Despite increasingly challenging market sentiment, driven by incredible inflation, looming rate hikes, and a Russian “special operation” that isn’t just blocking commodity transport from Ukraine, and Europe’s natural gas supply but seems to drag China into it as well, since the U.S. would like to see a tougher stance on Russia, Tectonic Metals Inc. (TECT:TSX.V; TETOF:OTCQB) managed to close their recent private placement at CA $2.3 million (CA$2.3M).

This was of course less than the intended CA$3M, but I still consider this a remarkable feat for a nano cap under the current market conditions, and it shows the support of the likes of key shareholders such as Crescat Capitaland Doyon go a long way. Not only does Crescat do a lot of the heavy lifting themselves, they also draw in other investors because of their reputation.

It is also noteworthy that both of these major shareholders are stepping up once again after having participated in previous rounds, but this time increasing their ownerships in Tectonic even more. This injection of fresh cash enables Tectonic to drill their projects, and that is exactly what they are doing at the moment, as drilling commenced on July 7, 2022, at their district-scale Seventymile project, Tectonic’s 40km long greenstone belt located in Alaska.

It was good to see that after an extension of the earlier announced financing, Tectonic managed to close the second tranche of the non-brokered private placement financing by issuing 7,183,339 units at a price of CA$0.06, for aggregate gross proceeds of CA $431,000 (CA$431k). CEO Tony Reda was pleased with the proceeds:

“As we close our financing, I am humbled by the trust our investors have placed in us despite the current challenging market conditions. Their continued support is a recognition of the exciting opportunities we have at our Alaskan properties and is a reflection of our own enthusiasm for the compelling targets we have identified for the 2022 field season. Thanks to our investors and the hard work and dedication of the Tectonic team, the drills are now turning at Seventymile. We look forward to reporting on our progress at the earliest opportunity.”

This second tranche was part of a non-brokered private placement of up to 50M shares at CA$0.06, with a two-year half warrant (exercise price CA$0.10) for gross proceeds of up to CA$3M.

The warrants are subject to an acceleration clause when the share trades at CA$0.20 or higher during 20 consecutive trading days. Tectonic was originally looking to close this financing before May 16, 2022, but an extension was granted because of deteriorating market conditions, providing the company with a window of opportunity until July 8, 2022.

The first tranche closed May 30, with Tectonic issuing 32,185,666 units at a price of CA$0.06, for aggregate gross proceeds of CA$1,931,140. Total proceeds for both tranches came in at CA$2.36M, and net proceeds after costs were CA$2.35M, one of the advantages of doing non-brokered financings.

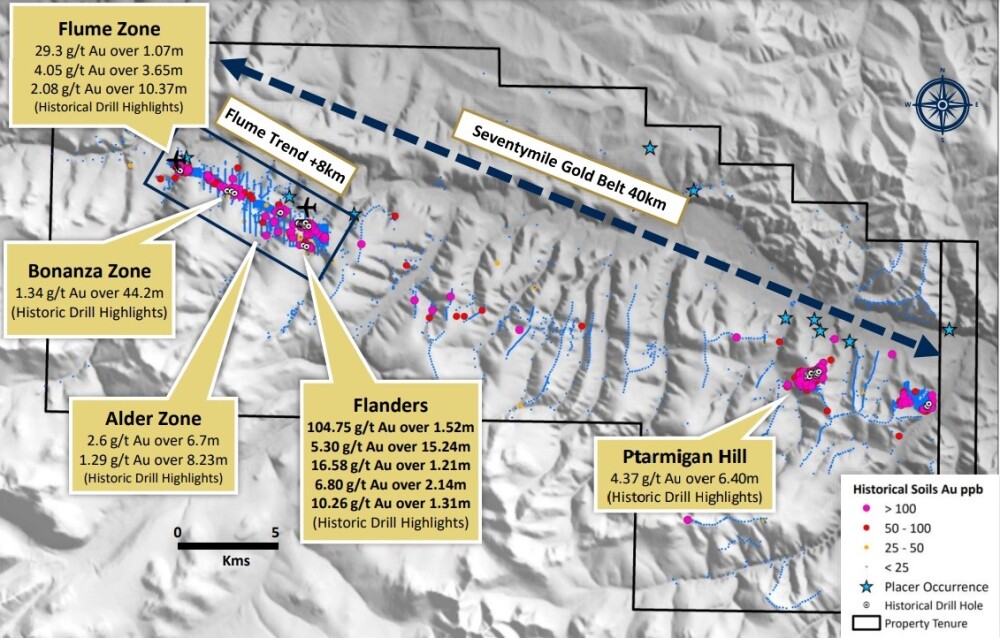

The Seventymile project is part of an underexplored, fully owned 40km long Greenstone belt, located 270km east of Fairbanks, Alaska.

