Copper is soaring and many experts believe the price will continue to rise sharply through the end of this decade. Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

S&P Global Market Intelligence estimates that new discoveries averaged nearly 50 Mt annually between 1990 and 2010. Since then, new discoveries have fallen by 80% to only 8 Mt per year. Mining.com says “any copper junior with a deposit of significant size and grades, will have no problem attracting a major or mid-tier acquirer.”

Red Metal Resources Ltd. (RMES:OTCBB; RMES:CSE) appears to be very well positioned.

New president elect opposed to open pit mining

Chile is the world’s largest copper producer and is home to many of the largest open pit mining operations. On Dec. 19, 2021, Gabriel Boric was elected Chile's new president, which is particularly concerning to copper and other mining interests because he is opposed to environmentally sensitive open pit mines which are quite common in Chile. He also has spoken loudly about the possibility of nationalizing lithium mining.

Investors saw this coming and have been selling the big lithium and copper stocks like ALB and SQM in anticipation of his election. This is not the best news for open pit mining stocks as investors clearly dislike uncertainty.

A couple of key points to keep in mind are: Boric does not yet have control of Chile’s Congress to negatively impact open pit mining operations (that may take a year or two), and Chile’s economy has grown dependent on copper mining. Nonetheless, investor concerns are real as evidenced by the recent sharp decline in Chilean copper stocks.

New president might actually be good for underground mining

If the worst case happens and Boric sends open pit mining stocks lower, there are also a number of underground mining companies that should do exceptionally well, as Chile continues to rely on the revenue from copper mining and as underground mines are likely to continue to operate without hurdles. Copper prices will continue their steady upward march, driven by several factors but primarily by the increased demand from electric vehicles.

Red Metal Resources is a compelling investment consideration for several reasons:

- Claims are for underground mining and not for open pit mining

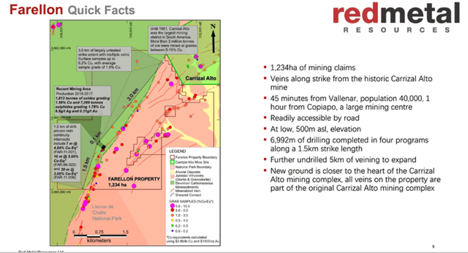

- Claims are large and are at low altitude, which is much less costly to operate

- Claims are close to roads and infrastructure

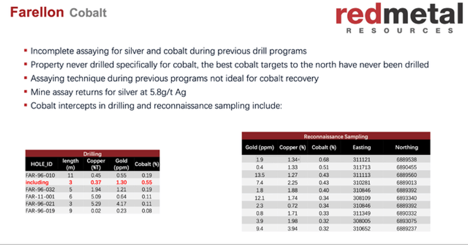

- Claims are in a historic and prolific copper, gold, and cobalt region

- Prior drilling results show strong indications of copper and gold

- Drilling is planned to commence in early 2022

High altitude mines are very costly

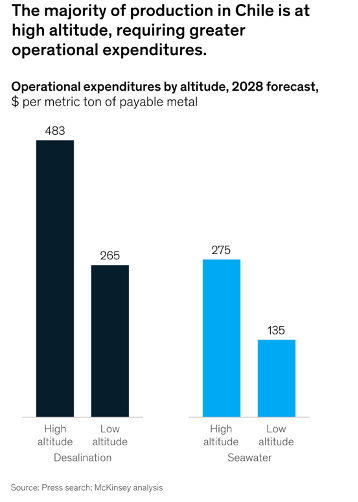

The majority of Chile’s largest copper mines are at high altitude where oxygen, roads and utilities are rare and the costs are high. The following chart shows that operational costs of high-altitude mines in Chile are almost double what low altitude mines require.

Red Metal claims

Carrizal Property

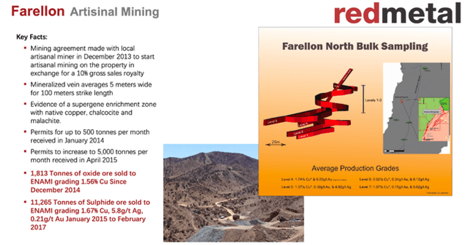

Red Metal's primary property is the Carrizal copper-gold-cobalt property in the Coastal Cordillera of Chile's III Region. The Carrizal Property consists of two projects, Farellon and Perth, and totals 3,278 hectares.

