The most satisfying part of my job is giving credit where credit is due. In an industry where constant failure is the norm and most "management teams" manage to do nothing more then destroy the capital of long-suffering investors, it is a genuine pleasure to highlight a company and a team that actually succeeded in spite of all the hurdles placed in their way.

To begin with I have to give credit to Thom Calandra for inventing Colombia. During the Spanish Empire, long before a series of stupid and useless wars fought only because they thought they could afford it (and if that sounds familiar, it should), most of the gold they discovered and took back to Spain came from Colombia. Of course, Colombia also included what is now Panama.

In 1946 years of misrule by various political parties literally started a civil war. (And if that sounds familiar, it should.) As a result what should have been one of the top gold mining countries in the world sank into a morass of crime and corruption at all levels. (And if that sounds familiar, it should.) Finally, after 60-some years of stupidity, the government woke up and realized they had a potentially valuable resource that could provide both taxes to the government and employment to their citizens.

But it was a Catch-22. No matter how good the new mining regulations may have seemed, Colombia had crapped in their own lunch bucket so many times that no one in the mining industry took them seriously.

That was until Thom Calandra came along and started pumping them like crazy. I remember back in the years 1999 and 2000, when there were a slew of Colombian gold mining companies with resources of millions of ounces of high-grade gold selling for less than the cash they had in the bank.

I owned one that I had bought in the belief that perhaps someday in the future, the government wouldn't be as stupid as governments usually are and investors might see some value in owning resources. It was late 1999, in the late stages of the dot.com bubble. The company announced that instead of mining, they were going into the computer-furniture-making business and would be selling their wares on the Internet. That was enough to make the stock go up 300% in a couple of days. So I sold.

I ignored Colombia for the next decade, as did anyone with any "cents." That was until 2011. A mining company with a giant potential gold project (is there any other kind?) contacted me and asked me to come to Colombia to visit their project. I rolled on the floor laughing for a few minutes before sputtering into the phone that I just couldn't spare the time, after all, someone had contacted me with this giant opportunity in an oil deal in Nigeria. I just didn't have the time or inclination.

Now, Thom had been touting Colombia for years as a land of milk and honey with a little gold thrown into the pot. I ignored him. Then he called me and pitched me personally on both the country and the deal. So I jumped on a plane and went down to the country. After a few days, I was sold. Colombia did have a lot of gold and the government was in one of those intermediary periods where they were relatively sane.

Dozens of juniors heeded Calandra's siren song and made their way into Colombia. For a few years the country was the go-to place to pick up a gold project. But as we are all well aware, government sanity is the exception, not the rule. The Colombian government should have minted a medal for Thom; he literally put them back on the map.

On one of my trips I was standing on the balcony of the offices of Bob Allen when I got a call on my cell phone. Bob Allen was an early adopter in mining in Colombia and held the second biggest land position in the entire country. If you wanted a mining project in Colombia, you needed to talk to Bob. I took the call; it was from the CEO of a brand-new company named Red Eagle Mining Corp. (R:TSX; RDEMF:OTCQX; R:BVL) that had just gone public. Ian Slater, the president and CEO of Red Eagle, wanted to know how soon I could be in Colombia to visit their Santa Rosa gold project.

I felt really cool telling him that actually I was in Colombia and if his people were ready for a visit, I could do it the next day. They were, I did and Santa Rosa was a great project.

I've made the comment before that probably 60-75% of junior mining companies are little more than scams designed to take money from the pockets of investors and put it into the pockets of the promoters behind the junior. In Colombia there was a three- to four-year lull in government stupidity and it appeared that you could actually advance a mining project. So even the scammers looked as if they were moving forward for a bright shining moment.

Alas, government sanity lasts only about as long as sunlight in London, and Colombia returned to a life of stupidity and idiotic regulations that no one could comply with. At the same time, the stupidity and cupidity of the conmen behind a slew of juniors blew their companies sky high and most of the investor money went to money heaven.

With one giant exception. Bob Bell and Ian Slater kept moving Red Eagle forward to projection. They formed the company and cashed up just at the very peak of the gold market and kept advancing Santa Rosa. While Red Eagle was not the biggest gold discovery in the last 20 years, or even the most significant, Red Eagle always delivered on their promises and is now in production.

I've visited hundreds of projects and written about hundreds of mining companies. The Red Eagle team—and I use that term as tightly as I can possibly do—the Red Eagle team did a better job for their shareholders given the price of gold, lack of interest in mining and general government stupidity in Colombia than any other company I am aware of.

