Goldshore Resources Inc. (TSXV: GSHR;OTCQB: GSHRF ;FWB: 8X00) experienced compelling growth in 2022 and may benefit from the increased outlook in the gold sector. Though gold swung through ups and downs last year, experts are expecting geopolitical factors such as the upcoming U.S. primaries, the threat of a looming global recession, and soaring inflation to create "investment demand for the safe haven commodity," according to Stockhead.

GSHR’s current low trading costs compared to peer companies have garnered a myriad of experts' interests.

Goldshore Intersects 5.64 g/t Au over 15.65m

Goldshore is a gold mining junior, focusing on its Moss Lake Property in Ontario, BC Canada. February 27, 2023, the company announced assay results from its 100,000-meter drill program at the Moss Lake Project in Northwest Ontario, Canada.

Highlights of this included:

- Results from the second half of the East Coldstream Phase One drill program have confirmed the potential for significant high-grade shears within East Coldstream, approximately 13 kilometers northeast of the Moss Lake Deposit. The best intercepts being:

- 3.49 grams per tonne gold (g/t Au) over 26.35m from 76.85m depth in CED-22-010, including

- 5.64 g/t over 15.65m from 87.55m

- 1.12 g/t Au over 21.9m from 206.5m

- 1.07 g/t Au over 31.0m from 288.0m depth in CED-22-011 and

- 1.48 g/t Au over 18.45m from 357.0m, including

- 4.68 g/t Au over 4.85m from 370.6m

- 0.94 g/t Au over 25.05m from 218.95m depth in CED-22-014, including

- 1.10 g/t Au over 16.0m from 226.0m

- 1.23 g/t Au over 35.15m from 338.45m depth in CED-22-017, including

- 2.19 g/t Au over 11.55m from 338.45m

- 3.49 grams per tonne gold (g/t Au) over 26.35m from 76.85m depth in CED-22-010, including

Past Intersection of 9.46 G/T

On November 15, 2022, it announced a 4.17M oz global gold resource mineral resource estimate (MRE).

Then February 7 of this year, Goldshore announced it had intersected 9.46 g/t Au.

Highlights included:

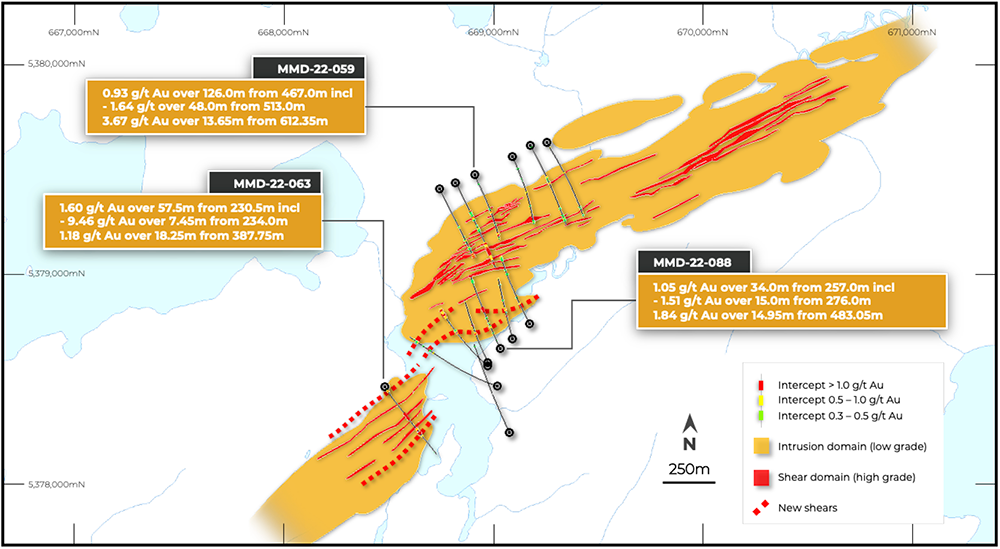

Hole MMD-22-063 confirmed the presence of high-grade mineralization within the previously perceived low-grade and low-tonnage Southwest Zone.

