Against a backdrop of fast-rising copper prices due to supply constraints and peak demand, Allied Copper Corp. (CPR:TSX; CPRRF:OTCQB) recently filed a technical report on its prospective Klondike copper property in Colorado in advance of an upcoming drill program.

Allied Copper has three main projects: the Klondike and Stateline sedimentary-hosted copper projects in Colorado and the SK copper-gold porphyry project in Nevada. That said, sources tell Streetwise Reports that Allied is evaluating other acquisitions to put into practice the company’s skill set of advancing assets to production—something not often found in junior exploration companies with an enterprise value of less than CA$10 million (CA$10M).

Executive Chairman Warner Uhl is what sets Allied Copper apart from other junior resource explorers.

Allied believes its summer drill program could return economic grades of copper at both projects in Colorado. If things go as planned, these properties could be near-term production assets to feed what’s expected to be a copper supply glut in the latter half of the decade.

Allied optioned Klondike from an alliance of companies with a track record of buying and selling quality assets, including London-listed Cloudbreak Discovery PLC (CDL:LSE), and its Canadian subsidiary, as well as Alianza Minerals Ltd. (ANZ:TSX.V; TARSF:OTCQB).

It’s noteworthy that Stateline and Klondike were brought to Allied Copper by consulting geologist Dr. Jon Thorson, who is credited with finding Lisbon Valley Mining Co.’s Flying Diamond copper deposit, which will eventually be put into production.

Thorson eventually became Lisbon Valley Mining’s head of exploration and spent about a dozen years there before “retiring” to become a consulting geologist.

Allied can acquire a 100% stake in Klondike by spending $4.75M on exploration [at least $500,000 ($500K) in year one] and making $400K in cash payments. Both must happen within four years.

The junior explorer must also issue 7 million shares to Cloudbreak and Alianza no later than two years from the deal’s closing. Another 3 million share purchase warrants must be issued to Cloudbreak and Alianza on the closing’s third anniversary.

Cloudbreak and Alianza get another 3 million shares if Allied files a National Instrument 43-101 mineral resource on Klondike that exceeds 50K tonnes at a minimum grade of 0.5% copper-equivalent (Cu-Eq). That would also trigger a 2% net smelter return royalty to the vendors, but half of that can be bought back for CA$1.5M within 30 days of commercial production.

Allied’s Klondike property sits along the Paradox Copper Belt and consists of 76 unpatented mineral lode claims (this means mineral rights only, no surface rights) over roughly 850 hectares at the southeast end of Big Gypsum Valley, about 25 kilometers south of Naturita, Colo. San Miguel County has a gravel pit there, so the dirt road to the Klondike property is well maintained.

