World Copper Ltd. (WCU:TSX.V;WCUFF:OTCQX; 7LY0:FRA), a Top Pick, was among Fundamental Research Corp.'s (FRC) Top five performers of the week, the equity research firm reported in its March 4 note.

The Canadian company with advanced-stage porphyry copper projects, Zonia in Arizona and Escalones in Chile, took the fifth spot with a week-over-week (WOW) return of 17%.

In other news, the copper explorer-developer is arranging a CA$4 million financing, FRC reported. Further, the Chilean government recently designed an area encompassing Escalones as a sanctuary, and World Copper's management is "reviewing its options."

Week in Review

In its Analyst Ideas Of The Week report, FRC highlighted the performance of certain commodities and reported key events that happened during last week, which ended March 1.

"We believe these developments should encourage higher investor risk tolerance, prompting increased capital allocation to small-cap stocks, which have significantly trailed the performance of large-cap stocks in the past year," FRC wrote.

Global equity markets were up 1.3% on average, a slightly better performance compared to its 1.2% increase the week before. FRC attributes the most recent week's change to slower-than-anticipated gross domestic product growth in the U.S. and slowing inflation in Europe.

Standout Metals

In its report, FRC addressed gold, nickel, and lithium specifically.

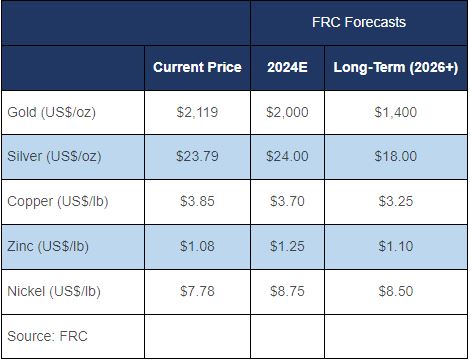

About metals overall, however, it noted metal prices were up 2.9% last week versus 0.1% the prior week. FRC maintained its metal price forecasts.

Gold Near Record Highs

As for gold, it was up 5% and trading near record highs, having surpassed US$2,100 per ounce (US$2,100/oz), reported FRC. The research firm maintained its bullish outlook on gold and still expects its price to reach US$2,200/oz this year.

Also up last week were the valuations of gold producers, by 2%. This was an improvement over the previous week when they were down 8%.

"On average, gold producer valuations are 27% lower compared to the past three instances when gold surpassed US$2,000/oz," FRC wrote.

Base metal producers were up 4% last week, continuing the trend of the previous week when they were up 6%.

Nickel on the Upswing

As for nickel, it hit US$7.78 per pound (US$7.78/lb), up 10% since FRC predicted in January it was about to rise, the firm reported.

FRC reiterated its bullish stance on the nickel price and its forecasted 2024 high of US$8.75/lb.

Lithium E&D Outperforms

Lithium was in the spotlight during the week, as FRC's best-performing Top Pick under coverage was Noram Lithium, a Canadian company with a large high-grade project in Nevada. Noram's stock was up 41.9% WOW.

Also, in lithium news, Mitsubishi Corp. announced it is acquiring a 7.5% interest in Frontier Lithium Inc. for US$25M, with an option to increase its interest to 25%. This coincided with FRC's thesis that mergers and acquisitions are going to pick up in the electric vehicle sector. Frontier has a lithium project in Ontario, Canada, that is high grade and large tonnage.

"The transaction price reflects a 67% premium over Frontier Lithium's last closing price," added FRC.

Cryptocurrencies

Like gold, bitcoin (BTC) was up last week and trading near its all-time high, noted FRC. BTC rose 7%, while the Standard & Poor's 500 crept up 1%.

"Our models suggest that the current fair value of BTC is US$49,100 (previously US$46,500), indicating 27% downside potential from the current price," FRC wrote.

The global hash rate of BTC was up 1% WOW, to 569 exahashes per second (EH/s) and up 3% month over month (MOM).

