On Dec. 3, 2015, the gold market completed a 51-month bear market by touching down at $1,045.60; the market for gold miners, as represented by the NYSE Arca Gold BUGS Index (HUI) Index, completed a 51-month bear market bottoming on Jan. 19, 2016 at 99.09. The home of a vast majority of junior exploration companies, the TSX Venture Exchange (TSX.V), recently completed a 58-month bear market finding its trough on Jan. 20, 2016 at 466.43.

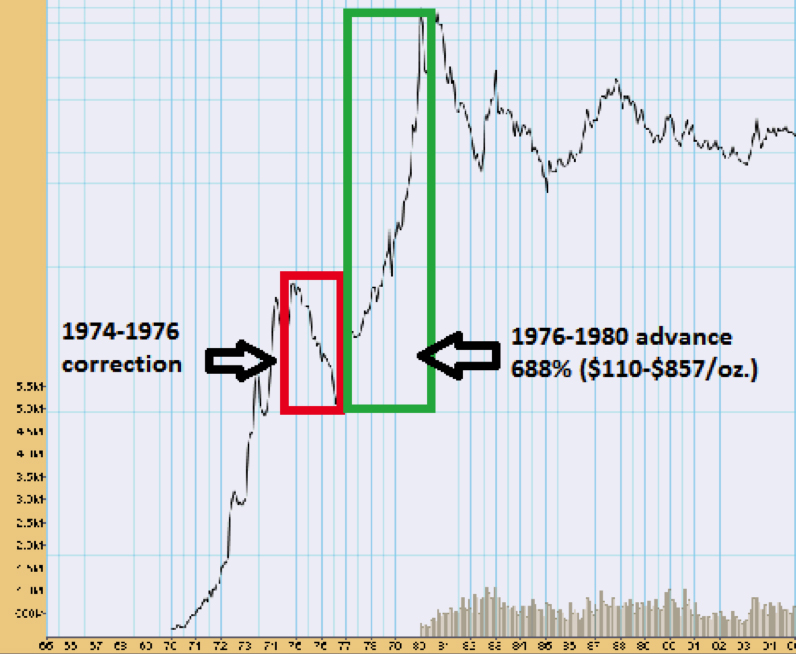

These three bear markets will go down in history among the most vicious bear markets ever. Some were longer (1988-1993) and some were sharper (2007-2008) but only one bear market compares in terms of misery and that was the 1975-1976 bear market that saw gold drop from $190/ounce ($190/oz) to around $110/oz after gold advanced from $35/oz to $190/oz in reaction to Nixon taking the U.S. off the Gold Standard by abandoning the Bretton Wood Agreement in 1971. That bear, a precursor to the most dramatic, wealth-preserving ascent in gold's history, was particularly acute because of the speculative mania that gripped the junior mining and exploration market from 1971-1975 during the initial blast to $190.

When the correction began, investors were embarrassingly long a vast amount of gold-related securities and even more so the penny miners that didn't need gold (or anything else, for that matter) to be swept up in the fever. Naturally, when the price of gold began to correct from $190, it mirrored the September 2011 peak in gold above $1,900/oz and the HUI around 643 such that by the time gold bottomed in 1976, there were body bags at the side of every road leading to Bay Street. Firms went under, salesmen droves taxicabs to supplement income, and the losses in customer accounts were mortally large. However, it did turn up and by the time I entered the investment industry, in May 1977, the bulls were back in control, wounded and scarred, but back. I believe that we are today in that same early-stage period that we saw in 1977 with prices having bottomed but skeptics everywhere and very little public participation.

Therein lies the wonderment of opportunity for investors as they try to find a rational place to invest in a completely irrational financial world.

Long-term Outlook: The "Rhyming" of Events"

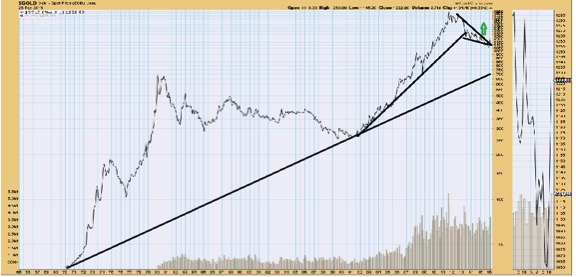

The long-term bull market for gold began in mid-1999 at around $250/oz after a near 20-year bear market. This initial advance had a 10-year consecutive year-on-year advance streak broken in 2011. The great debate in the world of gold analysts and technicians is whether the 1999-2011 advance constituted a "bubble" or was it simply the result of 20 years of credit creation and currency debasement disguised behind the façade of serial bubbles in real estate and stocks. For this gold prognosticator, the notion of a gold stock or gold bullion "bubble" is beyond ridiculous; all one need do is compare money flows into bonds and stocks versus gold and gold-related investments and the result is that many hundreds of times greater in "flow" is the dollar amount allocated to bonds ("debt") and stocks than to the precious metals. Ergo, I view the long-term outlook for gold as unequivocally "bullish" with and even greater emphasis on the gold miners and explorers.

