Idaho-Maryland

Mine, Nevada County, California

1. Introduction

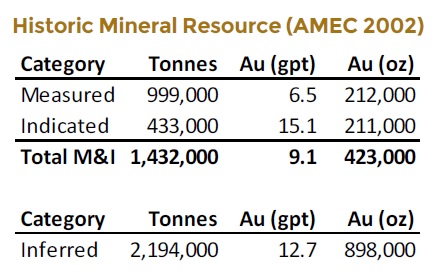

Sometimes I come across mining stories that read like an old-fashioned treasure hunt of sorts. Rise Gold Corp. (RISE:CSE; RYES:OTC), a small junior headquartered in Vancouver, falls neatly into this category in my view. CEO Ben Mossman found the past-producing high-grade Idaho-Maryland gold mine after intensely searching the internet for about five months, scanning eligible projects up for sale, historic databases and other leads. When he started doing his due diligence, which meant sifting through a basement full of old documents, it soon dawned on him that this project could host huge exploration potential, besides the considerable historic (2002) high-grade estimate of 0.4Moz @ 9.1g/t Au M&I and 0.9Moz @12.7g/t Au Inferred, as the Idaho-Maryland had to halt production in 1954 when it was nowhere near depletion.

After bringing in a team of advisors for further research, Mossman became convinced he had a substantial venture on his hand, and started to develop plans to acquire the Idaho-Maryland project. This all became reality in January 2017 when Rise acquired the mine for $2 million, after raising no less than C$4.2 million in December 2016. Since then, the hunt for the ounces of gold left in the ground is on. The company has been busy digitizing the truckload of old documents into 3D models, determining exploration targets and setting up the first drill program, which is about to commence after the current financing will be closed. As the share price seems to have bottomed out now, it seems like a good time to analyze the potential of this exciting story for investors.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

2. The company

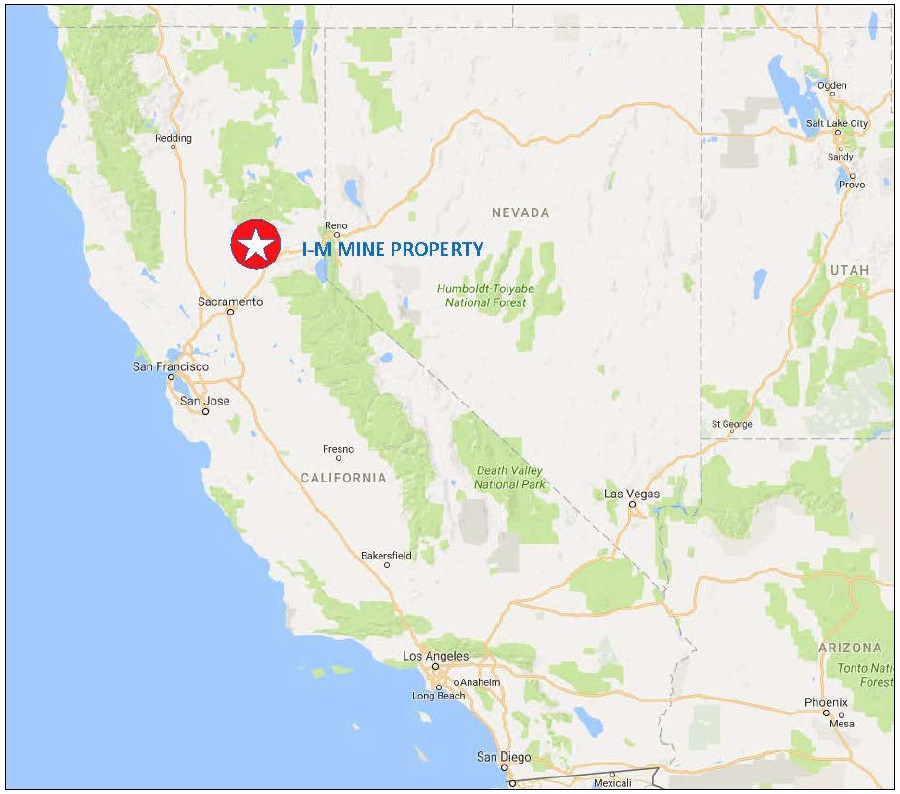

Rise Gold Corp is a U.S. exploration and development company with Canadian headquarters, focused on creating shareholder value through advancing a gold project in California. The company is developing an exploration strategy for its fully owned Idaho-Maryland gold project, a former past producing mine located in Grass Valley, California, U.S.

The management team is led by President and CEO Ben Mossman, who knows all about underground gold mines in North America with over 15 years of experience as a mining engineer under his belt (Snap Lake Mine for DeBeers Canada, Mine for Alexco Resource Corp). Previously, as CEO of Banks Island, he led the exploration, permitting, financing, construction, and operation of a profitable gold mine in British Columbia which was one of the only hard rock metal mines in the world to use pre-concentration (DMS) to eliminate all surface disposal of tailings.

The real heavyweight of Rise Gold is Chairman Alan Edwards, working in the mining industry for over 35 years. He was the General Manager for three major mining operations in the United States, and the Senior VP of Operations for Freeport Indonesia where he was responsible for the leadership of a workforce of over 6,000 employees. Mr. Edwards served as the VP Operations for Kinross and as the COO for Apex Silver Mines where he directed the successful construction of the $675 million San Cristobal Mine in the difficult political climate of Bolivia. He also served on numerous boards of public companies, including as Chairman of AuRico Gold Corporation during a period of extensive growth which culminated into a successful US$1.5 billion merger with Alamos Gold.

