Novo Resources Corp. (NVO:TSX.V; NSRPF:OTCQX) put out a press release on July 12th that lit the stock on fire with the stock up 55.2% with 1.7 million shares trading and the price up to $1.49, up $.53 on the day. The press release was interesting in that for the first time to my knowledge the TSX has allowed a YouTube video to be attached to a press release.

The first video shows someone using a metal detector to find the signal of a nugget in the first test pit and the second shows someone using an air chisel to actually pry out a rock containing several gold nuggets.

It's funny that the stock goes up 55% just now because Novo press releases have been talking about the style of mineralization and people using metal detectors to find gold since May 26, 2017. The company's web page discussing the style of gold and showing samples of nuggets in rock and a close up picture of the gold has been up for a month without anyone taking notice.

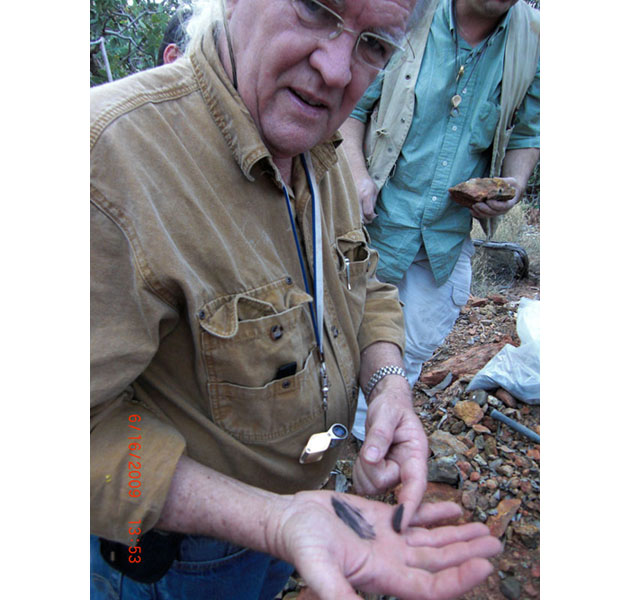

I don't pay much attention to bulletin boards but a poster named TexasT has been posting on the Novo Resources Stockhouse Bullboard since June 12, 2017, talking about how rich is Comet Well and the area that Novo did a deal on in May. He says that he was the first person to find gold at Comet Well, which is part of the Karratha package. I don't have any idea of who he is but he's been saying for weeks that the area is loaded with gold and he thinks Novo is on to a giant find.

I first wrote up Novo Resources in August of 2012 calling it a Wits system. Well, it is and 24 years after Quinton Hennigh first came up with the theory about how gold got into the Wits Basin while he was still a doctoral candidate at the Colorado School of Mines. At the time I wrote my piece five years ago Novo only controlled 698 square miles of a potential Wits system.

In their press release of June 26th, Novo went on to say they now control 9,228 square km in the Karratha region. For those more comfortable with miles, that is 3562 square miles. And they went on to again point out that people were using metal detectors to find nuggets in the area. So while I find the video posted showing use of a metal detector to find gold on the project very interesting, it's hardly news.

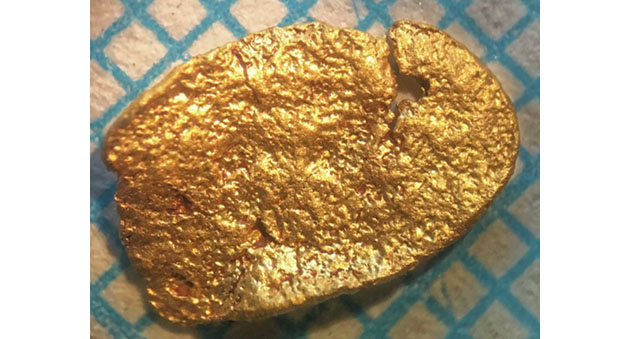

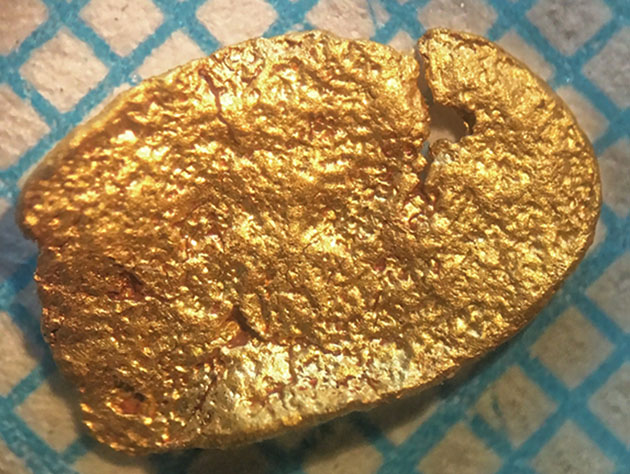

Novo has begun to do trenching. It's going to be a real bugger to get accurate grades due to the nugget effect. Given that the nugget found by the metal detector and pried out of the ground on the video is almost an inch in length it is going to skew any assay results if it is left in or if it is left out. The only way to determine true grade of this project is going to be either average a hundred random samples that represent the real distribution or to mine it.

