Rare earth element (REE) explorer Defense Metals Corp. (DEFN:TSX.V; DFMTF:OTCQB; 35D:FSE) has announced the successful completion of its Phase 1 hydrometallurgical pilot plant at SGS Lakefield. The main purpose of this phase was to test the flowsheet for operability and identify any changes that might be required before a longer test campaign.

According to the company, "During the five days of continuous operation, the parameters for the various unit operations were varied slightly to allow optimization of the circuit ahead of the Phase II pilot plant run scheduled for late April 2023."

The company reports that the extraction of Pr (praseodymium) and Nd (neodymium) from the acid bake calcine was in excess of 90%, the impurity removal circuits were very efficient, and reagent regeneration and water recirculation were effective.

Noble Capital Markets analyst Mark Reichman continued to rate the stock Outperform with a CA$0.90 target.

Recently, Defense Metals has also announced it had joined the Vancouver-based Discovery Group, formed by mining entrepreneurs John Robins and Jim Paterson, to advance mineral exploration and mining projects.

Discovery Group said it had generated over CA$500 million in direct and indirect expenditures, including more than CA$2.6 billion in M&A activity.

Its most recent success was the sale of Great Bear Resources Ltd. to Kinross Gold Corp. (K:TSX; KGC:NYSE) for CA$1.8 billion last year.

"We continue to educate and inform shareholders about market opportunities that exist with high-quality junior mining explorers," Discovery cofounder Robins said.

"The foundation of our success has been built upon people, projects, and integrity," Robins explained on the company's website. "We strive to identify world-class opportunities and attract the best technical and management talent to develop them."

On its website, Kinross called Great Bear a "world-class project" that is a "centerpiece" of its portfolio that could support a large, long-life mine complex.

Last month, Defense Metals updated the 3D geological model of its Wicheeda REE project in British Columbia with 10,000 meters of new drilling from 47 holes completed in 2021 and 2022, which the company called a "significant milestone."

It next plans to update its resource estimate and complete a preliminary feasibility study (PFS) for the site.

The new drilling "yielded some of the longest and highest-grade drill intercepts to date and led to the discovery of a new zone of high-grade mineralization at depth that has the potential to positively impact an updated mineral resource estimate," Noble Capital Markets analyst Mark Reichman wrote in an updated research note on March 24.

Reichman continued to rate the stock Outperform with a CA$0.90 target.

"Defense Metals is advancing toward what we believe will be a compelling preliminary feasibility study," Reichman wrote. "In addition to [the] significant potential to expand the resource and extend the mine life beyond 19 years, we expect grade enhancement and the meaningful conversion of inferred to indicated and potentially measured resources."

The Catalyst: Catching Up With China

The company wants to produce as much as 10% of the world's light REEs to reduce reliance on China, which has about 85% of the world’s processing capacity of the elements.

REEs are in high demand in the new green economy for purifying water, MRIs, fertilizers, weapons, research, wind turbines, computers, and permanent magnet motors for electric vehicles (EVs).

Analyst Michael Gray of Agentis Capital wrote that Wicheeda was well-located with access to key infrastructure and "could become a globally significant producer" of REEs.

According to a report by Fortune Business Insights, the global REE market is expected to grow from US$2.6 billion in 2020 to US$5.5 billion in 2028.

"The rising demand for consumer durables such as tablets, laptops, and smartphones is one of the factors driving the consumption of rare earth elements," the report said. "The demand for these elements in developing economies is estimated to expand rapidly owing to an increase in industrialization, building and construction activities, and various digitization activities by governments in the respective countries."

Demand for EVs in Western countries is also estimated to create a surge in the consumption of REEs, the report said.

"However, the high cost of these minerals and the monopoly of China-based manufacturers is expected to hinder the market growth," the authors wrote.

High-Grade Intercepts

The holes from 2021 and 2022 returned some of the longest and highest-grade intercepts from Wicheeda, the company said.

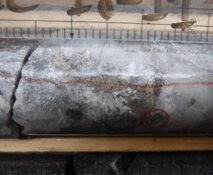

Hole WI21-58 returned 3.09% total rare earth oxide (TREO) over 251 meters, and WI22-68 returned 6.7% TREO over 18 meters.

High-grade REE dolomite-carbonatite was discovered in the north area of the deposit, returning 3.17% TREO over 196 meters, including 4.29% TREO over 55 meters to a depth of 201 meters extending 30 meters below the resource pit shell.

Defense Metals is also building a hydrometallurgical pilot plant at SG Lakefield in Ontario.

Construction has started, and commissioning should start later this month, with pilot operations completed by the end of April.

Defense Metals also announced that Dale Wallster had been appointed to its Board of Directors. Wallster is a prospector and a geologist with more than 40 years of experience exploring mineral deposits in North America. He was president and founder of Roughrider Uranium Corp. and is credited with the discovery of Hathor Exploration Ltd.'s Roughrider deposit.

"In the recent explosion of strategic, geopolitical, and investment interest in North American critical minerals, rare earth element companies represent the 'Rodney Dangerfield' of the class; they are getting no respect," Wallster said. "Given their importance in the electrification of the world, I expect this to change soon, and Defense Metals, with its Wicheeda project pre-feasibility study expected in 2024, is leading the pack."

Analyst Michael Gray of Agentis Capital wrote in a research note that Wicheeda was well-located with access to key infrastructure and "could become a globally significant producer" of REEs. He set a 12-month valuation of CA$3.50 for the stock.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Defense Metals Corp. (DEFN:TSX.V; DFMTF:OTCQB; 35D:FSE)

"DEFN is a best-of-breed North American REE developer that is well-positioned to its leverage-growing global REE demand and government support to become part of a North American REE critical metals supply chain," Gray wrote.

Ownership and Share Structure

About 5% of the company’s stock is owned by insiders, including Director Andrew S. Burgess with 2.01% or 4.18 million shares, and CEO Taylor with 1.2% or 2.5 million shares, according to Reuters.

About 5% of the company is owned by institutional entities, including U.S. Global Investors Inc. with 0.96% or 2 million shares, Reuters said.

The rest, 90%, is retail.

Defense Metals has a market cap of CA$68.54 million with 207.7 million shares outstanding, about 165 million of them free floating. It trades in a 52-week range of CA$0.39 and CA$0.165.

Sign up for our FREE newsletter

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Defense Metals Corp. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Defense Metals Corp., a company mentioned in this article.