Last but not least is director Thomas Vehrs, who is a huge asset in determining the right exploration strategy. Holding a PhD in geology, Dr. Thomas Vehrs is a highly regarded and experienced exploration geologist with over 40 years of experience in the Americas. For the past ten years, Dr. Vehrs held the position of VP Exploration for CA$1 billion market cap Fortuna Silver Mines.

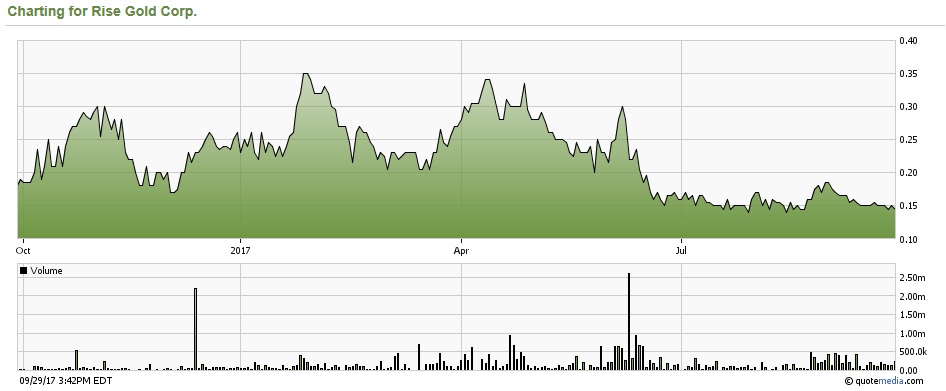

Rise Gold has its main listing on the Canadian Stock Exchange, where it's trading with RISE.CSE as its ticker symbol. As CSE listed stocks aren't eligible for many large-scale investment outfits, and average liquidity is lower compared to the TSX Venture, management is looking to uplist to the TSX Venture as soon as possible. According to Mossman, this is planned as soon as the current financing is fully subscribed, which could be very soon. The company needs to meet the minimum working capital requirements in order to complete the listing. With an average volume of in excess of 97,000 shares per day, the company's trading pattern is still quite liquid considering the CSE, the early stage and little amount of marketing, which makes it not too difficult for retail investors to get in or out.

Rise Gold currently has 66.7 million shares outstanding (fully diluted 108.48 million), 36 million warrants @C$0.39 average (the majority is due @C$0.40, of which 22.1 million warrants @C$0.40 expiring on Dec. 23, 2018), and several option series to the tune of 5.7 million options (C$0.24 on average) in total, which gives it a market capitalization of C$9.67 million based on Friday's share price of C$0.145. The company has no trouble raising cash despite its CSE listing, as it raised C$4.2 million in Dec. 2016, and C$2 million in April 2017. When the current C$3.6 million @C$0.15 (full warrant) financing will be closed, which is any moment now, Rise Gold will have a working capital position of about C$4 million.

Share price; 1 year time frame

Although gold has seen

significant gains on a dropping U.S. Dollar and North Korea tensions for the

last few months, Rise didn't follow. One reason for this could be that the

company is still flying very much under the radar, but another reason could be

private placement holders who might have expected more action and decided to

hold the warrants and go for other projects with much more exposure/hype (For

example even I bought into Novo Resources (NVO.V) after talking to a geo who

did a site visit down under for a fund I am familiar with, as everybody and

his/her dog seems to be afraid now to miss out on a potential monster 1 billion+

oz Au Wits 2.0, although not a single recent drill

hole has been reported yet).

I view the current low as a clear buying opportunity, after the C$3.6 million PP would be closed (of which the first tranche of C$1 million very recently closed). The drill program should start soon, and if assays would indicate anything resembling the excellent historic grades/sampling/drilling, Rise Gold should be in for a re-rating. Solid drill results and an updated resource estimate according expectations should be able to move things considerably, as the current market cap is tiny at C$9.67 million.

3. Project

Rise Gold has one project, the Idaho-Maryland Gold project, located in Grass Valley, Nevada Country, in the state of California, U.S. Grass Valley deposits are classified as a gold quartz vein type deposit, often higher grade. California didn't exactly build the best reputation as a mining friendly jurisdiction over the years (ranked #74 out of 104 jurisdictions worldwide by the latest Fraser Survey), predominantly based on permitting issues, but a lot has changed this year. New President Trump has indicated he is much more favorable towards mining compared to previous administrations, and filled the position of the Environmental Protection Agency (EPA) head by loyal, anti-legislation, pro-energy industry Scott Pruitt.

Pruitt is the one person who opposed the EPA many times himself (self-proclaimed "leading advocate against the EPA's activist agenda") as an Attorney General of Oklahoma. Pruitt is currently in the process of quickly and methodically breaking down everything at the agency that could hamper the U.S. economy. Mining companies that already profited from this, having experienced huge permitting issues in the past, are Northern Dynasty Minerals (Alaska, ticker NDM.TO) and NewCastle Gold (California, ticker NCA.TO), which all of a sudden seem to have a real shot at permitting now, and sport much higher market caps because of this.

On a more local scale, an aggregate open-pit mine and a large open-pit placer operation, the Blue Lead Placer Mine, have been permitted in 2015 in Nevada County, very close to the Idaho-Maryland project and well before Trump was elected. The firm handling this permitting was Braiden Chadwick, the premier legal and permitting firm for mining in California, and Rise Gold has hired them as well for their own permitting process. As the Idaho-Maryland mine is an underground mine, the surface disturbance would be much less than the Blue Lead Mine. Besides this, CEO Mossman has developed a plan to use historic, mined out stopes of the Idaho-Maryland mine to treat and store all tailings underground. Any development waste rock will be crushed and sold as aggregate in the area, as there is huge demand for it. Last but not least, the project is located on private land, which makes permitting much easier compared to federal (BLM) land, as stated in the technical report:

"The Project area is covered by private land and no permits or consultations with the US Bureau of Land Management (BLM) or the US Forest Service (USFS) would be required."

