First of all, we need to ask ourselves the major question: Why are we buying gold?

At a time when the world is awash with debt and central bank liquidity, and world geopolitical turmoil is everywhere. Inflation is rising, the U.S. dollar is collapsing, and the US T Bond market is falling over because of the need to roll over so much debt.

Or is it really like that?

So, again, another question: Is the world really in such a bad place?

The answer is actually no.

When the Bretton Woods Agreement was abandoned in August 1971, the world did change. Politicians rubbed their hands with glee as they could all spend as they wished and bribe the electorate with fake money.

The gold price was set free.

But do note that the background work was done by Lyndon Johnson in 1968 with legislative changes and a partial freeing up of gold then.

Poor old Richard Nixon was left with the blame when the complete freeing up came in 1971.

The main reason I am a great Trump supporter is that someone at last is changing the way we are being governed. This change for good is as important as 1971 was for bad. The Middle East is being sorted out and Ukraine might be too.

And this is worth watching with the Epstein issue in train.

Trump is returning the U.S. to a Constitutional Republic.

As has been stated here numerous times, the Founding Fathers of the U.S. Constitution saw a Union of Sovereign States with very limited powers for a central government.

The U.S. Constitution limited Federal Responsibilities to just Treason, Counterfeiting, and Piracy.

All other activities were the responsibility of the individual States.

The 450 or so Federal Agencies now in existence have no Constitutional basis to exist.

The original Constitution prohibited personal taxes from being raised by the Federal Government. Income tax came as an Amendment to the Constitution in 1913 at the same time as the U.S.Federal Reserve was established. The reduction and/or removal of personal income taxes can be replaced by tariffs and offset by cuts in outlays and a lower Federal interest bill.

These actions will be very positive for the U.S. economy and its working citizens especially on top of all the major new investments. So, what we are seeing now is a major reconstruction of the U.S.

The vast Federal Bureaucracy is being unwound. The endless rise in Federal Debt is coming to an end. The relationships between the three arms of government is being sorted out.

The Executive (i.e., the President and his Administration) is having its role and powers better defined. The Congress is being made more accountable with its legislation. The Judiciary is being shown that its role is only to interpret legislation and not to have any Executive power. This is a major sea change.

And we are seeing the changes.

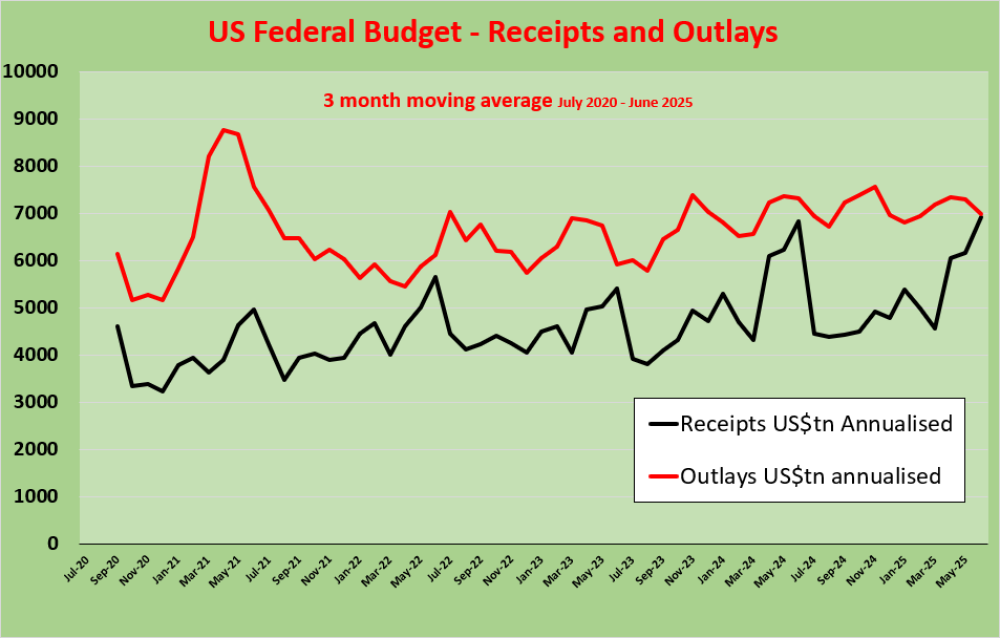

Look at this.

