I was emailing back and forth with my pal Brien Lundin, editor of Gold Newsletter, this week and as we were basking in the limelight of analytical brilliance, it occurred to me that having a stock that many of us own, Kaminak Gold Corp. (KAM:TSX.V), suddenly the target of a $520,000,000 bid by a major mining company, Goldcorp Inc. (G:TSX; GG:NYSE), is exactly how proper analysis should be rewarded. At least, that's how we were taught, to say the least. To wit, this event is truly a significant watershed and a concrete block of confirmation that the New Golden Bull has arrived. Whether or not you are a raving foam-in-the-mouth bull, or a patient hiding-under-the-desk bull (as am I), Goldcorp's bravado is a wonderful thing to behold and would have made Harry Callahan proud.

What really got me thinking that inevitably Kaminak would be acquired was when the company released the preliminary economic assessment in 2015 where it basically told us that in an area covering perhaps 20% of the land package, it had identified 1.8 million ounces (1.8 Moz) gold Measured and Indicated and 3.4 Moz Inferred. So with a 5 Moz deposit in arguably the most mining-friendly territory in the world, it really wasn't much of a surprise when mighty Goldcorp stepped in with a half a billion dollar bid, but it WAS an absolute delight. Good on Goldcorp and good on all of you that own/owned Kaminak, but rather than standing here holding the bouquet of roses, batting my eyes and curtseying, let's move on. . .

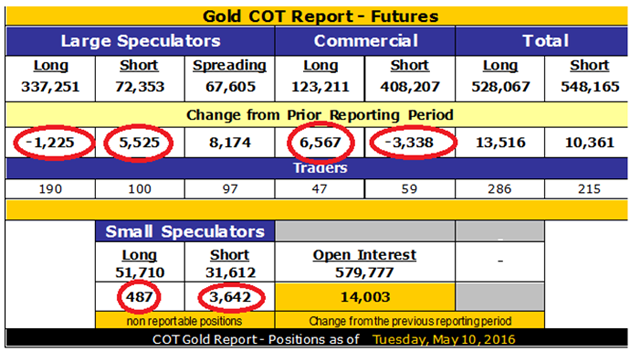

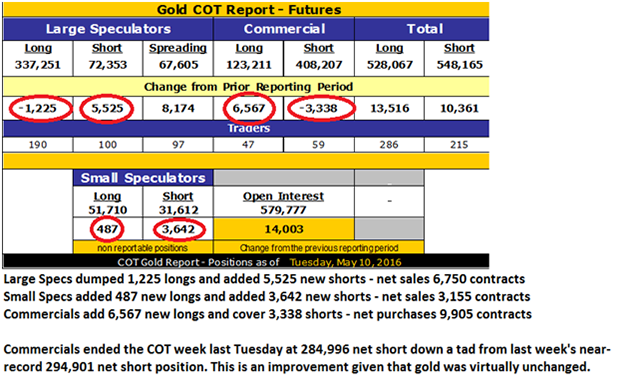

The COT Report:

For the week ended May 10, this Ali-Frazier slugfest continues with the Commercials covering a few shorts modestly. I think that whenever the bullion bank bubbleheads cover shorts into essentially a flat or rising market, the following move is not likely to be down. However, these last few weeks have been as chopped up as I can recall and traders usually get that kind of treatment with whipsaw losses everywhere. I have determined that gold and silver miner ETFs (GDX [Market Vectors Gold Miners ETF]/GDXJ [Market Vectors Junior Gold Miners ETF]/SIL [Global X Silver Miners]) are far too overbought to initiate new positions, but selective junior explorers that have yet to move look OK and the gold-to-silver ratio still favors silver over gold and is a glaring short. One thing I am not doing right now is TRADE; I am holding on for dear life with modest hedges in place with self-medication a necessity.

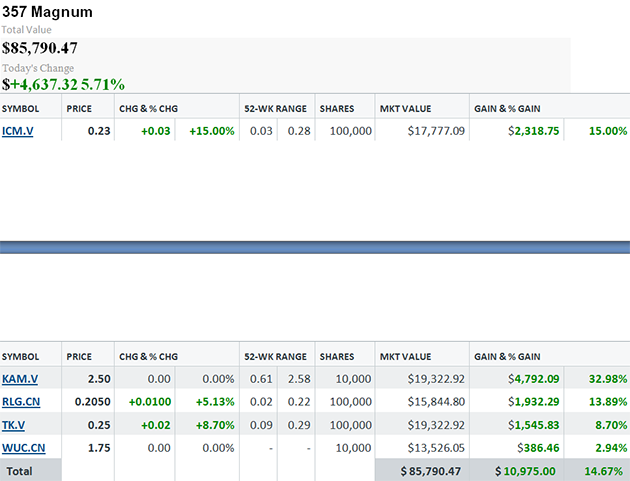

I've had a lot of emails this week asking me where I will deploy the proceeds from the Kaminak sale and surprisingly, I will leave the original $0.77/share entry price in Goldcorp stock and then take the profit of $1.83/share and buy the "Magnum" portfolio with the proceeds. I launched the Magnum two weeks ago and as you can see from below, it got a nice boost this week.

Because Kaminak is now gone, it will be replaced with Stakeholder Gold Corp. (SRC:TSX.V), maintaining our exposure in the White Gold District of Canada's Yukon Territories. The new names on the list are Iconic Minerals Ltd. (ICM:TSX.V), West Red Lake Gold Mines Inc. (RLG:CSNX) and Western Uranium Corp. (WUC:CNQ), and a fourth will be added but shall remain nameless until some material, non-public information becomes material public information. The last one will be also a silver/gold story and it could very well be the next Kaminak. (Don't you love how I shamelessly bait the hook with that?)

I have never seen a bull market as powerful as the one in which we find ourselves after five years of psychological and financial agony where central bank management of "everything" has given way to a massive migration to real money and sound currency alternatives. I wish I would have been sage enough to understand the importance of Chris Powell's famous line, "There are no free markets; there are only interventions," back in 2011 but since we can't turn the clock back, I just keep my head down and my feet moving because this gold market has serious legs beneath it and silver even more so.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) The following companies mentioned in the article are sponsors/billboard advertisers/special situations clients of Streetwise Reports: None. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

2) Michael Ballanger: I or my family own shares of the following companies mentioned in this article: Kaminak Gold Corp., Stakeholder Gold Corp., Iconic Minerals Ltd., West Red Lake Gold Mines Inc. and Western Uranium Corp. I personally am or my family is paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. Statement and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Michael Ballanger was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

3) Articles are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All charts courtesy of Michael Ballanger