The theme of this year's conference was "Central Banks and Financial Turmoil," the role of central banks in preventing and overcoming turmoil, as well as the role of central banks in causing such turmoil. There are always subthemes: This year, for example, the seemingly arcane debate on risk-based capital reserves—arcane but with critical implications.

Bank reserves: What is sufficient?

At first blush, it might make eminent sense for bank regulators to risk-base loans and require different amounts of reserve for each. However, as so often with minutely detailed regulations, there are unintended consequences. John Allison, former CEO of BB&T Bank, explained how political decisions often intrude on seemingly objective decisions. Thus, because the government was pushing mortgages to low-income people in the early part of this century, less capital was required for subprime loans than for loans to triple-A Exxon. No capital was required for Greek government debt. And so on. When an asset is regarded by banking regulators (not credit analysts) as low, investors flow to such assets, thereby making them more risky.

Thomas Hoenig, Vice Chairman of the Federal Deposit Insurance Corporation, noted that more than a century ago capital reserves for banks used to be about 50%. When the Federal Reserve was created, with the implicit lender-of-last-resort role, the level of reserves dropped, and it dropped again when the FDIC, protecting individual depositors, came in. Hoenig made the startling assertion that if banking losses today were of the same magnitude as in 2008, it would wipe out all tangible capital at U.S. banks.

Why banks are not lending

It should hardly be a surprise that when the risk is transferred to someone else, the level of reserves drops. Currently, reserves are a little over the required 10% level, although they have increased meaningfully since the 2008 credit crisis. This is not because of a fit of prudence on the part of the banking fraternity, but rather because banking regulators have made it increasingly difficult for banks to make loans, particularly to small business, while at the same time, the Fed is paying risk-free interest on bank reserves.

James Grant referred to the "PhD standard," where central banks are run almost entirely by academics without any practice experience. Referring to the old saying that "ships are safest when in harbor," he quoted the head of a Scandinavian bank that "the purpose of banks is not just to not go bankrupt." With ever-increasing regulation making loans more difficult, regulators have as a top priority that banks do not go bankrupt, but in so doing, they are failing to fulfill their purpose.

Government policy and the credit crisis Allison, no theorist but someone running a bank at the time, made the clear assertion that government housing policy was the cause of the 2008 crisis. Contrary to popular belief that banks were deregulated prior to 2008, he showed how there had been a huge increase in regulations in the years before 2008, including under President G. W. Bush. Under both Clinton and Bush there was enormous pressure on banks to make more low-income for political goals. Regulators had the power to prevent a bank from so much as opening a new ATM machine if it did not increase subprime loans. I would add that banks, quite rationally, packaged these toxic loans and got rid of them as quickly as they could.

Those themes were picked up by former senator Phil Gramm, heading of the Senator Banking Committee at the time. It was neither low regulation (which was a myth) nor low levels of capital that caused the credit crisis. Rather it was that regulators forced subprime mortgages on banks, and required very little capital for such loans. Shortly before Lehman went broke, the Fed had found that over 98% of banks were well capitalized. It was a liquidity crisis, not a solvency crisis, he noted.

Fed policy is not working

Many speakers also criticized the current zero-rate policy (and even the negative rates in many countries). Kevin Down, professor of Finance at Durham University in England, note the perverse consequences of the zero-rate policy. Rather than pressure banks to lend and consumer to spend, they have the opposite effect; banks put more money on deposit with the Fed and consumers increase their saving. The personal savings rate in the U.S. has virtually doubled since the crisis. He saw little sign of the Fed and other central banks "realizing their errors;" rather, they reinforce failure by going from low interest rate to zero interest rate to negative rates. "Central bankers have long since lost the plot."

Former Vice President at the Federal Reserve Bank of St. Louis Daniel Thornton called the Fed's response to the financial crisis "a disaster." Reinforcing many of themes of others regarding the unintended consequences of Fed policy, often precisely contrary to their intended goals, he noted that low interest rates cause excessive risk-taking among savers and those living off their savings, and among pension funds, which are forced to reach for yield in order to meet their actuarial targets.

One speaker (it could have been Jim Grant) noted, and many alluded to, the perversity that though it is commonly acknowledged that price controls distort markets, we allow the central bank to control the price of the thing most central to an economy, namely money. Many distortions flow from that.

Do we need central banks?

The two best questions of the day came from two female students. The first, somewhat incredulously, commented that, "It seems you don't think central banks are doing a good job." The other, succinctly, asked "Why do we even have a central bank?" In answering her question, no one on that particular panel gave her a reason.

The Cato conference brings together former central bank personnel, academics and politicians. Former key note speakers have included Ben Bernanke and Ron Paul. Topics cover history, theory and policy. Some talks at the conference are technical (missing from my brief comments), some more policy-oriented or even political. I would highly recommend this annual conference to anyone interested in this money, and suggest you support Cato in order to get on their list. A brief synopsis of the talks as well as full video is available here.

Alice in Wonderland

In his talk, Prof. Down said central bankers "are doomed to remain stuck in this trap like Alice in Wonderland." Coincidentally, I took Alice in Wonderland as my theme for a recent talk at the New Orleans Conference and discussed how to invest in this topsy-turvy world.

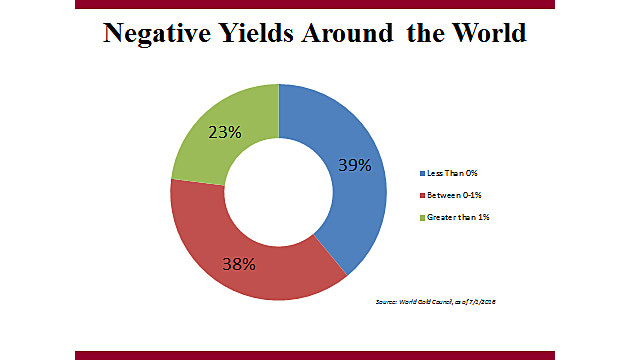

Right now, almost 40% of global government debt has a negative yield (and almost 80% yields less than 1%). Essentially, if you lend money to the government, you are guaranteed to receive less.

The policies of the Fed and other central banks since the credit crisis have had almost the reverse effects than they desired: lower bank lending, more consumer saving, higher levels of government debt, more people exiting the employment pool, low inflation, and an overall sluggish economy. We have central banks who want to increase inflation and reduce savings. In short, one can hardly but agree with Alice when she says to the Queen: "What a strange world we live in."

Adrian Day, London-born and a graduate of the London School of Economics, heads the money management firm Adrian Day Asset Management, where he manages discretionary accounts in both global and resource areas. Day is also sub-adviser to the EuroPacific Gold Fund (EPGFX). His latest book is "Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks."

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Adrian Day and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.