This is believed to be the perfect time for investors interested in junior mining stocks to move in and buy StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB) for a variety of fundamental and technical reasons.

Starting with the fundamental reasons, the stock is viewed as an exceptional bargain here, being just 1% of its price at its 2009 – 2010 peak. To a large extent this is due to the malaise afflicting the sector over the past several years which has seen most junior stocks trashed.

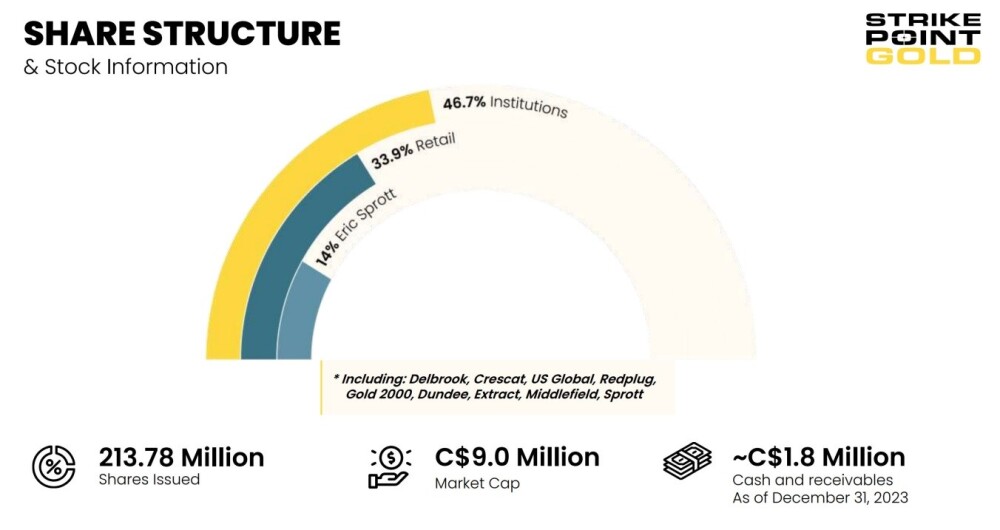

Whilst it is also partly due to the number of shares in issue having increased to the current weighty 213 million, this is the correct juncture to point out that of these, Eric Sprott owns 14% and institutions own 46%, so only 40% of the stock, or under 100 million shares, are available to be bought and traded by retail investors.

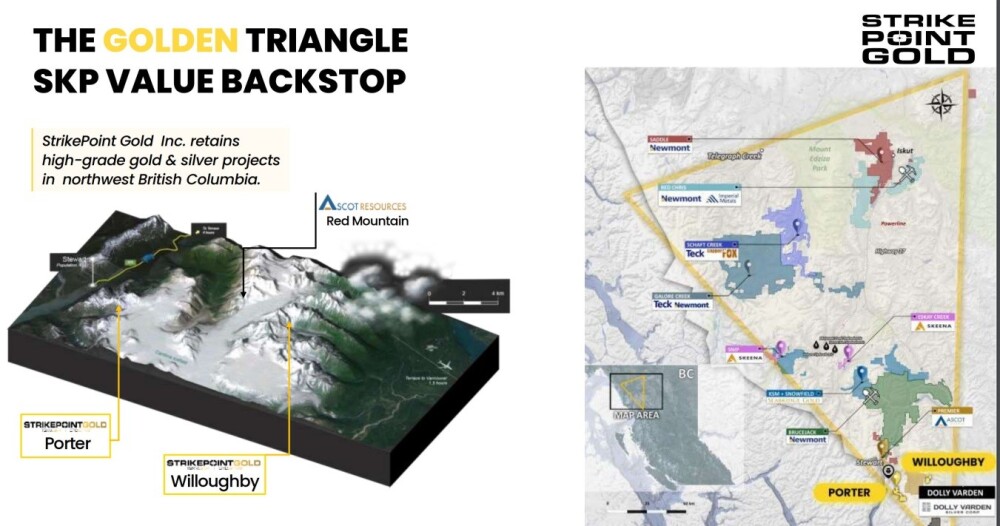

Now, here's where it gets really interesting — in addition to its other interests in the Golden Triangle in British Columbia where the company controls two advanced-stage exploration assets, the past-producing high-grade silver Porter-Idaho Project and the high-grade gold Willoughby Project, Strikepoint acquired its flagship Cuprite Gold Project which is centrally located within the renowned and prolific Walker Lane gold trend in western Nevada as recently as January last year and is about to start a drilling program this Spring.