Quinton is going to try to do something simply brilliant. In a system like this loaded with nuggets, finding true grade is difficult due to the small amount of material to be sampled. If you drill through a nugget with an ordinary core drill you get really high grade. If you miss the nuggets, you get low grades. In either case, you don't have enough rock to sample.

Quinton is bringing in a 16-inch water well drill. It will be picking up 500 kilo samples every meter or so. The sample will still have to be split and that will induce error but with enough assays, his team will have a pretty good idea of grade.

I was aware of the metal detecting and lots of nuggets going back to when the deal was done in May. I didn't want to write a piece until I actually had my boots on the ground and could verify what I was being told. Alas that trip wasn't going to happen until August and the market woke up first to the information that has been around for months.

No one will even guess what the grade might be. You simply can't, there isn't enough information. And it's also not possible to speculate as to the size of the area of mineralization. That will come through drilling. But here is what we do know. For the first time, we have had actual paleo-placer. There was free gold in the conglomerates at Beaton's Creek but it wasn't placer, it was free gold found in a stacked series of conglomerate beds just as Quinton predicted in 1994. These gold nuggets found in Karratha are free gold but have probably been remobilized through bacterial action into true nuggets.

Those nuggets littered the edge of the basin for a long time and were reworked by the tidal flow. When Novo has gotten a tiny sliver of an idea of grade, they have no idea at all of distribution. The gold sequence most closely resembles the beaches and offshore at Nome Alaska.

Where this deposit gets really interesting from a unique point of view is that the gold has been cooked. Yes, that's exactly what I mean, the gold was cooked. Here's what I think has happened.

- Some 2.5-3.5 billion years ago gold is dissolved in a very caustic solution of seawater that has the ability to contain between 1,000 and 10,000 times as much gold as salt water today.

- Single cell cyanobacteria began life about 3.5 billion years ago and produced oxygen as a byproduct.

- Iron dissolved in seawater literally rusted out as the oxygen content of the water increased and produced banded iron formations.

- As the chemistry of the salt water changed, after the iron precipitated out of solution, the gold began to precipitate out as well in shallow conglomerate beds near the edge of the basin it was in. Since gold has an affinity for carbon, in both the Wits East and Beaton's Creek in the Wits West, gold is often found at or near carbon. When Quinton showed me a blob of carbon next to some free gold at my first visit to the Pilbara in August of 2009, I became a believer.

- At least with the gold nuggets found recently in the Karratha property I suspect the free gold that came out of solution as the oxygen content of the water increased banded together through bacterial action and formed lumps of gold that was then washed back and forth with the tidal action producing the common watermelon seed gold nuggets.

- A hot intrusive covered the nugget containing conglomerate beds and literally cooked the gold. To the very best of my knowledge, this is unique. Certainly I have never heard of it before. That's meaningless from a mining or technical point of view but really interesting.

It is my belief that Quinton Hennigh has proved his theory of how gold got to the Witwatersrand and to the Pilbara basin. But I also believed that just based on my first trip in 2009 to the area. Certainly he recognized at once the potential when he learned of the Karratha gold discoveries made by prospectors using metal detectors. The Karratha gold is uniquely different from the Beaton's Creek gold but found in stacked conglomerate beds and is 100% compatible with his theory. Beaton's Creek certainly has enough gold for a gold mine but the Karratha conglomerates have game changing potential.

There are two major questions.

- What is the grade of the deposit? We aren't going to know this until we have a lot of results from trench samples and bulk samples from the water well drill unit. We need dozens of assay results before coming up with a reasonable guess. I would be very interested in knowing the exact composition of the gold from Beaton's Creek, Karratha and the Wits. Are they similar or how are they different?

- What is the extent of the project? If this is a Nome analog, there may well be miles of mineralization.

When I wrote my first piece about Novo in 2012 the company had about 31 million shares and was selling for $0.45 a share. I said, "It is easily a ten-bagger. It could be a 100-bagger. It's going to be big. What's the value of 700 square miles of the Wits?"

The company was on the C-Exchange and finally moved to the TSX-V. That was a giant improvement and allowed for far better liquidity. But they also ran the number of shares from 31 million to over 150 million fully diluted to raise money for exploration and land acquisition. I hated the dilution but understand why they did it.

We are at the "Interesting" stage. No one can predict either grade or size based on what we know today. We do know Quinton has picked up a giant land position. Certainly if the deposit has legs, Novo will benefit. I have loyal readers who have stuck with 321gold and Novo for the last five years because they believed in Quinton Hennigh.

With good results my predictions may well end up correct. For current investors sitting on your hands may be the most profitable action you can take. I cannot even suggest if buying or selling at today's price makes sense. It's not my money so the investor should make that decision.

I have been an investor since Novo was Novo. I still believe Roo Gold is a far better name but who am I to suggest a name change? Novo Resources is an advertiser.

Only you have responsibility for your own due diligence and decisions.

Novo Resources

NVO-V $1.49 (July 12, 2017)

NSRPF OTCQX 116.6 million shares

Novo Resources website

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Novo Resources. Novo Resources is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Photos courtesy of Bob Moriarty.