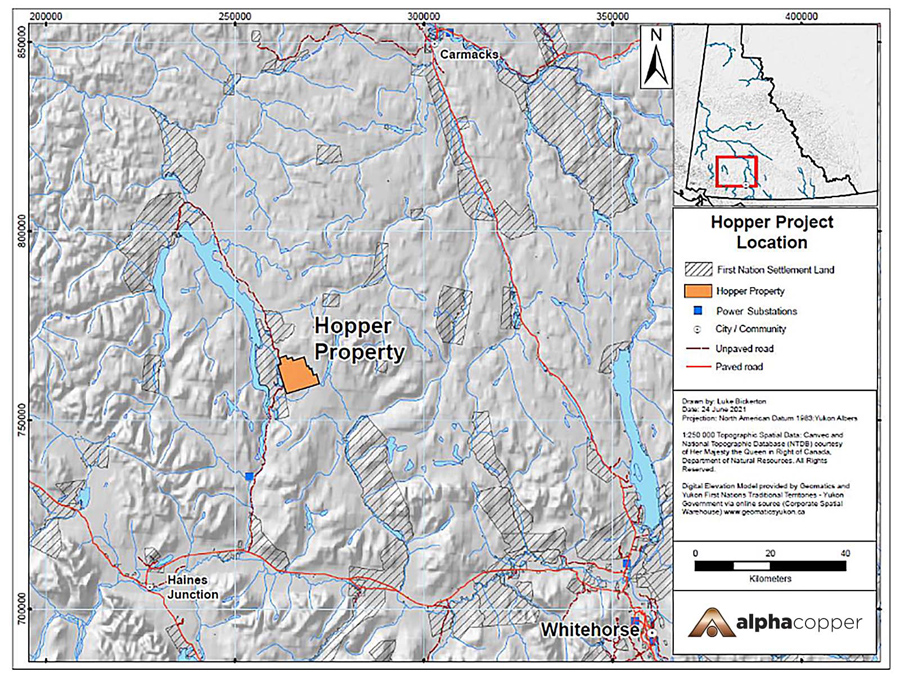

Alpha Copper Corp. (ALCU:CSE;ALCUF:OTC) has been issued a 10-year permit for drilling and road and trail building at its recently acquired Hopper copper-porphyry project in the Yukon Territory.

The Class 3 permit allows for up to three drills at the project, which was one of two properties that came with Alpha’s purchase of CAVU Energy Metals Corp. (CAVU:CSE; CAVVF:OTC; 5EO:FSE), which closed in December 2022.

The other was the Star project in British Columbia’s Golden Triangle.

"The Hopper Project is a great project with a lot of exploration upside," Alpha Chief Executive Officer Darryl Jones said. "The Project has proven skarn horizons that are ready to build towards a maiden resource and the potential for a large porphyry zone that was proven up in the last two years and is close to discovery. We believe there is something big here and are looking forward to unlocking the project’s potential."

Hopper, a 74-kilometer multi-target porphyry copper-molybdenum project, has "significant copper-gold-silver peripheral skarn mineralization," Alpha has said. The best intercept there was 22.28 meters at 1.405% Cu.

Auto manufacturers are turning toward electric vehicles (EVs) to power the new green economy, and those vehicles need at least three times as much copper, the "metal of electrification," as regular cars.

But according to a recent report from S&P Global, copper demand is expected to double from about 25 million metric tons (Mmt) today to about 50 Mmt by 2035.

"The chronic gap between worldwide copper supply and demand projected to begin in the middle of this decade will have serious consequences across the global economy and will affect the timing of Net-Zero Emissions by 2050," authors of "The Future of Copper" wrote.

Adding to the problem is the lead time of getting new mines online. The report said politicized regulatory processes and litigation make it "unlikely that efforts to expand copper output in the United States would yield significant increases in domestic supply within the decade."

The problem is an international one, the report said.

"Multidimensional challenges make the development of mines a generational endeavor, spanning decades and requiring hundreds of billions of dollars," it said. "Projects under development today would likely not be sufficient to offset the projected shortfalls in copper supply, even if their permitting and construction were accelerated."

The Catalyst: Moving Toward a Maiden Resource

Alpha will expand on the work that has been done at Hopper so far. The skarns there have been explored intermittently since they were discovered in the 1970s.

The company said it is a porphyry copper project with adjacent skarn mineralization. Most drilling so far has focused on the skarn horizons, which are near the surface with abundant copper, silver, gold, and molybdenum mineralization.

"Bottom line? We gotta find more copper," Newsletter writer Rick Mills wrote.

The company said there are over eight defined skarn horizons from the surface to more than 400 meters in depth.

Drilling at the skarns in 2021 and 2022 showed high-grade mineralization is open along strike, Alpha said.

"The shallowest and highest-grade skarn horizon to date that was the target of the 2021 and 2022 drilling is ready for denser drill spacing to prepare for a maiden resource," the company said.

‘We Gotta Find More Copper’

Some say copper companies like Alpha are in a good sector for growth.

"Bottom line? We gotta find more copper," analyst Rick Mills wrote. "That sentiment is clearly shared by some of the world’s largest copper companies, who are doing everything they can to expand existing mines and acquire prospective new deposits, as they seek to replace their rapidly depleting copper reserves and resources."

Much of the used red metal is recycled for things like plumbing tubes and roofing sheets.

But it’s not feasible to use scrap copper for all copper products, as electrical wiring and cables require the "very pure sort of copper that flows from the mining-smelting-refining process," the Copper Development Association Inc. wrote.

"The key point is this: technologies critical to the energy transition such as EVs, charging infrastructure, solar photovoltaics (PV), wind, and batteries all require much more copper than conventional fossil-based counterparts," the S&P report said. "The rapid, large-scale deployment of these technologies globally, EV fleets particularly, will generate a huge surge in copper demand. Major investments in the power grid to support electrification will further amplify the trend."

Star, Okeover, Indata Projects

Alpha also has three other projects: Star, Okeover, and Indata in British Columbia.

Drilling at Okeover was finished in December 2022. The company is pushing toward updating and publishing a new resource for it this year. Assay results are expected soon.

S&P report said, "The rapid, large-scale deployment of these technologies globally, EV fleets particularly, will generate a huge surge in copper demand."

Indata is close to Northwest Copper’s Kwanika and Stardust discoveries. Historical drilling includes 148 meters grading 0.20% Cu, including 24.1 meters grading 0.37% Cu, the company said. Assays from Indata are also expected soon.

Star, another CAVU property, is a multi-target copper-gold porphyry project with 106.98 meters graded at 0.77% Cu in one hole. Over 13,000 meters of modern drilling have been completed there, and it is fully permitted for 200 drill sites until 2026.

"We’re going to have our hands full with all four of these projects," Jones has said.

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Alpha Copper Corp. (ALCU:CSE;ALCUF:OTC)

About 85% of the company is held by insiders, and the rest is retail, Alpha said.

Top shareholders include Mango Research & Management Inc., which holds 2.49%; the CEO Jones, who holds 1.54%; and Daniel Matthews, who owns 1.11%, according to Reuters.

The company has about 52 million shares outstanding, 48.9 million of them free-floating, with a market cap of CA$21.97 million. It trades in a 52-week range of CA$1.08 and CA$0.19.

Sign up for our FREE newsletter

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Alpha Copper Corp. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.