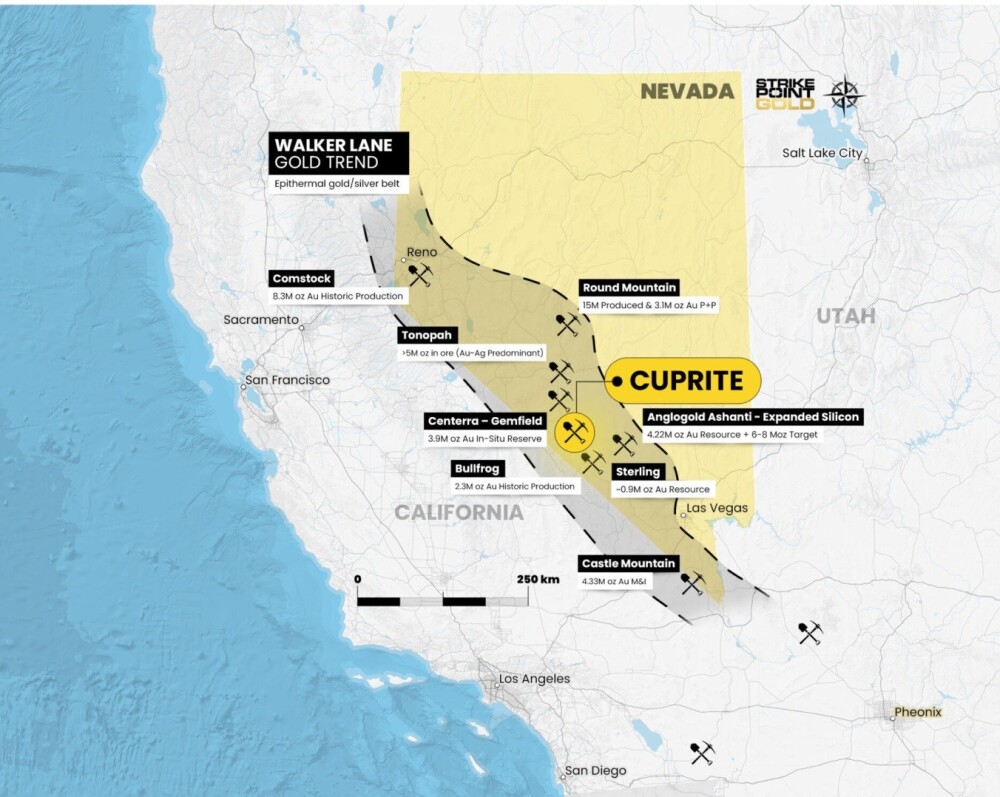

Location of the Cuprite Gold Project within the Walker Lane gold trend and within Nevada.

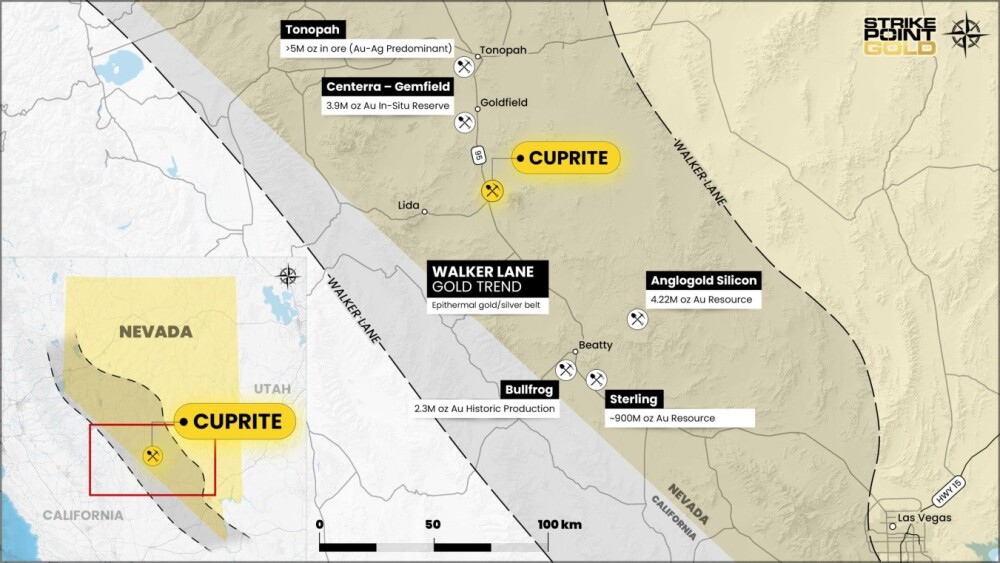

The Cuprite project's central location within the Walker Lane gold trend and big gold discoveries made not very far away along the trend in both directions.