On a side note, the 2017 technical report has been done by Amec Foster Wheeler, and this is one of the most respected

firms in this regard in Canada.

Because of all this I view permitting risk for Rise Gold as manageable. Now

let's have a look at the background of the project.

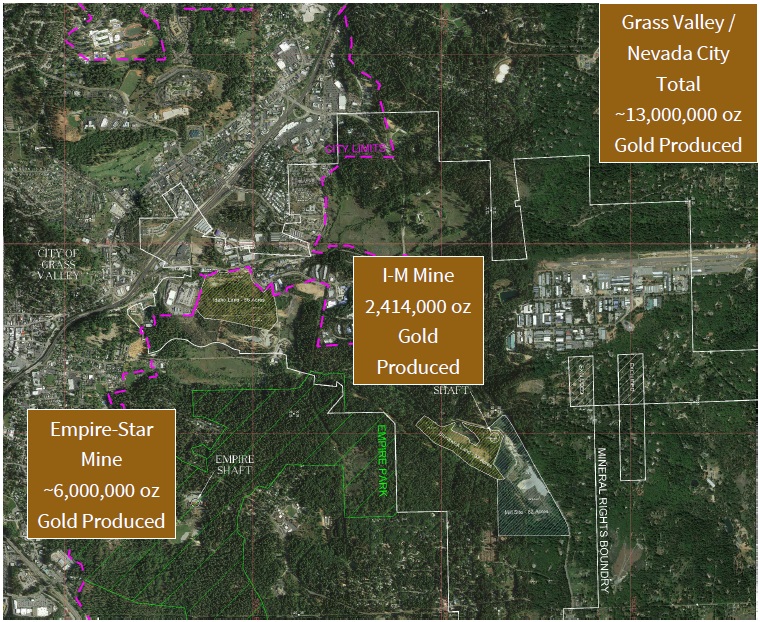

The former Idaho-Maryland Mine has a long past behind it, and has seen several interesting books being written about its story. This mine was one of the most productive and best-known gold mines in the United States. The Idaho-Maryland Mine has a rich history of gold production and mining work completed between 1863 and 1956 by various operators. The Idaho-Maryland Mine represents a consolidation of several important early day producing mines including Eureka, Idaho, Maryland, Brunswick, and Union Hill Mines. Based on historic production records, these mines produced a total of 2.4M oz gold at an average mill head grade of approximately 17.1g/t Au.

The mine was reportedly the second largest gold mine in the United States in 1941, producing up to 129,000 oz gold per year before being forced to shut down by the U.S. government in 1942 due to World War II, as workforce was needed in war efforts. Significant production after the war-time shutdown never occurred.

The property was rediscovered in 1990 by Emgold and efforts were made to reopen the historic mine; however, this company was unsuccessful due to inability to raise necessary funding in unfavorable market conditions, and lost the option on the project in 2013 which then returned to the former owners. CEO Mossman then discovered the existence of this remarkable project in the summer of 2016. Although he is very much a result-oriented mining engineer, I also noticed and liked his love for history and delving deep into the project and all its data. When I met him to discuss the project, he gave me two excellent books on the Idaho-Maryland Mine story so I could get a sense of history, and the Rise Gold website and presentation are packed with historic information about the project.

After Mossman and his team completed their due diligence and raised sufficient cash, the acquisition of the Idaho-Maryland gold mine was completed on January 25, 2017. The purchase price was US$2 million, the entire transaction included legal costs accounted for C$2.66 million. The property is located in a prolific historic mining district (Grass Valley), of which the former Empire Star Mine was the building block of Newmont:

