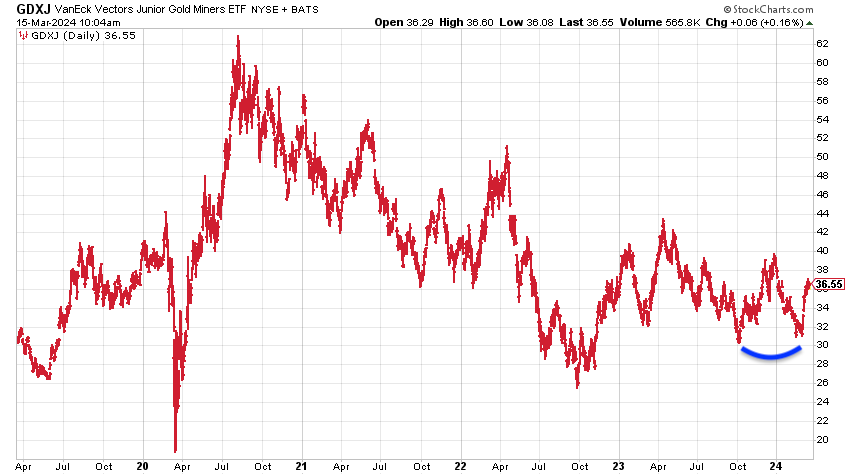

While we haven't exactly seen an unstoppable rebound, at least the direction of travel is now sideways rather than downwards GDXJ is as good a proxy as anything for midcap gold mining companies, and here we see the chart. Here's hoping we have found a low of around $30.

Perhaps the time has come to be dipping a tentative toe into the water if you haven't already.

Maybe even consider increasing your positions if, like me, you have been one of those who should have taken an early loss but chose to hold on instead.

I have a feeling gold is going to come in very handy in the not-too-distant future. If you are interested in buying gold rather than gold miners, you are a wise person. I have recently put together this guide. My recommended bullion dealer is Pure Gold Company.

When mining stocks are rising, every boat — or should I say turd? — floats. It's a bit like altcoin season. But even so I try to pick companies that have got something going for them beyond being a just gold miner.

Either they are likely to be taken out, have an extraordinary resource for which they are not getting proper credit, or have competent management that is going to engineer some growth and get the company a re-rating.

We have 10% of the Dolce Far Niente allocated to special situations — the fun part of the portfolio, in theory. Junior gold miners can make up part of that allocation.

With that in mind, here are four companies with the potential to shine brightly in a gold mining bull market: a likely, imminent take-out candidate, a development play, and two emerging producers.

Of all the picks, the first is the one that, for me, has the most immediate chance of fireworks: the likely take-out play.

Condor Gold

Little has changed with Condor Gold Plc. (CNR:LSE;COG:TSX) since this report I wrote last month, so take a look, if you are not already familiar with the situation. The normally vocal management remains so quiet that I'm inferring that some kind of deal is on the cards.

I will only add that when I tried to call Mark Child, the CEO, earlier in the week, he didn't pick up and then messaged me to say he was on-site in Nicaragua. Good sign.

More significantly, when I messaged the Chairman, Jim Mellon, as before, he said he couldn't speak to me. Also a good sign. Subtext: negotiations are still ongoing.

Make of it what you will. I guess we will know within a month or two if this one is going to work.

Here we see the last two and a half years:

STLLR Gold

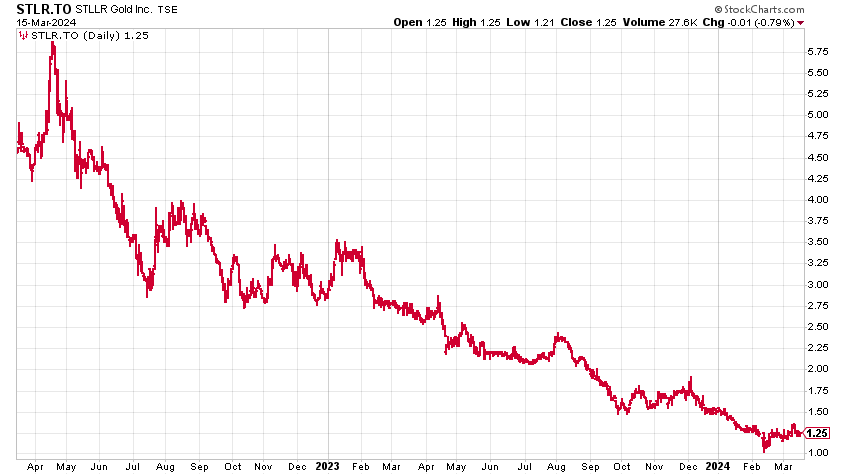

Previously Moneta, and a long-time holding, STLLR Gold Inc. (MEAUD:OTCMKTS;STLR:TO) is going to take a bit longer. But I think it has a lot of potential with fairly minimal downside risk (by the standards of a mining company).

