In a March 23 research note, Laurentian Bank Securities analyst Jacques Wortman reported that Troilus Gold Corp. (TLG:TSX; CHXMF:OTCQB) entered a definitive agreement to acquire UrbanGold Minerals Inc. (UGM:TSX.V) for CA$19 million in an all-share transaction.

"While adding longer-term exploration potential, we are encouraged that the transaction will not dilute Troilus Gold's cash position and will have no impact on the timeline to completion of the prefeasibility study scheduled for later this year," commented Wortman.

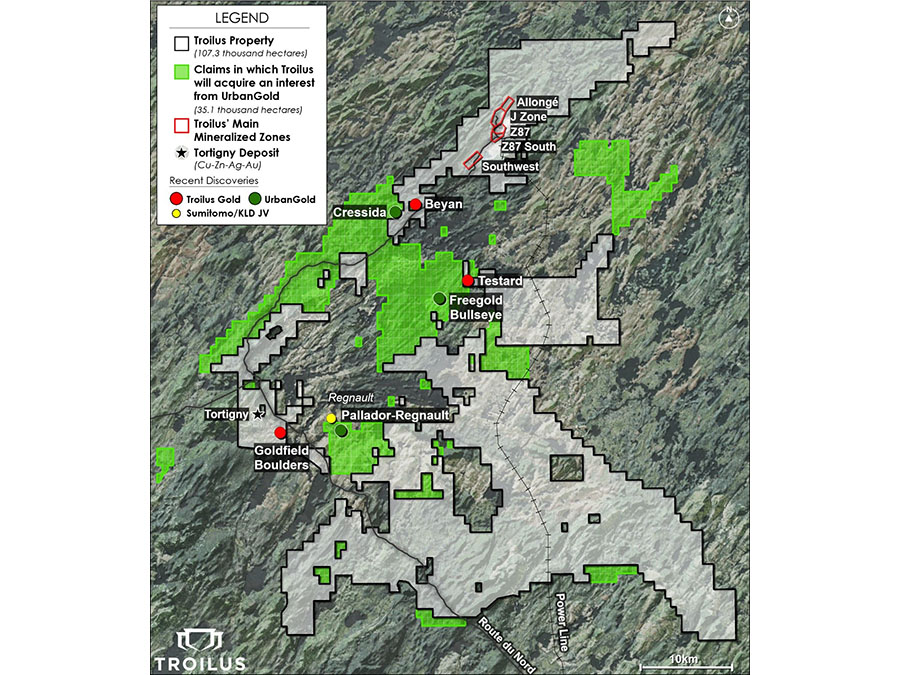

Wortman highlighted that the transaction will expand the total hectares Troilus Gold owns in Quebec's Frôtet-Evans Greenstone Belt by 33% to 142,400. This added land encompasses the area to the southwest of the northeast-to-southwest mineralized trend along which lie the past-producing pits in the Z87 and J zones, the Southwest zone and the Beyan prospect.

Also, this added land is near prospective properties, the analyst noted, including UrbanGold's Pallador-Regnault, where maiden drilling encountered gold mineralization in four out of 10 holes, including "visible gold in a quartz vein," and Kenorland Minerals' Regnault, that yielded "encouraging high-grade assays" in April 2020.

In the transaction, Wortman noted that UrbanGold shareholders will receive "0.3004 TLG shares, implying a consideration of $0.30 per share, or a 35.3% premium to the 20-day VWAP." Of the outstanding UrbanGold shares, Troilus Gold already owns about 9.7% or about 6.2 million shares. "UrbanGold management and the Board, holding 6.6% of shares, have entered into support agreements to vote their shares in favour of the Amalgamation," the analyst wrote.

Laurentian has a Buy rating on Troilus Gold and a target price of CA$3.80 per share. The stock is currently trading at around CA$1.01.

Read what other experts are saying about:

| Want to be the first to know about interesting Gold and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Troilus Gold and UrbanGold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of UrbanGold, a company mentioned in this article.

Disclosures from Laurentian Bank Securities, Troilus Gold Corp., March 23, 2021

Laurentian Bank Securities Inc. and/or its officers, directors, representatives, traders, analysts and members of their families may hold positions in the stocks mentioned in this document and may buy and/or sell these stocks on the market or otherwise.

The Research Analyst's compensation is based on various performance and market criteria and is charged as an expense to certain departments of Laurentian Bank Securities (LBS), including investment banking.

Laurentian Bank Securities Inc. may, in exchange for remuneration, act as a financial advisor or tax consultant for, or participate in the financing of companies mentioned in this document.

The analyst(s) certify that (1) the views expressed in this report in connection with securities or issuers they analyze accurately reflect their personal views and (2) no part of their compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed by them in this report. The Research Analyst's compensation is based on various performance and market criteria and is charged as an expense to certain departments of Laurentian Bank Securities (LBS), including investment banking.

Within the last 24 months, LBS has undertaken an underwriting liability with respect to equity securities of, or has provided advice for a fee with respect to, this issuer.

The Analyst has visited material operations of this issuer.

This issuer paid a portion of the travel-related expenses incurred by the Analyst to visit material operations of this issuer.

To access Laurentian Bank Securities' regulatory disclosures, please click here.