Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) was slammed after a disappointing fourth-quarter result and modest guidance for the next three years. Higher costs were the main reason behind the 4Q miss. Cost pressures, on lower volumes, saw anticipated costs increase, with cash cost guidance, at a mid-point of US$865/ounce, up 11% over last year.

Next Few Years May Be Lower Than Expected

Looking ahead, the company’s 2023 and 2024 guidance (after adjusting for its increased ownership in the Canadian Malartic mine) was below expectations. Production is expected to increase by only around 6% over the next three years.

The lower guidance reflects both operational challenges at a couple of its legacy mines as well as ongoing regulatory restrictions at Fosterville in Australia and Kittila in Finland.

Cost guidance has also increased, with this year up 14% on prior guidance, partly because of general cost pressure but also some operational items. A far high strip ratio at Meadowbank, for example, going from 16:1 to 4:1, will increase costs on the entire company by about US$37 an ounce, president Ammar Al-Joundi said.

Agnico also released its year-end reserves and resource, up 9% and 4% from the prior year respectively, with increases at Detour the prime driver. These reasonable results got lost amidst disappointment at the three-year guidance and higher costs.

Rare Bad News From Agnico, and It Wasn’t That Bad

The market is not accustomed to bad news from Agnico, and the stock fell sharply, as much as 9.5% before a modest recovery, and this from an already weak level. The stock is down over 20% since the end of January, a stunning reversal for this blue-chip gold stock.

We think the market reaction is grossly overdone. The fourth quarter was only a slight miss while guidance was not as bad as it appears at first blush. This year’s production guidance is in line with previous guidance, while 2024 guidance has increased, and new 2025 guidance shows an increase, albeit modest, from 2024. There are opportunities for upward revision at Fosterville and Kittila as the disparate issues get resolved.

There are also opportunities for reductions in costs, such as power costs at Kittila. It should be noted that Agnico is famously conservative; its guidance can be viewed as a baseline.

From the acquisition of Kirkland, with consolidation now complete, and the purchase of Yamana’s Canadian assets, including the half of Malartic it did not already own, Agnico has many longer-term development assets ahead of it. It has a strong balance sheet, with CA$660 million of cash and CA$1.2 billion undrawn on its credit facility, after paying down CA$225 million of debt last year. It has paid a dividend for 39 straight years, with a current competitive yield of 3.5%. Agnico is a great company, and all-on-all, this correction offers a great opportunity to buy it.

Crunch Time for Franco’s Cobre Panama Asset

Franco-Nevada Corp. (FNV:TSX; FNV:NYSE) continues to be hostage to ongoing developments in Panama, as discussions continue between First Quantum, owner of Cobre Panama mine, on which Franco holds its largest stream, and the government. While First Quantum says that negotiations have accelerated over the past couple of weeks, with the number of outstanding items down to just two or three.

The most significant and difficult unresolved issue concerns First Quantum’s understandable desire for some protection in the agreement against future revisions. Separate from the negotiations, however, First Quantum appears subject to ongoing harassment designed (presumably) to force it to agree to the revised contract. It said that it will need to suspend mining operations by the end of this coming week unless an issue at the port is resolved.

Currently, no concentrates are being loaded and exported, and the mine has limited storage for concentrates. In addition, if the company does not win an appeal in the Supreme Court, it will have to start the process of putting the mine on care and maintenance. The company is now pursuing all legal avenues available, as well as both local and international arbitration, the latter of which can take well over a year before a decision.

Franco Could Be Hurt by Failure of Negotiations

The stream on Cobre Panama represents about 15% of Franco’s revenues and somewhat more of its NAV. Since this is a streaming contract with the local operating company (First Quantum’s local subsidiary), Franco receives revenues only if the mine continues to be operated by that company. There are three possible outcomes that would affect Franco in different ways.

• An agreement is reached with which First Quantum is satisfied and both mining and ongoing capex continues, and Franco continues to receive its full stream revenues. FQ would be responsible for higher costs and taxes.