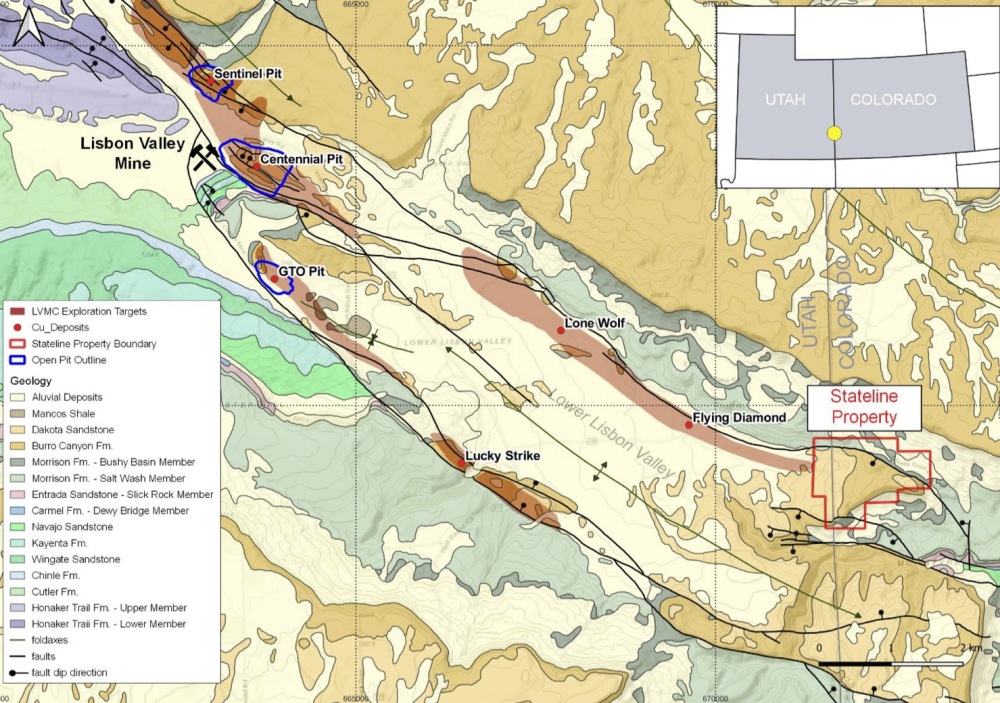

The Lisbon Valley Mine Complex (LVMC), held by private firm Lisbon Valley Mining Co., currently mines copper from the Centennial open pit and recovers it using heap leaching — about as inexpensive as copper mining gets in America. The pit is about 8 kilometers northwest of Allied’s Stateline property.

“Electrification will bring investors to junior copper developers … and Mr. Uhl’s considerable contacts in the global copper space will result in multiple high-quality projects crossing his desk and ultimately driving valuation.”

—Michael Ballanger

Once the copper is leached out, the copper-in-solvent solution is made into pure copper cathode via a process known as solvent-extraction electrowinning (SXEW). Copper cathode fetches more money than a copper concentrate because its purity is ideal for battery cathodes in electric vehicle batteries and giant magnets in windmills—this helps make copper the key element in the world’s “electrification.”

Copper Mining at the LVMC

Copper-silver mineralization has been mined since 2007 at the LVMC, which sits across the state line in Utah, about 40 kilometers northwest of Klondike.

The disseminated copper mineralization at Klondike is hosted in sandstone units (sedimentary) of the Cretaceous Dakota and Burro Canyon formations.

Copper exploration in the 1960s transitioned to uranium exploration in the 1970s. Some previous work reported high-grade copper mineralization highlighted by results of 6.3% copper (6.3% Cu) and 23.3 grams per tonne silver (23.3 g/t Ag) in outcrop. Allied believes copper-silver mineralization at Klondike could be amenable to SXEW processing, much like the copper deposits at the LVMC.

The Stateline property is also in San Miguel Cty. The property consists of 22 unpatented mining claims (meaning the holder owns all the rights) in the emerging Paradox Copper Belt and is a long trend of the Lisbon Valley Mining’s promising Flying Diamond copper deposit.

Allied will soon publish another Technical Report on Stateline.

Copper mineralization has been recognized in the Lisbon Valley since the 1890s. Exploration programs were done by Noranda (now Xstrata Plc (XTA:LSE)) in the 1970s and Kennecott (now Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK)) in the 1990s focused on bulk-tonnage deposits.

More recent work by Constellation Copper Corp. and, later Lisbon Valley Mining, identified a series of near-surface deposits in the Lower Lisbon Valley. Regional programs as part of this work included sampling over the Stateline claims and are highlighted by results of 1.6% Cu and 1.7 g/t Ag from a rock sample, and 0.47% Cu and 2.1 g/t Ag across a 12-ft. chip sample.

According to Allied, Thorson and another geologist did much of the preliminary exploration work on the Stateline and Klondike properties but lack the resources to completely de-risk them through drilling and advanced geophysics. Nonetheless, they know the geology well.

“Despite both Klondike and Stateline having little exploration work done, they are both mirror production assets. Stateline, in particular, is on trend and on strike with the Flying Diamond deposit at the Lisbon Valley Mining Complex. These assets were brought in because they only require quick drill programs to prove out an asset,” McClain said.

He added, “To be perfectly honest, at Stateline (Allied) could put a dozen holes in the ground and be done. Maybe it's not there but if the first half dozen holes in the ground come back the way (Thorson) thinks they will, this will be a very large deposit.”

Allied Copper’s third property is the Silver King (SK) property In Lincoln Cty., Nevada. It is thought to be a copper-gold porphyry deposit and is situated near where the Battle Mountain and Cortez trends meet. It’s comprised of 316 unpatented lode claims over 2,560 hectares.

Allied can earn up to 100% ownership in SK for a total of $420K over five years.

SK was drilled previously by Anaconda Mining Inc. (ANX:TSX). Two holes returned grades above 2% copper-equivalent. Allied completed some ground geophysics work there earlier this year.