The Farellon Project lies along strike from the historic Carrizal Alto mine and was mined as part of the Carrizal Alto mining complex in the late 1800s. Records indicate that copper mining commenced at Carrizal Alto in the 1820s and continued on a significant scale, mostly by British companies, until 1891 when disastrous flooding occurred and the mines closed. It is estimated that during this period, in excess of 3 million tonnes with grades in excess of 5% copper and widths of 8 m was extracted, as well a large quantity of direct shipping ore at 12% copper. At one time, there was a considerable body of tails present to support these figures but the high gold and copper prices in recent years lead to the trucking and reprocessing of this material.

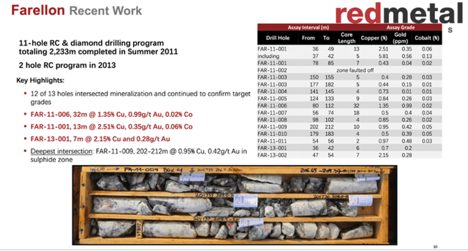

Drilling programs on the Farellon Project between 1996 and 2013 have totaled 6,992 m and covered a 1.5 km strike length of mineralized veins that were historically part of the Carrizal Alto Mining District. A further 3 km strike length of vein has been identified and sampled on surface and remains to be tested at depth in future drill programs. Significant results of historic RC drilling are summarized in Table 1.

Table 1 - Significant drill results 1996-2011 (1)