• An agreement is reached reluctantly, with limited long-term protection for FQ, so though mining would continue, it might be cautious about new major capex to expand the mine, in which case Franco’s future revenues would be less than otherwise projected.

• Were the mine to be expropriated, Franco would lose out on revenues and would have no claim. But it would receive a portion of any award that FQ were to receive in international arbitration. This would be not only an unknown outcome but also potentially years into the future.

In the meantime, any suspension of mining operations at Cobre Panama would result in lower revenues for Franco for that period. The fourth quarter should not be affected at all, since although the dispute came to the fore in December, mining and sales continued. We expect an agreement to be finalized between FQ and the government, though whether there will be any interruptions between now and then, or whether the agreement will be one that enables FQ to continue to spend money in Panama with confidence is unknown.

In addition, as we have emphasized many times, though this is Franco’s largest asset, the company is well diversified with 112 producing assets and another 40 plus in

development. It has top management and a solid balance sheet; it remains a core holding for us. Right now, however, the stock price does not reflect the risk from the Cobre Panama situation, and there is a near-term risk in the overall gold market. We are holding.

Royal Boosts Revenues Helped by Recent Acquisition

Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX) reported a strong quarter, largely due to Cortez. The higher Cortez revenue, almost five times last year’s revenue, was due to the additional royalties that Royal recently purchased as well as, in all likelihood, Barrick increasing mining on areas of the mine subject to Royal’s royalty.

In addition, production at the Khoemacau copper mine in Botswana continued to ramp up, reaching its target production in December.

Royal ended the quarter with about US$119 million in cash and US$425 million available on its US$1 billion credit facility. Absent another acquisition, it expects to repay its outstanding balance by the middle of next year. The company increased its dividend for the 22nd consecutive year, up about 7% on last year, which is positive, though the current yield is only 1.2%.

Arguably, Royal, following a series of expensive acquisitions last year (on potentially large and long-life high-quality assets), has more leverage to a higher gold price than most other major royalty companies. However, given its lack of free cash flow and higher debt than its peers, we will hold and look for better buying opportunities, particularly given our near-term caution on gold.

Barrick See 4Q Loss, With Costs To Blame

Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) reported a loss of US$735 million in the fourth quarter, broadly in line with expectations after pre-releasing production and costs, though a large swing from the US$726 million in profit in the third quarter. Barrick ended the quarter with net debt of US$342 million, up from the prior quarter, indicating a base dividend of US$0.10 per share, with no additional payment.

This year’s guidance calls for 4.4 million ounces of gold at cash costs of US$850/ounce (mid-point of ranges). Last quarter, the company repurchased 6.8 million shares bringing its full-year repurchased to over 24 million shares for US$424 million. It has renewed its US$1 billion repurchase program.

Although CEO Mark Bristow has made clear that he has no intention of getting into a bidding war with its large rival Newmont for the Australian company Newcrest, he opened the door to the intriguing possibility of buying Newmont’s share in the Nevada Gold Mines joint venture.

Barrick is one of the two largest gold producers in the world, one that has grown largely organically (at least since the Barrick-Randgold merger in 2018), with world-class assets around the world, in both gold and copper (which is playing an increasingly large role at Barrick). It has a solid balance sheet, the best among the large miners, and aggressive management, with a focus on both finding ounces and operations. Given our near-term caution on the gold market, we will hold Barrick, but be ready to buy on any further weakness.

A Rare Miss for Nestle, as It Can’t Keep Up With Higher Costs

Nestle SA (NESN:VX; NSRGY:OTC) reported a reasonable set of full-year results with sales up 8.4% and organic growth of 8.3% but hurt by higher costs. The second half saw a dip in sales compared with the first half, compounded by higher costs. Indeed, the company said that its price increases — nearly 12% on average in North America––were insufficient to offset its higher input costs.

