You should never, never ever, put in a market order when buying or selling junior mining shares. The liquidity is so low that it is the financial equivalent of putting a sign around your neck saying, "I'm stupid. Steal from me."

I wrote Nobody Knows Anything a year ago to try to educate investors on the basics of investing they need to know. Some of the most valuable advice is what not to do.

When I had someone design a cover for the book, the first cover I selected an investor standing in a boat trying to reel in dollars while the boat floats in a sea of sharks. It makes a great analogy. Everyone you deal with is trying to take your money. The biggest sharks of all are the brokers. They will steal from you in a moment if you allow it.

The same stock gave two different perfect examples of what can happen with market orders in just the last six weeks. The stock is Irving Resources. The U.S. symbol is IRVRF and for American buyers not trading the Canadian symbol through Penntrade, everyone else is pretty much forced to buy in the U.S. using the U.S. symbol.

It vital that investors understand that on Canadian listed shares with companies domiciled in Canada; the Canadian symbol is the real stock. But when Americans cannot trade the Canadian symbol through their brokers, U.S. brokerage houses will have set up an OTCBB symbol. It is a derivative; it is not the real deal.

So when trading Canadian shares, every investor should track the stock on Stockhouse or Stockwatch in Canadian dollars. Those are the real prices. The U.S. symbol will more or less track the Canadian shares but with a currency conversion. But the U.S. symbol will always have less liquidity.

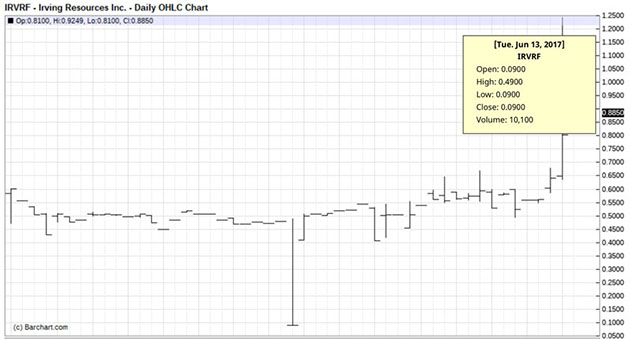

On June 13th I began to get a flurry of emails, all in a panic, wanting to know what happened to Irving. Had they gone belly up? I went to Stockwatch and looked at my screen. It showed the stock trading in a range of $0.64 to $0.66 with just over 22,000 shares traded. The stock closed up a cent on the day. Mentally I was scratching my head. Why were people contacting me in a panic? I asked one of the writers why he believed there was a problem. I didn't see any problem.

He wrote back that the shares had crashed to $0.09 a share. Naturally he was fearful. I scratched my head again before pulling up the U.S. symbol for Irving and the answer was as distinct as a pimple on the tip of your nose. The IRVRF symbol traded 10,109 shares on June 13th in four trades. Three trades were between $0.46 and $0.49, but the first trade of the day was at $0.09.

Someone put in an order to sell 5,000 shares at the market to insure he would get an execution. And he did. From a close of $0.48 the day before, the shares went to $0.09. I don't have any clue as to who the hopeless seller was but finding the culprit who stole $1,950 US from the investor was easy. All you had to do is go down to the slimiest gin joint around Wall Street and look for the broker with the giant grin buying free drinks for everyone.

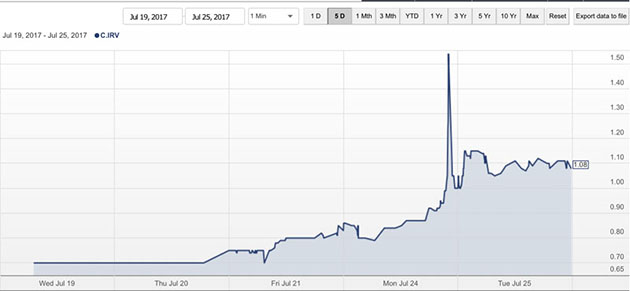

Then on July 20th I wrote a piece that first went up on Streetwise about the same Irving Resources. I went to see them a couple of weeks back and was quite impressed. Strangely enough, in the piece I suggested the shares would double once the liquidity dried up. Little did I know that there had been a big seller in the market for days dropping a few hundred or thousand shares at a time. One of the original big shareholders was going through a divorce and needed to liquidate. The lack of liquidity was killing him until my piece came out and a lot of people felt the same way about the stock as I did.

So on the 21st of July the buyers came out in force and bought up over 700,000 shares in a stock that traded by appointment for many months. On Monday July 24th the buying continued. The shares closed up $0.15 from $0.70 on Friday, opened strong on Monday the 24th. By about 3:00 in the afternoon with the shares up another $0.20 on the day to $1.05 some investor decided that he really needed to own some Irving. So he put in a market order.

Same broker, same story. The stock goes from about $1.05 to $1.54 in seconds and drops right back to close at $1.00 on the day, up another $0.15. So someone was nice enough to make me look as if I could forecast the future and it only took two days. The free float dried up and the stock doubled.

It was stealing on the part of some broker and if you think this is some free market where everyone plays fair and square let me assure you that it is not. If you want to live in a world with a totally free market, you need to move to Zimbabwe.

You are in shark-infested waters. Don't swim with the sharks lest you get eaten. Sharks abound, they feed you manure and call it mushrooms. You can tell because they are always mumbling about how markets are manipulated when we all know that all markets are manipulated. They talk about "naked short selling" when we know that doesn't even exist in commodities. They shriek about how Comex is about to default but it somehow never does.

They are sharks. They want your money.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Irving Resources. Irving Resources is not an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Irving Resources Inc., a company mentioned in this article.