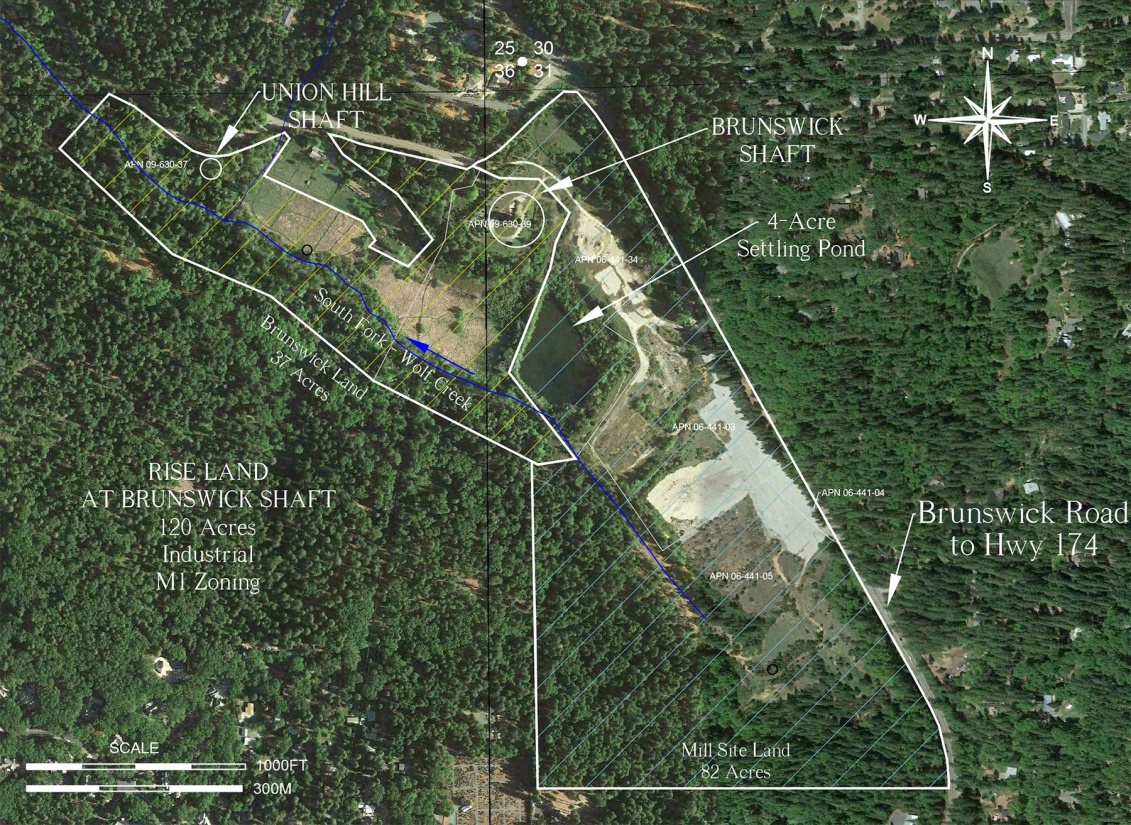

The asset accounts for 2,750 acres of mineral

rights, including the surface rights at the Brunswick shaft. This shaft provided

access to the productive Brunswick block, and extends to a depth of 3,000ft

(about 1,000m) and was the main production shaft of the former mine. The

property is royalty-free and there are no other agreements or encumbrances. The

property is completely within the M1 zoning of the nearby city of Grass Valley,

M1 meaning Light Industrial Zoning District. Mineral exploration is allowed in

M1 zones without a permit; only certain circumstances, not relevant here, would

demand a Use Permit. The same goes for underground mining, considered eligible

in a M1 zone, although this certainly will need a Use Permit as buildings will

be necessary, which is a circumstance that triggers such a permit.

There is a historic resource estimate completed in 2002, also by Amec, using a cut-off grade of 3g/t Au (for correct and full disclosure see company documents, as one cannot rely on a historic resource estimate):

This is the estimate by Amec

at the time of the gold, which is estimated to be remaining in the historic

workings. Interestingly, a few more historic resource estimates have been

completed since then, the most recent being the one by Pease in 2009. They estimated 472koz @10g/t M&I, and

1Moz @12g/t Au Inf, based on a 1.44 Mine Call Factor

multiplier (the grade at the mill head was much higher than the sampling grade,

so a correction factor was applied), but Rise considered the Amec resource to be the safest although on no historic, non

NI43-101 compliant resource estimate can ever be relied upon as mentioned, and

this has been clearly stated by Rise throughout all relevant documents.

Notwithstanding this, I am no listed company or registered investment advisor,

so I consider at least the Amec resource a useful

indicator for existing resource potential.

As might be concluded by the more experienced investor, grade and number of ounces could already likely indicate an economic deposit. Metallurgy has proven to be excellent in the past (recoveries of 99% were achieved). Although I have my reservations about the very recently released PEA of Pure Gold Mining (PGM.V) with a very low capex as it has an existing mine on care and maintenance (C&M) and very high IRR, its Madsen deposit (also a historic mine) is also high grade, deep and flooded, and already indicates potential for Rise Gold.

The underground workings of the former Idaho-Maryland Mine are flooded, and it would cost a lot of time and money to dewater this just for drilling, so exploration will take place from surface. Rise Gold is almost wrapping up the current C$3.6 million financing as mentioned, and after this, its treasury will contain about C$4 million, which will be more than enough for the first drill program. More on this later. Rise Gold has also other expenditures in the near future, as it has paid $600,000 for the option to purchase the mill site which is a wise acquisition as this land has large leveled areas fit for future mining buildings and new shafts. There is also room for stockpiling rock and other materials, and a 4 acre settling pond for future water management, and Rise will have to pay another $1.3 million before June 30, 2018.

<

<

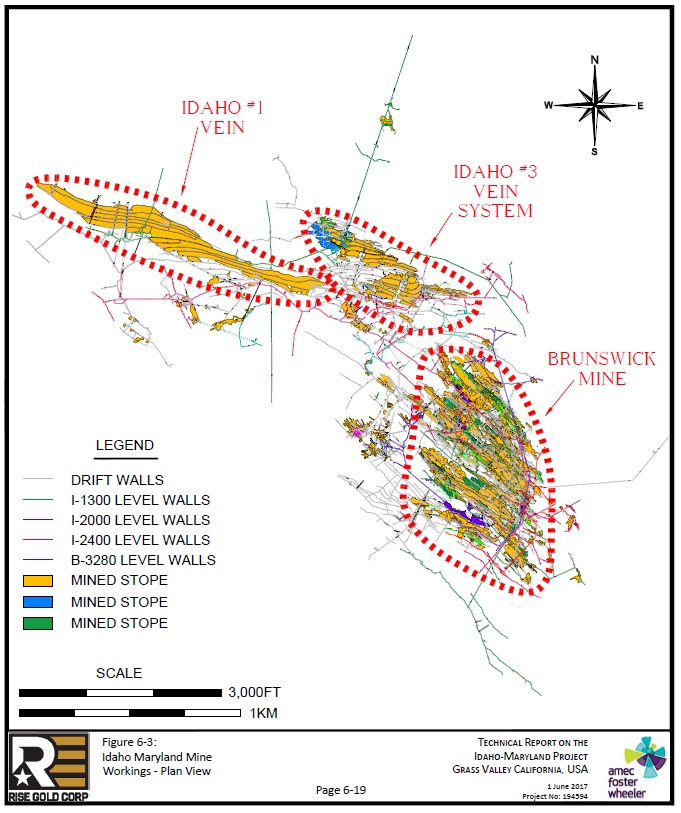

To get a bit of an impression about the Idaho-Maryland Mine itself, here is a plan view of the different underground workings, ranging from surface to a depth of -1650ft (about -550m):