Acquisitions had a positive effect on sales of just over 1%. All in all, what the company calls “real internal growth” was barely positive, at 0.1%. The company achieved production guidance but costs were above target. The Greater China region was weaker than it has been and weaker than other

regions, with a growth of just 3.5%, largely due to the covid shutdowns.

Looking ahead, the company expects organic sales growth of between 6% and 8% with operating margins of 17%. It expects to continue increases in the prices of staple items. It promised a continued focus on Nestle Health Science, which saw several acquisitions last year. The company has a solid balance sheet, boosted by recent sales of shares in L’Oreal. Proceeds helped fund the repurchase of Sfr 10.6 billion in Nestle shares last year, with more repurchases expected this year. The company boosted the dividend for the year ahead, the 28th consecutive annual increase. For 63 years, the company has increased or maintained its dividend. The prospective yield of 2.7% will be the highest since 2016.

Nestle fell after its earnings were released, but rallied on Friday. If you do not own Nestle, this is a good price at which to take an initial position in this global blue chip.

BEST BUYS THIS WEEK, in addition to those above include Hutchison Port Holdings (HPHT, Singapore US$0.192). We remain a little cautious in the immediate term on gold stocks, while global markets are vulnerable to a sharp decline in the coming months.

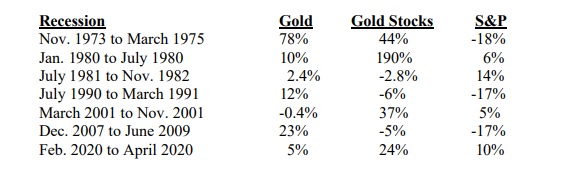

GOLD DURING RECESSIONS — Redux Last Bulletin I reported on a bank study on the performance of gold and gold stocks during recessions. I need to clarify what I wrote. First, the study included the periods six months before, and six months after, so to call that performance during recessions is a little elastic, shall we say. I also found what appears to be an error.

I recalculated the numbers, looking at only the recession periods themselves. I used the XAU index since 1984 (when the index was launched), and Barron’s Gold Miners Index for periods before that. (Note: The numbers for the Barron’s Index are approximations, based on visual estimates.)

As you can see, gold itself had positive returns in each recession going back to the early 1970s, except one, and that saw a very marginal decline. The gold stocks had positive returns in four of the seven recessions, and very strong returns at that, while in the three in which they declined, modestly, they outperformed the broad market in each case.

These returns for recessions support the conclusions of the study that I mentioned last time which looked at periods around recessions.

MARKET COMMENTARY A long-time friend, Canadian money manager Peter Cavelti with whom I worked in the 1980s, has an occasional newsletter commenting on markets from with global viewpoint. The updates are approximately monthly, and I find them unusually well-informed and thoughtful. You can subscribe without cost. Go to his website to view recent letters.

DISCUSSION WITH DOUG CASEY Our guest on the next quarterly On the Move webinar will be Doug Casey. Tentatively scheduled for the evening of 19th April —make a note — we shall send a notice with links closer to the date. Two live events are upcoming. Early next month is the annual PDAC convention in Toronto.

On Sunday the 5th is a one-day investor conference with many well-known letter writers and others. I’ll be talking about gold’s drivers. Register here. Then July 23-27, in Boca Raton, Fla., is Rick Rule’s annual resource symposium which promises to be even better than last year’s superb event. Once again, Robert Friedland will keynote the conference. For details and to register, visit here.

Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Adrian Day Disclosures:

Adrian Day’s Global Analyst is distributed for $990 per year by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. www.AdrianDayGlobalAnalyst.com. Publisher: Adrian Day. Owner: Investment Consultants International, Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. © 2022. Adrian Day’s Global Analyst. Information and advice herein are intended purely for the subscriber’s own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.

Disclosures:

1) Adrian Day: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: All. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Funds controlled by Adrian Day Asset Management, which is unaffiliated with Adrian Day’s newsletter, hold shares of the following companies mentioned in this article: All. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in the securities mentioned. Directors, officers, employees, or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company release. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Agnico Eagle Mines Ltd., a company mentioned in this article.