With the Brexit vote underway, we can expect to see big volatility in markets immediately following it, and possibly even before it, if the market thinks it has got wind of the outcome ahead of the final count.

If Britain votes to leave the European Union, the presumption is that the euro will drop hard, because this would be a big prominent nail in the coffin of the failing Union. And because the euro comprises about 57% of the dollar index, we can expect it to soar.

If Britain votes to stay in, the outcome is less clear, since Britain staying in will not solve the mounting problems of the EU.

The European Union is now doomed to fail and eventually break up. If Britain does vote to leave, then other disenchanted countries can be expected to follow suit in time, and this rotten, self-serving organization will slowly lose its power base. If Britain stays, then increasing polarization and the rise of the extreme right can be expected to get the job done.

A wild card during these uncertain times is Europe deliberately setting out to provoke Russia at Washington's bidding by imposing sanctions on it, permitting the stationing of missile batteries along its borders and staging military exercises, etc. European leaders need to remember that Russia is a lot closer to Europe than the U.S., and pushed to the limit or beyond, Russia has the capacity to turn most of the citizens of Europe into pieces of smoking charcoal. You would think that they would have learnt the lessons of World Wars I and II but, sadly, they have not, and seem hell-bent on inviting catastrophe. The military-industrial complex and the Neocons safely nestled in their bunkers in Colorado and Nevada might find this all very entertaining, but the citizens of Europe are the ones who are going to pay the biggest price if things get out of hand.

The focus of this article is not a geopolitical rant, but rather to consider why the dollar is likely to rally going forward, and to look at a way or ways to profit from it.

As noted above, if Britain votes to leave the EU, the writing will be on the wall for this doomed organization and it will disintegrate faster than if Britain votes to stay in. The euro should, therefore, tumble and the dollar, in consequence, rally. If Britain votes to stay in, the euro will probably stage a relief rally, but it is likely to be short-lived because of the ongoing, deepening crisis within the EU. The dollar should turn up again after an initial drop, with the dead-end desperation of negative interest rates in Europe helping to sluice money out of the euro and into the dollar.

While it is impossible to determine the outcome of the Brexit vote in advance, we can at least attempt to draw some conclusions from market statistics. As we will see they suggest that the dollar is more likely to rally after the vote than drop.

On the 3-year chart for the U.S. dollar index, we can see that it has stabilized above strong support toward the lower boundary of a giant rectangular trading range, with a potential base pattern forming in recent months.

On its 6-month chart it looks like the dollar index may be working on completing the Right Shoulder of a Head-and-Shoulders bottom. If so, a sizeable rally is brewing.

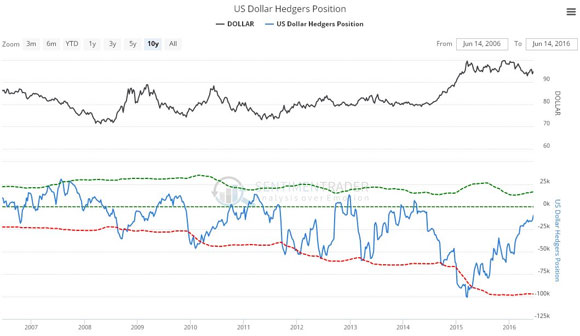

The latest U.S. dollar hedgers chart makes for interesting viewing. This chart shows that Hedgers' positions have been steadily improving since the dollar peak over a year ago, following the strong runup, and they are now closing in on being outright bullish—and we should note that the dollar doesn't have to wait for that to happen to start rallying.

Chart courtesy of www.sentimentrader.com

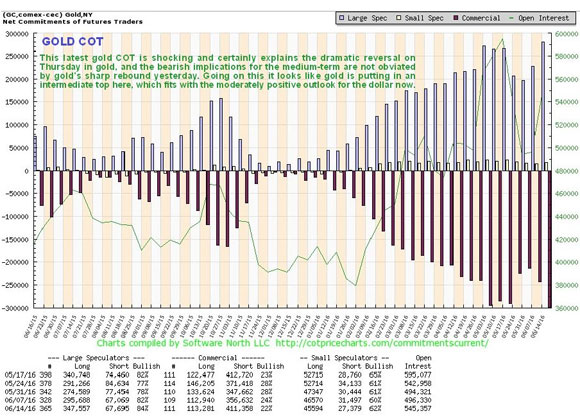

An important factor suggesting that the dollar is set to advance is the latest gold COT, whose readings are at record extremes, which makes a decline in the gold price very likely soon, and clearly that is likely to coincide with a dollar rally.

