Quaterra Resources Inc. (QTA:TSX.V; QTRRF:OTCQX), a small-cap company with a portfolio of assets in the historical copper mining area of Yerington, Nevada, owns water rights, valuable assets in the deserts of Nevada. And it has begun to monetize them.

"Controlling the water rights gives Quaterra a massive advantage in a very mining-friendly state where water resources are scarce." - Keith Kohl, Pure Energy Trader

In September 2018, Quaterra entered into a purchase agreement to sell certain primary ground rights to Desert Pearl Farms LLC for $6.2 million. The State of Nevada Division of Water Resources needs to approve the change of the water rights from mining to agriculture, a process that is currently underway, and the company expects the deal to close shortly.

After the deal closes, Quaterra reported it will still have about 6,700 acre-feet per year of primary ground water permitted for mining on its 52 square mile Yerington property.

"These water rights are key to district development," explained Quaterra Chairman and CEO Tom Patton. "These are already permitted for mining and milling, and have seniority it terms of priority of usage. Based on the recent purchase and sale agreement, Quaterra's 6,700 acre-feet of primary ground water is valued at about US$20 million."

"The value of the company's water rights greatly exceeds its market valuation." - Clive Maund, CliveMaund.com

The company noted that the 2012 PEA at MacArthur estimated water usage of 2,590 acre-feet per year for a 41,000 ton per day oxide project, and it estimates that a 50,000 ton per day sulfide mill will consume about 3,100 acre-feet annually. Quaterra additionally has substantial water rights associated with parcels of private land it has under option.

Analyst Sid Rajeev with Fundamental Research Corp., in a September, 2018, report, placed a fair value estimate on Quaterra shares of CA$0.49 per share. With 257 million shares fully diluted, that valuation implies a market cap of about CA$126 million, or around US$96 million.

Shares are currently trading at around CA$0.095, resulting in a market cap of approximately CA$24 million, or US$18 million, substantially below the estimated value of the water rights of US$26 million.

Rajeev commented that Quaterra's announcement that it had entered an agreement to sell some water rights is a "very positive development as it is a non-dilutive way to fund advancement of the MacArthur copper project."

Keith Kohl wrote in Pure Energy Trader on January 25, that controlling the "water rights gives Quaterra a massive advantage in a very mining-friendly state where water resources are scarce. Without the proper water rights, development of the Yerington District would grind to a standstill."

However, "Quaterra doesn't need to sell these water rights right away, and can use them to their full advantage whenever it suits them. In the event that we start to see more consolidation in the Yerington District, these groundwater rights will be immensely valuable to Quaterra and its shareholders," Kohl stated.

Bob Moriarty of 321 Gold noted on January 28, "At today's price, the market only values Quaterra at $8.76 million USD yet sometime between now and the end of March they will be closing on the water sale and will bring in $6 million USD. For all practical purposes, valuation of the water rights sets a floor under the price of the shares. Selling the surplus water rights gives an implied value of about $20 million USD for the remaining 6,700 acre-feet of water."

Technical analyst Clive Maund wrote on CliveMaund.com on January 28, Quaterra Resources "is in possession of valuable water rights that are much in demand, and in fact the value of the company's water rights greatly exceeds its market valuation, which should mean that either the stock price will improve or it will get bought up. . .Quaterra has already sold some of its water rights and will be in receipt of the proceeds soon, which means that it is solvent and can, if it wishes, proceed to advance its projects."

Quaterra is exploring its property as demand for copper is projected to skyrocket, due to the increasing popularity of electric vehicles, such as Teslas, along with the development of renewable sources of energy. Electric vehicles can use more than three times the amount of copper than gasoline-powered vehicles.

U.S. copper projects, in particular, are coming into the limelight, as manufacturers look for steady sources of metal. According to Reuters, pro-mining policies in the U.S. and increasing nationalistic sentiment in other countries are driving this trend, and more than $1.1 billion has been invested in U.S. copper projects.

The International Copper Study Group and DBS estimate U.S. copper production to increase by at least 8% over the next four years, Reuters reported, and four companies, including Nevada Copper Corp. plan to open copper mines by the end of next year.

"The copper industry needs areas of good supply with low political risk, and that's what we get in the United States," Stephen Gill of Pala Investments, which is Nevada Copper Corp.'s (NCU:TSX) largest shareholder, told Reuters. Located in Yerington, Nevada, Nevada Copper's Pumpkin Hollow project is less than 60 km from Tesla's Gigafactory.