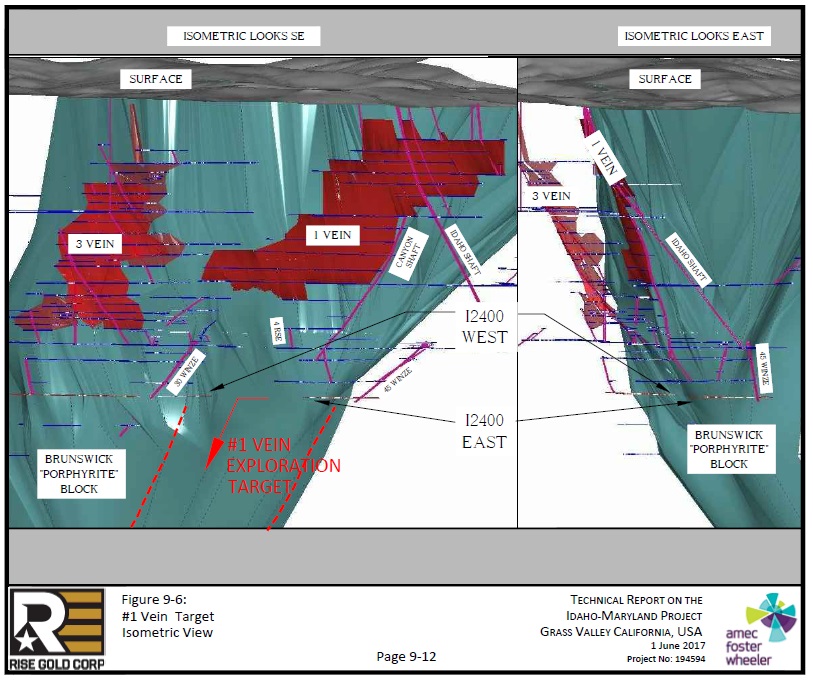

And here is a 3D presentation of the Idaho vein systems, also from the Amec report:

Please note that the nearby former Empire-Star Mine had underground workings going as deep as 1,600m, which is almost 1.5 times deeper. This mine was shut down due to a labor strike, and also contained significant reserves, and is still owned and shelved by Newmont. The same goes for most other gold mines in the Grass Valley District. Because of this, the geological setting and the historic underground samples and drilling, a number of geologists (from the past and current) believe there is excellent potential waiting to be explored.

4. Exploration plans

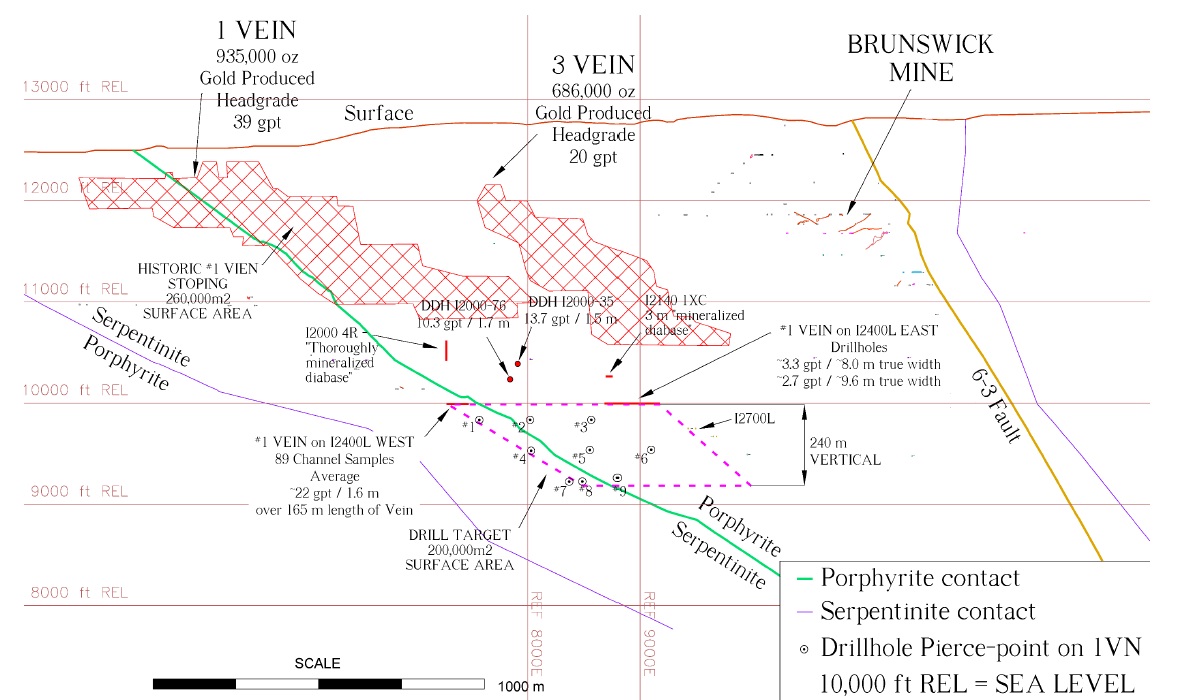

As the operators were mining three separate, rich veins and ramping up to double the production to 250,000oz before WWII in the past, it will be understandable that numerous exploration targets in and around the mine workings were identified during and after operation.

The central thesis for exploration is, as mentioned, the analogy with the nearby former Empire Star Mine and other former mines in the area, which indicates continuing mineralization at depth. This is probably a familiar theme for many, as it is standard MO in the Red Lake district, Val D'Or, South Africa and many other locations.

