Royalty and streaming companies provide capital to mining companies in exchange for the right to receive revenues correlated to the mine's metal output (royalties) or to buy a portion of the mine's metal output at an agreed upon price (streaming). Mining companies agree to these terms because they need capital for various reasons. Sometimes a mining company will sell a stream or royalty as a part of a financing package. Other times mining companies need capital and sell royalties/streams on operating mines.

Several companies operate almost exclusively through this business model, and it has been incredibly lucrative over the long term. The three big players—Franco-Nevada Corp. (FNV:TSX; FNV:NYSE), Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX) and Silver Wheaton Corp. (SLW:TSX; SLW:NYSE)—have all generated above-average returns in the long run, having outperformed mining stocks, broader stock market indexes and the underlying precious metals. There are a couple of reasons for this. First, royalty and streaming companies make money in virtually any metal price environment, including during downturns. Meanwhile, all but the most efficient mining companies take large write-downs, are forced to sell non-core assets, and issue shares at inopportune times in order to stay afloat. Royalty companies were very aggressive in making acquisitions last year, including providing much-needed capital to companies such as Barrick Gold Corp. (ABX:TSX; ABX:NYSE) and Yamana Gold Inc. (YRI:TSX; AUY:NYSE; YAU:LSE). This speaks to their strength, and the deals made during the bottoming phase of the cycle will serve to generate strong cash flows on the inevitable upturn, which seems to have commenced late last year.

"Silver Wheaton Corp.'s cash flow will be bolstered through mine expansions at two of its biggest streaming assets—Salobo and Peñasquito—over the next few years."

Second, royalty and streaming companies make a one-time payment in order to acquire their royalties and streams. Mining companies have to continually put capital into their projects in order to replace/increase reserves and to maintain equipment. As a result, any additional discoveries that are made benefit royalty and streaming companies at no cost. A good example of this is the stream that Silver Wheaton owns on Primero Mining Corp.'s (P:TSX; PPP:NYSE) San Dimas mine, which it purchased more than 10 years ago, back when Goldcorp Inc. (G:TSX; GG:NYSE) owned the project. Silver Wheaton now generates ~50% of its initial investment on an annual basis, and the investment has already more than paid for itself. Primero was stuck with the exploration and mill expansion bills while Silver Wheaton reaped substantial benefits as a result.

This is a phenomenal state of affairs, but there is a catch: the market has caught on and investors realize the potential of the royalty/streaming model. Mining companies have caught on as well. As a result, royalty and streaming companies now trade at fairly high multiples to cash flow, and mining companies are pricing the aforementioned advantages into their models, so that streams and royalties have become much more expensive.

Is there a way for investors to benefit from this powerful business model without overpaying for investments?

The good news is that there is. Here are three ideas.

First, while the "big three" royalty/streaming companies aren't cheap, they are not valued equally by the market. Silver Wheaton is inexpensive relative to its peers on a price-to-operating-cash-flow basis. Shares trade at ~20x forward cash flow, which sounds high. But the company's cash flow will be bolstered through mine expansions at two of its biggest streaming assets—Salobo and Peñasquito—over the next few years. The company also has exposure to some of the most efficient mines in the world, which will likely not shut down in the event of a commodity price slump. Such exposure makes up the bulk of Silver Wheaton's portfolio.

Second, in an upward-moving gold market it makes sense to assume more risk, and one way do this in royalty/streaming is to invest in Sandstorm Gold Ltd. (SSL:TSX; SAND:NYSE.MKT). Sandstorm did not have exposure to the high-quality assets and low-cost producers that Silver Wheaton did during the downturn. In fact its cornerstone stream—on Luna Gold Corp.'s (LGC:TSX; LGC:BVL) Aurizona mine—stopped generating cash flow as that mine had to shut down. Shares were hit hard as a result. However, Sandstorm was also very aggressive in the downturn, and going into a market upswing the company is positioned to grow its cash flow meaningfully. Given that it has exposure to lower quality assets than the big three, and given its rocky history, Sandstorm shares trade at a discount to its peers: closer to 15x operating cash flow. This is set to grow as various development projects go into production, and also as Aurizona goes back into production, a real possibility over the next few years.

"Terraco Gold Corp.'s goal to become a pure-play junior royalty company makes it stand out among its peers."

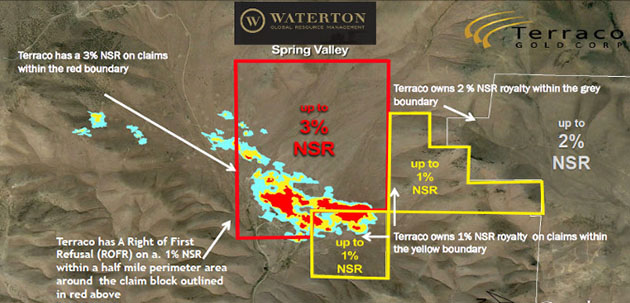

Finally, the best opportunities lie in junior royalty/streaming companies with exposure to high-quality assets. In a recent article we singled out Terraco Gold Corp. (TEN:TSX.V; TCEGF:OTCPK) as one such opportunity. Terraco Gold stands out given its very low market capitalization and its royalty on the multimillion-ounce Spring Valley project in Nevada. The project is held by a well-capitalized firm called Waterton Global Resource Management, which just spent millions of dollars to acquire it from a bankrupt Midway Gold and a desperate Barrick Gold. Spring Valley is currently not producing, and as a result we believe the market is overlooking Terraco's upside potential. However, we calculate that Terraco trades at less than 6x future operating cash flows. While this figure is contingent upon Spring Valley meeting certain production figures, the sharp valuation gap between Terraco and its more advanced royalty/streaming peers makes it attractive.

We note that there are stark differences between junior royalty companies, the primary one being that many are junior companies that happen to own royalties. Companies such as Almadex Minerals Inc. (AMX:TSX.V) or AuRico Metals Inc. (AMI:TSX) may own quality royalties on Ixtaca and Young Davidson, respectively, but these companies emphasize exploration and project development, the cost of which diminishes the compounding power of the royalty model (i.e., royalty income being used to further invest in royalties, whose cash flow in turn can further be invested, and so forth). It also exposes investors to some of the risks we are trying to avoid by investing in royalty/streaming companies. Terraco's goal to become a pure-play junior royalty company makes it stand out among its peers, and this in turn makes it an attractive acquisition target for any of the larger royalty/streaming companies mentioned above.

The royalty/streaming model's success has made it more difficult for investors to get quality exposure to the sector without overpaying for investments, although we've seen that it is not only possible but also potentially lucrative. The largest, most well-known names will benefit from a bull market in gold and silver, but some of the smaller companies that don't have multiple low-risk cash-flow sources (if they have any at all) can potentially outperform. Investors who are able to locate royalty companies that fly under most investors' radars will be best positioned to profit from the sector.

Ben Kramer-Miller is the chief analyst at miningWEALTH. He is well respected for his unique ability to find under-the-radar precious metals opportunities, as well as for his extensive research into rare earth elements and other critical materials. His research has been featured by Nasdaq, Kitco, Mining.com, The Financial Post, The Globe and Mail, Investing News Network and RealClearDefense, among others.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Ben Kramer-Miller: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Silver Wheaton Corp. and Sandstorm Gold Ltd. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Silver Wheaton Corp. and Terraco Gold Corp. The companies mentioned in this article were not involved in any aspect of the article preparation. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.