|

Drill Hole Number |

Assay Grade |

|||||

|

From (m) |

To (m) |

Length (m) |

Gold (ppm) |

Copper |

Cobalt |

|

|

FAR-11-001 |

36 |

49 |

13 |

0.35 |

2.51 |

0.06 |

|

FAR-11-006 |

80 |

112 |

32 |

0.99 |

1.35 |

0.02 |

|

FAR-11-0092 |

205 |

211.55 |

6.55 |

0.49 |

1.21 |

0.02 |

|

FAR-11-0102 |

179.13 |

183 |

3.87 |

0.39 |

0.50 |

0.05 |

|

FAR-09-A |

32 |

37 |

5 |

0.59 |

1.30 |

0.02 |

|

And |

97 |

106 |

9 |

0.44 |

1.63 |

0.04 |

|

FAR-09-B |

60 |

63 |

7 |

0.46 |

1.42 |

0.04 |

|

FAR-09-B |

75 |

87 |

12 |

0.71 |

1.28 |

0.03 |

|

FAR-09-C |

77 |

82 |

5 |

4.16 |

2.57 |

0.05 |

|

FAR-09-D |

95 |

103 |

8 |

0.33 |

2.02 |

0.02 |

|

FAR-09-E |

25 |

30 |

5 |

0.54 |

1.35 |

0.02 |

|

And |

65 |

68 |

3 |

0.58 |

1.46 |

0.06 |

|

FAR-96-07 |

25 |

34 |

9 |

0.38 |

1.05 |

0.02 |

|

FAR-96-09 |

57 |

84 |

27 |

0.51 |

0.91 |

0.03 |

|

FAR-96-010 |

31 |

36 |

5 |

1.00 |

0.68 |

0.04 |

|

FAR-96-013 |

86 |

93 |

7 |

0.87 |

1.68 |

0.04 |

|

FAR-96-014 |

77 |

83 |

6 |

0.66 |

0.85 |

0.06 |

|

FAR-96-015 |

59 |

79 |

20 |

0.99 |

0.98 |

0.06 |

|

And |

99 |

109 |

10 |

0.18 |

1.02 |

0.03 |

|

FAR-96-016 |

24 |

26 |

2 |

0.95 |

1.57 |

0.02 |

|

And |

64 |

70 |

6 |

0.73 |

0.81 |

0.07 |

|

FAR-96-020 |

14 |

16 |

2 |

0.46 |

1.85 |

0.05 |

|

And |

39 |

43 |

4 |

0.75 |

0.90 |

0.03 |

|

FAR-96-021 |

22 |

25 |

3 |

4.17 |

5.29 |

0.11 |

|

FAR-96-022 |

29 |

39 |

10 |

1.53 |

1.31 |

0.04 |

|

FAR-96-022 |

100 |

108 |

8 |

3.72 |

2.49 |

0.06 |

|

FAR-96-023 |

50 |

53 |

3 |

0.48 |

1.10 |

0.06 |

|

And |

132 |

147 |

15 |

0.6 |

1.42 |

0.03 |

|

FAR-96-024 |

33 |

36 |

3 |

0.94 |

2.89 |

0.06 |

|

FAR-96-025 |

65 |

85 |

20 |

0.97 |

1.22 |

0.02 |

|

FAR-96-029 |

30 |

34 |

4 |

0.18 |

1.15 |

0.07 |

(1) Widths are drill-indicated core length, as insufficient drilling has been undertaken to determine true widths at this time. Average grades are calculated with uncapped assays as insufficient drilling has been completed to determine capping levels for higher grade intercepts. FAR-11 and FAR-09 holes were drilled by Red Metal Resources. FAR-96 holes were drilled by a previous operator, the results of which have not been verified by the QP.

(2) Drillholes FAR-11-009 and 010 had diamond drill for the lower half of the hole and significant intercepts are in core, not RC chips.

Conclusion

Red Metal Resources owns substantial claims of properties with copper, gold, and cobalt that are indicated by extensive drilling results and 43-101 filings. Copper and cobalt prices are both rising and projected to continue to experience continued and prolonged strong demand until at least 2030.

An aggressive drilling program planned for 2022 is expected to outline the expanded potential of the full property and add significant value to today’s market capitalization of Red Metal Resources. If future assays are successful, the share price of RMES has the potential to increase substantially.

The fact that Red Metal's target is an underground deposit and not open pit mining bodes extremely well for future operations, and the added benefit of low altitude enhances valuations even further.

Red Metal Resources appears to be very well positioned. As soon as adequate drilling results are known and reported, its favorable location close to all needed infrastructure combined with low altitude make its claims a standout to the large miners seeking to acquire reserves for their pipeline. Drilling is planned for early 2022.

All graphics provided by author.

About BioResearchAlert: I served as an analyst and big block trader for Charlie Munger and Warren Buffett from 1967 until the early 1970s, when he ventured out as an entrepreneur focused on real estate, clothing manufacturing, retail, biotech and now investor-related services. I have been active in the markets every day since then. I believe that publicly traded equities offer some of the greatest potential for wealth creation if the investor exercises diligence in identifying risk as well as reward, and if the investor employs the valuable trait of patience.

Cautionary Note Concerning Forward-Looking Information and Disclosure: This article contains forward-looking information. All statements, other than statements of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding the completion of the proposed Unit Offering and SR Offering, mineral resource estimates, drill targets, exploration results, future drilling and other future exploration, potential gold discoveries and future development) are forward-looking information. This forward-looking information reflects the current expectations or beliefs of the Company based on information currently available to the Company. Forward-looking information is subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking information, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things, the possibility that planned drilling programs will be delayed, uncertainties relating to the availability and costs of financing needed in the future, activities of the Company may be adversely impacted by the continued spread of the recent widespread outbreak of respiratory illness caused by a novel strain of the coronavirus (“COVID-19”), including the ability of the Company to secure additional financing, risks related to the exploration stage of the Company’s properties, the possibility that future exploration (including drilling) or development results will not be consistent with the Company’s expectations, failure to establish estimated mineral resources, changes in world gold, copper markets or equity markets, political developments in Chile, fluctuations in currency exchange rates, inflation, changes to regulations affecting the dCompany’s activities, delays in obtaining or failure to obtain required project approvals, the uncertainties involved in interpreting drilling results and other geological data and the other risks disclosed under the heading “Risk Factors” and elsewhere in the Company’s annual report on Form 10-K filed on SEDAR at www.sedar.com and EDGAR at www.sec.gov. Forward-looking information speaks only as of the date on which it is provided and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein. BioResearchAlert was compensated $5,000 for this article. For further information, please visit our website atwww.redmetalresources.com, or contact [email protected].

| Want to be the first to know about interesting Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Streetwise Reports Disclosures:

1) BioResearchAlert's disclosures are above.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Red Metal Resources Ltd. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Red Metal Resources Ltd., a company mentioned in this article.