"The increase in hash rates is negative for miners as their efficiency rates (BTC production per EH/s) are inversely linked to global hash rates," FRC explained.

Also up last week were the prices of mainstream/popular cryptos, by 10% on average versus 3% the week before. The global market cap of cryptos was US$2.5 trillion, up 48% MOM and 138% year over year.

Companies operating in the crypto space traded at an average enterprise value:revenue of 10.6x, up from 9.6x previously.

| Want to be the first to know about interesting Base Metals, Gold, Cryptocurrency / Blockchain and Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- World Copper Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for Fundamental Research, March 4, 2024

The opinions expressed in this report are the true opinions of the analyst(s) about any companies and industries mentioned. Any “forward looking statements” are our best estimates and opinions based upon information that is publicly available and that we believe to be correct, but we have not independently verified with respect to truth or correctness. There is no guarantee that our forecasts will materialize. Actual results will likely vary. Certain companies mentioned are covered by FRC under an issuer paid model. FRC or companies with related management, and Analysts, may hold shares/securities in some companies mentioned in this report. Distribution procedure: our reports are distributed first to our web-based subscribers on the date shown on this report then made available to delayed access users through various other channels for a limited time. To subscribe for real-time access to research, visit https://www.researchfrc.com/website/subscribe for subscription options. This report contains “forward looking” statements. Forward-looking statements regarding the Company, industry, and/or stock’s performance inherently involve risks and uncertainties that could cause actual results to differ from such forward-looking statements. Factors that would cause or contribute to such differences include, but are not limited to, continued acceptance of the Company’s products/services in the marketplace; acceptance in the marketplace of the Company’s new product lines/services; competitive factors; new product/service introductions by others; technological changes; dependence on suppliers; systematic market risks and other risks discussed in the Company’s periodic report filings, including interim reports, annual reports, and annual information forms filed with the various securities regulators. By making these forward-looking statements, Fundamental Research Corp. and the analyst/author of this report undertakes no obligation to update these statements for revisions or changes after the date of this report. Fundamental Research Corp DOES NOT MAKE ANY WARRANTIES, EXPRESSED OR IMPLIED, AS TO RESULTS TO BE OBTAINED FROM USING THIS INFORMATION AND MAKES NO EXPRESS OR IMPLIED WARRANTIES OR FITNESS FOR A PARTICULAR USE. ANYONE USING THIS REPORT ASSUMES FULLRESPONSIBILITY FOR WHATEVER RESULTS THEY OBTAIN FROM WHATEVER USE THE INFORMATION WAS PUT TO. ALWAYS TALK TO YOUR FINANCIALADVISOR BEFORE YOU INVEST. WHETHER A STOCK SHOULD BE INCLUDED IN A PORTFOLIO DEPENDS ON ONE’S RISK TOLERANCE, OBJECTIVES, SITUATION, RETURN ON OTHER ASSETS, ETC. ONLY YOUR INVESTMENT ADVISOR WHO KNOWS YOUR UNIQUE CIRCUMSTANCES CAN MAKE A PROPER RECOMMENDATION AS TO THE MERIT OF ANY PARTICULAR SECURITY FOR INCLUSION IN YOUR PORTFOLIO. This REPORT is solely for informative purposes and is not a solicitation or an offer to buy or sell any security. It is not intended as being a complete description of the company, industry, securities or developments referred to in the material. Any forecasts contained in this report were independently prepared unless otherwise stated, and HAVE NOT BEEN endorsed by the Management of the company which is the subject of this report. Additional information is available upon request. THIS REPORT IS COPYRIGHT. YOU MAYNOT REDISTRIBUTE THIS REPORT WITHOUT OUR PERMISSION. Please give proper credit, including citing Fundamental Research Corp and/or the analyst, when quoting information from this report. The information contained in this report is intended to be viewed only in jurisdictions where it may be legally viewed and is not intended for use by any person or entity in any jurisdiction where such use would be contrary to local regulations or which would require any registration requirement within such jurisdiction.