In the last few days, Fed heads have made it very clear that they want to hike the Fed Funds Rate at the March FOMC meeting, which concludes on the 15th, despite recent downgrades to the Fed's own first quarter GDP estimates. We continue to believe that the Fed is not economic data dependent but rather market dependent. Thanks to Trumpomania, the stock market is strong enough that the Fed can feel confident a rate hike will be accepted without significant damage. If not now, when will the Fed ever raise rates again?

Anticipation of a March hike has boosted the dollar and depressed the gold price, which is typical of before-the-event behavior. After the hike, we can expect gold to rise sharply, as it usually does. Why? Because a measly 25 basis point hike will leave the Fed well behind the curve and the Fed Funds Rate well below the current rate of inflation.

There is a further factor that could help gold to the upside: the unwinding of an unusual co-relation between inflation and the dollar.

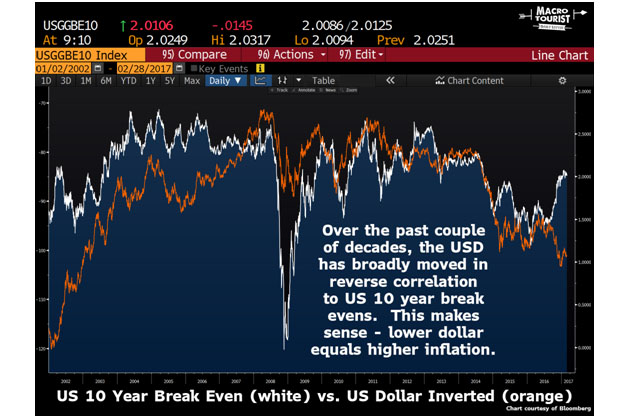

Historically, the dollar and inflation have traded inversely to each other. This makes sense. A lower dollar tends to boost inflation. Also, higher inflation tends to weaken the dollar as investors consider parking assets in other currencies.

Here is the evidence, as charted by Kevin Muir of The Macro Tourist blog. As a measure of inflation expectations, this chart uses 10-year break-evens, the difference between the yield on a 10-year nominal fixed-rate Treasury note and the real yield on an inflation-linked Treasury note (TIP) of the same term. As inflation expectations rise, the dollar falls.

Looking at a shorter time frame highlights the fact that, since the beginning of 2016, the inverse co-relation of the dollar and inflation expectations has flipped. The red box in the chart below shows the divergence. During this period, the U.S. dollar has rallied strongly yet inflation break-evens have rocketed higher.

Why has a logical and historically valid relationship reversed? We believe the answer is that the market this time believes that the Fed will raise rates at a faster pace than inflation. The Fed's newish policy of publishing dot plots including interest rate projections by the FOMC members has captured the mind of the market despite the fact that (1) the Fed has proved to be the worst forecaster on the planet, and (2) the Fed has never yet managed to get ahead of inflation with a program of rate hikes. The Fed is projecting multiple rate hikes this year and the markets believe it.

We believe that the inverse co-relation of the dollar and inflation will return. The economy is loaded up with record levels of debt and has never been more vulnerable to higher interest rates. The Federal Government is about to enter a very divisive debate on the need to raise the federal debt ceiling and approve a controversial new budget. Fed heads have said repeatedly that they think more inflation would be good for growth and that the economy should be allowed to "run hot." We think the likelihood of the Fed choosing this rate hike cycle to prove, for the first time, that it can contain inflation before it gets loose is next to zero.

When will the markets begin to see that the Fed is not serious about nipping inflation in the bud? We don't know the answer but any rate increase could be the one that looks too timid and too late compared to the inflation data. The evidence of inflation is starting to emerge. Note that the prices paid index of the February ISM report released last Wednesday exploded to 68, which is its highest level since 2011. As the markets begin to take note, the dollar will weaken and gold will once again behave like an inflation hedge.

This article is the collaboration of Rudi Fronk and Jim Anthony, cofounders of Seabridge Gold, and reflects the thinking that has helped make them successful gold investors. Rudi is the current Chairman and CEO of Seabridge and Jim is one of its largest shareholders.

The authors are not registered or accredited as investment advisors. Information contained herein has been obtained from sources believed reliable but is not necessarily complete and accuracy is not guaranteed. Any securities mentioned on this site are not to be construed as investment or trading recommendations specifically for you. You must consult your own advisor for investment or trading advice. This article is for informational purposes only.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Rudi Fronk and Jim Anthony and not of Streetwise Reports or its officers. The authors are wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation. The authors were not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the authors to publish or syndicate this article.

2) Seabridge Gold is a billboard sponsor of Streetwise Reports. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.