Santa Rosa has been mined for 400 years and there is so much gold there that I believe it will be mined for another 400 years. Red Eagle should concentrate on profit, not mass production. They don't need to be the biggest mining company in the universe; they can be the most profitable for their shareholders.

Really successful people have learned a pattern of how to succeed at what they do. The lesson once learned is fairly easy to repeat. Ian Slater and Bob Bell and the rest of the crew have a franchise in Colombia. They have learned how to work with the government and how to move a mining project to production in the least time at the least cost.

So they are doing it again. Same team, slightly different name.

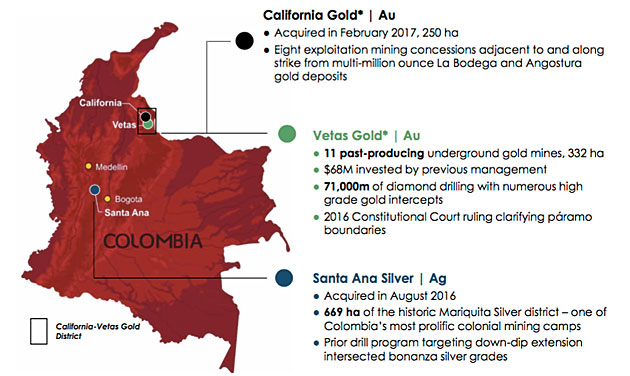

The new company is named Red Eagle Exploration Ltd. (XR:TSX.V) and they hit the ground running. Red Eagle funded the company and currently owns 90% of the shares. They made a hostile takeover of CB Gold in 2015 when previous management had stumbled after investing $68 million to conduct 71,000 meters of drilling at the Vetas Gold property, with 11 prior producing mines on the project.

Drill results showed over 177 intercepts averaging 30 g/t over 1 meter. The initial 43-101 had an inferred resource of 239,000 ounces of gold and 920,000 ounces of silver. Red Eagle Exploration plans a 20,000-meter diamond drill program for 2017, along with drifting and taking a bulk sample.

In August of 2016 the company bought the Santa Ana silver property in the Mariquita silver district, consisting of 669 ha. Historical results showed mining of 17 kilos of silver per ton over widths of 1.4 meters. The company plans a 4,000-meter diamond drill program for 2017.

Red Eagle Exploration added an even more interesting series of concessions in February 2017 when they added eight mining properties adjacent to and along strike with the La Bodega/Angostura gold deposits owned by the Mubadala Development Company owned by the Abu Dhabi Sovereign Wealth Fund. They call these six deposits the California Gold property. It consists of six different small concessions totaling 250 square ha.

Mubadala Development bought the 3.27-million-ounce La Bodega/Angostura gold deposit out of bankruptcy. They are moving the project forward and their PFS calls for 450 thousand ounces of production per year. The final Feasibility and permitting are expected in 2018. They will either put the project into production or sell it to a major. Their mine plan includes those same six concessions now owned by Red Eagle Exploration. So Red Eagle can continue to march to production on the California gold deposits or sell out at a healthy profit to a major.

XR plans 10,000 meters of diamond drilling for 2017 at the California package, along with drifting and a bulk sample. Coming up with a resource will increase the value of the properties when a major comes calling.

Red Eagle is in the process of doing a financing via a Short Form Prospectus. They intend to raise between $10 million and $20 million at a price of $0.15 for a free trading share and a full 18-month warrant at $0.25. The company wants to close the financing on May 12, and it is open to ordinary investors. Any investors interested should contact Haywood Securities, National Bank Financial or PI Financial for more information.

After the financing is complete, Red Eagle will still own about 65% of the stock. The $0.25 eighteen-month warrants will provide an additional $28 million in capital when they are all exercised. I expect XR to continue advancing in Colombia.

The race is not always to the swiftest nor the battle to the brave but that is the way to bet. The same brilliant team that took Red Eagle from a $45-million-dollar gold exploration company in 2011 to a $175-million-dollar gold production company today operates Red Eagle Exploration.

Red Eagle Exploration intends to be an advertiser. I have participated in their financing so naturally I am biased. Please take responsibility for your own due diligence.

Red Eagle ExplorationXR-V $0.145 (May 03, 2017)

CBHDF-OTCBB 367 million shares outstanding

Red Eagle Exploration website

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Read what other experts are saying about:

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Red Eagle Exploration. Red Eagle Exploration intends to become an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) Red Eagle Mining Corp. is a billboard sponsor of Streetwise Reports. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.