Apart from the failing euro, why should the dollar rally after suffering so much abuse at the hands of the Fed and big banks in recent years? Important reasons are not hard to find. In the first place, the Fed may have been abusing the dollar, but most of the rest of the world has now followed suit, with many Central Banks around the world striving to outdo the Fed. The European Union and Japan, in particular, have evolved into masters of outdoing the Fed.

Another big reason is that global markets are now in the late bubble stage (and this includes bonds, stocks and real estate), and are increasingly unstable, so that various "black swan" events could trigger a general crash, like the Fed stubbornly raising rates later this year in the face of an already crumbling economy.

Finally, like it or not, the U.S. dollar remains the global reserve currency, and U.S. elites intend to keep in that way, which is why Russia, which has been teaming up with China to circumvent using the dollar, is finding itself under an economic and military siege, subjected to sanctions on trumped up charges, and being encircled by military hardware.

If the dollar is set to rally, then dollar bull ETFs like the two shown below should rally. The gains in these will not be big as they are not leveraged, but at least they will do more than preserve capital, and if markets crash they will prove to be a good bolthole.

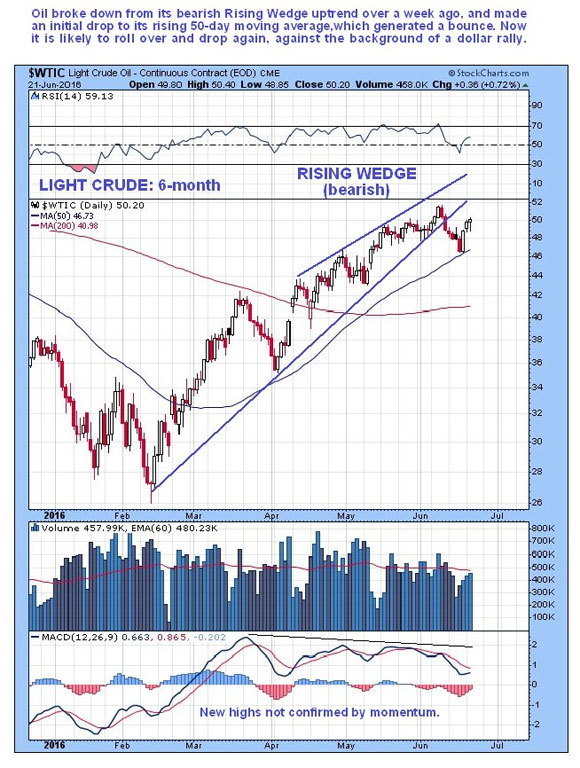

If the dollar rallies after the vote, then commodities will drop, and gold, silver and oil look particularly vulnerable over an intermediate time frame. On the 6-month chart for Light Crude we can see that it has already broken down a bearish Rising Wedge uptrend that lasted from February, and looks set to drop away.

If Britain votes to leave the EU, the elites, who control global stock markets with their vast wealth, will be roiled and we can expect a big drop in world markets to occur, which the U.S. market is certainly in position for, although we should be clear that this could break either way. Having said that, the S&P 500 index chart, shown below, does present a dangerous picture—from this position it could easily crash the support shown and plunge. . .

A couple of bearish looking candles with rather large "upper shadows" have appeared on the S&P 500 index chart in recent days, two "shooting stars." Although not conclusive evidence, these usually lead to a drop. . .

Whichever way the vote goes, one thing is for sure, and that is that we are going to see some wild swings in markets once the results are known.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation or editing so the author could speak independently about the sector. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

Charts courtesy of Clive Maund