The Amec report lists the characteristics of

typical orogenic gold deposit types, as Idaho-Maryland falls in this category,

and here are some relevant highlights:

"Tabular fissure veins in more competent host lithologies, veinlets, and stringers forming stockworks in less competent lithologies. Typically occur as a system of en echelon veins on all scales."

"Vein systems may be continuous along a vertical extent of 1-2 km with minor change in mineralogy or gold grade; mineral zoning does occur, however, in some deposits."

Orogenic gold deposits can also have their disadvantages, as they can be hard to delineate, also due to possible nugget effects and narrow veins at depth. Fortunately for Rise Gold, Idaho-Maryland is something special in this regard:

"Past production at the Idaho-Maryland Mine has demonstrated significant vertical and horizontal continuity of the veins. The great vertical extents of veins of similar gold deposits, such as the adjacent Empire Mine, suggests extensions of the #1 Vein, 3 Vein system, and the Brunswick Veins to depth and there exists potential for significant stockwork-style mineralization within the Brunswick Block."

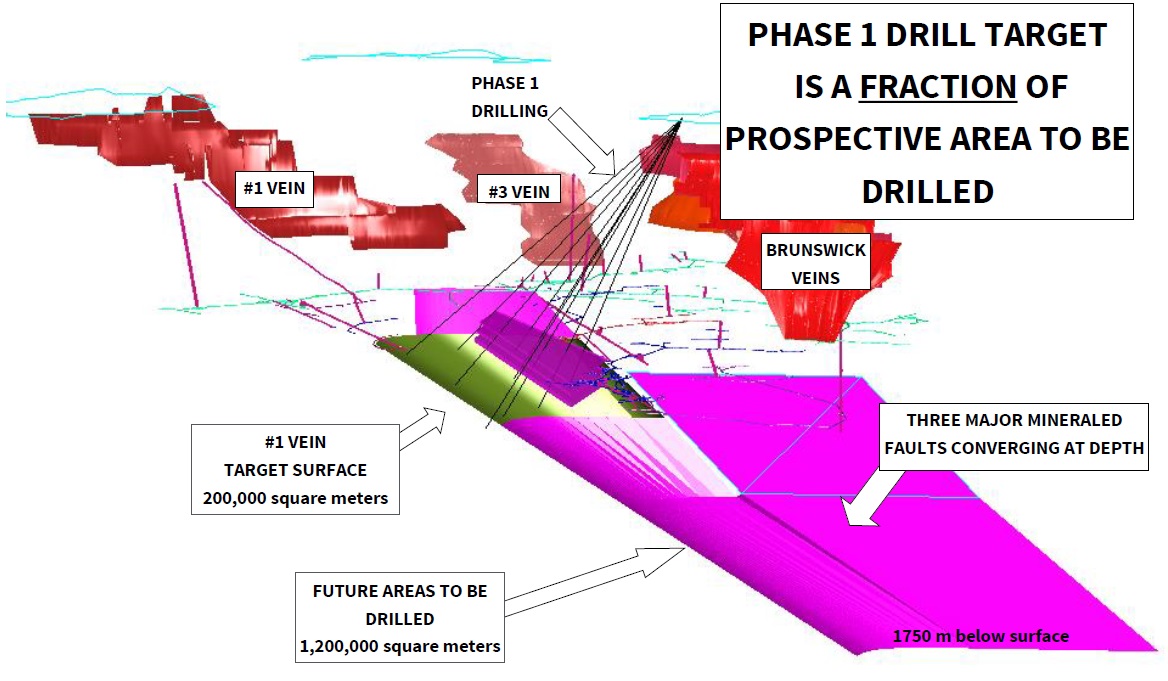

As the Idaho-Maryland system will probably be too complex to drill out completely from surface, the strategy of Rise Gold will be exploration and in the end delineation to Indicated and Inferred, probably on a grid spacing of 50m. Drill costs are estimated by the company at $270/m all-in. Because of considerable depth, management will use directional drilling, with a few widely spaced, deep motherholes first after which multiple branch holes will be drilled. Drilling will commence in October.

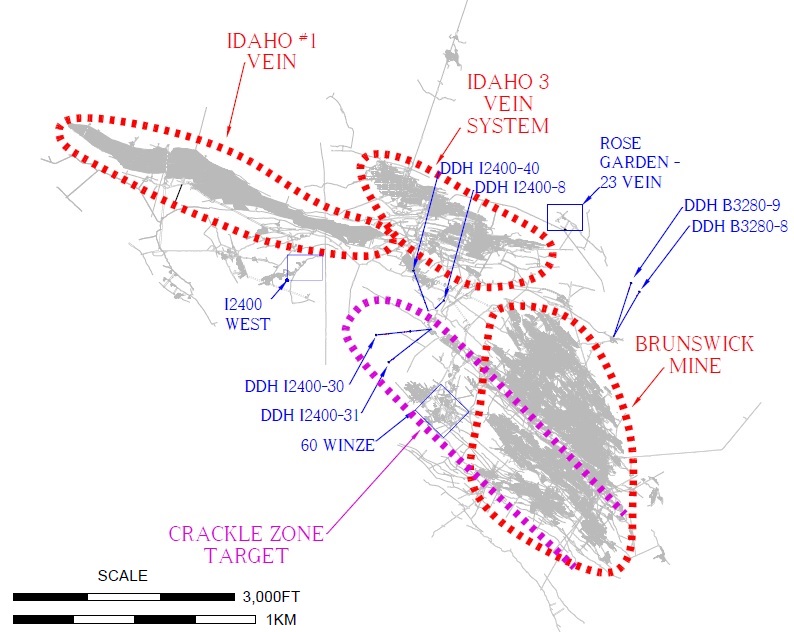

The currently most significant exploration targets identified at the Idaho-Maryland Gold Project are in untested ground below the historic mine workings. These targets are the Idaho #1 Vein, Crackle Zone, Brunswick, and 3 Vein System.

