On its long-term 10-year chart silver superficially looks like it may still be in a bear market, but on more careful inspection we can see that a large Head-and-Shoulders bottom pattern is completing, which is tilted compared to the similar pattern that is completing in gold, because silver tends to underperform gold at the end of bear markets and the beginning of bull markets. As we can see, unlike gold, it is still some way from breaking out of this base pattern, but should do so not long after the dollar breaks down from its Broadening Top, that we look at in the parallel Gold Market update.

Volume indicators are most auspicious, with the On-balance Volume line in particular looking very bullish indeed, since it is already at new highs, which is remarkable given that the silver price is still a long, long way from its 2011 highs. Since silver is in the late stages of forming the Right Shoulder of its H&S bottom it is at a good point to accumulate, although given that there is considered to be a high chance of a near-term relief rally in the dollar before it finally collapses, we may see an even better price in coming days and weeks, although this is likely to be the last chance to buy silver anywhere near to its bottom for this cycle.

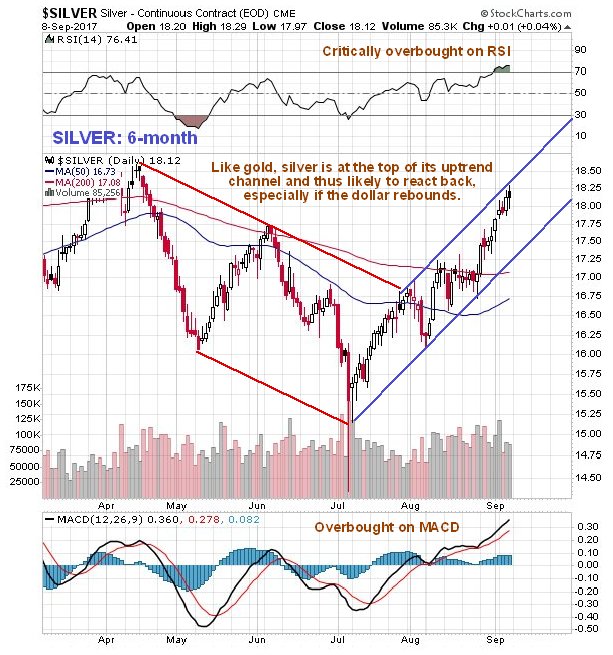

On silver's 6-month chart we can see that it is at a good point to react

back on a near-term dollar bounce, because it has arrived at the top of

the channel shown in an overbought state, and any such reaction will be

regarded as throwing up a buying opportunity, especially if it should

break down from the channel and drop back towards its July lows,

although it is considered unlikely that it will drop back this far.

Copper reacted sharply on Friday, and as it has been leading the metals in the recent past, this is viewed as an additional sign that a dollar bounce is pending and a near-term reaction in gold and silver. The latest copper chart may be viewed in the new Gold Market update.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by the author.