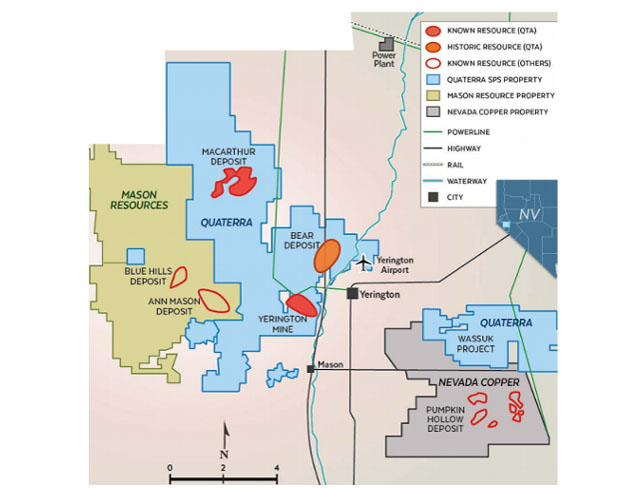

The Yerington area, where Quaterra hosts several properties, is re-emerging as a copper district; it is the site of the old Anaconda mine. The area has more than 17 billion pounds of copper in the Measured and Indicated categories, and is 70 miles southeast of Reno.

Quaterra's properties adjoin both Nevada Copper's land and Mason Resources' copper projects that HudBay Minerals Inc. (HBM:TSX; HBM:NYSE) just acquired.

"Quaterra's assets at Yerington have multiple development and redevelopment opportunities, significant exploration upside and are a logical starting point for District consolidation," Patton told Streetwise Reports. "They consist of the MacArthur oxide and sulfide deposit; the Yerington pit sulfide and oxide deposit previously mined by Anaconda; the Bear porphyry copper deposit; and several untested exploration targets."

The company is preparing a prefeasibility study for MacArthur, located in the north of Quaterra's land position. A 2012 preliminary economic assessment (PEA) estimated the production of approximately 748 million pounds of copper over 18 years at an average operating cost of $1.89 per pound. According to the company, "based on the three-year average copper price at the time ($3.48 per pound) the PEA estimated a pre-tax internal rate of return of 29.3%, a payback of 2.7 years and a pre-tax net present value of $284.1 million at an 8% discount rate." Copper is currently trading at around $2.70 per pound.

Quaterra's properties have not escaped notice. Bob Moriarty of 321 Gold wrote on January 28, "Quaterra is in progress with a Pre-Feasibility Study with the intention of lowering capital costs with the elimination of a $65 million acid plant, using a more timely base cost of $3 a pound for copper and using higher copper grades. They expect to complete the PFS within eighteen months with an updated resource model and an optimized mine plan."

"The Yerington Copper District is ripe for consolidation. Nearby Nevada Copper is going into production at their Pumpkin Hollow deposit at the end of 2019. Hudbay Minerals only recently announced completion of a purchase of Mason Resources and their Ann Mason copper property in Yerington for about $31 million CAD. Other companies than Quaterra put value in the Yerington Copper District," Moriarty concluded.

Keith Kohl wrote in Pure Energy Trader on January 25, "MacArthur truly is a huge low-cost, conventional project with near-term production potential. . . Right now, the company is currently working to solidify the PEA for MacArthur, and the goal is to move forward with the preparation of a Pre-Feasibility Study. . . As one of the best conductors out there, roughly 60% of total copper use is for electricity and heat. Copper plays a critical role for renewables, too, from photo-voltaic solar cells to wind turbines."

Fundamental Research Corp analyst Sid Rajeev, in a September 2018, report, commented, "A prefeasibility study (PFS) on the MacArthur deposit was initiated in January 2018. We expect significant improvements in the PFS from lower CAPEX and higher grades and recovery rates."

Quaterra currently has 204 million shares outstanding, and 257 million fully diluted.

Read what other experts are saying about:

| Want to be the first to know about interesting Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Quaterra Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Quaterra Resources. Please click here for more information. An affiliate of Streetwise Reports is conducting a digital media marketing campaign for this article on behalf of Quaterra Resources. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Quaterra Resources, a company mentioned in this article.

Additional disclosures:

Bob Moriarty of 321 Gold:Quaterra is an advertiser. I have bought shares in the open market and participated in a private placement. I am naturally biased. Do your own due diligence.

Clive Maund does not own shares of Quaterra and he or his company has not been paid by Quaterra

Fundamental Research Corp.: The opinions expressed in this report are the true opinions of the analyst(s) about any companies and industries mentioned. Companies mentioned in this report may be covered by FRC under an issuer paid model or be candidates for coverage. FRC or companies with

related management, may hold shares in some companies mentioned in this report.

Keith Kohl does not own shares of Quaterra and and he or his company has not been paid by Quaterra.