A follow up to our last week's special update: COT data has been instrumental in guiding us and helping us navigate market conditions during a bull and bear market. The latest COT data is quite alarming, and has our full attention going forward.

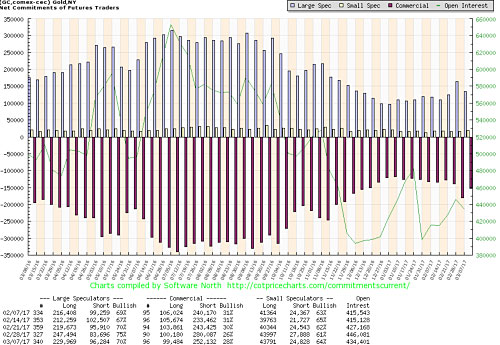

Long-time readers are familiar with the chart above, and it is self-explanatory. But for newcomers, here is a detailed breakdown:

• A bull market attracts speculators and the net long positions at both tops and bottoms are significantly higher of those in a bear market. Common sense.

• The price spike in 2016 attracted a record crowd with 280k net long positions at the 2016 summer top, giving us hope that a new bull market was in progress.

• However, the sharp sell-off into December reduced the net long positions to 96k, which was much lower than average bull market value at bottoms.

• Since December, prices have recovered about half, while net long positions only reached 164k, which is a bear market value.

COT data this week shows a sharp pull back, confirming a peak in speculation, with the peak at bear market value.

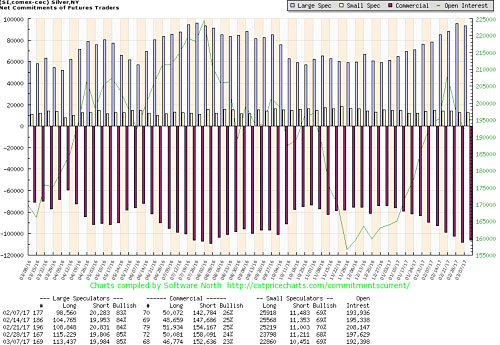

The speculation in silver is even more alarming. Net long positions reached 95k this week, barely lower than the recovery peak of last summer, and yet the price of silver is 10% below that peak.

Speculators in silver also retreated this week, confirming the previous week as a speculative peak.

Summary

We have been monitoring COT data for the past seventeen years, and by observing speculative activities, it has helped us to identify the speculative values of a bull and bear market. The latest data has alerted us to the potential return to a bear market. Caution is advised.

Jack Chan is the editor of simply profits at www.simplyprofits.org, established in 2006. Chan bought his first mining stock, Hoko Exploration, in 1979, and has been active in the markets for the past 37 years. Technical analysis has helped him filter out the noise and focus on the when, and leave the why to the fundamental analysts. His proprietary trading models have enabled him to identify the NASDAQ top in 2000, the new gold bull market in 2001, the stock market top in 2007, and the U.S. dollar bottom in 2011.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Jack Chan and not of Streetwise Reports or its officers. Jack Chan is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation or editing so the author could speak independently about the sector. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) Jack Chan: We do not offer predictions or forecasts for the markets. What you see here is our simple trading model, which provides us the signals and set-ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion. We also provide coverage to the major indexes and oil sector.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts courtesy of Jack Chan