Management Gets Things Done

Executive Chairman Warner Uhl is what sets Allied Copper apart from other junior resource explorers.

Uhl’s experience in taking assets to production, sourcing the necessary equipment, and fundamental understanding of supply chain routes (especially in the current landscape) gives Allied a significant leg up in both evaluating assets and building out a camp and, ultimately, a production facility.

Vancouver-based consultant William McClain, who has done some work for Allied Copper, says having Uhl at the helm helped bring shareholders to the company when it listed on the TSX Venture Exchange.

Source: Allied Copper Corp.

“Having Warner Uhl on the team makes all the difference in the world and differentiates Allied Copper from other junior resource explorers,” McClain said. "Allied’s stated main goal is to acquire assets that they can get to production as quickly as possible in the near term.”

Uhl comes to Allied with a reputation for getting things done.

As an engineer with Fluor Corp. (FLR:NYSE), Uhl helped design and build the $1.5B Mt. Milligan copper-gold mine, 150 kilometers north of Prince George, British Columbia. The mine, now owned by Centerra Gold, has reserves of 736 million lbs copper and 1.83 million oz gold.

He was also project director for Wood Engineering at the IAMGOLD Corp.'s (IMG:TSX; IAG:NYSE) Cote Gold Project, some 125 kilometers southwest of Timmins, Ontario. The mine is expected to enter production in 2023 and produce 489,000 oz gold annually for the first five years, and about 6.6 Moz total.

Now Uhl’s focus is on copper, as the red metal trades near unprecedented highs.

“With the recent change in governments in Chile and Peru, there’s uncertainty on royalty costs and other aspects of mining across S. America, home to nearly half the world’s copper production. Investors are now looking for secure, politically safe jurisdictions. Allied Copper is well-positioned to meet this need with its key asset in Nevada and the purchase of additional projects in the western U.S.,” Uhl said during a presentation earlier this year.

He added, “We have an experienced management team prepared to take assets into production to support the world’s transition to battery-electric cars.”

Copper Price Popping

Sedimentary-hosted copper deposits, like Klondike and Stateline, contribute heavily to world copper production, accounting for more than 20% of the world’s annual copper supply.

In 2000, the world consumed about 15 million tonnes of refined copper annually. In 2022, that number is expected to exceed 26 million tonnes—and more than 40M tonnes by 2030.

Since March 2020, copper prices have more than doubled and sit just below $5 lb.

Copper is used to generate and transmit energy, as well as store it. After aluminum and steel, it is the most widely used industrial metal due to its conductivity and resistance to corrosion (gold and silver are also great conductors but are too expensive for industrial use).

In his top picks for 2022, mining expert Michael Ballanger believes the strength of the copper market will push Allied well beyond its 52-week high of CA$0.62.

“I am taking the view that electrification will bring investors to junior copper developers and that Mr. Uhl’s considerable contacts in the global copper space will result in multiple high-quality projects crossing his desk and ultimately driving valuation. With only 38 million shares issued and a CA$8.37 million market cap, there is a great deal of room for appreciation,” Ballanger wrote.

Ballanger set his target price for Allied Copper in 2022 at CA$1.25.

Playing Hookey

Kyle Hookey was named interim CEO in late March after former CEO Richard Tremblay resigned from the company in February. Hookey has a background in finance and spent some time with Goldman Sachs.

He is as well connected as any mining executive under 40. He is principal of Vancouver-based Cronin Capital Corp., a natural resource focused merchant bank. He is also a director of Cloudbreak.

Hookey was the CEO when Allied Copper was Cariboo Goldrush, a gold explorer with a focus on its namesake region in British Columbia. He rebranded it as Allied, rolled back the share count, restructured the debt, and brought in a fresh group of core shareholders.

In late March, Hookey told Andrew O’Donnell, host of investment news program The Market Mindset on YouTube, that Allied wants “sticky shareholders” or stakeholders that are interested in being around for a while and participate in financings as needed. About 40% of Allied shareholders are “insiders,” which one might say is fairly sticky.

Allied raised $7 million ($7M) in mid-2021 and still has more than $4M or enough to fund its 2022 exploration plans, which include drill programs on at least two of its projects later this year.

Allied Copper has about 40 million shares outstanding, but with outstanding warrants and options the total increases to almost 60 million.

Sign up for our FREE newsletter

Disclosures

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Allied Copper Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Allied Copper Corp., a company mentioned in this article.