For historical reasons, the Cuprite Gold Project is on virgin ground as it was formerly unavailable, meaning that it has never been drilled, and the property is surrounded by the following impressive mines and deposits:

- Comstock - 8.3M oz Au historic

- Round Mountain - 15M oz Au produced, 3Moz P&P

- Bullfrog - 2.3 Moz Au historic production

- AngloGold - expanded Silicon (4.22Moz Au plus 6-8M oz Au target at Merlin)

- Sterling - 0.9M oz Au resource

- Castle Mountain - 4.33 Moz Au M&I

- Centerra-Gemfield - 3.9M oz Au In-Situ Reserve.

Last year saw a lot of activity on the Walker trend nearby, especially by AngloGold, so for all these reasons, the chances of Strikepoint finding something very worthwhile this year at the Cuprite Gold project are considered to be high.

Other facts worth taking into consideration are that the company has CA$1.2 million in cash before the current CA$2 million financing and CA$500,000 in receivables.

With respect to the financing currently in progress, it is at CA$0.04, which explains why the stock dropped to touch a low of CA$0.035. It comes with a 7-cent half warrant, and it is understood that CA$1.5 million has already been raised, which is good considering that this funding was only announced on the 13th of this month.

The potential for rapid appreciation of the stock rests not merely with the fact that the funding at CA$0.04 will soon be out of the way but centers more on the big maiden drilling program that will commence on the property in March, with results expected as soon as April — this clearly could generate some serious interest. The planned drilling is 5,000 meters (10X 500-meter holes of reverse circulation drilling) and should be completed within March.

Lastly, it should be kept in mind that while the Cuprite Gold Project is the company's flagship project, it retains high-grade gold and silver projects in the Golden Triangle in NW British Columbia.

Now, we will proceed to examine the stock charts for Strikepoint Gold.

Starting with the long-term 20-year chart, we see that there was a huge runup in the stock back in 2009 that was followed in 2010 and 2011 by a decline of equal proportions, this whole "there and back again" move leaving behind a giant "stalagmite" formation on the chart.

After that, though, apart from some large tradable swings, the price has essentially run off sideways in a broad trading range of varying widths ever since. Note that all the charts for Strikepoint Gold in this report are arithmetic because they best serve our purpose.

Zooming in via a 5-year chart enables us to examine the last of these tradable swings in much more detail, and the first thing that we notice is that it was of sufficient magnitude to be classed as a bull and bear market in its own right, and this is especially so because the price got so low at times. Following a top pattern during the latter part of 2020 and the first half of 2021, the price went into another bear market.

Initially steep, the rate of decline later moderated, and it is now evident that this bear market has taken the form of a 3-arc Fan Correction. Sometimes, you can have more than three of these fan lines, but usually, once the price breaks above the third one, the bear market is over.

As we can see, although the price went on to make new lows recently, it has already broken out above the third fanline, putting it in a position to begin a new bullmarket. There are several strongly bullish factors to observe on this chart, which suggest that this is an excellent time for investors to step up and buy the stock here at the current very low price, which is not expected to last for much longer.

The first is that the recent bear market has brought the price down to an important support level near the 2020 lows, which is a good point for it to turn up. The second is that the volume pattern has been bullish for months — more upside volume than downside volume — which is why the Accumulation line shown at the top of the chart has been trending steadily higher, and remarkably, it is already higher than it was at the start of 2021 when the price was almost eight times higher than it is now!

This certainly bodes well. Lastly, downside momentum has now dropped out completely, as shown by the MACD indicator at the bottom of the chart, which has been trending higher for months. The confluence of all these factors points to a new bull market beginning soon, even without any help from the gold price, and the good thing is that there is likely to be help from the gold price going forward.

We will end by looking at the 1-year chart on which we can examine recent action in much more detail. On this chart, we can see the tail end of the bear market from the start of the 2021 peak and how it has been ended by the price building out a Double Bottom pattern, with the first low being in November and the second low occurring last month.

Of particular note is the rather dramatic build-up in upside volume as this pattern has formed and driven the accumulation line strongly higher. This is a clear indication of "Smart Money" position-taking ahead of the start of a new bull market, and now, with the second low of the Double Bottom having completed and the price and its moving averages have converged so that they are now tightly bunched together, everything is in place for the new bullmarket to begin — and it just so happens that funding at 4 cents is approaching completion, and it is considered likely that the announcement of the completion of the funding will be the "starting gun" for the expected new bullmarket to get underway.

The conclusion is that Strikepoint Gold is a Strong Buy for all timeframes.

Strikepoint Gold's website.

Strikepoint Gold's investor deck.

Strikepoint Gold closed at CA$0.05, $0.03 on February 20, 2024.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- StrikePoint Gold Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.