While the long-term fundamentals remain robust and I continue to expect silver to push toward $100/oz. at some point in 2012; the short-term situation is not so clear. The dollar may be the last fiat currency standing, as the sovereign debt situation in Europe deteriorates. In turn, the euro's weakness will likely provide strength for the dollar in the short term, along with the end of QE2 and continued silence from "The Bernank" regarding QE3. Throw in weak seasonality during the summer months, and we might have a recipe for lower silver and gold prices over the next month or two.

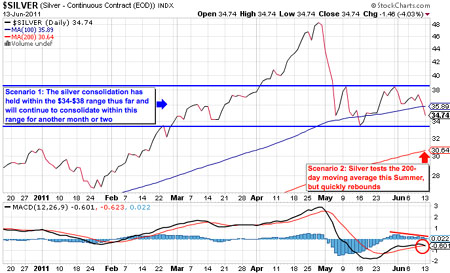

The technical chart for silver is not looking very bullish in my estimation and points to one of two scenarios. Either silver continues to be rangebound and consolidates within the $34–$38 channel for another few months, or the fundamental conditions mentioned in the previous paragraph create downward pressure and silver tests support at its 200-day moving average around $30.

I am inclined to believe that silver will test the 200-day moving average, as has occurred during every correction over the past decade. Even silver's long consolidation of September 2009 to September 2010 eventually hit the 200-day moving average before blasting higher. I think there are plenty of buyers waiting for such an opportunity, so any dip to the $30 area is likely to be short-lived.

Getting a gauge on short-term price movements is useful, especially to traders, but it really has little impact on silver's long-term price. Whether silver stays within the consolidation range or dips to its 200-day moving average, I believe the outcome for later this year and into 2012 remains the same.

Silver is destined for much higher prices, and all of the jawboning about the last move toward $50 being the top is utter nonsense. The inflation-adjusted high for silver is somewhere between $150 and $300, using conservative estimates of inflation. Furthermore, the fundamental conditions that created the previous high in 1980 are significantly worse today. The percentage move, while impressive, is also significantly less than the gain achieved during the last bull market.

So, I remain confident the silver bears that have called a top will be proven wrong (again). They will likely make the same top call when silver hits $100, $150 and $200. Eventually, they will be right, just like a broken clock tells the correct time now and again, but we are a few years and a few hundred percentage points away from that moment. To those of you who have given credence to these "analysts" calling precious metals a bubble, why are you paying any attention to the people who've gotten it wrong so consistently? That is akin to trusting Jim Cramer or Ben Bernanke for advice on when the housing market has bottomed.

Waiting for August

I am currently in a holding pattern with a reasonable percentage of my portfolio in cash and short positions against overvalued stocks and ETFs. It can be boring at times, and overactive investors are often frustrated by the lack of action. But I firmly believe that it is sometimes best to exercise patience and watch from the sidelines. The next opportunity will emerge soon enough, while our short positions advance and our core precious metals holdings catch any unexpected upside move.

I still hold a few junior miners, which I am convinced are significantly undervalued and will play an explosive game of catch-up into the close of the year. I'm looking forward to utilizing the cash I've placed on the sidelines to pick up already-oversold key mining-stock bargains that will likely fall further, as investors throw out the proverbial baby with the bathwater. It always happens during liquidations and the slow summer months, but precious metals are always quick to bounce back.

Gold and silver are increasingly being viewed as money—not just an investment vehicle. This realization is huge, given the declining USD and growing concern about the government's ability to repay the mounting debt. The situation is reaching a boiling point, as it has already raided public pensions and many suspect IRAs and 401k funds could be next. This is all under the guise of protecting us, of course.

In the meantime, I am patiently waiting until August, when the pressure will build for the next round of quantitative easing and the government will have to choose to either default on their debt obligations or push the nation one step closer to hyperinflation. Either way, I expect gold and silver to make new highs by year-end and, absent an all-out stock market collapse, we should see some truly incredible gains in select mining stocks that are currently trading as if gold was at $1,000 and silver at $20. The situation is out of whack and when equilibrium is restored, I believe those holding shares of quality miners are going be rewarded handsomely.

Jason Hamlin

Gold Stock Bull

If you would like to see which mining stocks I am holding and which I am targeting to buy during the dip, sign up for the Gold Stock Bull Premium Membership. You will get the highly rated monthly contrarian newsletter, real-time access to the model portfolio and email alerts whenever I am buying or selling. I also make myself available to premium members for questions via email. Best of all, you can try it out for just $35/month and cancel at anytime if it doesn't prove its value many times over.