The property is only accessible by air (small aircraft, helicopter), and in the winter by a winter trail. Seventymile is an orogenic gold system (for example Abitibi, Kalgoorlie, Red Lake, Hope Bay, and Las Cristinas) with lodge-style high-grade quartz mineralization occurring in shear zones and faults. Drilling highlights are 5.5 grams per tonne gold (5.5 g/t Au) over 15.0m, 1.1m at 205.9g/t Au, 6.1m at 2g/t Au, 19.8m at 1.37g/t Au and 6.1m at 4.38g/t Au.

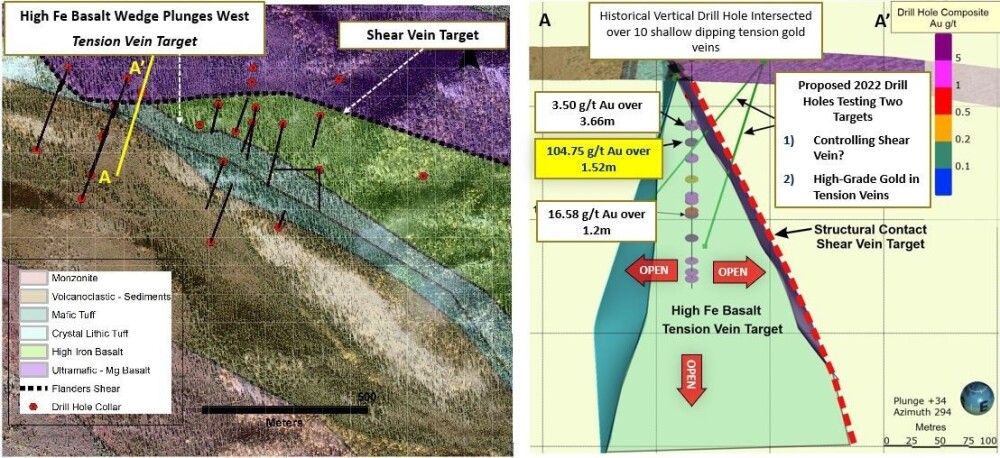

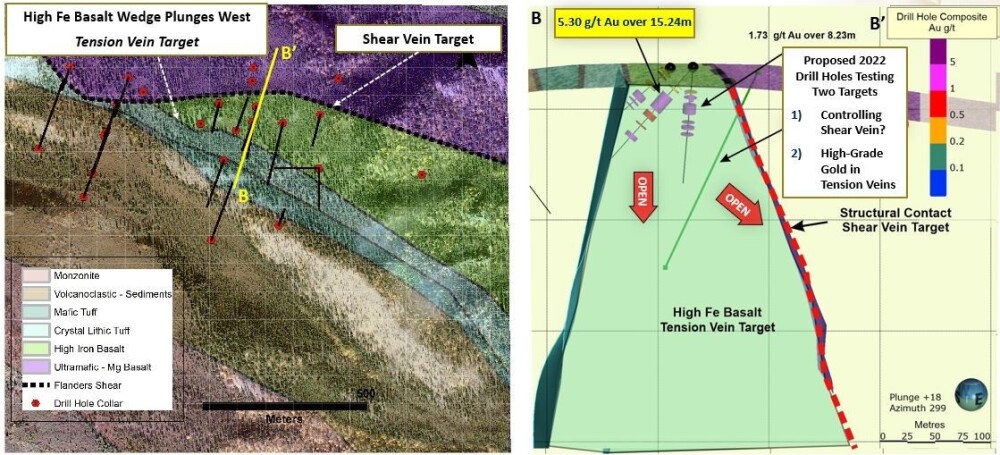

On July 7, 2022, Tectonic announced the details of their recently commenced drill program. Their strategy focuses on testing two concepts with each drill hole within the highly prospective 8km-long Flume orogenic gold trend, located in the northwestern region of the project, consisting of the Flanders, Flume, and Alder prospects:

A.) The newly interpreted main gold-bearing shear zone feeding the historically drilled tension veins carrying diamond drill results up to 104.75 g/t Au across 1.52m;

B.) The true width, scale, and continuity of the historically drilled, shallowly dipping tension veins, where select historical vertical drill holes intersected multiple stacked, high-grade gold veins;

These three targets are known to contain shallowly dipping, low-angle tension vein swarms, occurring adjacent to interpreted, largely undrilled, controlling shear structures. Limited historical diamond drilling in 1990 and 2000 at these targets demonstrated the presence of high gold grades and significant strike potential.

The following sections provide more detail on the third dimension of the drilling strategy:

And:

The news release of July 7, 2022, elaborated some more on the drilling strategy at the three aforementioned targets:

- Flanders: High-grade north-dipping quartz tension veins hosted by a distinctive iron-rich basalt unit are open for expansion to the northwest, east, southeast, and at depth. Diamond drilling in 1990 and 2000 by previous operators intersected two highlight diamond drill results of 104.75 g/t Au over 1.52m and 5.30 g/t Au over 15.24m within tensional veins, both of which are open along strike and at depth. Additionally, a 2020 Tectonic RAB infill drill hole testing extensional, tension-gash quartz-pyrite-arsenopyrite veins at Flanders returned a highlight result of 4.38 g/t Au over 6.10m. Additionally, the 2022 program will test for shear-hosted mineralization at the northern structural contact of the high iron basalt unit, which is interpreted to be the controlling feature of the tension veins drilled to date.

- Flume: Drilling will focus on expanding the known shear-tension vein gold mineralization system by testing the down-dip extent of the shear while also stepping east across Flume Creek to test the interpreted continuation of the system in an undrilled area of high-tenor gold-in-soil anomalies (trace to 590 ppb Au).

- Alder: Undrilled high tenor gold-in-soil anomalies with values from trace to 2.34 g/t Au found in the same iron-rich basalt as observed at the Flanders prospect. Drilling will focus on stepping west of the historic drilling into the basalt.

So the idea is to explore the iron-rich basalt shear zone at Flanders/Flume, as earlier drilling showed it hosts multiple stacked mineralized veins. As this shear zone seems to be starting out small, widen at depth to about 250-300m, and has a strike length of many kilometers if continuous, it will be clear the potential for something big is there if mineralized and continuous.

CEO Reda couldn’t tell me when the first drill results for Seventymile are expected back from the labs at this moment, as it depends on many things.

As a reminder, Tectonic is targeting district-scale projects in safe jurisdictions, which have the potential to generate multi-million-ounce deposits. In some senses, choosing a secure and predictable jurisdiction in which to operate has become the new ESG (Environmental, Social and Governance) standard, as current LatAm developments but also extremely corrupt and dictatorial jurisdictions like Russia could create havoc for mining investments. This is why Tectonic has chosen Alaska, as it is one of the safest pro-mining jurisdictions worldwide to operate in.

The other property to watch this summer is the 100% owned Flat Gold project, Tectonic’s latest acquisition is located 40km north of the 45Moz Au Donlin Gold project, jointly owned and operated by Barrick and Novagold, who are spending $60M at Donlin this year.

As you probably know, Donlin is one of the largest undeveloped open-pit gold resources in the world (39 million ounces [39Moz] at 2.24g/t Au) and Flat is located in the same mineral belt that produced this behemoth. According to management, Flat is a 92,000-acre district-scale intrusion-hosted gold system with multi-million-ounce potential in the heart of Alaska’s fourth most prolific placer mining district. Historic drilling from 1997 returned interesting highlights, like 24.7m at 12.5g/t Au, 36.6m at 1.36g/t Au and 31.7m at 1.28g/t Au.

The priority target, Chicken Mountain, hosts a robust 4km long gold-in-soil anomaly where drilling indicated gold mineralization over a kilometer and is the likely source of the majority of the historic 1.4Moz of placer gold mined in the area. Once drilling is complete at Seventymile, Tectonic will be conducting metallurgical testing on historic Flat core samples in an attempt to corroborate earlier results which suggested the potential for free milling gold at the property.