Just as the 1975-1976 bear market ended after a 50% correction, the 2011-2015 bear ended after a 45.5% correction and if events in history truly do rhyme, the advance from the 1976 low of $110/oz to the 1980 peak at $857/oz (intra-day) was 688%. If my theory of this new bull market in gold rhyming with the 1976-1980 bull, then a 688% advance off the December 3rd bear market nadir at $1045/oz sets my target at $7,189/oz. If you impute the leverage contained in the HUI and in the TSX Venture Exchange to this kind of advance in the underlying commodity, the HUI at 162 could easily see three times the percentage advance in gold projecting out to 3,302. The TSX Venture Exchange, being the Wild, Wild West of penny mining exchanges, could see five times the leverage and projects to 16,305 off the 474 January 2016 lows, a level which is around the current level of the Dow Jones Industrials.

The Intermediate Term: One Day at a Time

The intermediate-term outlook for me is about five to seven years, and since we just exited a period of Novocaine-less root canal surgery lasting almost five years, it's important to remember that it takes many, many small rallies in any market (that is coming out of a major bear) before investor confidence really settles in. For that reason, I think that the advance to the major downtrend line at $1,450/oz is going to be arduous and labored and that for most of the next year gold will be range-bound with $1,140/oz as support and $1,450/oz as stout resistance. However, I look for the miners as represented by the HUI and the explorer/developer names to massively outperform physical gold as valuation compression abates, as new companies are formed, and as new discoveries are made and rewarded by a new generation of investors and speculators burnt to a crisp by the Biotech meltdown or the bursting of the Amazon/Netflix/Valeant bubbles. I further think that the gold market will actually absorb many losing positions in short order because of the relatively minuscule market capitalization of the entire sector when compared to the trillions upon trillions currently held in high-yield "junk" bonds and NASDAQ companies. By doing so, this golden horse will throw many riders to the dirt and leave them behind and that is precisely how bull markets should evolve.

The senior gold miners as represented by the HUI is shown on a monthly basis below and it is pretty clear that the ugliness of 2011-2015 has now ended and ended in a blaze of bull market glory. Every single cylinder is fully engaged from volume to sentiment to momentum with little signs of the hedge-fund naked-shorting shenanigans that characterized the past four years. They have tried to knock my beloved miners back more than five times since the Jan. 19 sovereign wealth fund regurgitation and every single time the market inhales any selling pressure and moves them all higher. On an intermediate-term basis, the miners look like they can be accumulated on weakness over the seasonally weak summer months while they work off overbought conditions (weekly chart) and settle in.

Short-Term Outlook: "Lookout Below!"

Before I proceed, it must be stated and stated clearly that I have two main accounts that I use for the precious metals with one dedicated to long- and intermediate-term positions and the other to short-term trading. I own large positions in a number of junior TSX.V explorer/developers and some of these have been held since 2010—which means that I have exposure to gold (and silver) literally 100% of the time. I never trade my physical, I seldom trade the high-quality miners, and I often hedge both by using ETFs or options. So, when I tell the world that I am looking for a "better entry point" for my trading positions, I don't want to read a post in some chatroom that "Ballanger's bearish!" because as you have read earlier in this missive, I am NOT a "bear" but make no mistake—I look for a bone-jarring correction in March-April that will singe the eyebrows. Here is why:

- Commercials (the bullion banks that "act" for the producers in their "hedging" operations) are now within 3,000 contracts of that 166,000 contract short position they sported at the exact top in mid-October. After momentum died a few weeks later, they gave the market a nudge to the downside and it unleased a torrent of selling to the tune of $150/oz. Here is a chart I posted back in December...