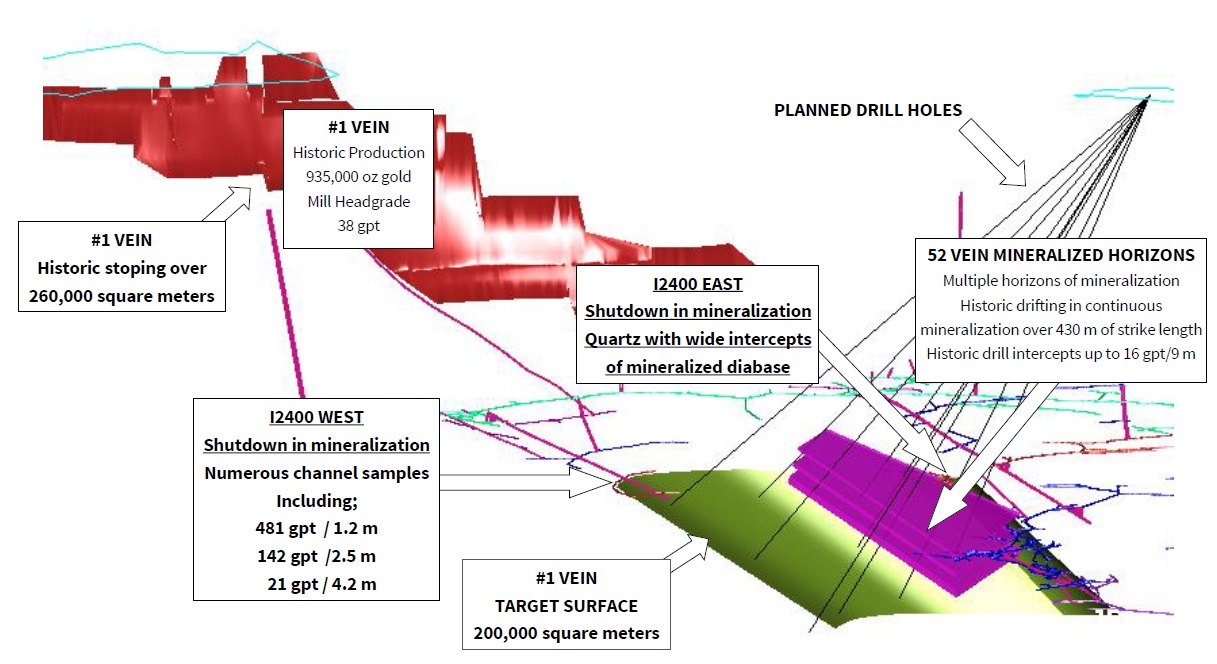

Rise Gold initially planned a $600,000 limited drill program to start off, and Amec proposed a single, 1,800m drill hole, intended to describe most of the geology and exploring mineralized extensions below the 1 Vein and 3 Vein. This has been adjusted, and management now wants to verify the possible existence of multiple mineralized horizons at depth:

This 3D drawing might be a bit hard to read, but it effectively envisions the extension of the #1 Vein (green target surface), accompanied by multiple, stacked horizons of mineralization, expected as an extension of the nearby 52 Vein workings. As sampling results of the #1 Vein at the end of the workings showed consistent high-grade gold, and continuity of all mineralization was strong at Idaho-Maryland, I have high hopes for this target.

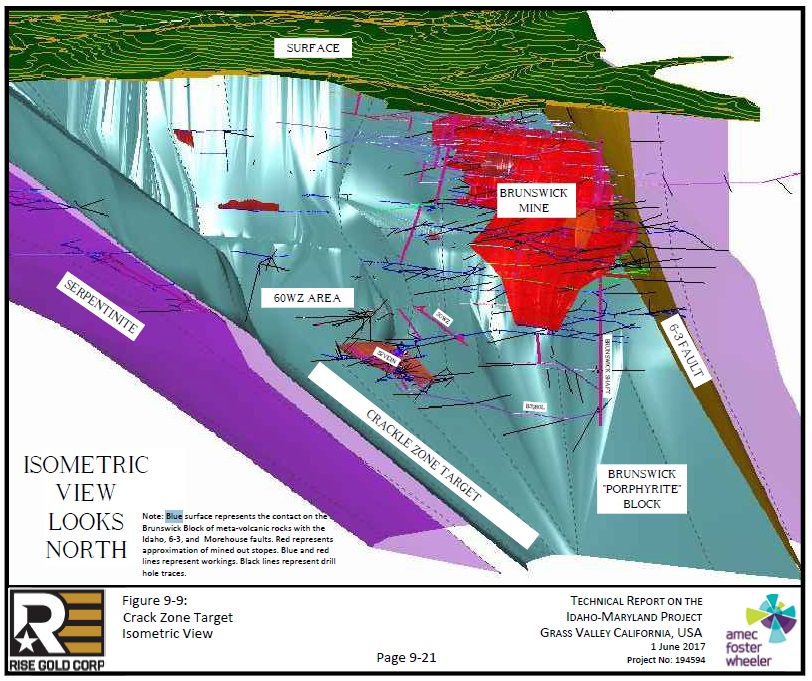

The Crackle Zone, a concept initiated by renowned geologist and Hall of Famer Alan Bateman a long time ago, could prove to be the theory that propels the Idaho-Maryland project into Tier I territory if correct. It basically envisions a feeder structure to all currently know mineralized zones, located below them and continuing at depth.

