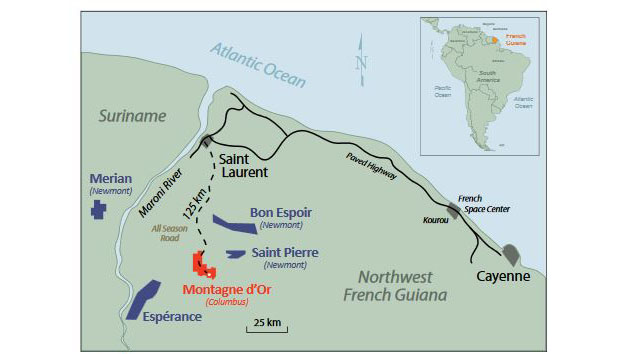

And Columbus Gold Corp. (CGT:TSX; CBGDF:OTCQX) proved that they discovered a gold mine with their press release of March 20th, 2017, covering the bankable feasibility study I said was coming by the end of March in the piece I wrote about them in January. Those numbers suggest the Montagne d'Or gold project in French Guiana is going to be a gold mine. And for an interesting snapshot of someone who is a believer in the mine take a gander at this short video.

The fellow in the blue hat cutting the core is Emmanuel Macron, the current Minister of Economy and Industry for France. While Marine Le Pen is favored to score highest on the first round of the French election scheduled for April 23rd, Macron is favored by most to win the French presidency in the runoff between the top two candidates taking place on May 7th. Is that a big deal, the upcoming President of France giving his stamp of approval on a gold mine in French Guiana? Well, all I can say is that if you ever see Trump tweeting about exceptional drill results coming from a company in Nevada, sell everything you own and buy that company's shares.

I've been covering mining companies and projects for almost seventeen years now. One of the things I have realized and I wrote about it in my bestselling book, Nobody Knows Anything, is that everyone has a bias and everyone has an agenda. That's not me commenting in any negative way about humans in general even though the majority of them are brain dead. But everyone is biased. Everyone has an agenda.

You get an email from one of our heroic soldiers in Syria over there training terrorists. He wants to share a trunk load of slightly used U.S. $100 bills with you. Well, you are probably biased and think that U.S. solders training terrorists is just a wonderful idea, no doubt. You are biased. After all, the NYT and WP have been supporting our brave soldiers off protecting the freedom of Americans by killing rag heads since the Carter administration. While this soldier doesn't even know your name well enough to use it, he wants to share his fortune with you.

You need to ask yourself, "What's his agenda?" Because if you spent $4 like thousands of other of my readers have, you would understand everyone has an agenda including him.

Yes, he has an agenda and it is not to give you money, it is to take your money. If you pass the reverse IQ test and respond to him, he goes into great deal of detail about how the bills are only slightly tarnished and it's not 100% legal for him to send it to you but since he likes you a lot, he will. All you have to do is send him $100 as a sign of good faith.

Don't snicker. It's a scam. I know it's a scam because of the 86 times I paid up, not a single guy sent me my money.

It's a scam just like reading about how gold is manipulated and was the biggest financial fraud in world history. If you go down today and buy an American Eagle one-ounce coin for $1350, you have been stolen from because gold really should be $5000 an ounce. Now I can't quite figure out just who stole from you when you walked out of the coin store but I'm told someone stole from you because the gold really should be $5000 an ounce. All financial markets are manipulated. It's not a big deal.

If someone writes you from Nigeria and has this really great oil deal, send money, it's a scam. If someone tells you about gold manipulation and wants your money, it's a scam.

When someone does any sort of a mining deal each of the participants has an agenda. While it's not important for the agenda to be identical it is vital that the agendas at least overlap.

For example if you ever see any sort of deal that calls for a giant cash payment in advance for a piece of moose pasture, it's a scam. While the moose pasture may well contain the 85.3 mt of moose poop measuring 1.6 g/t ms, the agenda of the seller may well be to take the money up front and then queer the deal.

If you could really make money buying moose poop, the seller would take a NSR or payment down the road. But when the seller wants most of his money up front, his agenda is to take the buyer's money now and he will immediately do everything in his power to make sure the buyer doesn't get permitted or be allowed to go into production.

As projects advance, the interests of the parties involved should get closer and closer to alignment. Such is the case with Columbus Gold and their 55% partner in the Montagne d'Or gold project, Nordgold N.V. (NORD:LSE). One Russian shareholder owns Nordgold. The company runs nine gold mines. It may well be the agenda of Nordgold to put the project into production. It also may well be the agenda of Nordgold to simply sell out to a major and take the cash.

Columbus on the other hand is an exploration company. At some point they are going to want to cash out. Having the ability to outline nearly 4 million ounces of gold in French Guiana is not the same skill set as putting a big gold mine into production or to operate a big gold mine.

The feasibility study goes a long way to making the interests of Columbus Gold and Nordgold align in a good way. Nordgold has earned their 55.01% interest. The study reveals the project has an NPV of about $500 million CAD with a twelve-year mine life of almost 3 million ounces production. While the IRR of the project appears low at 18.7%, there is an additional 1 million ounces of gold in the inferred category within the existing pit that can be turned into reserves with more drilling.

This project was exceptional before the BFS. It's better now. The numbers are only going to improve. If I use a figure of 4 million ounces of gold and $100 an ounce USD, Columbus Gold should be worth about $1.50 to $1.75 a share for their 45% of the Paul Isnard project.

One of three things will happen.

- Nordgold buys out Columbus Gold's 45% interest and puts the project into production. If they do, it probably would be at $200 USD an ounce or better. While the Isnard project is the flagship project for Columbus Gold, it isn't their sole pony. Columbus also owns the 1 million ounce Eastside project in Nevada. Columbus now has a fall back project and that's a big deal for them. They are not a weak hand in any negotiation.

- Another major comes along and either buys out Columbus' interest in Paul Isnard or buys out both Nordgold and Columbus. That could be as high as $200 USD to $300 USD per reserve ounce. I expect the partners to be tightly focused on increasing reserve ounces ASAP now that they both are interested in the highest price possible for their interest.

- A bidding war starts and either Nordgold or a major or two majors get into competition for the project. Reserve ounces could go for $400 an ounce.

Announcing the BFS allowed all the weak hands a liquidity event so they could bail out. The shares dropped 12% on what should have been taken as brilliant results. In my book I keep trying to say, buy cheep, sell deer. Columbus Gold just got really cheep.

Columbus Gold is an advertiser. While I don't own shares, I am biased. Do your own due diligence.

Columbus Gold

CGT-T $0.87 (Mar 21, 2017)

CBGDF-OTCBB 152.7 million shares

Columbus Gold website

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Read what other experts are saying about:

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. Columbus Gold Corp. is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: Columbus Gold Corp. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.