These commercials are probably short more than the 166,000 from last October because of the rise in open interest late this past week and if past is indeed prologue, the they are going to carry out another selling jamboree very shortly that will force all of the momentum-chasing and technical funds to puke positions overboard exactly as happened with the culmination of the decline shown above with Commercials lifting a 16,000,000-ounce synthetic short position into Large Speculator (hedge-fund) losses. - HUI is massively overbought and soon to be rolling over. A couple of weeks back, the RSI for the HUI got to over 80 as it moved up through 160. RSI is now under 65 and has been in decline for a week. The MACD lines are dangerously close to a negative crossover, which has been a precursor to declines in the past, some of them quite extreme.

Here is the same chart but with a couple of ideal "set-ups" for re-entry. I don't want to be chasing the miners after a 70% move in the HUI with MACD, RSI and Histograms all pointing to a rollover; I DO want to be accumulating miners under conditions illustrated below. - The "PDAC Curse": The Prospector and Developers Association Convention (PDAC) held every March in Toronto has become the perfect "sell" signal over the years and while it made sense to sell your junior miners going into the pre-convention hype and market-grooming in advance of a PDAC-inspired financing, it has actually morphed into a much broader market-timing event. The chart below shows how accurate it has been for the TSX.V but it also applies to the HUI as well; how much it is based upon the bear market versus the PDAC Curse has yet to be determined. However, in light of the overbought status of the precious metals complex, early March would be a logical point in time for a correction to unfold.

Silver is Underperforming: The icing on the proverbial cake for precious metals bulls is ultimately the point where gold's juvenile delinquent little brother finally gets to grab the limelight because if you think a charging gold price can light up the emotional juices, there is nothing quite like a hysteria-charged, testosterone-filled, gold-bug-on-steroids bull market in silver to send the crowds into a financial frenzy. That's why I monitor silver and more importantly, the gold-to-silver ratio (GTSR) as a confirmation tool for the health of the advance. If, after a big run-up, silver starts to lag gold, it shows up in the GTSR and that is usually a sign that the rally is fading. This week, the GTDR closed at 83.27, a new weekly high for the move and a midst the highest recorded Commercial shorts since 2008. We can postulate and speculate until the cows come home as to WHY silver is under so much pressure (and that it a topic for another day and one I'll soon be covering) but the fact remains that unless the GTSR is moving lower as a complement to any advance in gold, the health of the advance is in question.

Silver is Underperforming: The icing on the proverbial cake for precious metals bulls is ultimately the point where gold's juvenile delinquent little brother finally gets to grab the limelight because if you think a charging gold price can light up the emotional juices, there is nothing quite like a hysteria-charged, testosterone-filled, gold-bug-on-steroids bull market in silver to send the crowds into a financial frenzy. That's why I monitor silver and more importantly, the gold-to-silver ratio (GTSR) as a confirmation tool for the health of the advance. If, after a big run-up, silver starts to lag gold, it shows up in the GTSR and that is usually a sign that the rally is fading. This week, the GTDR closed at 83.27, a new weekly high for the move and a midst the highest recorded Commercial shorts since 2008. We can postulate and speculate until the cows come home as to WHY silver is under so much pressure (and that it a topic for another day and one I'll soon be covering) but the fact remains that unless the GTSR is moving lower as a complement to any advance in gold, the health of the advance is in question.

Overview and Conclusion

As you have read from my earlier remarks, I am delighted to report that the long-term and intermediate-term status of the gold market and its associated gold miners is unequivocally BULLISH with every indicator I have used since the late 1970s kicking into gear. That's the good news. The bad news is that in the short term, I see an ever-increasing probability for a seriously sharp correction and one that will ignite all of the recent memories of what just happened back in the 2011-2015 bear market. This happened in the U.S. equity market in 1983 after the Dow advanced 40% off the lows of August 1882. The 1983 correction reminded people of how AWFUL 1981-1982 was and they sold stocks down 30% in a New York minute. However, that first major correction off of the initial advance gave investors an unprecedented buying opportunity into the summer of 1983 and stocks then proceeded to advance over 270% until mid-1987 without blinking an eye. That is exactly what I see playing out in the next two to four months for gold and gold miners; I see a sharp correction starting in mid-March the severity of which will give me a clue to when and what and how much I buy.

To wit, the operative and critical thought to take away from this missive is this: I WILL be a buyer of gold, silver and the mining stocks into the next correction and the risk I take is that there IS a correction. If I am wrong, then this bull market will have policemen turning in their badges and the bullion banks following the rules, both Black Swan events of the highest order.

Stay very closely tuned...

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment.

From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All images/charts courtesy of Michael Ballanger