My most recent write-up of this CA$125 million market cap development play is here.

Have a read of that if you haven't already. In response, CEO Keyvan Salehi got in touch to refute some of my comments. I'll summarise them here.

- He is Iranian — not Iraqi-born!

- With regard to my point about management only owning 1%, they were at 5.6% ownership of Nighthawk, but with the exchange ratio of the merger, they have been diluted down. "It will take time for us to raise to those levels, considering that we have not been working for cash. Also, that ownership is our own capital; it doesn't include options or shares that have been granted." So that is good.

- He was also at pains to point out that he only took over at Nighthawk 30 months ago, after the large part of the declines. "Share prices have been horrible, there is no denying that, but on a relative basis, and prior to the Moneta merger, Nighthawk was a better performer than most in the peer group. Not a great relief when share prices are down by 40-50%, but we did maintain our market cap of 50-70M CAD during my tenure even though we raised over $110M in capital during that time. So all and all, and relative to the market, it was better than most."

- "I still stand behind my comment regarding this being the worst market I've known. What makes it worse for me is the valuations in relation to the price of gold. In 2011 and 2015, the price of gold was struggling, so lower valuations were somewhat understood. Today, the entire junior gold space trades at less than 0.1NAV.

What can I say? It makes me like the CEO more than I already did, and I'm happy to invest my capital in him.

If, in 12-24 months, we can see STLLR valued at peer averages around US$30/oz rather than US$5-6/oz, where we are now, we will have had a very big win.

Here's the two-year chart. Signs of a low, I'd say:

Fortitude Gold

I include Fortitude Gold (FTCO:OTCMKTS) because it is a long-term hold of mine and because I have covered it before in Best in Class, though, at the moment, it has some permitting issues it needs to get through.

Fortitude Gold has a portfolio of assets — some producing, some still in development — all cherry-picked during the bear market of 2011-2015 by CEO, Jason Reid, formerly of Gold Resource Corp, which was a big winner in the last cycle.

It produces around 38,000 oz per year at below $656/oz and has around $50 million in cash. It yields a fat dividend of 9% per annum - 48 cents, payable monthly at 4 cents per month. There is the blue sky of increased production, thus increased dividends, plus lots of exploration upside. But as a US OTC stock, it is a pain in the backside for UK investors to buy.

Hargreeves Lansdown allows you to buy it but only as a telephone trade. UK investors with $25,000 could also open a Charles Schwab account and also buy it there.

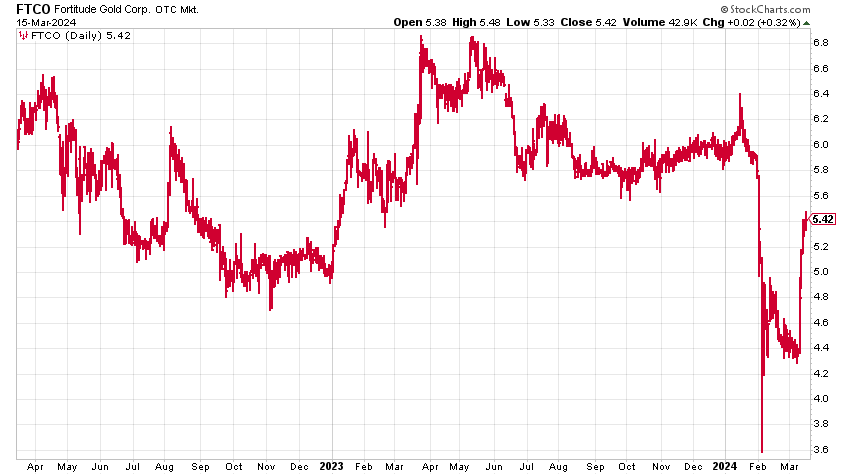

As a dividend-paying producer, this one stayed strong during the bear market between $6-7 dollars, but it took a dive last month after a hit piece exposed that it is suffering from permitting delays at its main asset, Isabella Pearl, and argued that the 50% decline in production from Q4 2022 versus Q4 2023 is going to impact the dividend. It's running out of high-grade gold, in other words.

Fortitude needs these permits to expand and develop the mine.

I spoke to CEO Jason Reid, who bemoaned that a shortage of personnel at the Bureau of Land Management (BLM — not to be confused with Black Lives Matter) was leading to long processing times. He admitted frustration that the lack of permitting would slow development. But he insists there is still plenty of ore on the leach pad, so the dividend isn't in any imminent danger. But sooner rather than later, please.

In addition, he was quick to point out the latest drill results at another of the company's properties, East Camp Douglas, which, if the early indications prove right, could prove a company changer.

The permitting is an issue. You might remember Trump fast-tracked a lot of this stuff when he was in office, whereas Biden has not, so a Trump win, assuming he does something similar, would be good for Fortitude.