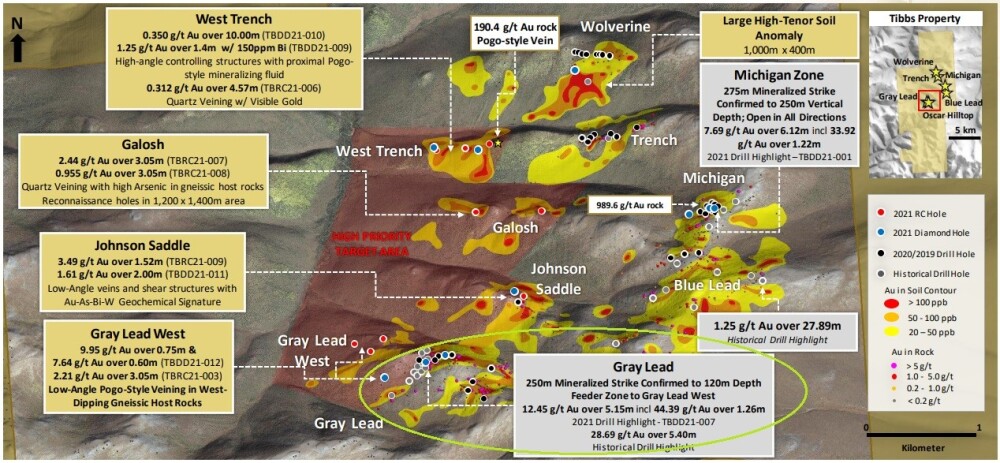

Finally, Tectonic’s third district-scale property is the fully owned 29,280-acre Tibbs Gold Project located35km east of the 200,000 ounces (200koz) Au per annum Pogo Mine. High-grade gold mineralization at Tibbs occurs in steeply dipping veins, crossing multiple lower-grade low-angle veins similar to the Pogo Mine, which serves as an analogy.

The Tibbs property is close to existing infrastructure and an active mill and has seen lots of exploration, ranging from soil sampling, airborne and land-based geophysical surveys, trenching to drilling. Drill highlights are 28.95m at 6g/t Au, 5.3m at 15.7g/t Au, 5.7m at 19.1g/t Au, 1m at 104.5g/t Au and 5.1m at 12.45g/t Au. These are very substantial results, and the most impressive drill results were obtained at the Gray Lead area:

Phase II drilling already established a 1000m x 350m mineralized zone, where the majority of drill results returned grades over 5g/t Au, and within this high grade, steeply dipping veins with grades up to 127g/t Au. It is still early days, but if we would guesstimate a mineralized envelope of 1000x350x5m x2.75t/m3 density, this would result in 4.8Mt, and at an average grade of say 5g/t this could already result in a hypothetical 770koz Au. And keep in mind that this is only a small part of the entire project. Although it seems a no-brainer to delineate a 1Moz Au maiden resource here pretty easily, Tectonic is focusing on Seventymile now first, in order to see if there could be even bigger potential.

It seems that, despite increasing recession talk and deteriorating market fundamentals, Tectonic is firmly on its way to drill one of the more exciting, larger exploration projects, and looking to explore another one pretty soon. As they are freshly cashed up, they have room to maneuver it seems. The wait is on for incoming drill results.

Conclusion

After raising CA$2.3M, Tectonic Metals seems to have recovered somewhat, with their extremely low market cap of CA$8M going to CA$12M again, trading at financing prices of CA$0.06 per share. You have juniors choosing to do absolutely nothing when markets turn into a recession, not able or willing to raise more, saving cash at all costs while grinding lower and lower as investors lose all interest in inactive companies.

Not so at Tectonic, as it courageously jumps forward, determined to create value for shareholders regardless of market conditions. And as CEO Tony Reda so often reminds investors, if you are not drilling, you are not finding.

Personally, I like the latter type as fortune favors the bold in my view, and in case they create value but don’t get immediately rewarded by it through bad market sentiment, investors will recognize value at all times and will get back as soon as sentiment turns for the better. Let’s see what kind of value Tectonic can create, as we are awaiting Seventymile drill results.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

The Critical Investor Disclosures

The author is not a registered investment advisor, and currently has a long position in this stock. Gold Terra Resource is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldterracorp.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence and talk to their own licensed investment advisors prior to making any investment decisions.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Gold Terra’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Gold Terra or Gold Terra’s management. Gold Terra has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

Streetwise Reports Disclosures

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.