According to the Amec report:

"The

Crackle Zone exploration target is a conceptual target based on an idea

proposed by Bateman that mineralizing fluids responsible for the gold mineralization

encountered at the Idaho-Maryland Mine may have formed a zone of intense quartz veins and stockwork within the Brunswick Block in response to the

interaction of the Idaho, 6-3, and Morehouse faults. The Crackle Zone

target generally lies beneath all current development and drilling but quartz

vein and stockwork hosted gold mineralization

identified by drilling, development, and mining of the 52 Vein and 60 Winze area may represent part of this target.

The 52 Vein was discovered during exploration development across the Brunswick Block from the Idaho #2 Vein to the Morehouse fault."

"The Crackle Zone target forms a wedge-shaped area 2,000ft (610m) wide and 500ft to 1,000ft (152m to 305m) thick at the I2700 Level and plunging as much as 5,000ft (1,524m) to the south east where it pinches out against the intersection of the Idaho, Morehouse, and 6-3 Faults.

Within this zone, gold mineralization may occur in shallow dipping quartz veins and irregular quartz stockworks in metavolcanic rocks that may be highly fractured due to the interaction of the Idaho, Morehouse, and 6-3 Faults as proposed by Bateman."

The size of this wedge could have an average width of 305m, average thickness of 115m and a length of 900m, creating a volume of 31.6M m3. Based on a gravity of 2.75t/m3, the Crackle Zone target could be 86.8Mt, which is sizeable of course. If this Zone indeed proves to be the converging point of the other zones, I wouldn't be surprised if the total resource could pan out to be 2-3Moz or even larger.

5.

Valuation

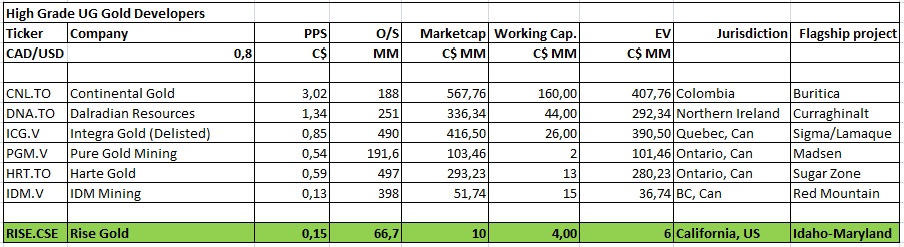

Although it is pretty hard to compare Rise Gold with peers, as there aren't many high grade underground gold deposit in something of a safe jurisdiction out there, I set up a peer comparison table based on available developers rather than explorers (as there aren't any with a high grade resource), to give an indication of what could happen if Rise Gold could eventually advance their Idaho-Maryland project to PEA status and beyond:

Part I:

Part II:

As can be seen, if Rise Gold can prove up its historic estimate, a very significant re-rating is in the cards. Of course, there will be additional dilution, but I don't expect the numbers of Integra, Harte or IDM Mining, to be honest. Generously assuming Rise Gold will arrive at the PEA stage with about 200 million shares and just proves up the 1.3Moz Au, also assuming the Enterprise Value/oz metric having a ratio of 60 (pretty conservative for a solid and profitable project in general), an estimated EV could be expected of C$78 million, assuming a further C$10M million in working capital would result in an estimated market cap of C$88 million. This in turn would result in an estimated share price of C$0.44. If Rise Gold manages to get the share price higher at an earlier stage through for example good drill results and likewise maiden resource estimate, raising cash will be less dilutive and upside increases further. In case Rise hits big on the Crackle Zone, I expect fireworks, based on things happening to current exploration success stories.

6. Conclusion

Without knowing what is out there on the CSE, it looks like the resource potential for the Idaho-Maryland project ranks easily among the top high grade, undeveloped underground gold deposits in the Western Hemisphere, listed on the TSX and TSX Venture. This type of deposits is very rare, and it seems this project has so much exploration potential that it could become a Tier I deposit, suitable for a major.

I'm fascinated by the history and

the exploration theory for the Idaho-Maryland project, and if CEO Mossman

manages to actually find the theorized mineralization, Rise Gold will likely be

a multi-bagger stock. The uplisting is around the

corner, the current C$3.6 million financing is almost closed, and drilling is

about to begin, so results can be expected from November 2017 onwards. As there

is no winter break in California, expect a steady news flow after that,

hopefully confirming Idaho-Maryland as a top-tier high-grade gold deposit in

the Americas.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, and follow me on Seekingalpha.com, in order to get an email notice of my new articles soon after they are published.

The author is not a registered investment advisor. Rise Gold is a sponsoring company. All facts are to be checked by the reader. For more information go to www.risegoldcorp.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

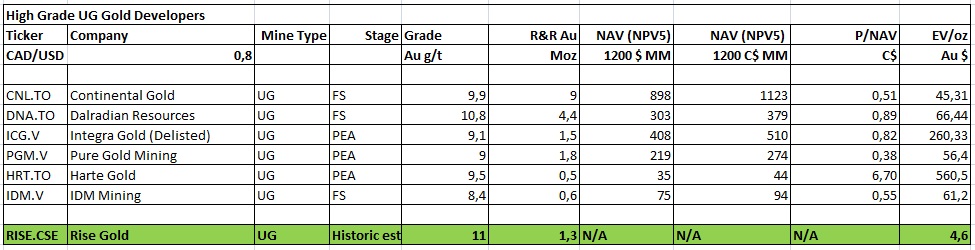

Good old days

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long term commodity pricing/market sentiments, and often looking for long term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles with industry analysts and commentators, visit our Streetwise Interviews page.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Images and charts provided by The Critical Investor