Receipts are seasonally strong ( April is tax month), but tariffs have been boosting Receipts. Outlays made a 17-month low in June as DOGE cuts took effect.

Treasury Secretary Scott Bessent talks about the U.S. growing out of debt as Receipts increase and Outlays are cut.

He also says, "listen to the markets, not the economists!"

The next two months of Federal Budget data should show these impacts.

Playing with numbers actually sees permanent monthly surpluses by the end of 2025.

So, the marketplace is fixated with a collapsing bond market that just ain't collapsing.

My obsession with bonds becomes apparent here.

And that Big Beautiful Bond Rally is looking better every day.

Today's yields are well below April highs and much lower than January. Despite all the REALLY BIG names saying otherwise. As bonds go, so goes currency.

The U.S. dollar is bottoming out and heading much higher.

All the other major currencies are showing their governments are still following the spend and tax game.

The recent rallies in their currencies are over.

And all those currencies have cracked.

Gold prices will be relatively strong in those currencies, so demand should be maintained there. Their bond yields are now rising. And rising from low coupon rate levels.

If you were a European bond fund manager, high yield U.S. dollar 10-Year Treasury Bonds at 4.45% in a rising currency would be far more attractive than low coupon bonds where yields are rising and forcing bond prices lower.

If this TLT ETF for 20-Year T Bonds breaks higher, then the run will be from 85 to 130 = >50% plus a running yield of 4.45% from coupon payments.

It would take two to three years.

It would be very bullish for the U.S. Stock market!

So again, why are we buying gold?

Market sentiment has been super bullish, so no one is left to buy!

There has been very little inflow into gold stock funds, and the number of shares in GDX has continued to decline as investors exit.

But let's look at the big picture.

Gold had a peak in 2008, a decline and then a liquidity fueled rally into April 2011 to make a B wave high well above wave1.

Silver, copper, tin, and iron ore joined to make new highs.

Nothing else did.

The CRB Index B wave was normal and failed to make a new high.

Gold bottomed in its C wave much earlier than the CRB Index.

And now it is leading it higher, but has probably reached a short-term peak.

It is still in a major long-term bull market.

This can be clearly seen here with A and B waves, but the C wave is yet to come.

This C wave might actually be more savage than usual, so be watchful.

Those long term clients will recall the five stages of markets

- Wave 1 Disbelief

- Wave 2 Pessimism

- Wave 3 Optimism

- Wave 4 Opportunity

- Wave 5 Euphoria.

The market breadth strongly suggests Wave 1 Disbelief applied for the past 18 months of the bull market in gold. This would coincide with the no gold stock fund inflow and the decline in GDX outstanding shares despite a rising gold price.

Wave 2 , with its C wave to come, should bring about some real Pessimism about gold over the balance of 2025.

Once that low is in the Wave 3 Optimism leg should be starting, which will bring all that cash on the sidelines in.

Which brings the question about why gold should rise in wave 3 if bonds are rallying?

If gold is the metal of prosperity and not of crisis, you might get a clearer picture.

Looking at the gold share indexes, it is clear they are all overextended.

The breakouts have taken place, but back tests are still required.

And these gold stocks have simply failed to break out versus gold.