But it's not ideal to be investing on the basis of permitting, even if the stock is currently discounted. I already own Fortitude and will continue to hold. I have a lot of faith in the competence of Jason Reid, and I'm sure he will make this work. But my inclination is to hold if you already own, and wait if you don't.

Mucky chart:

Minera Alamos

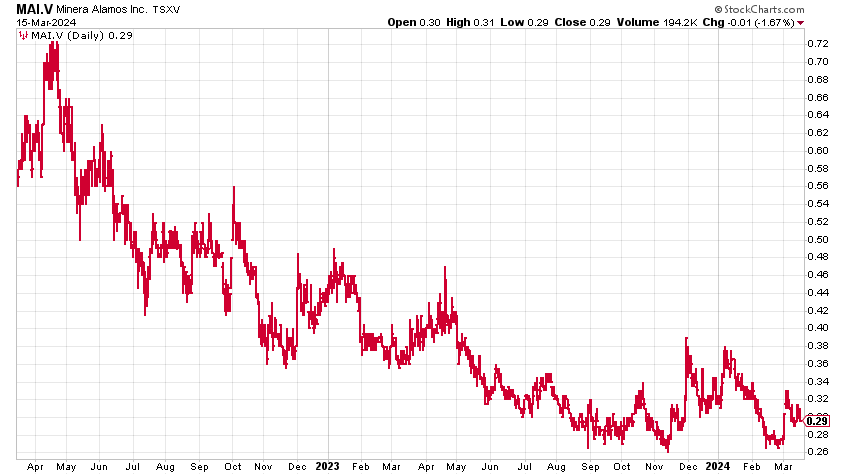

Minera Alamos Inc. (MAI:TSX.V; MAIFF:OTCQB) is my single biggest position in any gold stock (it was a close call with STLLR, but with the share price action of the last year, MAI now wins).

The story briefly with this CA$130 million market cap company is this: it has three low-cost mines in development in Mexico. The aim is to bring them all into production. My investment thesis is that the management has the competence and track record to execute this, and once executed, you will no longer own a development play but a mid-tier, 100,000 oz producer. This will result in a re-rating of the stock.

Guess what? It's all taking longer than we hoped. Welcome to mining.

The first and smallest of the mines, Santana, was built for US$10 million and is now producing. It should now easily return its capex in free cash flow every year. It began producing last year but suffered some delays due to water shortages. This issue is now behind it.

The gold that was not produced at Santana last year will now be produced this year with gold at higher prices. That is good.

So we come to mine number two, Cerro D'Oro — in my view, the company maker. Production should start some six months after the permits come through, but guess what? There are permitting delays. I spoke to CEO Doug Ramshaw, who is baffled by the delays but seems confident he will have the permits he needs either shortly before or after the elections in Mexico in June.

This will be a 60,000 oz per year mine with a capex of $28 million at a cost below $800/oz. Ramshaw says these costs should prove reasonably inflation-proof. The funding package is largely agreed, he also says.

Meanwhile, efforts are now mainly going into ramping up Santana, increasing production, and exploring nearby while the wait for permits at Cerro D'Oro goes on.

The final mine, La Fortuna, is already permitted, I'm pleased to report. It will hopefully see production about a year to 18 months after Cerro D'Oro, and it will be built from the cash flow of the other two mines. Why not start this one up first, as it has the permits? Ramshaw insists it has to be in the existing order.

I remain confident this one is going to work. The team is too good for it not to. But it is going to require patience.

Like many of the senior Canadian brokerages, I have a target of a dollar on the stock and in a benevolent mining market, I think it can go to two. That's a lot higher than the 29 cents where the stock sits today.

Here's the two-year chart. Another one that seems to have found a bottom. Looks like 26 cents was the low.

Conclusion

In the near term, my view is that Condor has the most potential. Let's just hope these discussions, if I have inferred that right, result in a deal. Fortitude is what I regard as a hold, a buy if its permit comes through. STLLR one up from that. Minera Alamos, I really like the look over the next two-to-four years, if you can pick it up below 30 cents.

But at the end of the day, these are gold miners. Miners have underperformed the metal since 2004. They are the perennial underachiever. Why should now be any different? Higher gold prices, I suppose, is the answer. But if they can find a way of disappointing, rest assured junior gold mining companies will. On the other hand, we are overdue a bull market, and hopefully, these ones have the potential to rise even in flat markets because of their circumstances.

If you'd like to read more from Dominic, you can sign up for The Flying Frisby here.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of

- Dominic Frisby: I, or members of my immediate household or family, own securities of: Condor Gold, Fortitude Gold, Minera Alamos, STLLR Gold Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Dominic Frisby Disclosures: This letter is not regulated by the FCA or any other body as a financial advisor, so anything you read above does not constitute regulated financial advice. It is an expression of opinion only. Please do your own due diligence and if in any doubt consult with a financial advisor. Markets go down as well as up, especially junior resource stocks. We do not know your personal financial circumstances, only you do. Never speculate with money you can’t afford to lose.