With the best intercepts being:

13 holes drilled have expanded the cumulative width of multiple close-spaced, high-grade gold shears by 150-200 meters over 550 meters at the Main Zone with best intercepts of:

- 93 g/t Au over 126.0 meters from 467.0 meters depth in MMD-22-059 including:

- 64 g/t over 48.0 meters from 513.0 meters

- 67 g/t Au over 13.65 meters from 612.35 meters

- 05 g/t Au over 34.0 meters from 257.0 meters depth in MMD-22-088 including:

- 51 g/t Au over 15.0 meters from 276.0 meters

- 84 g/t Au over 14.95 meters from 483.05 meters

Moss Lake Only One of Many Catalysts

Company catalysts in 2023 will include an additional 40K meters of planned drilling, with result press releases released to the public every three to four weeks so that investors can keep track of progress at Mountain Lake.

In December, mining analyst Barry Allan of Laurentian Bank Securities rated Goldshore a Speculative Buy.

GSHR has also recently announced plans to put another MRE into the market in April of this year. A tertiary MRE will be completed at the end of 2023 to assess all drilling completed by GSHR to this year, as well as all historical drilling so that it can be QA/QC’d and brought into the resource model.

In December, mining analyst Barry Allan of Laurentian Bank Securities rated Goldshore a Speculative Buy. He commented that "The addition of the active drills will allow Goldshore to reach their targeted meterage of 10,000 of drilling and allow them to test extensions to Moss Lake as suggested by their airborne geophysical survey analysis," Allan noted, adding the Canadian company is conducting this drill program for a preliminary economic assessment (PEA) expected in 2023.

On April 22, 2022, Velocity initiated coverage on the company with an Outperform rating and a target of CA$0.85 per share, saying there was acquisition potential.

During H1 of 2023, Goldshore Resources intends to focus this PEA (Phase I of a large mining camp build) on surface high-grade shear domain material that will deliver substantial valuation to the company. The company plans to present the results to the market around the gold conference season in September 2023.

On April 22, 2022, Velocity initiated coverage on the company with an Outperform rating and a target of CA$0.85 per share, saying there was acquisition potential.

Goldshore Resources is currently trading at CA$7 per oz of global resources, equating to a fraction of the cost of its leading peers in the industry. The company expects global factors, its mining practices, and its PEA to more than triple the value of the company from CA$40 million MC to >CA$200 million MC this year.

Will Gold Stay Strong?

Gold equities have improved significantly from their volatile pricing changes in 2022, and the global macro commodities environment has not held as much opportunity in the past three decades as it does now.

The National Inflation Association released a statement to commodities investors to address concerns that gold may become volatile once more: "According to NIA's exclusive gold moon indicator, gold is projected to finish 2023 at US$2,670 per oz!"

In essence, the combined effects of U.S. election cycles, inflation, stagflation, and high-interest rates have set the stage for gold, the reliable favorite commodity in times of scarcity and concern, to experience an outstanding 2023.

"Annual gold demand jumped 18% to 4,741 tonnes" in 2022, according to Rick Mills of Ahead of The Herd, which implies Goldshore Resources’ mining project will have plenty of need to meet in 2023.

Ownership & Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Goldshore Resources Inc. (TSXV: GSHR;OTCQB: GSHRF ;FWB: 8X00)

Approximately 11% of the company's shares are held by management, members of the board, and insiders. Out of management, Chairman Galen McNamara holds the most shares at 2.44% with 4.01 million shares, according to the company.

CEO and Director Brett Richards is next at 2.43%, with 3.97 million shares. Director Victor Cantore has 1.38% with 1.96 million. Director Doug Ramshaw is at 1.10% with 1.57 million shares. Director Shawn Khunkhun has 0.56%, with 0.8 million shares, and Director Brandon Macdonald has 0.25%, with 0.36 million shares.

Among the 14% of institutional investors and strategic investors. Strategic Investor Wesdome Gold Mines Ltd. (WDO:TSX) has the most stake in the company at 27%, with 43 million shares. Wesdome was given this stake as a part of Goldshore's May 2021 acquisition of Wesdome's Moss Lake Property. Sprott Asset Management LP is at 8.65%, with 12.33 million shares. Commodity Capital AG is at 3.24%, with 4.62 million shares, and U.S. Global Investors Inc. has 0.26%, with 0.38 million shares.

The company has CA$7 million in the bank (a one million dollar improvement since the end of 2022), with a sustained monthly burn rate of CA$1.2 million, including CA$1.1 million in drilling costs.

Goldshore Resources Corp. has a market cap of CA$40 million with 165 million shares outstanding. The company has 110.78 million shares in the public float and trades in the 52-week range between CA$0.16 and CA$0.65.

Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Disclosures:

1) Cori Rupe wrote this article for Streetwise Reports LLC. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Goldshore Resources Inc. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Goldshore Resources Inc., a company mentioned in this article.