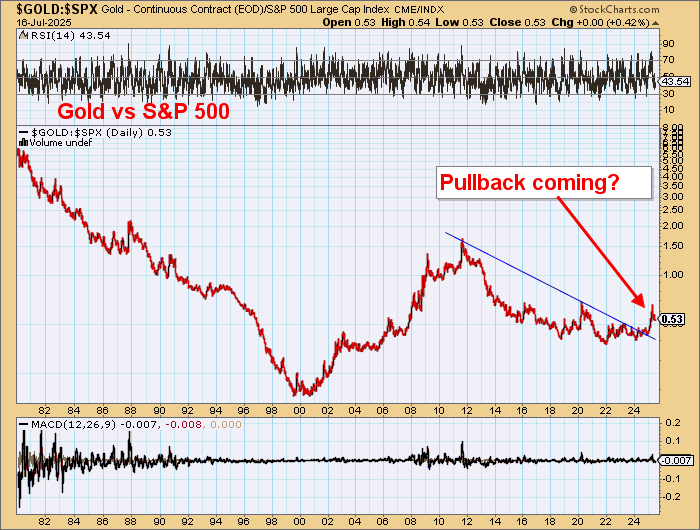

Now, look at gold vs other asset classes.

Gold is simply overbought and now at extremes.

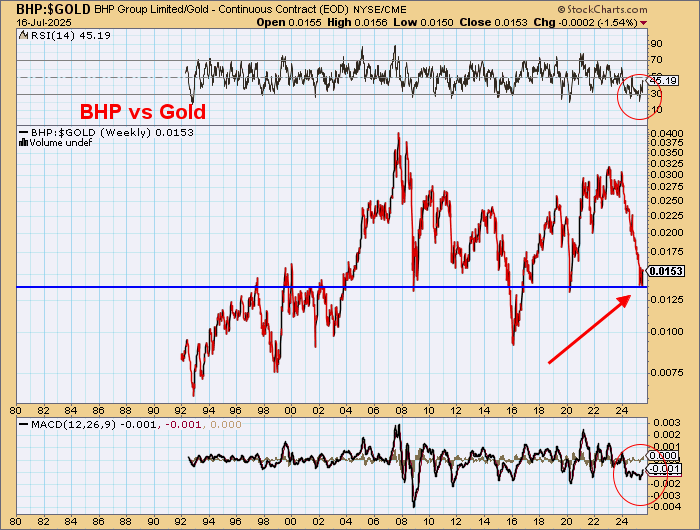

And here with BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK):

And here with Brent crude oil versus gold:

And here with copper versus gold:

And here with lithium versus gold:

And here with CRB Index versus gold:

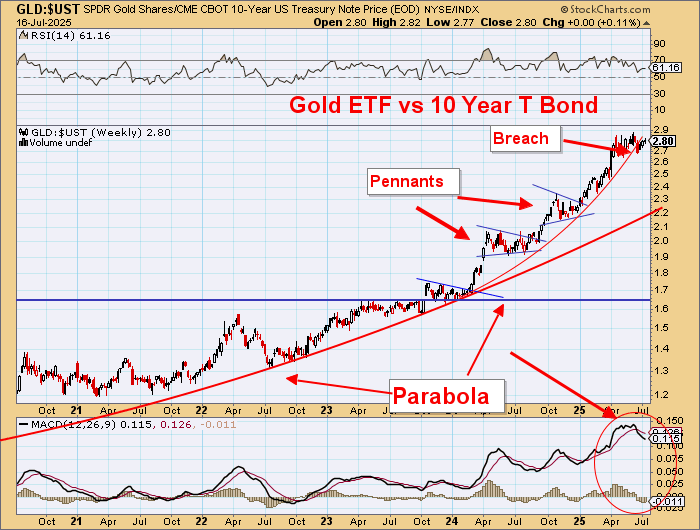

And here with gold ETF versus the 10-year treasury bond:

And here with gold versus the 30-year bond:

And the U.S. dollar is oversold.

But this is the best thing for us.

The misery of the past 17 years is coming to an end.

Small-cap resources companies are looking so good.

Head the markets!

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.