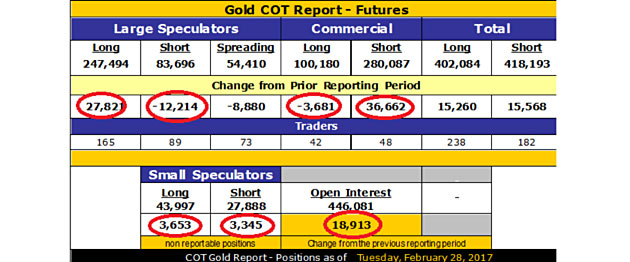

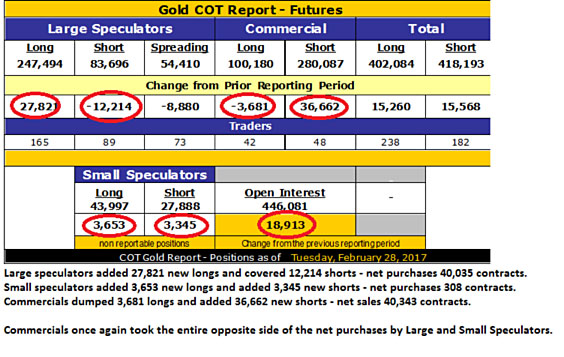

Given the big down move this week in the precious metals, it would certainly follow that the activities of the Commercials would be no surprise. They matched all of the demand brought to bear on the Crimex gold pit by selling over 40,000 contracts representing over 4,000,000 ounces of synthetic gold, and then nudged the gold market off the ledge. They did it with much-revered aplomb, but nowhere more daunting than in the nearly $1.00 collapse in silver that had the blogosphere buzzing last week.

After several decades of this maddening collusion, nothing surprises me anymore. To have an order executed with such virulence and total disregard to "Best Price Possible" is a clear signal from the ruling elite that removing fiat currency from the system in favor of real money will not be tolerated. To deplete your bank balance at your local Fed-member bank is considered to be blasphemy in the religious order of fiat worship, because every dollar you deposit of your own fiat allows the bankers to play around with ten to fifteen times that in discretionary deal flow and trading. The more fiat you remove in favor of real money, such as gold and or silver, the less room (leverage) the banks have to "play."

The Indian central bank has been battling this for decades because Indian citizens have grown accustomed to watching the purchasing power of their currency evaporate under the debasement regimes of central bankers. In other words, by removing cash from your bank, you are taking cash from the pockets of the bankers, and nothing removes cash quicker than gold and silver because when it leaves, it leaves for good, and that is an anathema to the banking brethren.

I have been warning all of you against rushing to replace your miners (HUI) and the various ETF positions due to the numerous dead-cat bounces since the breakdown in late February, which were the same type of bounces that lured me back in too early on previous occasions.

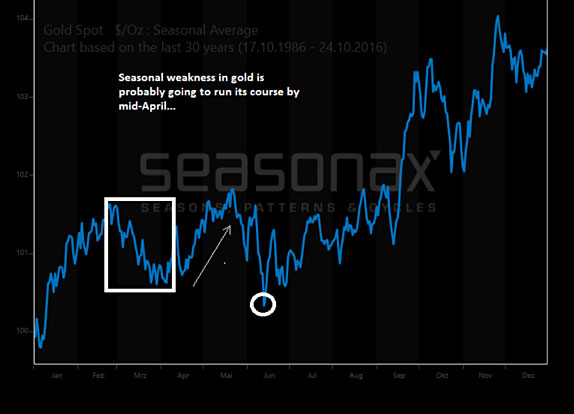

Whenever I ignore the optimum entry point for the RSI (relative strength index), I end up getting punished. So, here we are at 31.29 for the HUI's RSI, which is, incidentally, the very place where they have turned in earnest since the bottom in late 2015. Now, the vast majority of letter writers here at the PDAC in Toronto are unanimously insinuating that gold "might" have a corrective phase in here, corresponding to the seasonal tendency for downside in March-April.

However, if you observe the seasonality chart for gold, you can see how mid-April offers such a superb entry point. So the answer to the question "Do you sell here into the PDAC curse?" is "No," because the bulk of the decline could quite easily be behind us, especially with the RSI for the HUI now a tad above 30.

The same applies to my number-one trading vehicle for the mining stocks, the Junior Miner ETF (GDXJ), which was sporting an RSI above 75 back on Feb. 12 with the stock at $42.50. I warned you against the KoolAid guzzling that was rampant at the time, because every single top had occurred from an RSI above 70. Now, with the stock at $33.42, I see another $5 downside before the RSI breaks 30. However, that could be here by the end of the week, so stay sharp and on your toes.

Janet Yellen is exactly like her Russian name suggests—a riddle wrapped in a mystery inside an enigma—with apologies to Sir Winston Churchill. I listened to her Friday afternoon for a very brief moment or two, and I honestly didn't understand a word that she uttered. I thought for a flash that I was listening to Alan Greenspan in drag as she droned on about "inflationary and employment expectations," as if she actually had a clue as to their possible outcomes.

Meanwhile markets continue to tread water at or around the all-time record highs, and only today has the knitting begun to unravel as the swamp-draining exercise promised by President Trump is becoming somewhat problematic. The bickering between former President Obama and the Donald has now truly polarized the U.S. into pro-Donald and anti-Donald camps, and is beginning to create a visible dividing line between the administration and three very important bodies of power, including the judiciary, the FBI, and the CIA. The last time a sitting president decided to take on any one of those three was JFK, and he was one of the most popular presidents in U.S. history, not a new president with a 37% approval rating. (JFK's was mid-50s in August 1963.)

This morning I will be watching the RSIs for the HUI and GDXJ very closely, in an attempt to locate the bottom. These "technical breakdowns" have been fakeouts as long as I have been writing about the metals, and every so-called "gold guru" out there is calling for a move to test the $1,175-1,180 level due to the "technical breakdown."

In addition to the always-wrong tea-leaf readers, another bottom-spotting indicator and one that is more accurate than a wife's rolling pin is the "Fido Indicator," and it is screaming "Buy!!" right now because he just crawled out from under the toolshed with a rabbit hanging out of his yap, wagging his tail. Contrast this to mid-February, when I told everyone to avoid the GDXJ because of the elevated RSI, when Fido heard me scream at one of the CNBC commentators and went tearing out of the house in search of the toolshed sanctuary. Fido has a nose for the rapture of an oversold gold market, and a screamingly oversold GDXJ, and that is why I use him for market timing and rabbits.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All charts courtesy of Michael Ballanger.